How Much Difference Does Risk Level Make With Nutmeg Investments?

Regular readers will know I’m a big fan of the Nutmeg robo-advisor investment platform.

You can read my full review of Nutmeg here. You can also see how my own Nutmeg stocks and shares portfolio has been performing over the last year or so in my monthly Coronavirus Crisis updates (here’s my latest May 2021 update).

Table of Contents

Nutmeg Risk Levels

One of the many things I like about Nutmeg is that you can choose the risk level for your portfolio and any pot within it. In the case of a fully managed Stocks and Shares ISA such as mine, you can choose between risk levels of 1 (ultra low risk) and 10 (highest risk).

- With other investment products and styles on Nutmeg, the scale may be different. For example, with a Smart Alpha portfolio, the risk range you can choose is between 1 and 5.

In the case of my main portfolio, I set the risk level near the top of the scale at 9/10 and have kept it there since I opened my account in April 2016. I felt I could afford to be bullish, as I don’t have any living descendants (my partner Jayne passed away a few years ago and we didn’t have children). And I didn’t have any particular purpose in mind for this portfolio, so was willing to take a few more chances with it.

As regular PAS readers will know, my Nutmeg ISA has performed very well for me. At the time of writing it is showing an overall profit of 57.71 percent, even after a tumultuous year due to Covid.

Recently, however, a reader named Kevin asked if I knew whether the high risk level I chose had any impact on my return, or whether I would have had a similar return with a lower risk level. It was a good question and one I hadn’t really looked into before, so I decided to check. I have to admit the results surprised me.

Researching Performance

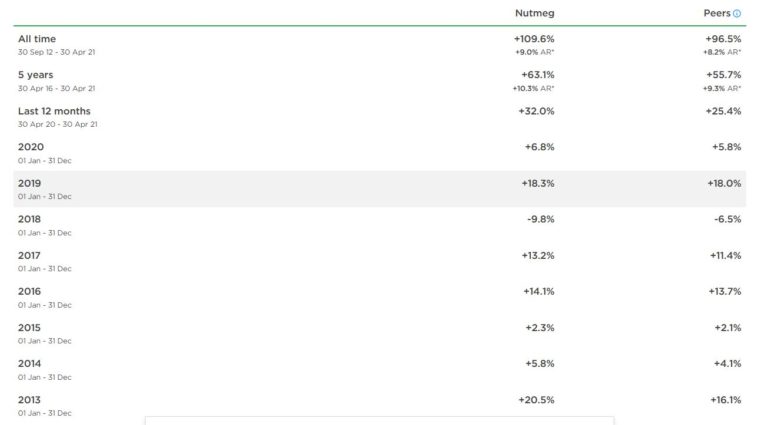

For a fully managed Nutmeg stocks and shares portfolio like mine, the good news is you can can research performance yourself on this page of the Nutmeg website: Use the slider to set the risk level from 1 to 10 and you will be able to see the net returns for the risk level in question over a range of periods. Here are the figures for a 9/10 portfolio such as mine.

As you can see, for the five-year period to 30 April 2021, overall performance is quoted as +63.1%. That is slightly above the +57.71% currently showing for my portfolio over a similar (but not identical) period. There are various reasons why the figures may differ, notably that I added to my investment at various times over the last five years rather than investing one lump sum at the start. But the numbers are close enough to appear reasonable to me.

As you will see, even though this is a level 9 portfolio, in every year bar one (2018) it has produced a positive return. Anyone investing in a level 9 portfolio from Nutmeg’s launch in September 2012 will have seen the value of their portfolio more than double.

So What About Lower Risk Portfolios?

Obviously I am not going to reproduce the table above for every other risk level. Here though is a table showing the five-year performance of every fully managed Nutmeg stocks and shares portfolio from risk level 1 to 10.

| Risk Level | 5-Year Performance % |

|---|---|

| 1 | +1.7 |

| 2 | +11.1 |

| 3 | +17.2 |

| 4 | +23.5 |

| 5 | +31.2 |

| 6 | +37.0 |

| 7 | +47.4 |

| 8 | +55.9 |

| 9 | +63.1 |

| 10 | +67.0 |

I hope you will agree this makes interesting reading. Over a five-year period, as you can see, risk level has made a huge difference to performance achieved. Anyone choosing risk level 1 will have seen a return of just 1.7% over that period. That looks poor to me – you would almost certainly have done better putting your money in an ordinary bank savings account. And there were actually two years – 2017 and 2018 – when the value of a level 1 portfolio went down. Okay, it was only by small amounts, but even so it is hard to see any good argument for opting for the lowest risk level .

By contrast, the higher up the risk scale you go, the bigger the returns have been. Yes, there has been more volatility, but even so over most time periods – and certainly when investing for at least five years – higher risk portfolios have significantly out-performed lower-risk ones.

Of course – as I always have to say – past performance is no guarantee of what happens in future. Even so, looking at these figures makes me glad I opted for a high risk level initially, and having done this analysis I intend to continue doing so. I may even raise my risk level to the maximum 10!

- One other thing I should mention is that if you are thinking of withdrawing money from your Nutmeg account soon (in the next few months, say) there is then a strong case for reducing risk level. This should help protect your capital in the event of a downturn.

Nutmeg’s Flexible Options

As I said to Kevin – who has a level 6 portfolio – if you are happy with the returns you are getting from Nutmeg and increasing the risk might cause you sleepless nights, there is of course a case for not rocking the boat.

But if you want to test the water without risking too much, Nutmeg does offer a few options. For example, you could create a new ‘pot’ with a higher risk level to see how it compares going forward. You could use new money for this and/or transfer some of your existing pot over. You don’t have to switch your entire portfolio to a higher risk level if this would worry you.

You can also have pots with different investment styles. In my case, as well as my fully managed main portfolio, I have a small Smart Alpha portfolio (mentioned earlier). As discussed in this blog post, Smart Alpha portfolios are managed by J.P. Morgan’s Asset Management team. As well as allowing Nutmeg investors to tap into the expertise of this leading investment house, these portfolios are ESG integrated, meaning that environmental, social and corporate governance considerations are factored into every investment decision. These portfolios are therefore suitable for investors for whom ethical considerations are especially important.

You can have multiple pots with different risk levels and/or investment styles. You can also change risk levels or investment styles any time you like. Nutmeg does just caution about chopping and changing too often, as this can incur additional charges. But there is no reason you shouldn’t take advantage of the flexibility Nutmeg offers if your needs or circumstances change or you just want to try something different.

- It’s also worth mentioning that you are only allowed to invest in one tax-free ISA of each type per year (stocks and shares ISA, IFISA, cash ISA, etc.). However, if you have a Nutmeg account, you can invest in as many different pots within that ISA as you wish (as long as you don’t exceed your total annual ISA allowance of £20,000). This can provide valuable diversification compared with putting all your money into one single investment product.

Conclusion

As I said above, I was genuinely surprised to see how big a difference risk level made to overall performance with a Nutmeg Fully Managed Stocks and Shares ISA. And obviously I’m glad I opted for a high risk level initially, as doing so has clearly paid off for me.

Of course, nobody knows what will happen in the months and years ahead. It is still possible that opting for a lower-risk portfolio could prove a good decision as we move into a post-pandemic world with all its uncertainties. But personally I hope to see a strong economic recovery and am willing to accept a reasonable degree of risk in order to capitalize on this. You might see this differently, of course. But I hope that at least comparing the historical performance of portfolios at different risk levels will help you decide how best to proceed, whether you’re new to Nutmeg or an existing investor.

Bonus Offer

I am obviously a fan of Nutmeg and have a significant amount (by my standards!) invested with them. You can read my full review of Nutmeg here if you like..

Of course, I am not a qualified financial adviser and everyone should do their own ‘due diligence’ (and/or take professional advice) before deciding to invest. In addition, you shouldn’t consider investing with Nutmeg (or anyone else) unless you have paid off any interest-charging debts and have at least three months of easily-accessible savings in case of emergencies.

Based on my personal experiences with Nutmeg, though, I am happy to recommend them. They provide a simple, easy-to-understand investment platform, the customer service is excellent, and certainly in my case the results to date have exceeded my expectations.

In addition, if you are considering investing with Nutmeg, you might like to know that if you click through this link you can get six months’ free portfolio management when you invest. I will also receive a bonus for introducing you. Just enter your email address on the page that opens for further details, without any obligation.

If you have any comments or questions about this post or Nutmeg in general, please do leave them below.

Disclosure: This post includes referral links. if you click through and open an account with Nutmeg, I will receive a commission for introducing you. This will not affect in any way the product or service you receive. Indeed, as mentioned above, it will entitle you to six months’ portfolio management entirely free of charge. All investments carry a risk of loss.

May 14, 2021 @ 11:21 am

It is amazing how much difference it can make changing the risk level, but you’re right you have to feel comfortable going for a higher level if you want to take more risk x

May 14, 2021 @ 12:39 pm

Thanks, Rhian. Yes, this is something every Nutmeg investor needs to think carefully about, but it does illustrate the huge difference risk level can make to performance.

May 16, 2021 @ 6:53 am

I am afraid I don’t know more about investing, so it’s nice to see that there are ways to mitigate risks. I will look more into this, as it seems that you are very happy with nutmeg.

May 16, 2021 @ 7:00 am

Thanks, Anca. Yes, Nutmeg has definitely been one of my better investments!

October 12, 2021 @ 11:14 am

Nick, Thanks for following up my query in this post. Following my last correspondence i did very slightly raise my risk level on my Nutmeg account to 7. It hasn’t as yet had any noticeable difference – but my investment isn’t even a year old. But it is running at 5.55% time weighted return – which seems OK to me.

Interestingly, i read a post on an other forum who said that Nutmeg rarely goes over 7% per annum interest and they didn’t like it on that grounds. They recommend a multi asset fund instead such as Baile Gifford. I would have to do some research on those kind of products though.

October 12, 2021 @ 11:53 am

Thanks, Kevin. All equity investments have had a rocky time over the last few weeks, so I wouldn’t judge performance based on that short period. Indeed, you shouldn’t really judge any stock market investment over less than a year or two. I would have to disagree with that comment you read about Nutmeg, though. For a risk level 9 portfolio like mine, the overall rate of return over the last 5 years has been 63.1%, which by my calculation represents an average rate of return of over 12% a year. A risk level 7 portfolio has achieved a five-year rate of return of 47.4%, representing an average annual return of over 9%. Of course, some years will have been more profitable than others, but these should be regarded as medium- to long-term investments and judged on that basis. I am sorry I don’t have any personal knowledge of Baillie Gifford multi-asset funds but I wish you every success if you decide to try them. I am sticking with Nutmeg, though!

October 12, 2021 @ 12:27 pm

Thanks – good advice in terms of the short duration of my investment.

You mention the recent volatility of equity investments, it does raise the question that when you come to withdraw funds or close an account does Nutmeg wait/choose its moment to sell funds at the best market point? Or do they just automatically sell them and the investor takes the risk? And potentially loses money. If the latter an investor is going to need to be less passive and aware of the market at that point.

October 12, 2021 @ 1:30 pm

No worries. You can (of course) see the value of your portfolio at any time on the Nutmeg website. If you choose to sell up, Nutmeg will do this for you within a day or two. It is of course possible that by then the value of your portfolio may have changed a bit, for better or worse. So yes, if you are thinking of selling up it is important to be aware of what is going on in the markets at that time. The same would apply with any investment fund, though. Unlike a single company share, where you can set a particular price for selling or buying with your stockbroker, with pooled funds which are typically composed of holdings in a wide range of shares, ETFs, bonds, etc, once you have placed your sell order, you get whatever your investments are worth when the sale goes through.

October 17, 2021 @ 11:19 am

Thank you for the great post and that investment planning advice. It was incredibly detailed and really helpful..

October 19, 2021 @ 8:28 am

Many thanks for the kind comment, Philip.