Get a Free Share Worth Up To £100 With Trading 212

Offer Reopened!

Today I’m featuring a way you can get a free share worth up to £100 by signing up with an online share trading platform called Trading 212.

Trading 212 is unusual in that it offers commission-free and fee-free share trading. As a special offer, until 16 April 2024 they are offering people new to the platform a free share just for signing up via a referral link (such as the links in this post). The share you will get is chosen at random, but could be worth up to £100. You can either keep this share or sell it.

Table of Contents

How to Sign Up

Signing up with Trading 212 is pretty straightforward. Just visit the Trading 212 website via any of the (referral) links in this post and follow the on-screen instructions to register. Note that you will be required to provide various items of information, including your date of birth, National Insurance number, annual income, employment status, and contact details. I understand that this is to meet their legal ‘Know Your Customer’ duty.

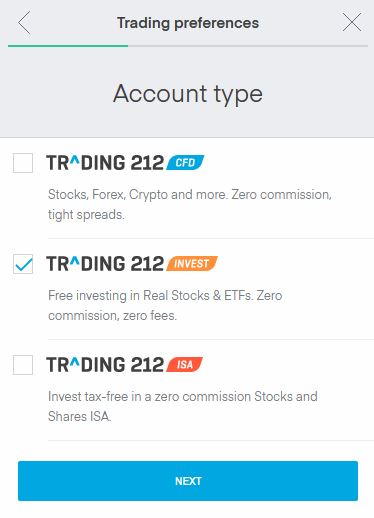

You will also need to indicate the type of account you want from the three options available (see screen capture below).

As you will see, the three account types on Trading 212 are CFD, Invest and ISA. You can apply for one, two or all three of these if you like.

CFD stands for Contract for Difference. CFDs are quite complex financial instruments, and unless you know what you’re doing I recommend giving them a miss. As you can see, you can also use this type of account for trading in Cryptocurrencies. Again this is pretty high risk and not something that appeals to me personally.

I would also recommend thinking carefully before you tick the ISA box. An ISA is, of course, a tax-exempt Individual Savings Account. Nothing wrong with that, except you can only invest in one of each type of ISA (Cash, Stocks and Shares, IFISA) in any one tax year (though this will change from April 2024).

Trading 212 are offering a Stocks and Shares ISA, so if you have already invested in one of these this year (e.g. with Nutmeg), you won’t be able to open another. Equally, once you invest in a Trading 212 ISA, you won’t then be able to open another Stocks and Shares ISA in this financial year. So you do need to be pretty sure that is how you want to use your 2023/24 Stocks and Shares ISA before doing this.

All you need to take advantage of the Trading 212 offer is a standard Invest account, so I recommend ticking this box only (as per the screen capture above).

Getting Your Free Share

There is one more step you will need to take in order to get your free share. You will need to deposit a minimum of £1 into your account. There are various ways you can do this, but i just used my debit card. There is no obligation to invest the £1 (or whatever you choose to deposit) and if you wish you can withdraw it once your free share has been credited.

The next business day you should receive an email confirming that a free share has been added to your account. As mentioned above, this is allotted at random. If you’re lucky you might get one worth up to £100. Even if you get a less valuable one, though, it’s still a share for free. If you choose to keep it, it may rise in value. There may also be dividends payable in future (and credited to your account).

- Already have a Trading 212 account? You can also get a free ETF share worth up to £200 (and now guaranteed to be worth at least £10) with new DIY wealth-building app Wealthyhood. A minimum investment of £50 is required to get the free share (although if you’re not bothered about this you can start investing on the platform with as little as £20). Click through here for more info!

Selling Your Share

You can’t sell your share immediately. You have to wait three business days before doing so, but it is then just a matter of clicking the Sell button on your member’s dashboard.

The money will be credited to your Trading 212 account but you will have to wait 30 days before withdrawing it. So there may be a case for waiting to see if your share’s value goes up in that time. Of course, it could also go down!

In my case, I received a free share in the Ford Motor Company worth about £8 at the time. Obviously this wasn’t as exciting as I might have hoped, but it was still – in effect – free money for almost no time or effort 😀

How Safe Is Trading 212?

Trading 212 is registered in England and Wales and authorized and regulated by the Financial Conduct Authority. In addition, all clients’ funds are kept separately in segregated bank accounts which are covered by the Financial Services Compensation Scheme. So even if the company itself were to go broke, any cash in your account would be protected up to a value of £85,000.

Of course, the FSCS guarantee doesn’t apply to the value of your stocks and shares, which can go down as well as up. All investments carry a risk of loss, although in the case of your free share you can never lose any more than the original cost, which was of course zero!

Referral Scheme

Any Trading 212 member can also refer new members. In this case, both you and the person concerned will receive one free share worth up to £100. Obviously, the links in this blog post include my referral code – so if you register and get a free share, I will receive one also. Under the terms of the current offer you can get up to five free shares in this way. Five is the limit per person. Although you can still refer new members who will get a free share after this, as a referrer you won’t receive one as well.

Final Thoughts

I first heard about Trading 212 a while ago, but wasn’t initially sure whether it was legit and here for the long term. And I thought the free share offer was, frankly, too good to be true. However, my own experiences have been entirely positive. My original free share in the Ford Motor Company was credited the next business day as promised and I received an email notifying me about it.

I can log in to my Trading 212 account any time to see how my Ford share is doing. I have also collected a few other shares from referrals as well. These include a share in AMD (the semiconductor company), which is currently worth £151.51, and one in Nike, which is worth £88.33. I still have my original Ford Motor Company share and it has risen in value to £9.65. I also received an annual dividend payment from them a while ago. I haven’t sold any of my free shares yet but could of course do so any time I choose. I am not in any rush, as Trading 212 do not impose any platform or inactivity fees.

Although in this post I have focused on the free share offer, Trading 212 is worth considering as a share-dealing platform too. In particular, the fact that it’s fee-free and commission-free means it is well suited for people who are dipping a toe in stocks and shares investment for the first time. By contrast, the dealing fees and commissions charged by some other share-trading platforms can make small share purchases prohibitively expensive. This review by Money Savvy Daddy looks at the pros and cons of Trading 212 as a share-dealing platform in a bit more detail.

In conclusion, I hope this post has inspired you to consider registering with Trading 212 to claim your free share. If you do, I hope you get a valuable one! Please let me know what share you receive in a comment below. And, as always, any other comments or questions are very welcome too.

- Don’t forget, the current free share offer ends on 16 April 2024.

Disclosure: The links in this post include my referral code. If you click through and register as described above, I will receive a free share (as will you). Please note also that I am not a qualified financial adviser and nothing in this post should be construed as individual financial advice. Everyone should do their own ‘due diligence’ before investing and seek advice from a qualified financial adviser if in any doubt how best to proceed. All investment carries a risk of loss (although not in the case of free shares, obviously).

This is an update of my original post about this special offer.

October 6, 2022 @ 7:06 pm

This is a really good offer, I have to admit I am already with Trading 212 or I would sign up now to get one!

October 6, 2022 @ 8:08 pm

Thanks, Sarah. Fair enough!

October 7, 2022 @ 10:02 am

I have my free share already and it is with a company whose share is worth £8 also and has dipped in recent weeks to £7.49. But I was intrigued to see what I would get and as yet, I know of no one else who has got the £100 share.

October 7, 2022 @ 11:32 am

Thanks, Rachel. It’s pot luck what you get, but my Nike and AMD shares are currently both well over £50 and were worth even more prior to the recent stock market shake-out.