My Coronavirus Crisis Experience: July Update

Regular readers will know that I have been posting about my personal experience of the coronavirus crisis since lockdown started (you can read my June update here if you like).

In what I hope will be my final update, I thought I would discuss what has been happening with my finances and my life generally over the last few weeks. As previously, I will start with the money-related stuff…

Financial

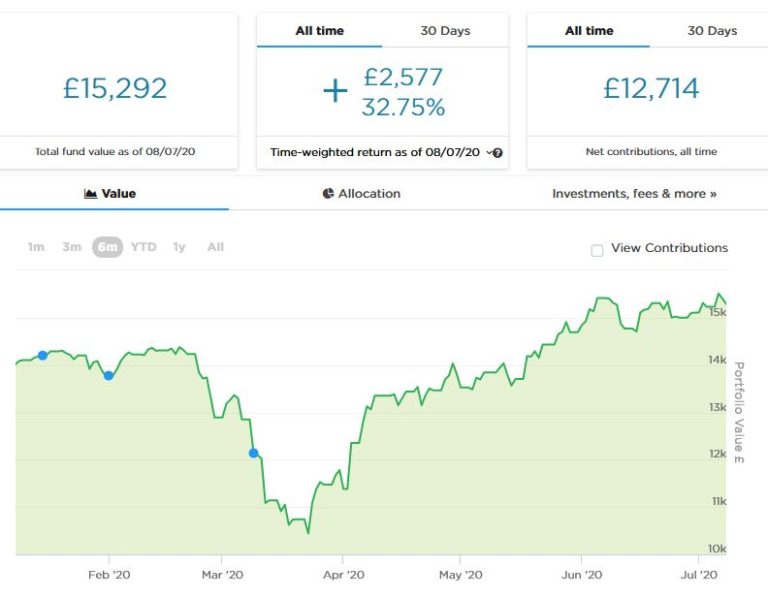

Overall things haven’t changed dramatically since my update last month. Here’s the latest chart showing how my Nutmeg stocks and shares ISA is faring…

As you can see, my ISA made a good recovery after losing over a third of its value in March (admittedly I helped things along by investing another £1,000 when the markets were near their lowest point). In the last few weeks things have plateaued somewhat, though the overall trend is still upward. Allowing for the extra £1,000 invested in March, my portfolio is now back at the level where it was before the crisis started.

Assuming there is no major second wave of the virus – and there has been little sign of that so far – I am hopeful the recovery will continue over the longer term. Of course, there are likely to be bumps along the way, and in the short term at least we face the likelihood of a recession. Even so, I am keeping my fingers crossed for a recovery over the next year or so, and am continuing to invest cautiously where I see value. I haven’t put any more money into my Nutmeg ISA yet but definitely plan to. I may, though, take the opportunity to reduce my risk level (which is easy to do from the Nutmeg dashboard). Do take a look at my in-depth Nutmeg review if you haven’t already.

My monthly payments from my two Buy2LetCars investments (totalling around £420) continue to appear in my bank account every month like clockwork. I was initially wary about this, as it is obviously a bit outside the usual range of investments. However, I have had no issues at all, and am glad also to be supporting key workers by providing reasonably priced transport for them.

Again, if you’d like to learn more, you can read my review of Buy2LetCars here and my more recent article about the company here. Obviously the minimum investment is £7,000 so this opportunity isn’t going to be for everyone – but if I had that sort of money burning a hole in my pocket right now, I wouldn’t hesitate to invest through them again. Each car generates a monthly income, with a large lump sum at the end of the three-year term. Interest rates range from 7 to 12 percent per year.

My other equity-based investments generally are doing about as well as could be expected in the circumstances and in some cases better. In particular, my Bestinvest SIPP hasn’t lost any significant value when you allow for the fact that it’s in drawdown and I am currently withdrawing £200 a month from it. I’m not claiming any special skills as a stock picker, but having a broad range of funds in my portfolio has undoubtedly served me well. Years ago, also, I decided to invest some of my pension money in specialist healthcare funds, and these have done better than average over the last few months 🙂

On the property crowdfunding side, the picture isn’t so rosy. A number of my property investments still seem to be stuck in limbo, though I did hear from The House Crowd that they had received an offer for a house in Liverpool in which I invested £1,000 six years ago (pictured below).

The offer was for slightly less than the original purchase amount, but nonetheless the investors (including me) voted by a clear majority to accept it. So I will get a bit less than my original £1,000 back, though when you add in the dividend payments (from rent) since I first invested, I should be slightly up overall. But that’s before you allow for inflation, of course!

I am hoping that the Stamp Duty holiday announced by chancellor Rishi Sunak this week will help get the housing market moving and maybe ‘unstick’ some of my other property crowdfunding investments that have been on hold for a while. In retrospect I probably let my enthusiasm for the property crowdfunding concept run away with me a bit in the past. Overall I have still made some money from these investments, but not as much as I hoped or expected. And I still have a fair-sized sum tied up in properties I really expected to be sold by now. I do still think property crowdfunding can merit a place in people’s portfolios, but would advise diversifying as much as possible across platforms and properties. And definitely don’t invest money you might need any time soon!

Finally on this subject, I would just say that I exclude property loan investment platform Kuflink from the criticisms above. All of my investments with them have been doing well. Although there was a short delay with one loan, it has now been repaid (with added interest). Kuflink are adding new investment opportunities to the platform most days and I have been investing modestly in them, along with loan portions that have just a few months left to run via the Kuflink Marketplace. See my Kuflink review here for more information. Their up-to-£4,000 cashback offer for new investors is still open, incidentally.

- One other thing I have mentioned before is that I have a few invitations available for an unusual sideline-earning opportunity based on matched betting. I have been asked not to divulge too many details about it on the blog for very good reasons I will explain privately to anyone who may be interested (and no, it’s not illegal!). What I can say is that it doesn’t require any financial outlay, is entirely hands-off, and will provide an income of £50 a month. No knowledge of betting is required, and you won’t have to place any bets yourself. Just note that the opportunity is only open to people who haven’t done matched betting before and have no more than two accounts already with online bookmakers. For more info (and receive a no-obligation invitation) drop me a line including your email address via my Contact Me page 🙂

Personal

As I’ve said before, I live on my own since my partner, Jayne, passed away a few years ago. I am lucky to live in a fairly large house with a good-sized garden, so being mostly confined to home hasn’t been as big a challenge for me as I’m sure it has for some. Also, I am well used to working from home, having done this for the last 30 years or so.

Nonetheless, the ongoing nature of the crisis is undoubtedly taking its toll on me. Every day seems so similar it is starting to feel like Groundhog Day. And while that is one of my all-time favourite movies, I definitely don’t want to live in it myself. Mind you, I saw someone on Twitter compare their experience of lockdown at home with the Overlook Hotel in The Shining. At least I wouldn’t claim it’s as bad as that!

So far as work is concerned, as you may know I’m a semi-retired freelance writer and editor (age 64). I’ve had very little work since the lockdown started, and was duly grateful to receive some financial support from the government’s SEISS scheme. I have, though, been keeping myself busy (and sane) with this blog and – as you may have noticed – have enjoyed quite a productive period. I ran out of inspiration a bit this week, but hopefully that is just a temporary blip.

I am still available for freelance writing, editing or proofreading work, although I am not taking on book-length projects any more. Feel free to drop me a line if you think my services might be of interest to you 🙂

Life generally is changing now as – touch wood – the worst of the pandemic appears to be behind us. The experience of shopping is still evolving and I guess it will be many months before it is entirely back to normal. I haven’t yet been to any ‘non-essential’ shops, but at my local Morrisons supermarket it feels a bit more relaxed. I would say only about a quarter of people are wearing masks or other face coverings now. I was wearing a bandana over my nose and mouth but have mostly stopped that unless I find myself surrounded by other shoppers. Of course, in England face coverings are now compulsory on public transport, so I will be keeping my bandanas washed and ready for that.

UPDATE: Just heard that the government is considering making the wearing of face-masks in shops in England compulsory. I find that bizarre at a time when – apart from a few local outbreaks – the virus is waning rapidly. It also sends out a mixed message at a time when the government is encouraging people to eat out, obviously not wearing masks. And the evidence in favour of wearing masks in public is weak anyway. Personally I really hope.the government refrains from doing this.

Many pubs are open again now. I walked past my nearest, The Drill, on Sunday afternoon. It all looked quite continental, with people sitting at tables outside and waitresses going in and out with trays of beer and other drinks. There was a happy buzz of conversation and laughter. The only less cheerful note was struck by the manager standing by the door with a clipboard, presumably taking the contact details of people as they arrived for contact-tracing purposes. I wasn’t tempted to go in myself, though I don’t rule out going for a drink and a meal soon, maybe taking advantage of the government’s £10 off vouchers 🙂

I am still looking forward to my short break in Minehead in September, which I booked before this crisis happened. I am also mulling over whether to try to book a couple of days away in August. I worked out the other day that I have been to Wales every year for over 30 years, and it would be a shame to break that long run in 2020. Llandudno or Aberystwyth could both be contenders.

I am still working my way through my box sets of Deep Space Nine and Bergerac. With the latter, it’s quite interesting to see how mobile phones evolved as the series was made. In the earliest episodes I guess they didn’t exist at all, and Bergerac’s office generally seemed to know telepathically where he was and phoned him at his father-in-law’s or wherever. Later on car phones make an appearance, and then house-brick-sized mobiles with aerials sticking out of them. Ah, the nostalgia!

I am trying not to spend too much time on social media as I know it’s bad for my mental health. There are a few people I follow regularly on Twitter and and enjoy hearing from, though. Last time I mentioned Professor Karol Sikora, a well-respected cancer specialist with a doctorate in immunology. Many people, including me, have found him a beacon of hope amid all the negativity, with his generally positive and optimistic view (though still informed by science and statistics). He doesn’t have a political axe to grind and is willing to give the government credit for things they have done well and criticize things they have done badly. If you want one person to follow for unbiased news about the pandemic with a measure of hope for the future, I highly recommend checking out his Twitter page.

Lately I’ve also been enjoying reading the posts of Scottish blogger Effie Deans (who blogs as Lily of St Leonards). She is a Scottish academic who has a lot of interesting things to say about nationalism, education, culture, and more. You may or may not agree with all her views; but if you want an interesting and genuinely thought-provoking perspective on events from someone who isn’t afraid to challenge current orthodoxies, I highly recommend checking out her Twitter page and blog.

To end on a positive note, I am looking forward to having my hair cut for the first time in four months next week. I’ve actually quite enjoyed revisiting my long-haired student days, but enough is definitely enough! I am also looking forward to going swimming again after it was announced that outdoor pools can reopen from tomorrow and indoor pools a fortnight later. The David Lloyd Leisure club I belong to has both indoor and outdoor pools, so I am waiting to hear whether they will be opening the outdoor pool immediately or whether I will have to wait a bit longer till both pools can reopen. (UPDATE – Now heard I have to wait another fortnight 🙁 )

So that has been my experience of the coronavirus crisis to date. I do of course appreciate that I am in a fortunate position compared with many others, and hope you and your family are coping in these strange and worrying times. Here’s hoping that things continue to improve and we can all return in due course to something approximating normal life.

As ever, I’d love to hear your thoughts and experiences. If you have any comments or questions, as always, please do post them below.

Disclaimer: I am not a registered financial adviser and nothing in this post should be construed as personal financial advice. You should always do your own ‘due diligence’ before investing and seek advice from a qualified financial adviser/planner if in any doubt how best to proceed. All investments carry a risk of loss.

July 10, 2020 @ 4:10 pm

I am always fascinated by stocks and shares portfolios, even though I don’t have any and have never invested, but your graph made me suck my breath in for April 2020 with that drop!

July 10, 2020 @ 5:22 pm

Thanks. Yes, that was a worrying time to say the least!

July 11, 2020 @ 4:57 pm

I just heard about the ‘mask’ in shops – so much is so confusing and makes no sense – so do they provide masks that are ‘right?’ – anyway that aside – seems like you made some strategic and self-supportive choices during the crisis – which is clever and inspirational to read!

July 12, 2020 @ 9:10 am

Thanks for the comment. At the moment it’s just a proposal and personally I hope it doesn’t happen. If it does, it will presumably be down to individuals to provide their own face coverings. Shops may or may not offer them for customers, and are likely to charge for them if they do. The evidence on the benefits of wearing masks/face coverings in public places is weak, and many people don’t use them correctly, which could actually increase the risk of transmitting the virus. So yes, I am very sceptical about this proposal!