Ways to Prevent Scams From Reducing Your Savings

Sadly scams of all kinds are on the rise at the moment, with older people especially vulnerable to them. Read on for some top tips on how to spot attempted scams and keep your money safe.

Scams are a growing problem in the UK, with millions of people being taken advantage of each year.

From fake investment schemes to phishing e-mails, scammers are constantly finding new ways to trick unsuspecting individuals into giving away their money or personal information. The financial impact of scams can be devastating, leaving victims with empty bank accounts and a damaged credit rating.

Over 12% of UK consumers have fallen victim to payment fraud over the past four years, with an estimated £1.2 billion lost to scams in 2021 alone. With so many people having their savings impacted by fraud, it’s crucial to know how to protect yourself.

This article will set out four practical ways to prevent scams from reducing your savings.

Be cautious of unsolicited phone calls, e-mails and text messages

Scammers often use the promise of quick and easy money to lure people into their schemes. They do this through unsolicited phone calls, e-mails and text messages. Elderly people are particularly vulnerable to these monetary scams as they may not have the same level of technological literacy to spot one. However, anyone can easily fall into this trap as scamming methods grow increasingly sophisticated.

To protect your savings, you must not disclose your personal or financial information if you receive suspicious communication. You can also report dubious messages to the Information Commissioner’s Office, which has the power to take enforcement action against those involved in the scam.

Use strong passwords and security features

The government’s Cyber Aware campaign was launched in 2021 in response to growing scam and cybercrime incidents in the UK. One central piece of advice from the campaign is to use strong passwords and security features to prevent scammers from gaining access to your bank accounts.

For example, you can use a combination of letters, numbers and symbols on passwords to make them difficult to crack. Two-factor authentication provides another layer of protection by requiring a second form of verification in addition to your password. These two measures can significantly reduce your risk of falling victim to a scam that can empty your savings accounts.

Familiarise yourself with the technology used by merchants

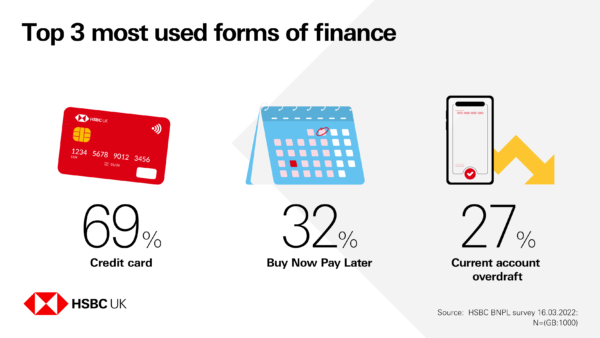

As technology continues to evolve in the UK, so do the methods scammers use to steal your hard-earned savings. One way to protect yourself is to understand the methods used by merchants for their transactions.

Case in point, mobile card machines are commonly used by restaurants, cafés and pubs to process payments on the go. These devices are held to compliance standards like the Payment Card Industry Data Security Standard or PCI-DSS, which ensures that the machine follows protocols to protect cardholder data. Similarly, online merchants use virtual payment terminals to process payments online. Because shopping fraud schemes are on the rise in the UK, familiarising yourself with the technology merchants use can ensure you only interact with trusted businesses to keep your savings safe.

Choose banks with comprehensive fraud protection

In the UK, many banks offer fraud protection services as a standard feature. However, it’s still important to do your research and check that the bank holding your savings has the necessary fraud protection measures.

The Financial Ombudsman Service website offers resources regarding local banks’ anti-fraud policies. Additionally, you can check for your bank’s participation in the ‘Confirmation of Payee’ scheme. This initiative aims to protect customers from Authorised Push Payment scams, a type of fraud that tricks consumers into making a payment to a scammer. Banks participating in this scheme can check the recipient’s name against the account details provided by the customer and ensure the money is being sent to the correct person.

Scams can have a devastating impact on your savings—the fruit of your hard work. By taking the preventative measures outlined in this article, you can be vigilant and reduce your risk of being conned by one.

As always, if you have any comments or questions about this article, please do leave them below.

This is a collaborative post.