My Coronavirus Crisis Experience: January 2021 Update

Happy New Year! Here’s hoping it’s a better one for all of us than the year just past 🙁

I shall be continuing my monthly coronavirus crisis updates in 2021, at least till we are clearly over the pandemic and something resembling normal life has resumed. Obviously I very much hope that will be sooner rather than later.

Regular readers will know I have been posting these updates since the first lockdown started in the spring of 2020 (you can read my December 2020 update here if you like).

As ever, I will begin by discussing financial matters and then life more generally over the last few weeks.

Financial

I’ll begin as usual with my Nutmeg stocks and shares ISA, as I know many of you like to hear what is happening with this.

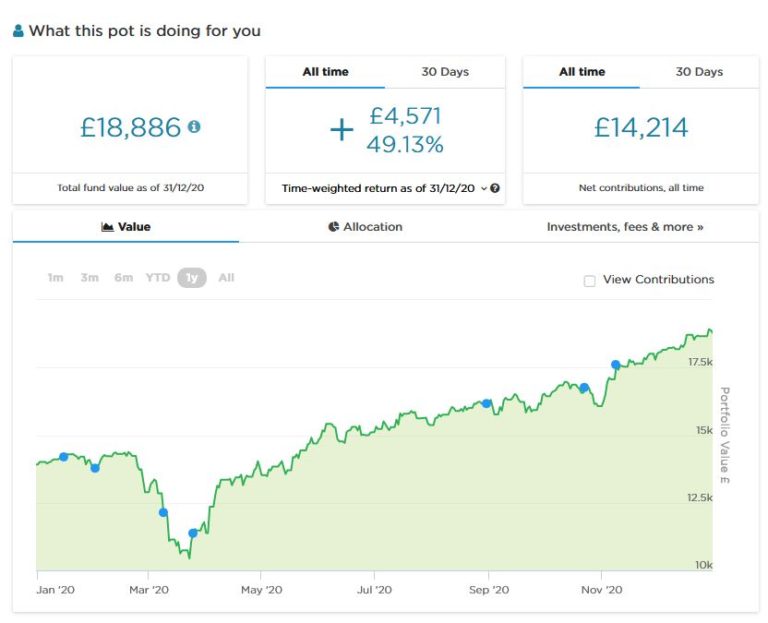

As the screenshot below shows, since last month’s update my main portfolio has continued on a generally upward trajectory and is currently valued at £18,886. Last month it stood at £18,008, so it has gone up by over £800 in value since then. Considering national and world events at the moment, I am more than happy with this.

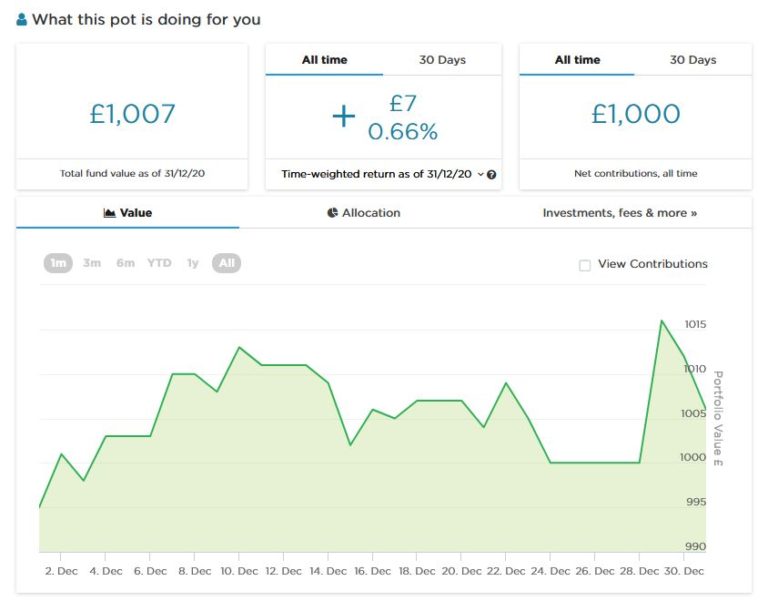

As you may recall, about a month ago I put £1,000 into a second Nutmeg pot to try out Nutmeg’s new Smart Alpha option. This pot has risen as high as £1,015 in value and currently stands at £1,007. Here is a screen capture showing performance to date, though obviously it is far too early to draw any conclusions from this.

You can see my in-depth Nutmeg review here (including a special offer for PAS readers). As a matter of interest I was recently asked by Nutmeg to contribute an article about my investing journey for their blog. I will add a link to the article here once it is published.

I had some bad financial news last month from Crowdlords, one of the property crowdfunding platforms I invested with. Three years ago I put £3,000 into a development project to build what was originally described as six eco-homes (it has lately been known more prosaically as Kennington Road). An update on the Crowdlords website revealed that due to a ‘perfect storm’ of problems caused directly or indirectly by the pandemic, the development had made a loss and investors would receive no returns. At a stroke I lost £3,000, which was (as you may imagine) a bitter pill to swallow.

I plan to write a more in-depth post about this soon, including lessons learned from the experience. But i will say two things now. One is that property development projects are inherently very risky and you shouldn’t invest in them unless it really is money you can afford to lose in a worst-case scenario. And second, while I don’t blame Crowdlords themselves for the failure of this project, I do think their communications about it could have been a lot better. I also think it would be a nice gesture if they were to offer modest ex-gratia compensation payments from their own profits to investors who have been hit hard (I know some people lost a lot more than I did). Events such as this clearly damage the reputation of property crowdfunding and mean investors are less likely to risk their money this way in future. I know I shall certainly be a lot more cautious now!

- In fairness to Crowdlords I should add that I have had other investments on their platform which did deliver the promised returns, However, with the loss described above I am certainly down overall with them.

On a brighter note, a couple of the loans I invested in with Kuflink were repaid (with interest) last month, and I duly reinvested the money in other loans.

Kuflink is primarily a platform for investing in bridging loans, and generally these are safer than development projects such as the one mentioned above. There is still a risk of loss, of course, but as your investment is secured by bricks and mortar, it is unlikely you would lose all your money (though delays in repaying loans can and do happen). I have a diversified portfolio of loans with them paying annual interest rates of 6 to 7.5 percent. These days I generally invest a few hundred pounds per loan at most (and quite often under £100). My days of putting four-figure sums into any single property investment are definitely behind me now!

As you may be aware, I recently updated my full Kuflink review. You can read it here if you like. They recently passed the milestone of £100 million loaned, and say that since their launch no investor has lost money on the platform. I’d particularly draw your attention to their revised and more generous cashback offer for new investors. They are now paying cashback on new investments from as little as £500 (it used to be £1,000). And if you are looking to invest larger amounts, you can earn up to a maximum of £4,000 in cashback. That is one of the best cashback offers I have seen anywhere (though admittedly you will need to invest £100,000 or more to receive that!).

Moving on, my two Buy2LetCars investments are still delivering the promised monthly returns without any fuss. As I am semi-retired but don’t yet qualify for the state pension, the £450 or so I receive from them every month represents a major part of my monthly income currently.

As you may remember, investors with Buy2LetCars put up the money to finance a car for a key worker such as a nurse or police officer. They then receive 36 monthly capital repayments followed by a final balancing payment of interest and capital. If you are looking for an income-producing investment with a substantial lump sum payment after three years – and you like the idea of doing a bit of good with your money too – they are well worth checking out (and likewise if you’re a key worker looking for a lease car yourself). If you’d like to learn more, you can read my review of Buy2LetCars here and my more recent article about the company here. And here is a link to Wheels4Sure, their car-leasing website.

Finally, I am still getting a few queries about the low-key matched betting opportunity mentioned in some previous updates. I checked with my contact there and they are still accepting new members, but for reasons related to the pandemic have had to reduce their payouts slightly. New members now receive £50 a month for the first six months, reducing to £25 a month thereafter. Considering that this opportunity is cost-free, risk-free and hands-free, that’s still a pretty good deal, though 🙂

As I said above, this opportunity is based on matched betting, a sideline-earning opportunity I have been pursuing for several years myself. I was asked not to divulge too many details about it publicly, for good reasons I will explain privately to anyone who may be interested (and no, it’s not illegal!). As I said above, it doesn’t require any financial outlay, is entirely hands-off, and will provide a passive income of £50 a month for the first six months and £25 a month thereafter.

No knowledge of betting is required, and you won’t have to place any bets yourself (this is all done by the company’s clever software). You just have to set up a separate bank account for bets to go through, but running the account is entirely financed by the company. Please note though that this opportunity is only open to trustworthy people who haven’t done matched betting before and have no more than two accounts already with online bookmakers. For more info (and to receive a no-obligation invitation) drop me a line including your email address via my Contact Me page.

Personal

December was another strange month in a depressing year.

A week before Christmas I had my 65th birthday. Normally reaching that landmark would be cause for celebration, but inevitably in the circumstances it was low key. I did at least manage to meet up with a couple of old friends for a birthday tea (don’t tell Matt Hancock!). It was great to see them and they did their best to make the occasion feel special. We had some laughs and a very nice cake, but it still wasn’t anything like I might have imagined my 65th. I didn’t even have the small consolation of being able to start claiming my state pension, as I am in the cohort of people for whom the age has just been raised to 66.

Work-wise it has remained very quiet (as you probably know, I’m a semi-retired freelance writer/editor). I’ve had very little paid work since the pandemic started and was grateful to receive further financial support from the government’s SEISS scheme. This time round you had to state that your income had been directly affected by the pandemic. I did agonize a bit over this, as it begged the question of how much money I would have been earning if things were normal. I honestly don’t know the answer to that, but it seems to me that the pandemic and government counter-measures have stopped the economy in its tracks, meaning there is less work around generally. Anyway, I applied and was paid without quibble.

The main good news over the last few weeks has concerned the vaccines. Two are now approved, with the Pfizer vaccine being distributed since before Christmas and the Oxford-AZ version coming on stream this week. One benefit of turning 65 is that I have presumably moved up the pecking order to receive it.

The government appears to be pinning all its hopes on vaccines bringing this pandemic to an end by spring/summer. I hope they are right, as the next couple of months in particular look pretty grim. At the time of writing my area has just moved to Tier 4, which effectively means lockdown. So I will have little/no opportunity to see friends or relatives, no more swimming, no more trips away, and the prospect of sporting ‘lockdown hair’ again. But I am still lucky compared to many, I know.

In my blog post Surviving the Covid Winter I mentioned some plans I had for getting through the winter months. In December I started several of these. In particular, I began a couple of DIY jobs I had been putting off. One of these was redecorating the en suite. Initially I planned just to repaint one wall where the paintwork was fading. But the new paint colour didn’t match the old one, so I am now planning to repaint the rest of the room as well. As is so often the case with DIY, what appeared a small job at first has grown into a much bigger one!

I have also taken my first tentative steps in the world of video gaming (my experience prior to this had been limited to Space Invaders/Asteroids and the games bundled with MS Windows such as Solitaire). With some trepidation I signed up with the games platform Steam and downloaded Coffee Talk to my Windows laptop. This was a game I had read about some time ago and liked the sound of. Here’s a typical scene from it…

Coffee Talk is actually more like an interactive movie or novel. You take the role of owner/barista at a late-night coffee shop in an alternative Seattle frequented by a mixture of human beings and mythological characters such as elves.

Mostly your customers chat with you and other customers about their lives and problems, while you prepare coffee and other drinks for them. This isn’t especially taxing, though I was quite pleased when one of the regulars, Freya, returned and asked for ‘the usual’ and I remembered what it was. It’s a pleasant enough way of spending a few hours, though I am thinking I might try something a little more ambitious next time 🙂

On the TV side, I finally finished the box-set of Deep Space Nine, which I very much enjoyed and recommend to any sci-fi fans among you. At the recommendation of my sister Annie (also a sci-fi aficionado) I have now purchased the box-set of Babylon Five. This is also set on a space station, though with quite a different vibe from DS9. With five (long) series, six full-length feature films, a spin-off series called Crusade, and various other extras, hopefully this will see me through to the end of the pandemic 😀

And for a change from sci-fi I also bought the box-set of Agatha Raisin, a tongue-in-cheek detective drama starring Ashley Jensen and set in the Cotswolds. I wasn’t sure about this at first, but after the first couple of episodes I thought it hit its stride, and I recommend it for a bit of amusing escapism with some gorgeous countryside settings. It’s only a shame that all three series are quite short.

Finally, as a Christmas present for myself I bought the DVD of Roger Waters’ Us + Them concert. This is an epic production, featuring a group of hugely talented musicians and some awesome visual effects (at one point a giant model of Battersea Power Station descends into the arena, accompanied – of course – by a flying pig).

Roger and his band play a selection of Pink Floyd classics alongside some of Roger’s solo compositions, all of which are excellent as well (The Last Refugee is particularly poignant). In the video below, though, they perform Time, one of my personal favourite Pink Floyd numbers. Check out Jess and Holly (aka Lucius) supplementing their backing vocal duties with some exuberant drumming!

So that’s it for now. I do hope you are staying safe and sane in these challenging times. Be kind to yourself and to others, and hopefully things will improve before too long. As ever, if you have any comments or questions, please do share them below.