Grow Your Money Every Week With Plum!

Updated 1 Feb 2021

British people generally are not very good at saving.

A third of us have under £600, and 1 in 10 have no savings at all (source: https://www.finder.com/uk/saving-statistics). Having so little money put away makes people especially vulnerable in the event of a sudden change in their circumstances such as redundancy or divorce.

So today I thought I’d bring to your attention a money-management app called Plum that aims to help with this problem.. Plum is designed to help you set money aside painlessly for any purpose – from holidays to major purchases or simply for a ‘rainy day’ fund.

Plum is one of a growing range of apps that make use of so-called Open Banking. This allows third-party apps to access your financial information (read only) – so long as you provide the necessary authorization, of course – and perform certain transactions on your behalf, if you choose to set up a direct debit.

Open Banking is now becoming well established in the UK, and safeguards are in place to ensure that your security isn’t compromised. Even so, this is something you need to be aware of – and comfortable with – before signing up with Plum or similar apps.

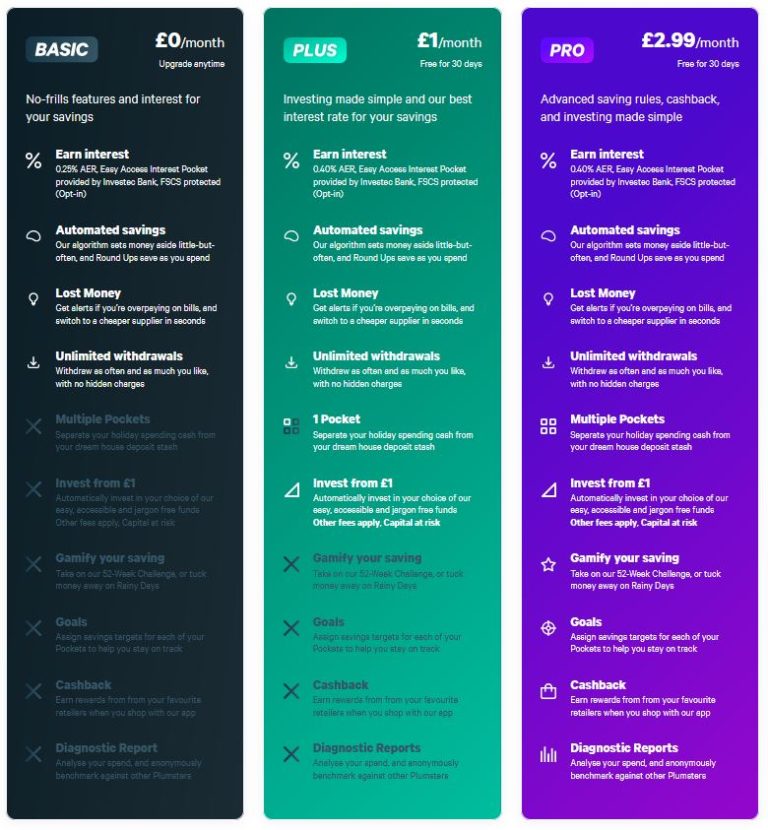

In this post I am looking at features available on the Plum Free (or Basic) account and the paid-for Plum Plus and Plum Pro Accounts. The Plum Free account is – of course – free of all charges. Plum Plus costs £1 a month (the first month is free) and Plum Pro costs £2.99 a month (again, the first month is free if upgrading from a Plum Free account). Plum Plus and Plum Pro offer a wider range of features and higher interest rates in interest-bearing ‘Pockets’ (further discussed below).

The screen capture below from the Plum website shows the features available with each type of account.

You can read more about the three account types if you wish on the Plum website.

Table of Contents

How It Works

Plum is available as an iOS and Android app. It uses Open Banking in combination with a direct debit authorized by you to manage and grow your money for you in an intelligent way.

Every few days, Plum’s algorithm calculates what you can afford to stash away based on your spending habits. It then transfers that money automatically from your current account to your Plum account. In this way you put money aside regularly while barely being aware of it – so it builds up, and in due course you can spend it on things that really matter to you.

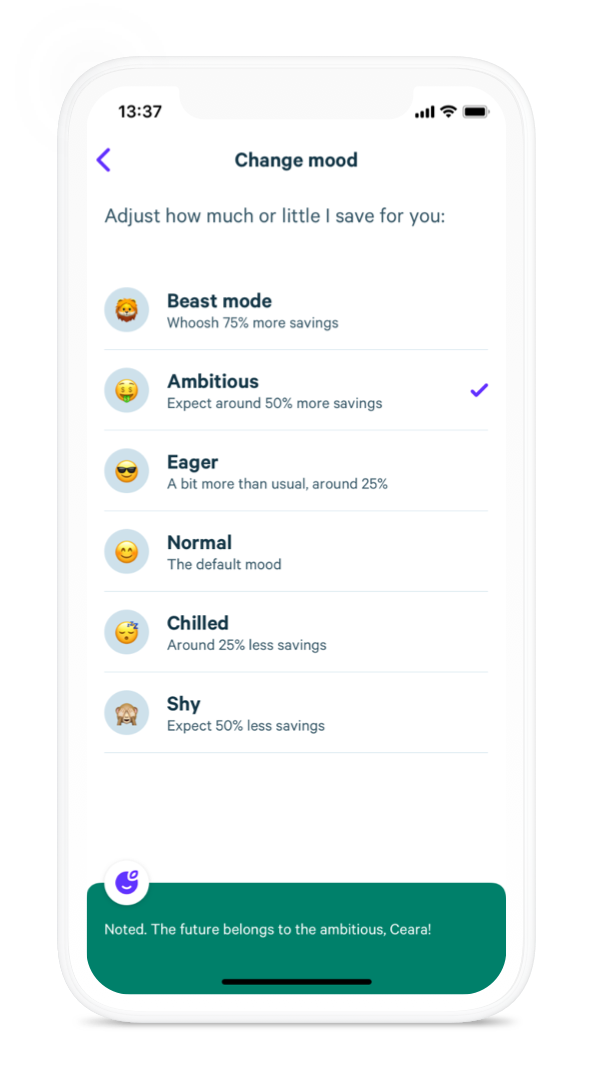

You can change the amounts the app takes at any time, and also pause the service if you wish. This means you don’t have to worry about Plum pushing you into the red. You always stay in control and can change the ‘mood’ at any time if you want to be more ambitious or cautious with your saving (see picture below).

Plum currently works with most major UK banks. The full list from the website is as follows:

- Barclays

- Danske Bank

- First Direct

- Halifax

- HSBC

- Lloyds

- M&S

- Monzo

- Nationwide

- Natwest

- Revolut

- RBS

- Santander

- Bank of Scotland

- Starling

- Tesco

- TSB

- Ulster Bank

Currently business accounts and joint accounts are not supported by Plum. They also do not support Channel Island bank branches.

How to Get Started

Start by downloading the app free of charge from Google Play or the Apple iStore (see links here).

Once you’ve downloaded the app and signed up, you can begin a dialogue with the Plum chatbot to help you set up your account. You will, of course, have to connect the app to your bank, so you will need to have your current account details to hand. Once it’s all set up, turn notifications on. This will allow the app to alert you when it wants to start setting money aside for you.

There is an option to speak to a real person if you need to. You can also increase or decrease the amount to stash away, set up ‘Pockets’ for specific purposes (see below), and even pause any transactions completely if you wish.

Do You Get Interest?

With the default ‘Primary Pocket’ on your Plum account the answer is no. The app is free and helps you set money aside painlessly, but Plum doesn’t pay interest on this.

Even Plum Free accounts can, however set up a secondary interest-paying Pocket. This facility is provided by Investec Bank and takes the form of an easy-access account paying 0.20% for all users

Plum Plus users can also set up one easy-access Pocket paying 0.40% interest. And Plum Pro users can have up to 10 such Pockets for different purposes, all paying 0.40% interest.

What Exactly Are Pockets?

Pockets let you set money aside with a specific goal and amount, e.g. to buy a car, save for a trip, or put down a deposit on a house. You can think of them as ‘pots’ or even jam-jars!

As money accumulates in each Pocket, the app will show your percentage progress towards achieving that goal.

All Pockets (except the default Primary Pocket) can be interest-bearing as well, as explained above. The interest paid will contribute towards achieving your goal/s.

Where Do Plum Keep Your Money (And Is It Safe?)

The app puts money away in your Plum account, which is the safeguarded account created when you sign up.

Your Plum funds in your Primary Pocket are held as e-Money by PayrNet (a subsidiary of Railsbank), Plum’s e-Money provider. Your funds are safeguarded with a UK Bank chosen by PayrNet. Your money is safeguarded because e-money cannot be lent out (this is also why it doesn’t earn interest). That same safeguarding also prevents any of Plum’s or PayrNet’s creditors from claiming your money in the event that either business should go bankrupt. Both Plum and PayrNet are regulated by the Financial Conduct Authority (the UK’s financial watchdog). Plum also boasts 256-bit TLS encryption to ensure your data is kept safe.

Money saved with Plum in interest Pockets is held on Trust with a UK Bank (Investec). A Trust is a legal mechanism that means Plum can look after your money but legally it never stops belonging to you. This means that if anything were to happen to Plum then the bank would return your money to you directly. Should something happen to the bank itself, you would be protected up to £85,000 under the Financial Services Compensation Scheme (FSCS).

How Easy Is It to Withdraw?

Transfers from non-interest Pockets back to your Primary Pocket are usually instantaneous. it is different with transfers from interest-bearing Pockets:

• When requesting an interest Pocket withdrawal before 15:00 UK time on business days, it will be completed the same day.

• When requesting after 15:00 UK time on business days or during weekends, it will be completed the next business day.

Note that withdrawals from interest and non-interest Pockets go back to your Primary Pocket initially. Withdrawals to your bank account will always be from your Primary Pocket. Such withdrawals are processed the same day (typically in around 30 mins) and will appear on your bank statement under your full name.

Other Benefits

As well as making it easier to put money aside, Plum can help you keep track of your income and expenditure. You can set it to provide daily or weekly balance updates, and it will also automatically track your transactions by category, week and month. Plum will let you know all of this without having to wade through bank statements.

In addition, Plum has AI (artificial intelligence) built in, so if it notices you are being overcharged on a bill or for a financial product, it lets you know. It will also suggest cheaper solutions for you and – if you wish – help you switch over in just a few clicks.

Plum also offers a variety of optional automated features. These include

Round Ups – Get Plum to round up your past week transactions to the nearest £1 and transfer the spare change.

52-Week Challenge – Starting with £1 in the first week, £2 in the second week and increasing up to £52 in the final week of the challenge, Plum can help you set aside £1,378 in a year. This feature is only available through Plum Pro.

Rainy Days – Once activated, Plum squirrels away extra cash automatically each day it rains where you live. This feature is also only available through Plum Pro.

Pay Days – The best time to set money aside is when you get paid, so tell Plum an amount and it’ll move this automatically for you on payday.

Plum Reviews

Plum has an average rating of 4.5 stars (‘Excellent’) from over 1200 reviewers on the independent Trust Pilot website. Just over three-quarters (76%) gave it the maximum five stars, with many mentioning the great customer service and how the app had helped them to save more. Of those who gave Plum three stars or less, the main issues mentioned were delays or problems in withdrawing. To be fair, the Plum team generally respond to such comments on the Trust Pilot website explaining how the app works and offering additional help where issues have arisen.

Final Thoughts

If you want to set more money aside but need a little help and encouragement to do so, Plum is well worth a look.

I like the way it stashes money away automatically, so in all probability you won’t even notice it. You can set it to take as much or as little as you like, and you can also make one-off additional payments if you are feeling particularly flush. You can also withdraw some or all of your money back to your bank account at any time.

Pockets are a great feature, allowing you to set aside money for specific purposes. And, as mentioned above, by using an interest-bearing Pocket, you can get interest as well (0.20% with a Plum Free account and up to 0.40% with a Plum Plus or Pro account). Obviously that’s not a fortune, but in the current low-interest rate environment it is still very competitive (and a lot better than nothing!).

In my view Plum is likely to work best for people with a regular monthly (or weekly) income. If you receive income more irregularly – e.g. you’re self-employed – it might not work quite as well. Even so, Plum say that their algorithm can detect patterns in your income and expenditure and adjust your transfer amounts accordingly.

In any event, there’s no reason not to try Plum yourself to see if it can help you set aside more. Just click through this link for more information and to sign up.

As always, if you have any comments or questions about this post, please do leave them below.

Note: This is a fully revised and extended version of my original Plum review from last year.

Disclosure: I am an affiliate for Plum so if you click through any link in this article and sign up, I will receive a modest referral fee for introducing you. This will not affect the service or benefits you receive in any way. Please note also that I am not a registered financial adviser and nothing in this post should be construed as personal financial advice.

August 9, 2020 @ 10:58 am

I wish we had that here too. It looks like a great way to grow your money and have some cash to spend for Christmas. We do have something similar. I will check on it and maybe start saving too.

August 9, 2020 @ 1:08 pm

Thanks for the comment. Yes, it’s a great way to set some cash aside while barely noticing it!

August 9, 2020 @ 12:53 pm

I love the idea of saving money on the days it rains! I wonder how many days it actually rains in a typical year?

August 9, 2020 @ 1:11 pm

Thanks, Jenny. Yes, I like that feature too. Apparently on average it rains for 156.2 days per year in the UK, so if you set aside £10 on every rainy day, you would have accumulated on average £1562 by the end of the year!

January 8, 2021 @ 11:07 pm

Looks like you need iOS 13 – my iPhone is too old to use that!

January 11, 2021 @ 7:15 pm

I have quite a few automatic savings through IFITT and my monzo account but Plum is something I want to look into more once I get used to extra money coming out over the next month or so. Very useful post, thanks x

January 11, 2021 @ 7:21 pm

Thanks, Rhian. Yes, Plum is definitely worth a look. The new interest-paying pockets are a very good feature.