Is It Time to Clean Your Solar Panels?

According to the Department for Business, Energy and Industrial Strategy (BEIS), there are now roughly a million homes in the UK with solar panels.

Mine is one of them. We had ours fitted in April 2011, just in time to benefit from the highest Feed-In Tariff (FIT) before the rate was slashed by over half.

I hadn’t really given the panels a lot of thought since then. I submitted meter readings every three months, and a few days later a handy, tax-free payment appeared in the bank account.

In March 2019, though, I had a couple of builders doing repairs to the woodwork around the eaves. This was an awkward job that involved having scaffolding put up. Anyway, one of the builders (a guy I have known for several years and trust) asked if I would like the panels cleaned while they were up there. “They’re filthy,” were his exact words.

He quoted me £60, which seemed a good price, and clearly it made sense to have the work done while they were there and the scaffolding was up. They gave the panels a thorough clean, using large sponges and buckets of warm water with washing-up liquid.

I was intrigued to see how much difference this would make to the amount of electricity the panels generated, so I downloaded a free program called Sunny Explorer that works with my solar PV system. It communicates with the inverter (the device that turns the electricity generated by the panels into usable power) via Bluetooth to show how much electricity your panels are producing. And, thankfully, it shows historical data going right back to when the panels were first installed.

Monitoring Solar Panel Performance

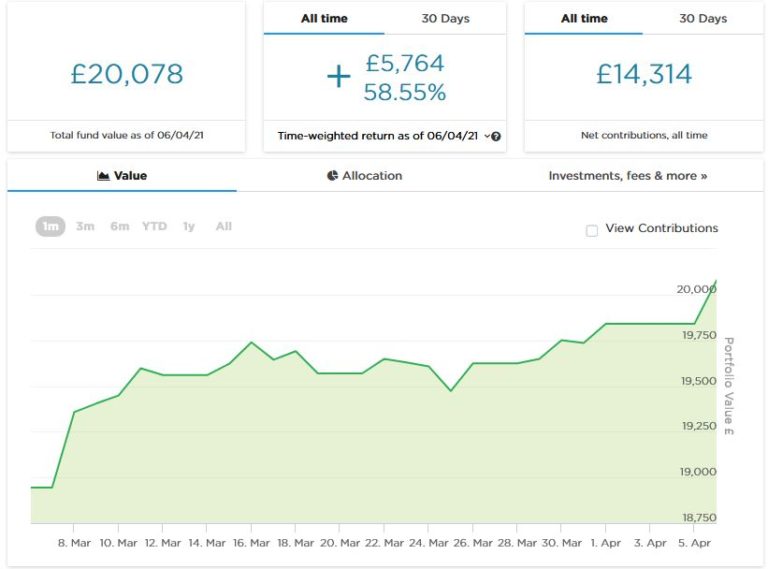

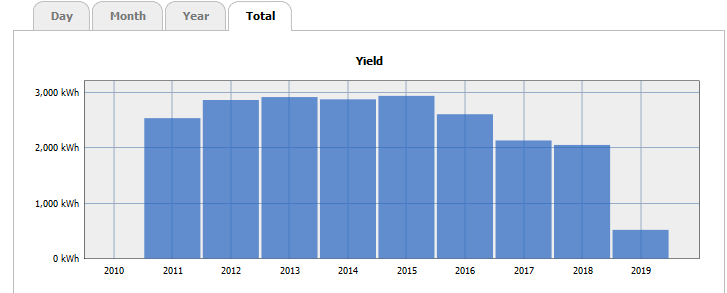

I found the data from Sunny Explorer genuinely eye-opening. First, take a look at this chart showing the total amount of electricity generated by my system year on year since the panels were installed.

As you can see (bearing in mind the panels weren’t installed till April 2011), for the first five years the total power output was pretty consistent. Then in 2016 and 2017 it dropped quite substantially, and again by a smaller amount in 2018, even though that summer was one of the hottest, driest on record. Obviously, if I was being scientific I would compare the total number of sunny days in each of those years, but I think it’s safe to assume that from 2016 onwards the build-up of dirt on the panels began reducing their efficiency.

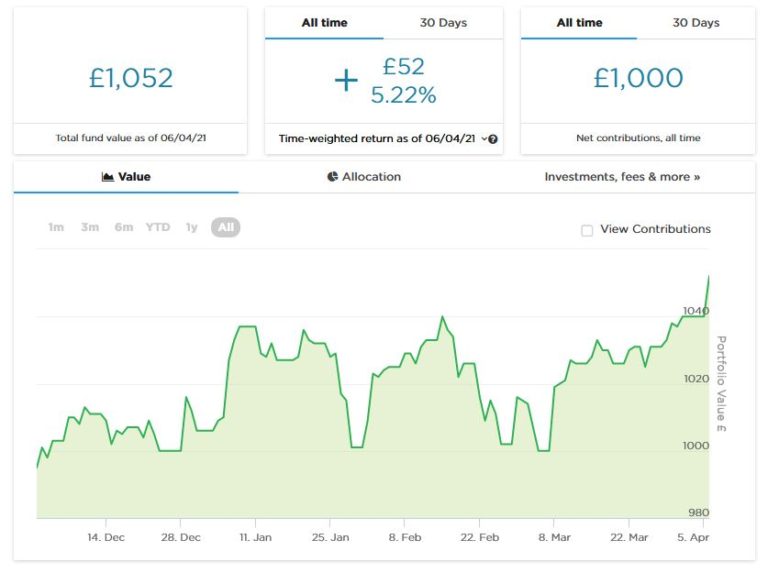

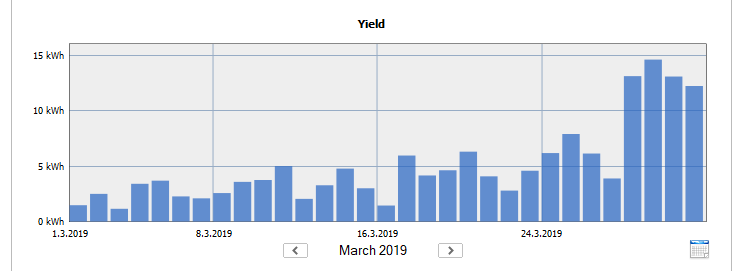

Now take a look at the monthly chart for March 2019. Can you guess what date the panels were cleaned?

Full marks if you said 27th March. The power generation was quite low that day as the panels weren’t cleaned until the afternoon, and obviously they had to be switched off while the cleaning was going on (the builders actually forgot to switch the system back on before they left, but I’ll forgive them that). Notice how much more power the panels generated in the last four days of the month, though.

2021 Update

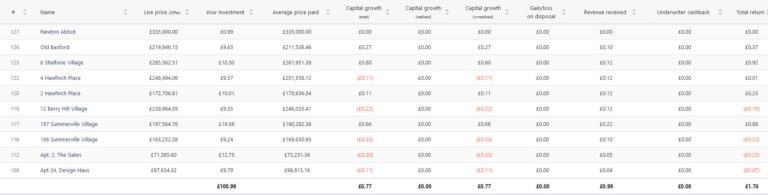

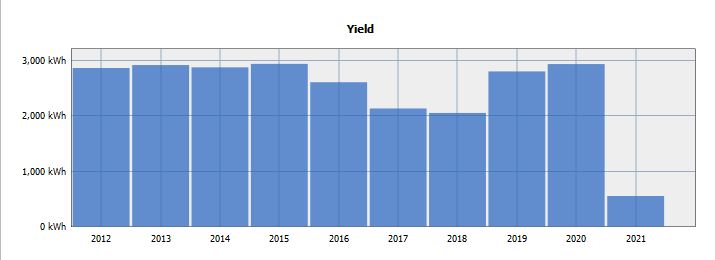

Two years on, here is a chart showing how much electricity my panels have been producing year on year. Remember, they were cleaned in March 2019.

As you can see, in 2019 and 2020 my panels were back generating at the same level they had been prior to 2016. And neither of these years featured exceptional amounts of sunshine. Obviously as it’s only mid-April now the total figure for 2021 is lower, but from comparing the month-by-month figures from previous years it is clear that they are still working well.

If I hadn’t had the panels cleaned it’s likely that their electricity production would have continued at the 2018 level (and probably lower). As it was, in 2019 and 2020 they generated an extra 1,700 kwh compared to the 2018 level, worth about £850 to me in financial terms. So that £60 I paid to have them cleaned was a very good investment!

Overall, I think the lesson from this is that it’s well worth monitoring the performance of your panels, and having them cleaned if you notice it is declining. When our panels were installed we were told that they were ‘self cleaning’ due to the amount of rain we get in the UK, but that clearly wasn’t sufficient in my case anyway!

More Top Tips

- I used the free Sunny Explorer software to monitor my system. This works with inverters made by SMA Solar Technology. If you have a different make of inverter it may not work for you, but there should be some other way to check your system’s performance. Ask your installer if in doubt.

- If you have trees nearby (as I do) there will probably be more birds around, and over time their droppings are likely to build up on your panels and reduce their efficiency. While dust generally washes off with a good rain shower, bird droppings may not.

- Before cleaning or inspecting solar PV panels, it is essential to switch them off via the main isolating switch (in my home it’s a bright red switch next to the solar power meter). Failing to do so could result in a severe electric shock.

- If you cannot safely access your panels to clean them, hire a professional to do it. Don’t get up on the roof yourself unless you have the necessary training, expertise and equipment.

- A good solution for cleaning solar panels that can avoid the need for going up on the roof is a water-fed pole with a soft brush, combined with a squeegee. Avoid using abrasive tools or products in case you scratch the glass.

- Avoid cleaning your panels when the weather is hot, as spraying cold water on very hot panels could cause smearing or even damage them. Instead try to clean the panels in the morning or evening or on cooler days.

- Based on my experience, it may not be necessary or cost-effective to clean your panels every year, but every three to five years could be a good strategy. In any event, monitoring the output of your panels will help you decide.

Good luck, and I hope your solar panels are soon working at peak efficiency again!

If you have any comments or questions about this post, as always, please feel free to post them below.

This is an update of my original 2019 post.