What is an eToro Money Account and How Can it Save You Money?

Regular readers will know that I joined the online trading and investment platform eToro earlier this year and have become a fan of it.

You can purchase a wide range of investment products on eToro, including individual company shares, ETFs, commodities, cryptocurrencies, thematic portfolios, and so on. You can also avail yourself of their popular copy trading facility, where you sign up to automatically copy the trades of an experienced (and hopefully successful!) eToro investor.

My own investments on eToro now comprise a thematic portfolio, a copy-trading portfolio, and a few shares in Tesla (basically because I had a spare $20 burning a hole in my account!). I will write more about thematic portfolios in a future post. Today, though, I want to talk about eToro Money.

Table of Contents

What is eToro Money?

eToro Money is a recently-launched e-money account for eToro investors. It can be managed via a mobile phone app. It is free to set up and there are no ongoing charges.

The key attraction of eToro Money is that it allows you to deposit to your eToro investment account without paying the usual currency conversion fee. This can save you up to £5 per £1,000 compared with depositing directly to eToro using a bank debit card.

Essentially what happens is that you deposit to your eToro Money account with your bank debit card using the account details provided. This money then appears instantly in your eToro Money account and you can use it to invest on anything on eToro when you are ready.

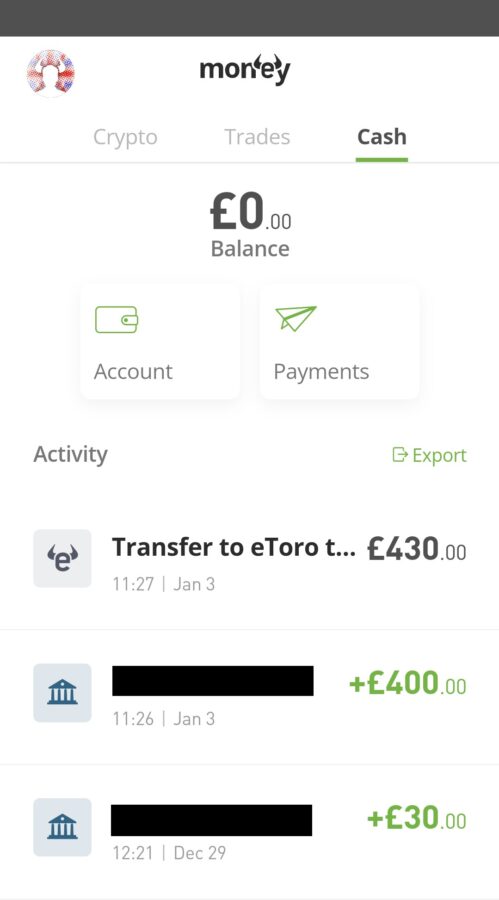

When I tried this myself, I was impressed by how straightforward the process was, and in particular the speed with which the money showed up in my account (it really did seem to appear instantly). Using it to invest on the eToro platform was then straightforward. Of course, eToro operates in US Dollars, so I worked out in advance roughly how much I would need to deposit in GB pounds to get the $500 I was aiming to invest (I transferred £430 in total to be on the safe side). The money was then converted at a fair rate with no fees or charges. You can see these transactions listed in the screen capture of the app on my phone below. I have redacted my account name for security reasons.

You can also use eToro Money to withdraw funds from your eToro account. I haven’t tried this yet, but again eToro promise that the process is instant and I have no reason to doubt that. There are modest fees for withdrawing from eToro and you will still have to pay them, but having an eToro Money account keeps costs as low as possible. As I noted in my original review, eToro’s fees are very reasonable and they don’t generally impose any transaction charges.

Other Features

As well as managing your main (‘fiat’) currency in eToro Money, you can also securely store, send and receive most popular cryptocurrencies. eToro Money incorporates the functionality of the previous eToro Wallet app for cryptocurrencies, while offering additional features as well.

You can also use your eToro Money account to send money to and receive money from friends and family, set up direct debits, manage your household expenses, and so forth.

The eToro Money Debit Card

This is a further benefit of eToro Money some may wish to take advantage of. It is a debit card linked to your eToro Money account which you can use in the same way as a bank debit card to fund purchases, exchange currencies, and so on. They claim to offer market leading exchange rates across the globe.

To qualify for an eToro Money debit card, you must be a member of the eToro Club. Anyone with over $5,000 in realised equity on eToro is eligible for this. Realised equity in this context means the combined value of the available funds in your eToro account plus the original amount invested in all your holdings. So if you have $1,000 in cash in your account and have invested $4,000 in shares and other investments on the platform, you will have $5,000 in realised equity and qualify for a free eToro Money debit card if you want one.

Closing Thoughts

For most users the primary benefit of an eToro Money account will be to eliminate the currency conversion fee when depositing on eToro. It also speeds up the process of depositing to the platform and withdrawing from it.

While eToro Money is not a fully-fledged online banking service, you can also use it to send payments and/or set up direct debits. In that respect, it is a bit like PayPal. Though you will need to know the sort code and account number of the person or business you want to pay. An email address alone (as with PayPal) won’t cut it!

As mentioned above, if you have $5,000 or more in realised equity on eToro you are also entitled to an Etoro Money debit card if you wish. You can read more about this on the eToro Money website.

Overall, I think anyone who plans to invest via eToro should seriously consider opening an eToro Money account to reduce costs and speed up depositing and withdrawing. They will obviously then have the opportunity to take advantage of the other benefits too.

To set up an eToro Money account, the best option is to download the eToro Money app from Google Play (Android) or the App Store (Apple) and follow the instructions in the app. Obviously you should have an account on eToro already in order to use eToro Money.

- Don’t forget, you can also read my in-depth review of eToro here and my post about copy trading on eToro here.

If you have any questions or comments about this post, as always, please do leave them below.

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that posts on Pounds and Sense may include affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered.