Is a Friendly Society a Good Home for Your Savings?

If you’re looking for a home for your savings (or some of them), a friendly society might not be the first thought that occurs to you. Nonetheless, it may well be worth considering.

Friendly societies are one of a number of UK institutions called ‘mutuals’. These were originally set up by groups of people for a common financial or social purpose. Before modern insurance and the welfare state, friendly societies provided financial and social services to individuals, often according to their religious, political, or trade affiliations.

Friendly societies today typically provide a range of savings and insurance services. Along with other mutuals, they are regulated by the Financial Conduct Authority (FCA).

Why Save With a Friendly Society?

One big attraction of friendly societies is that they are owned by the members themselves. This means any profits generated go to members (directly or indirectly) rather than shareholders, as is the case with banks.

A good example is Shepherds Friendly, which offers a range of savings, investments and insurance products. These include a highly rated Stocks and Shares ISA. There is a minimum investment in this of £30 a month or a minimum lump sum of £100.

The Shepherds Friendly Stocks and Shares ISA is an actively managed fund and rated medium to low risk. The fund invests in a mixture of UK and overseas company shares, property, government and company bonds, and cash deposits. Most of the fund is normally invested in stocks and shares for greatest growth potential, but at times of economic turbulence some may be switched to safer investments such as bonds and deposits.

Investors in the Shepherds Friendly ‘With Profits’ Stocks and Shares ISA receive an annual bonus based on how the fund has performed in the year in question. Shepherds Friendly say that this has worked out at 3% for the last five financial years after all management fees and costs are deducted. Members may also receive a final bonus when they exit their investment. Note that annual and final bonuses depend entirely on how well the fund has performed, and are not guaranteed.

As with all ISAs, any profits are free of income tax and capital gains tax. Everyone has an annual ISA allowance, which is currently a generous £20,000 a year. This may be divided as you wish among a Stocks and Shares ISA, a Cash ISA and an Innovative Finance ISA (IFISA). However, you may only invest in one ISA of each type per financial year.

A major attraction of the Shepherds Friendly ISA is that it is covered under the Financial Services Compensation Scheme (FSCS) up to £85,000 per person. That means if the society were to collapse in a worst-case scenario, your capital would be protected and returned to you by the FSCS.

Bonus Fund

A further benefit of saving with a friendly society is that because of their special status they can offer additional tax-free savings over and above the ISA limit. In the case of Shepherds Friendly, you can save from £10 a month to £25 a month tax-free in their Tax Exempt Bonus Fund. This is also an alternative option if you have already invested in another Stocks and Shares ISA in the current tax year and are therefore excluded from the Shepherds Friendly ISA.

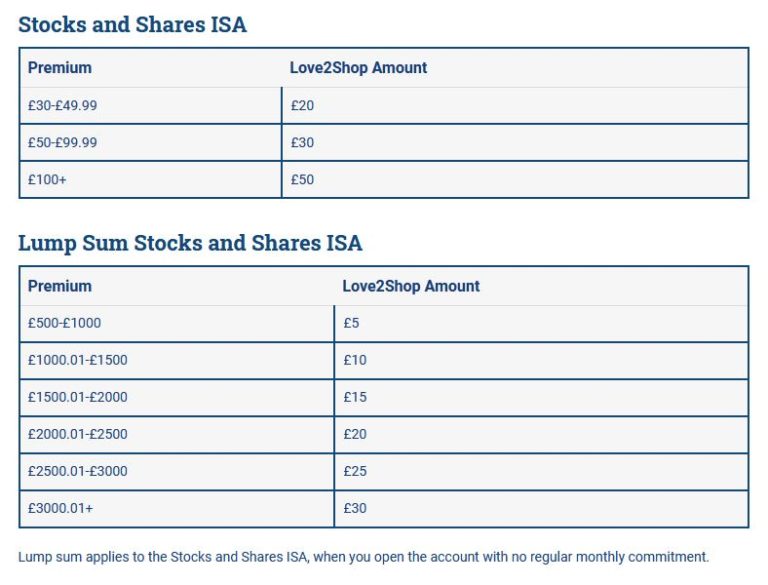

Voucher Offer

Shepherds Friendly are currently offering investors in their Stocks and Shares ISA a Love2Shop voucher worth up to £50 once you’ve made your first deposit. I’ve copied the actual amount you would receive for Stocks and Shares ISA investments below from the Shepherds Friendly website:

Many of the other financial products sold by Shepherds Friendly include a Love2Shop voucher as well – see this Terms & Conditions page on their website for more info.

Closing Thoughts

If you are looking for a home for some of your savings, Shepherds Friendly offers an interesting option. The society has over 100,000 members, so it is also one that is very popular.

The potential returns from the Shepherds Friendly Stocks and Shares ISA are higher than those currently on offer from banks, though not as high as the potential returns from P2P lending and property crowdfunding (among others). But those investment opportunities do of course tend to be riskier, and your money may not be as easy to access in an emergency. They are also not generally covered by the FSCS guarantee.

As with all stock-market-based investments, there are still risks involved, and past performance is no guarantee of what will happen in the future. Shepherds Friendly is at the lower-risk end of the spectrum, but you should still regard it as a medium to long-term investment (five years at least). With the Shepherds Friendly Stocks and Shares ISA, however, you can at least access some or all of your money at any time if you need it. As stated above, this is not the case with many P2P/property crowdfunding platforms.

- As always, if you have any comments or questions about this post, please do leave them below. I’d also be interested to hear from anyone who has invested with a friendly society – be it Shepherds Friendly or another one – what your experience has been and whether you would recommend this method of saving to others.

Disclosure: This is a sponsored post on behalf of Shepherds Friendly. If you click through one of the links in it and make an investment, I may receive a commission. Please note that I am not a qualified financial adviser and nothing in this article should be construed as individual financial advice. You should always do your own ‘due diligence’ before investing, and take professional advice if in any doubt how best to proceed.