Review: RING RTC1000 Rapid Digital Tyre Inflator

I was gifted this automatic tyre inflator from RING Automotive – a company specializing in this type of product – in exchange for publishing an honest review. So here are my thoughts about it.

The RING RTC1000 is not the first automatic tyre inflator I have ever used, but overall it is the best I have tried to date. It certainly beats the old foot-pump I used in bygone days, and is a lot more convenient (and probably more accurate) than the machines on garage forecourts. And once you’ve bought it, of course, it’s free to use!

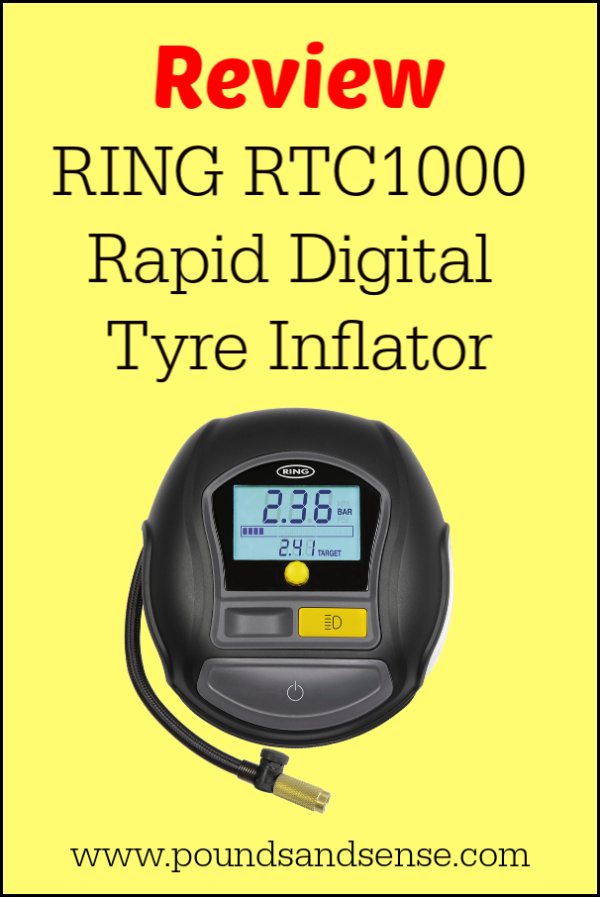

The RING RTC1000 Rapid Digital Tyre Inflator is undoubtedly smart looking. I like the round, flat design, which makes it very stable.

It comes with a range of accessories, including adaptors for bicycle tyres, balls and other inflatables, and even a set of plastic gloves for keeping your hands clean. There are also some spare valve dust caps and a spare fuse. These are all useful, thoughtful additions, though it would be nice if there was a compartment somewhere within the device in which to keep them.

Using the RTC1000 is simple and intuitive. You plug it in to your car’s cigarette lighter socket (it was quite a tight fit in my Vauxhall Corsa) and turn on the ignition. You can then set the target pressure you want by turning the small dial under the display (see photo below).

If you prefer, you can change from the default PSI to Bars or kPA by pressing down the dial (see below). This will cycle through the pressure measurement options available.

Once you have attached the air hose to your tyre using the brass valve connector, the device then operates to inflate it to your target pressure. I found this quick and surprisingly quiet. I did, though, find that it stopped inflating just below the selected target figure. I would guess that this is a safety feature to allow for any possible margin of error in the measurement, but it is still a little frustrating. Of course, you can get around it by setting a target pressure slightly above what you actually want, but I don’t really see why you should have to do this.

On the plus side, the device has a small recessed area on top in which to put the valve dust cap while inflating the tyre. This avoids the scenario of putting a cap on the ground and having it roll away and vanish (we’ve all been there). There is also a built-in LED light, which is great if you need to check your tyre pressures in poor lighting conditions.

Another welcome feature is the long power lead, which winds up inside the unit. There is also a recess on the side in which the air hose fits, so everything is neatly out of the way when not in use. And it comes with a zipped grey carrying case as well.

Overall, I think the RING RTC1000 is a great piece of kit to have in your car, with some excellent features and accessories. It is also by a distance the most user-friendly tyre inflator I have tried. It is a pity about the minor niggles mentioned above, but they don’t seriously detract from the quality of the product. If you need an automatic tyre inflator that is quick and easy to use (and reasonably priced), it is well worth your consideration.

The RING RTC1000 Rapid Digital Tyre Inflator is available from all good motor accessory stores and online suppliers including Amazon.

- If you want to know the many reasons correct tyre inflation is so important, check out this eye-opening article.

As always, if you have any comments or questions about this review, please do leave them below.

Disclosure: As stated above, this is a sponsored post. I was gifted a RING RTC1000 tyre inflator in exchange for publishing a review of it here. This has not affected my review in any way. All comments and opinions set out in this post are mine and mine alone.