Where to Get Pension Advice

Whether you’re just starting, mid-career, or approaching retirement age, getting the right pension advice is crucial to ensure a secure and comfortable future.

Fortunately, there are many places in the UK (both free and paid) that offer pension guidance and tailored advice. In this blog post, we’ll explore reasons why you need pension advice, the best places to get help, and answer some frequently asked questions about pension advisers.

Why Would You Need Pension Advice?

Pensions are a vital part of your financial future, yet many people don’t fully understand how to approach pension problems or what investment options are available. Before we look at where you can find pension advice, here are a few common situations where seeking advice might be a smart move:

- Near Retirement – As you approach retirement age, you’ll have to make important decisions such as when to access your pension, how to take your benefits, and how to minimise tax. Professional advice can help you make the most of your savings.

- Multiple Pension Pots – If you have changed jobs frequently in the past, you might have multiple pension pots. Getting expert advice can help you trace and consolidate them efficiently, ensuring you don’t lose track of valuable funds.

- Pension Transfers – Transferring pensions, especially from defined benefit (DB) schemes, can be risky if not handled carefully. Expert advice is essential to assess the risks and avoid losing valuable benefits.

- Investment Choices – If you have a defined contribution (DC) pension, you can choose where your pension contributions are invested. Advice can help match your investment risk profile with your long-term goals.

Places To Get Pension Advice in the UK

Many organisations and platforms in the UK offer pension guidance and advice. Some are free and impartial, while others are professional financial advice services that may charge a fee.

Here’s a breakdown of some places where you can get pension advice:

1. Pension Wise

Pension Wise is a government-backed service offered through MoneyHelper. It offers free and impartial guidance to people aged 50 or over with a defined contribution pension. If you’re unsure about what type of pension pot you have, they have a service that helps determine whether or not you have a defined contribution pension. You can book a free appointment online or over the phone with a pension specialist who will explain how each pension option works, what tax you could pay, and how to identify scams. It also offers a helpline and webchat open Monday to Friday from 9 am to 5 pm.

Pros

- Government-backed service

- Free online and phone appointments

- Suitable for people aged 50 or over with a defined contribution pension pot

Cons

- You may not be able to get an appointment if you are under 50 or only have a defined benefit pension

- Don’t offer tailored financial advice

- Potential waiting times over the phone

Website: https://www.moneyhelper.org.uk/en/pensions-and-retirement/pension-wise

2. Citizens Advice

Citizens Advice is an independent organisation in the UK that provides free and confidential guidance on a wide range of financial issues, including pensions. They have a network of local charities in around 1,600 locations across England and Wales with 14,000 volunteers and 8,843 staff. You can contact a guidance specialist online, on the phone, or by visiting your local Citizens Advice branch. Their website is also a helpful resource for general information about state pensions, workplace pensions, personal pensions, and more.

Pros

- Around 1,600 locations across the UK

- Free face-to-face and phone appointments

- A great resource for general pension information

Cons

- You may not be able to get an appointment if you are under 50 or only have a defined benefit pension

- Don’t offer tailored financial advice

- Long waiting times due to high demand

Website: https://www.citizensadvice.org.uk/

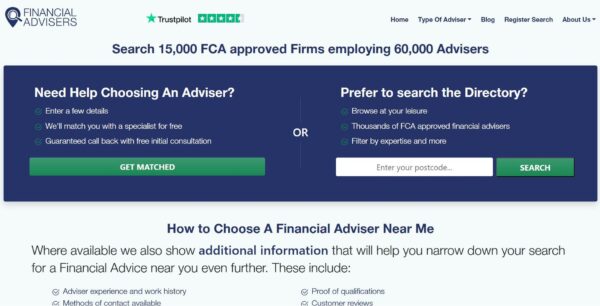

3. FinancialAdvisers.co.uk

FinancialAdvisers.co.uk is an online platform with a database of over 60,000 FCA-approved financial advisers and 15,000 firms across the UK. It works by connecting people with a range of financial advisers based on their postcode. Users can enter their postcode in the directory and filter the results by pension and retirement advice to find a list of pension advisers nearby.

In addition, they also offer a ‘Get Matched’ service that matches you with a suitable adviser. By answering a few questions and entering your personal details, it allows you to find an FCA-regulated adviser in your local area and request a guaranteed call back.

Pros

- Free directory to find pension advisers near you

- Free ‘Get Matched’ service

- Most pension advisers listed offer a free initial consultation

Cons

- You have to make contact with advisers unless you get matched

- Doesn’t show client reviews or ratings

- Limited information on adviser profiles

Website: https://financialadvisers.co.uk/

4. Personal Finance Society

As a part of the Chartered Insurance Institute group, the Personal Finance Society (PFS) serves as the UK’s professional body dedicated to the financial planning sector. This organisation is committed to elevating standards and fostering professionalism across the sector, primarily aiming to enhance public trust and confidence.

The Personal Finance Society provides a free search tool on their website, enabling individuals to locate qualified advisers nearby. By inputting their location, users can refine their search based on their specialty, such as retirement pensions and annuities. The tool also allows for filtering options to show only chartered financial planners, specialists in later life and retirement planning, or advisers who can be contacted by email or telephone.

Pros

- Free search tool to find advisers in your local area

- All listed advisers are qualified and members of the PFS

- Most advisers listed offer a free initial consultation

Cons

- No matching service

- Not all advisers in the UK are listed

- No client reviews or ratings

Website: https://www.thepfs.org/

5. Age UK

Age UK is a leading charity federation designed to provide support and guidance to older people on a wide range of topics, including pensions. They offer a free and confidential helpline and have specialist advisers at over 120 locations across the UK. The Age UK website provides general information on pension pots, state pensions, workplace pensions, finding old pensions, annuities, how to spot pension scams, and more.

Pros

- Free and impartial guidance

- Free helpline open 8 am to 7 pm, 365 days a year

- Specialist advisers in over 120 locations across the UK

Cons

- Potential waiting times

- Don’t offer tailored advice

Website: https://www.ageuk.org.uk/

6. NEST

NEST (National Employment Savings Trust) is a popular workplace pension scheme in the UK designed to make automatic enrolment as easy as possible. The scheme was set up by the government and introduced by the Pensions Act 2008. Under the act, all employers in the UK are legally required to put eligible staff into a pension scheme and contribute towards the pension pot. This is to help staff save as much as possible for retirement.

Whatever pension provider you are with, it is worth seeking advice from them. If you’ve been auto-enrolled into a NEST pension scheme, they offer guidance and support on their website in a range of areas, such as how to grow your pension, transfers, contributions, pension tax, and more.

Pros

- Government-backed scheme

- Free guidance on their website

- Live web chat available

Cons

- Advice is catered for NEST members only

- Don’t offer tailored advice

Website: https://www.nestpensions.org.uk/schemeweb/nest.html

Common Questions

What is the Difference Between Pension Guidance and Advice?

Pension guidance helps you understand your options and make informed decisions, but it doesn’t recommend specific financial products or tell you what to do. It’s usually free and impartial and offered by services like Pension Wise and Citizens Advice. Pension advice, on the other hand, is provided by regulated financial advisers. They assess your financial situation and recommend specific actions or products for a fee.

Is It Worth Paying a Pension Adviser?

It depends on your circumstances. If you’re close to retirement or have multiple pension pots, paying for tailored advice can be a smart investment. A good adviser can help you avoid costly mistakes, optimise your tax position, and choose suitable investments.

How Much Does a Pension Adviser Charge?

Most pension advisers offer a free initial consultation and charge a fee for their services. These fees vary depending on the complexity of your situation and how the adviser charges. Typical fee structures include fixed, percentage-based (0.5% to 2% of the pension value managed), or hourly. Before working with an adviser, it is recommended that you ask about fee disclosure to avoid hidden costs.

Where to Go From Here for Pension Advice

Getting the right pension advice can mean the difference between a comfortable retirement and financial uncertainty. Whether you’re just starting to save, consolidating old pension pots, or deciding how to access your pension funds, it pays to seek help.

Start with free, impartial guidance services to understand your options. If your situation is more complex or you want advice tailored to your retirement goals, consider hiring a regulated financial adviser. With a wealth of resources available, planning for retirement doesn’t have to be daunting.

This is a collaborative post.