Survey Sheds New Light on How People Choose Life Insurance

Today I am sharing some interesting data from my friends at HSBC regarding how British people choose life insurance.

This information comes from an online survey of over 2,000 people in the UK conducted on behalf of HSBC Life Insurance. It provides some interesting insights into who is – and isn’t – getting life insurance, and their reasons for doing so.

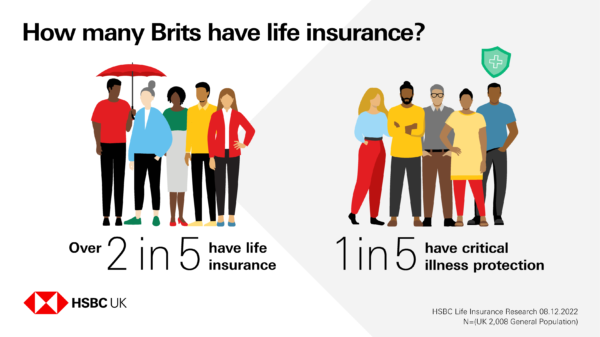

As you can see from the graphic below, the study revealed that more than two in five people in the UK have life insurance (43%), with another one in five (20%) saying they have critical illness protection. The latter provides protection (generally in the form of a one-off tax-free payment) if you become seriously ill or injured. It is typically purchased in addition to life insurance.

Financial worries are a key factor for those Brits who have researched their options but still decided against getting life insurance. One in two (50%) who’ve considered getting a policy but decided not to go ahead say that it’s because they’ve had to tighten their belts.

Table of Contents

Reasons for Choosing a Policy and a Provider

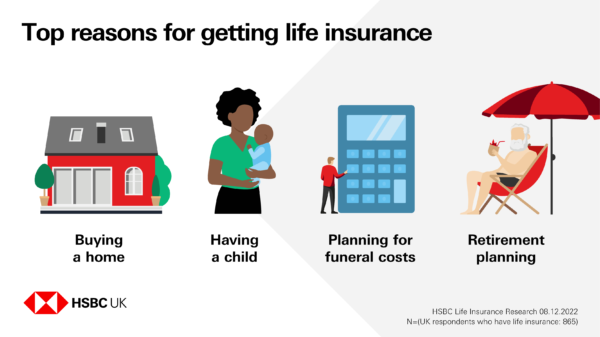

Brits with a policy said the primary reasons they got life insurance were: buying a home (19%), having a child (14%), planning for funeral costs (10%) and retirement planning (9%).

Perhaps surprisingly, people with long-term partners were more likely to say they had a single (54%) than a joint (42%) policy. Those couples who had a joint policy were most likely to say the main reason they chose it was simplicity (37%), followed by “level of cover” (30%) and budget (19%).

The biggest driver for those with life insurance or those who had considered purchasing it in the past two years was price (25%), closely followed by trust in their chosen provider (18%), and confidence that a claim would be paid (13%).

Understanding of Terms

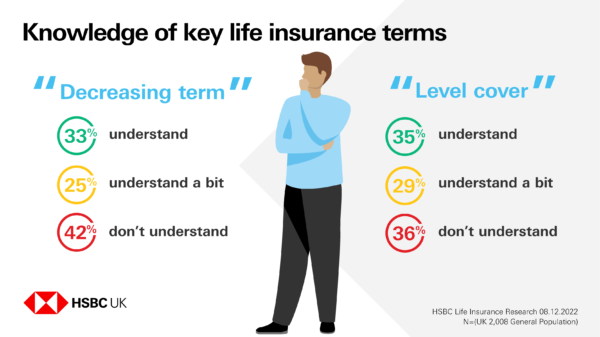

When it comes to key terms relating to life insurance, only around a third of people in the UK say they fully understand the phrases “level cover” and “decreasing term”.

More than two in five Brits (42%) say they don’t know what “decreasing term” means, and more than one in three (36%) don’t fully understand “level cover”.

- Both of these terms (and others) are explained in my blog post Do You Need Life Insurance?

Most people (53%) say they think “level cover” is the most important consideration when choosing which life insurance policy to purchase, after the terms were explained to them.

Purchase Preferences

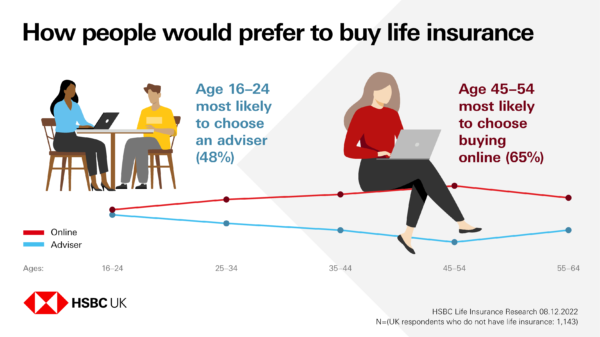

People in the UK who have life insurance are pretty evenly split when it comes to how they bought it, with 49% purchasing through an adviser and 47% completing their transaction online.

And overall, those without any cover are more likely to say they’d buy online if they did decide to purchase a policy (58%), compared with through an adviser (40%).

But there are some interesting differences in age – with nearly half (48%) of 16-24-year-olds without insurance saying they’d prefer to use an adviser, more than any other age group. Meanwhile the 45-54 age group were the most likely to say they’d go online (65%).

Closing Thoughts

Many thanks to my friends from HSBC for allowing me to share and discuss their data and graphics.

Nobody would pretend life insurance is an exciting subject, but in these uncertain times it’s something we all need to think about, cost-of-living crisis notwithstanding. Life insurance protects your loved ones financially if you die. It can help minimize the financial impact that your death could have on your family and provide peace of mind for you and them.

Most life insurance policies are designed to pay a cash sum to your loved ones if you die while covered by the policy. This can help them cope with everyday money worries such as mortgage payments, household bills and childcare costs. It may also cover funeral costs. You can take out life insurance under joint or single names, and you can pay your premiums monthly or annually.

I discussed this subject in more detail in my blog post Do You Need Life Insurance? (mentioned earlier) and I recommend checking this out if you haven’t already. You may also want to speak to a personal financial adviser to find out more about life insurance and what might be the best option for you.

As always, if you have any comments or questions about this post, please do leave them below.

Disclaimer: I am not a professional financial adviser and nothing in this post should be construed as personal financial advice.