Win Cash and Prizes with Lucky Leftovers

If you own an Android smartphone, here’s a great risk-free opportunity to win cash and prizes from it.

Lucky Leftovers is an Android app that takes advantage of your monthly text allowance. Nowadays most people get ‘unlimited’ texts on their mobile contracts, but unless perhaps they are teenagers they may only send a few texts a month. Lucky Leftovers allows you to put this mostly wasted allowance to good use.

Once you are signed up with Lucky Leftovers – which is free – you can enter any of the giveaways listed. You can enter just once or (better) daily. Once you have chosen the contests you want to enter, the app (in conjunction with your phone) will submit entries for you every day, with no other input required from you.

Just to make clear, these are not the type of contest where you are charged a fee per text (which I don’t recommend at all). So long as you have an inclusive monthly or prepaid contract and stay within your allowance, you will not be charged anything for entering these contests.

If you are lucky you will win a prize, but even if not you will get a point for every entry. The points can be converted to Amazon vouchers or cash in your PayPal account once you have earned £5 or more (see What Are Points Worth? below).

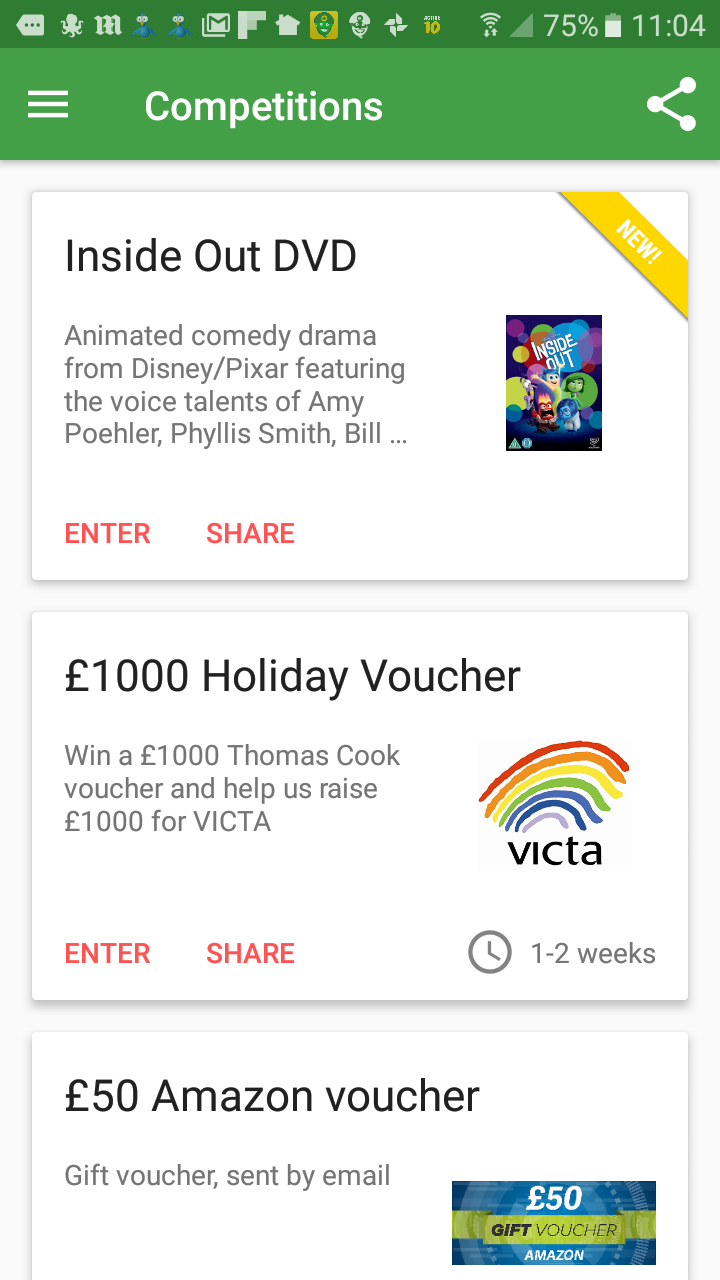

The prizes aren’t spectacular, but they aren’t bad either. Here is a screen capture showing some of them…

Other prizes on offer at the time of writing include Bluetooth speakers, headphones, a trip up the London Shard, two Lion King tickets, a remote-controlled drone, a PlayStation 4, and plain old cash. If you win a prize but don’t want it, you can usually request a cash equivalent.

As you may have noticed, many of the giveaways are also raising money for charities.

What are points worth?

I’ll resist the temptation to say “What do Points Make? Prizes!” (rest in peace, Sir Bruce).

Each point on Lucky Leftovers is worth £0.001p. In other words, 10 points are worth a penny, 100 are 10p, 1000 are £1, and 5000 are £5.00.

£5 is the minimum threshold to request a payment. You might think it will take a long time to accumulate 5000 points, but actually if you submit 5000 prize-draw entries a month, that would give you £5 every month (plus any prizes you win, of course).

That’s not the whole of it, though…

Extra ways to earn points

As mentioned, you get one point for every entry, including automated entries.

There are other ways to earn points as well, though. You can do so by watching short videos (typically promoting games) via the app. You seem to get anywhere between 10 and 30 points per video you watch, so this can boost your total quite quickly.

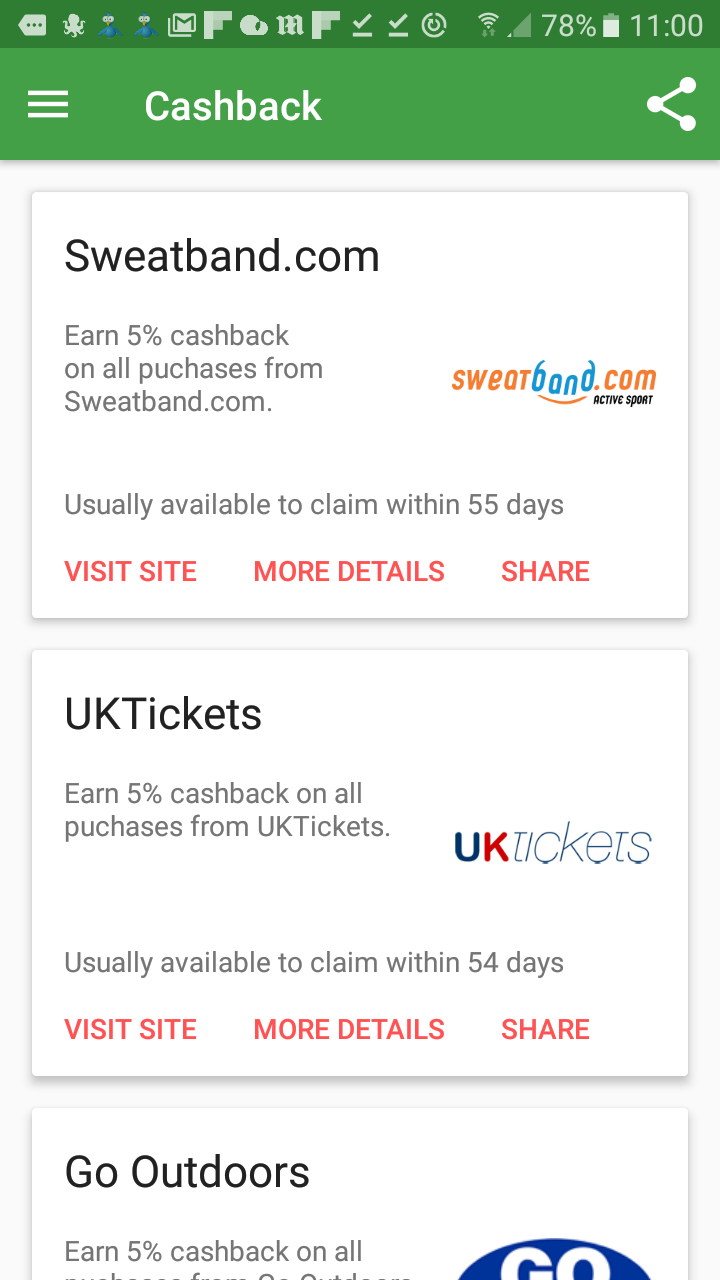

In addition, you can earn points by purchasing via selected retailers listed on the app (see screen capture below). You get ‘cashback’ on these purchases, which is paid to you in the form of points.

Finally, you can get extra points by referring other people or joining via someone else’s referral link. More about this below!

Watch your limits

I said earlier that most people nowadays have an ‘unlimited’ texts allowance, but that doesn’t apply to everyone. If you are on a cheap deal there may be an upper limit every month, and you don’t want to exceed this or you will start being charged extra. You should also to allow for the fact that you may want to send some text messages to friends and relatives yourself, so you need to leave a few in reserve!

Even if you do have an ‘unlimited’ allowance, so-called fair usage restrictions typically apply. A common one is an upper limit of 5000 texts a month. Again, you don’t want to exceed this. Check with your provider if you are unsure what your monthly limits are.

The good news is that Lucky Leftovers allows you to set maximum daily and monthly texting limits on your Settings page. You can start low to test the water if you like, and increase the numbers as you gain confidence. That’s what I did, incidentally.

Will you be spammed?

This is obviously a concern with any app of this nature, but my experience so far has been entirely positive. I have not received a single spam text or phone call as a result of using the app. This has also been the experience of others using the app longer than I have.

Get 500 points through me!

As mentioned earlier, Lucky Leftovers has a referral scheme that lets you earn points by referring others. So here is my referral link. If you click through this and install the app, you will be credited with 500 points (worth 50p), and so will I. That’s a nice little bonus to start you on the way to your first £5!

Good luck if you do decide to join up with Lucky Leftovers. I hope you win lots of points and prizes.

If you have any comments or questions, as always, please do leave them below.