My Investments Update: June 2023

Here is my latest monthly update about my investments. You can read my May 2023 Investments Update here if you like

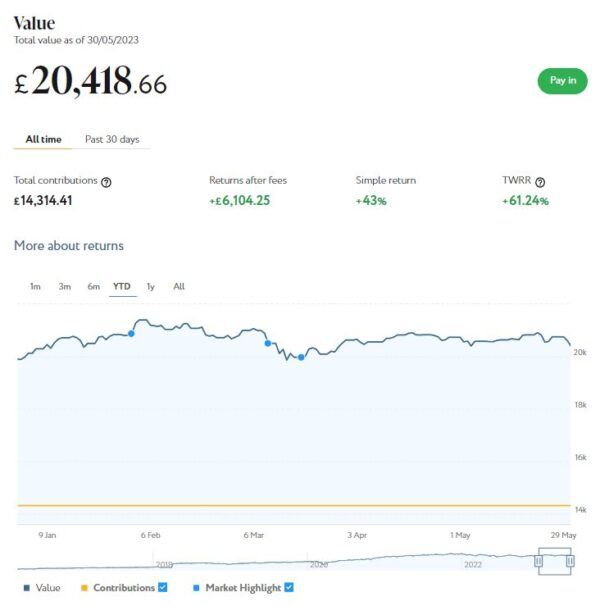

I’ll start as usual with my Nutmeg Stocks and Shares ISA. This is the largest investment I hold other than my Bestinvest SIPP (personal pension).

As the screenshot below for the year to date shows, my main Nutmeg portfolio is currently valued at £20,419. Last month it stood at £20,740 so that is a fall of £321.

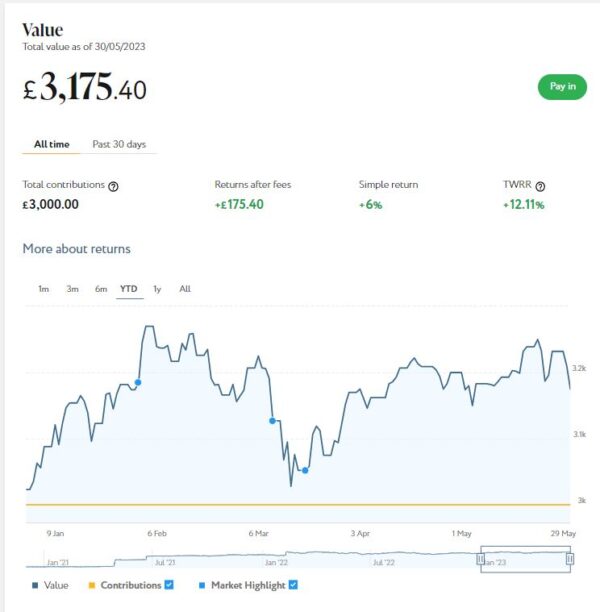

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £3,175 compared with £3,201 a month ago, a small decrease of £26. Here is a screen capture showing performance since the start of this year.

As you can see, this has been another up-and-down month for both my Nutmeg pots. Pro rata, though, my Smart Alpha portfolio has again done a bit better than my main portfolio. I am therefore tempted to switch more of my money into it, although there isn’t a massive difference in performance between them.

The net value of all my Nutmeg investments has fallen this month by £347 or 1.45% month on month. That is obviously disappointing, but both pots are still comfortably up on where they were at the start of the year. And their total value has risen by £1,781 (8.16%) since mid-October last year.

Of course, all investing is (or should be) a long-term endeavour. Over a period of years stock market investments such as those used by Nutmeg typically produce better returns than cash accounts, often by substantial margins. But there are never any guarantees, and in in the short to medium term at least, losses are always possible.

- Also, as you may know, both my Nutmeg pots have quite high risk levels (9/10 main, 5/5 Smart Alpha). If you haven’t yet seen it, you might like to check out my blog post in which I looked at the performance over time of Nutmeg fully managed portfolios at every risk level from 1 to 10 . I was pretty amazed by the difference risk level makes, with higher-risk ports over almost any period of three or more years in the last ten generating significantly better overall returns. If you are investing for the long term (and you almost certainly should be) choosing a hyper-cautious low-risk level might not therefore be the smartest strategy. The one exception is if you plan to withdraw your money soon and don’t want to risk losing too much if there is a sudden downturn.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are looking for a home for your annual ISA allowance, based on my overall experience over the last seven years, they are certainly worth considering. They offer self-invested personal pensions (SIPPs) and Junior ISAs as well.

Moving on, my Assetz Exchange investments continue to generate steady returns. Regular readers will know that this is a P2P property investment platform focusing on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my AE portfolio has generated a respectable £117.63 in revenue from rental income. As I said in last month’s update, capital growth has slowed, though, in line with UK property values generally.

At the time of writing, 7 of ‘my’ properties are showing gains, 4 are breaking even, and the remaining 14 are showing (small) losses. My portfolio is currently showing a net decrease in value of £23.62, meaning that overall (rental income minus capital value decrease) I am up by £94.01. That’s still a decent return on my £1,000 and does illustrate the value of P2P property investments for diversifying your portfolio. And it doesn’t hurt that with Assetz Exchange most projects are socially beneficial as well.

Obviously the fall in capital value of my AE investments is a bit disappointing. But it’s important to bear in mind that unless and until I choose to sell the investments in question, it is largely theoretical. The rental income, on the other hand, is real money (which in my case I have chosen to reinvest in other AE projects to further diversify my portfolio).

I also spoke to the CEO of Assetz Exchange, Peter Read, recently. He made the point that capital values on the platform simply reflect the latest price at which shares in the property concerned have changed hands on their exchange. They do not represent objective or independent valuations of the properties. If you are investing long term with AE, the annual yield from rentals is really a much more important consideration.

Peter also made the point that the current high inflation rate has actually been beneficial for Assetz Exchange investors. That is because properties on the platform generally have an annual review when rentals are increased in line with inflation. That means from the end of the financial year in April, rentals have increased in most cases by around 10%. I don’t want to go into too much detail about this here, but it is a subject I may return to in a future blog post.

To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as i am concerned. You can actually invest from as little as 80p per property if you really want to proceed cautiously.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

Another property platform I have investments with is Kuflink. They continue to do well, with new projects launching every week. I currently have around £2,500 invested with them in 18 different projects. To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question.

My loans with Kuflink pay annual interest rates of 6 to 7.5 percent. These days I invest no more than £200 per loan (and often less). That is not because of any issues with Kuflink but more to do with losses of larger amounts on other P2P property platforms in the past. My days of putting four-figure sums into any single property investment are behind me now! Nowadays I mainly opt to reinvest the monthly repayments I receive from Kuflink, which has the effect of boosting the percentage rate of return on the projects in question

Obviously a possible drawback with Kuflink and similar platforms is that your money is tied up in bricks and mortar, so not as easily accessible as cash savings or even (to some extent) shares. They do, however, have a secondary market on which you can offer any loan part for sale (as long as the loan in question is performing and not in arrears). Clearly that does depend on someone else wanting to buy it, but my experience has been that any loan parts offered are typically snapped up very quickly. So if an urgent need arises, withdrawing your money (or part of it) is unlikely to be an issue.

You can read my full Kuflink review here. They offer a variety of investment options, including a tax-free IFISA paying up to 7% interest per year with built-in automatic diversification. Alternatively you can build your own IFISA, with most loans on the platform being IFISA-eligible.

- Until 30 June 2023 Kuflink are offering enhanced promotional rates of up to 9.73% (gross annual interest equivalent rate) for their Auto-Invest products (IFISA-eligible). There is limited availability for this offer and it may be withdrawn any time before 30 June 2023 if the limit is reached. For more information, click here [affiliate link].

Last year I set up an account with investment and trading platform eToro, using their popular ‘copy trader’ facility. I chose to invest $500 (then about £412) copying an experienced eToro trader called Aukie2008 (real name Mike Moest).

In January 2023 I added to this with another $500 investment in one of their thematic portfolios, Oil Worldwide. I also invested a small amount I had left over in Tesla shares. My original investment of $1,022.26 is today worth $1,093.00, an overall increase of $70.74 or 6.92%. in these turbulent times I am happy enough with that.

Since last month the price of my Tesla shares has risen and my copy trading portfolio with Aukie2008 has performed steadily. Unfortunately my most recent investment in Oil Worldwide is in the red, though. I am hoping for better things in the months ahead 🙂

You can read my full review of eToro here. You may also like to check out my more in-depth look at eToro copy trading. I also discussed thematic investing with eToro using Smart Portfolios in this recent post. The latter also reveals why I took the somewhat contrarian step of choosing the oil industry for my first thematic investment.

- eToro also recently introduced the eToro Money app. This allows you to deposit money to your eToro account without paying any currency conversion fees, saving you up to £5 for every £1,000 you deposit. You can also use the app to withdraw funds from your eToro account instantly to your bank account. I tried this myself recently and was impressed with how quickly and seamlessly it worked. You can read my blog post about eToro Money here.

I had two more articles published in May on the excellent Mouthy Money website. The first was How to Save Money With Cashback Sites. If you ever buy anything online, you can almost certainly save money by signing up with these sites, which include Quidco and Top Cashback. You can read about my experiences with them and my top tips in this article.

My other article was Equity Release – Is It Right for You? In these financially challenging times, more and more older people are turning to equity release to release money tied up in their homes. My article explains the main options and sets out a range of points to consider before doing this.

As I’ve said before, Mouthy Money is a great resource for anyone interested in money-making and money-saving I always look forward to reading the articles by my fellow contributors. Shoestring Jane is a particular favourite and I enjoyed reading her recent article How to Start Comping and Win Big!

I also published a number of new posts on Pounds and Sense in May. One of these was about My Short Break in Aberdovey. This is a small town on the mid-Wales coast, between Aberystwyth and Tywyn. It was my first visit to Aberdovey and I recommend it for a chilled-out break – although (as I say in the article) I wouldn’t go there for the nightlife!

Also in May I published Get a Free Share Worth up to £100 with Trading 212. This offer is open until 8th June, so there is still time to take advantage if you haven’t already.

On a similar note, I published Get a Free ETF Share Worth up to £200 with Wealthyhood. Wealthyhood is a DIY wealth-building app aimed especially at people who are new to stock market investing. As from 1 June 2023 they changed their fee structure to make it even more attractive to small investors. It’s worth checking out, even if you only want the free share. This is an ongoing offer, but to qualify you do have to make a £20 minimum investment on the platform.

I also published an article titled Nibble Launches New Legal Strategy for investors. Nibble is a European crowdlending platform open to anyone. They are offering returns of up to 14.5% in their new Legal Strategy, which involves investing in loans that are in default and facing legal action (hence the name, of course). That is obviously higher risk, but NIbble guarantee to pay all investors in this strategy a minimum of 8% up to the maximum 14.5% depending how successful their recovery efforts prove. Average quarterly returns are currently 12.5%.

The other post I published in May was also about equity release. It’s titled Why Are People Opting for Equity Release? The article features some interesting research on why people are opting for equity release in the current economic climate, and what reasons are becoming more common. Definitely worth a look if equity release is on your radar.

One other thing I should mention is that I had an article published a couple of weeks ago in the Daily Telegraph newspaper about my investing experiences. If you read my monthly investment updates on PAS you won’t find too many surprises in it, but here’s a link anyway in case you’d like to check it out. Note that the article is behind a paywall so unless you are a Telegraph subscriber you will only be able to see the start.

Finally in May I enjoyed a short break in Yorkshire visiting my sister Liz and her family. Once again I stayed at the beautiful Hewenden MIll Cottages, between Wilsden and Cullingworth (near Haworth and ‘Bronte country’). If you’re looking for an unusual, rural-based short-break destination, Hewenden could certainly fit the bill. A photo of the old mill building (in which I stayed on a previous visit but not this time) is shown below. There is also a photo of the woodland at Hewenden in the cover image. You can read my original review of Hewenden Mill Cottages here.

That’s all for today. I hope you’re enjoying the better weather and taking the opportunity to get out and about in our beautiful country (or further afield).

As always, if you have any comments or queries, feel free to leave them below. I am always delighted to hear from PAS readers