Nibble Review – European Crowdlending Investment Platform Open To Everyone

UPDATED 27 May 2022

Regular readers of PAS will know I have a particular interest in P2P/crowdlending investment. Such platforms offer the opportunity to invest in loans to businesses or individuals and profit from the interest charged to borrowers.

With savings account interest rates still very low, many investors are understandably looking for better returns on their savings and investments. If that applies to you, European crowdlending platform Nibble is worth a look.

Table of Contents

What is Nibble?

Nibble is a crowdlending platform launched in 2020 by IT Smart Finance, a company with over five years’ experience developing innovative products in financial technology.

Nibble’s business method involves investing in P2P loans to businesses made through Joymoney (the flagship product of the ITSF group). Private investors can then invest in these loans to take advantage of the interest paid by borrowers.

What Are the Benefits?

Probably the biggest attraction of Nibble to investors is that it offers returns on investment of up to 14.5%. As you will doubtless know, this is well above the average in the collective financing industry.

The minimum investment with Nibble is just €10 (about £8.40 at current exchange rates). The platform has an auto-investment tool, allowing trading to be fast and straightforward. You aren’t required to choose individual loan investments, as this is handled by the company. You simply choose one of three investment strategies (see below) based on the timescale over which you wish to invest and the level of risk you are comfortable with.

Other attractions include a minimum investment period of as little as one month, with interest credited to your account weekly. You can withdraw the interest if you wish or reinvest it in an existing or new portfolio.

In addition, if you want to withdraw money from your account early, Nibble say they will find a new investor for your portfolio for a small commission fee.

What Are the Risks?

Obviously no investment is without risk, but Nibble have gone to some lengths to keep this as low as possible. You can read a detailed article about this on this page of the Nibble website (warning: it is quite long!).

For investors opting for the lowest-risk Classic Strategy (see below) a Buyback Guarantee applies. That means that if a borrower defaults on payment, the company will return your money, including interest earned, for the time you held the loan.

For the other two, higher-paying strategies, the risk is shared between the investor and the platform in the form of a variable interest rate. The rate paid is decided by the Risk Committee, which meets monthly to assess how loan portfolios are performing and set rates accordingly. The actual rates paid therefore vary from month to month.

Obviously the other risk is that the lending company itself will go bust. For various reasons set out on the Nibble website this appears unlikely, but of course it is not impossible. If that were to happen, you would not be covered by the Financial Services Compensation Scheme (FSCS) which covers deposits in registered UK savings institutions up to £85,000. Nibble say that in the worst case scenario ‘a management company will be assigned to help the investor to recover funds in accordance with the rights of claim against the borrower. In addition, there is always a reserve fund which serves as an additional “safety airbag” for the investor.’

Finally, as loans are currently all in euro, UK investors will of course have to contend with exchange rate fluctuations, which could work for or against you.

How Do You Get Started?

If you wish to invest via Nibble, the first thing you will need to do is set up an account via the Nibble website.

As Nibble is a European operation, you will need to invest in euro and your returns will be paid in this currency. That obviously adds a layer of extra complexity for UK citizens, but there are various ways round this. If you have a UK bank account you will normally be able to make (and receive) payments in euro, but may be charged a NSTF (Non-Sterling Transaction Fee).

You could use your own bank to fund your account initially, but if you become a regular investor with Nibble you might want to use a service or account that charges lower fees. You could use a money transfer service such as Paysera or Wise (formally TransferWise). These will enable you to transfer funds between Nibble and your own bank account with lower charges (and potentially a more favourable exchange rate). Another option would be to open a Euro account with a provider such as Starling. This will allow you to receive and make payments in both sterling and euro, again at a lower overall cost.

Nibble offers investors a choice of three investment strategies according to income and risk preferences. They call this approach Flexible Investment. The three strategies are called Classic, Balanced and Legal. They differ in the level of income on offer, the degree of risk, and how those risks are distributed between the platform and the user. Each strategy is described below using screen captures from the Nibble website.

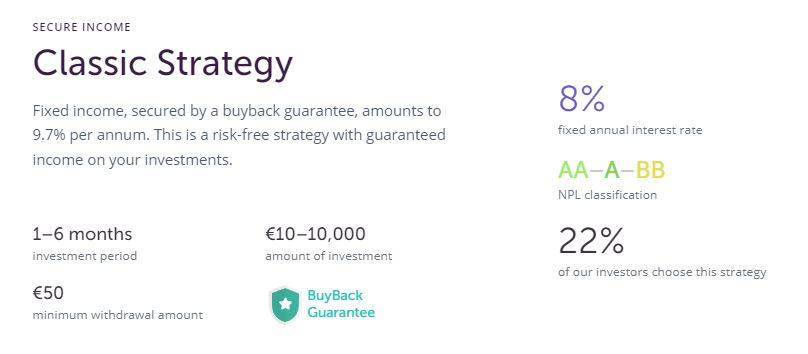

Classic Strategy

As you can see, this strategy offers the lowest level of risk and also the lowest rate of return (though still a respectable 8% at time of writing and up to 9.7% if you reinvest every time your investment matures). You can start with as little as 10 euro for a minimum period of just one month, so this may be a good way to test the water initially. Be aware that the minimum withdrawal is 50 euro though.

An important thing to note here is the BuyBack Guarantee. As mentioned above, this means that if a borrower defaults on their payment, the company will return your money, including interest earned, for the time you held the loan. That significantly reduces the risk of investing.

Balanced Strategy

As you will see, the Balanced Strategy offers higher potential returns than the Classic Strategy but without the safety net of the Buyback Guarantee. The minimum investment amount is 100 euro and the minimum period seven months. According to Nibble this is the most popular strategy among investors, with almost 2/3 opting for it.

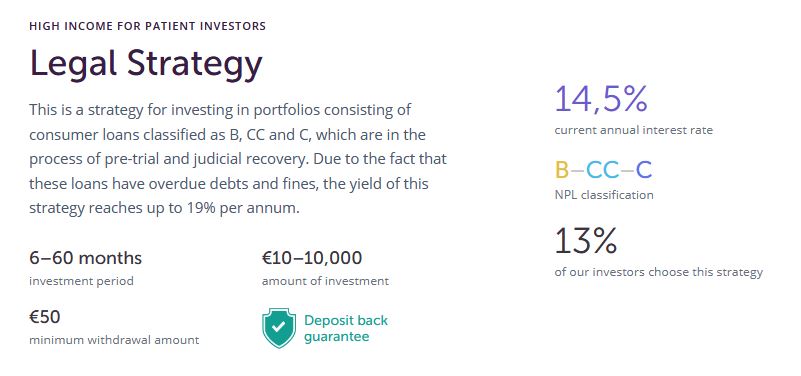

Legal Strategy

The Legal Strategy offers the highest potential returns. The loans in question are in default and facing legal action (hence the name). Nibble buy these loans at a heavily discounted rate and then seek to recover as much as possible of the amount owed. The minimum investment amount is 10 euro and the minimum period is six months.

As you can see, the Legal Strategy comes with a deposit back guarantee. This is a guarantee to return the full investment amount at the end of the investment period and a minimum yield of 9% per annum. The actual yield paid will depend on how successful recovery efforts prove, so you may end up with a return of anywhere between 9% and 14.5%.

According to Nibble 13% of their investors choose this strategy, which is a fairly new one.

My Experience

I wanted to try out Nibble myself,so I set up an account with them. The process was quick and straightforward. You just click on Create Account at the top of the Nibble homepage and follow the online instructions.

You are required to complete a short verification process before opening your account. This involves taking a photo of your passport, driving licence or some other form of ID, along with a selfie. You may use your mobile phone camera for this. It all worked smoothly and seamlessly in my case, and within a couple of minutes my application had been verified and approved.

After that, it is just a matter of making your initial deposit and deciding which of the strategies mentioned above you want to use. I chose the Classic Strategy as a low-risk test and so far everything has gone as promised. Interest is credited to my account every week, and so far at the end of each investment period I have reinvested all the capital and interest received.

I plan to try out the new Legal Strategy myself and will report in due course how this goes.

Closing Thoughts

If you are looking for a more exciting home for some of your cash that allows you to take advantage of the higher interest rates on offer in Spain (and other countries soon), Nibble is worth checking out.

I like the low minimum investment for the Classic Strategy and the fact that the minimum loan period for this is just a month. That allows you to try out the platform without risking too much or tying up your funds for too long. The BuyBack Guarantee provides additional reassurance. The other strategies offer higher rates of interest, though it is important to note the longer investment periods and the fact that rates paid may vary from month to month.

The website’s ease of use is another attraction, as is the fact that Nibble doesn’t impose any fees or charges on investors. As mentioned above, you do just need to bear in mind the need to switch between pounds and euro and the importance of minimizing the costs associated with this.

As a Spanish-based company NIbble doesn’t have too many UK reviews, but those that I have seen are almost entirely positive. On the popular independent Trustpilot website, they get an average score of 4.2 (‘Great’) with 75% of reviewers awarding them a maximum five star rating.

My advice if you want to try Nibble would be to start by investing modestly using the Classic Strategy (as I have). This will allow you to see how the platform works and get your capital returned with interest in as little as 30 days. You can then move on to the other investment options (Balanced and Legal) for bigger potential returns if you wish.

- I have just made a small additional investment in the Nibble Legal Strategy, so will be saying more about this soon.

Obviously, nobody should put all their money into Nibble, but it is worth considering within a diversified savings and investments portfolio, especially in the current low-interest savings environment. As stated above, you should also bear in mind that your money won’t be protected by the Financial Services Compensation Scheme (FSCS), which protects deposits of up to £85,000 in most UK bank accounts. Of course, P2P/crowdlending platforms in the UK are not generally covered by the FSCS either.

I will, of course, continue to report on Pounds and Sense how my Nibble investments fare.

As always, if you have any comments or questions about this post, please do leave them below.

Note: This is a fully updated version of my original Nibble review from 2021.

Disclaimer: I am not a qualified independent financial adviser and nothing in this post should be construed as personal financial advice. You should always do your own ‘due diligence’ before investing and seek professional advice if unsure how best to proceed. All investing carries a risk of loss. Note also that this review includes my affiliate (referral) links, so if you click through and end up investing with Nibble, I may receive a commission for introducing you. This will not affect the price you pay or the product/service you receive.

March 25, 2021 @ 6:02 pm

I have only recently started investing but have been looking into different options. Nibble sounds like a great platform and I will certainly check it out.

March 25, 2021 @ 6:08 pm

Thanks, Rebecca. Worth a look, certainly.

March 26, 2021 @ 11:54 am

I like that the classic one has a fixed interest rate so at least that way you kind of know what you’re getting. Definitely something to look into x

March 26, 2021 @ 2:37 pm

Thanks, Rhian.

February 27, 2024 @ 5:51 am

I highly recommend giving Nibble a try if you are looking to grow your money and invest wisely.

April 15, 2024 @ 4:06 am

I have been using Nibble P2P for a while now and it has lived up to my expectations. I trust the platform and feel confident in its reliability.