Why I Switched My Santander 123 Account to 123 Lite

As you may have heard by now, the Spanish-owned bank Santander recently announced that they are cutting the interest paid on their popular 123 current account by a third.

From 5th May 2020 they are paying just 1% a year interest up to £20,000. That’s a big drop from the maximum 3% on offer when the account was launched (to great fanfare) in 2012. At that time the account topped the best-buy tables and many thousands of people (including me) switched to it as a result. As well as offering market-leading interest rates, they also paid cashback of up to 3% on a range of household bills if paid by direct debit from the account.

Since the heady days of 2012, though, Santander have steadily watered down the benefits of this account. They introduced a monthly fee that was originally £2 and then went up to £5. They also cut the interest rate in 2016 to 1.5%, and now – as mentioned above – to 1%. They are still charging £5 a month, though, which means you need to have an average balance of £6,000 in your account just to cover the fee (which works out as £60 a year).

Cashback is still on offer, but from being unlimited it has now been capped at £15 a month maximum. The 123 account currently pays 1% cashback on water bills, council tax and Santander mortgage payments, 2% on gas and electricity and Santander home insurance, and 3% on phone, broadband, mobile and TV packages. From 5th May onwards each of these three tiers will be capped at £5.

All this means that if you are one of the millions of customers who still have a Santander 123 account, you need to look carefully at whether it is still the best option for you.

Crunching the Numbers

Although Santander is no longer the clear market leader among current accounts, it may still be a good (and possibly the best) choice for some people. But you do need to look carefully at how you use the account and what alternatives are on offer. That’s what I did, and in the end I stayed with Santander, but switched my account to 123 Lite.

Here how I worked this out…

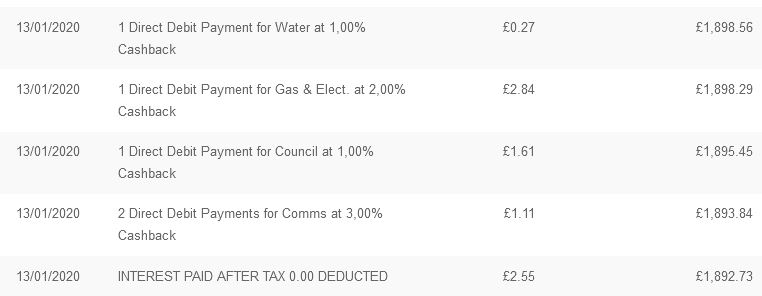

I started by looking at what I currently get from my Santander 123 account in terms of cashback and interest and setting this against the monthly charge. I have already cut down the amount of money I keep in my account due to the falling interest rates, so I now hold an average balance of around £1,800 in it. Here is a screengrab of the relevant section of my latest bank statement.

Adding this up, you can see that in January 2020 I received a total of £5.83 in cashback and £2.55 in interest. That’s a total of £8.38. Subtract the £5 monthly fee from this, and my net returns from the account are £3.38 a month or about £40 a year. On an average balance of £1,800, that works out as a return of about 2.25% – not great, but still better than most bank accounts currently (I am obviously counting cashback and interest together in this calculation – it’s all money, after all).

With the reduction in interest rates from 1.5 to 1%, though, that would have cut my monthly interest by a third to around £1.70. This would reduce my monthly ‘profit’ to £2.53, or about £30 a year. That works out as a rate of return on an average balance of £1,800 of about 1.7%. That’s obviously significantly worse than the previous 2.25%. Although again – taking into account the cashback as well as the interest – it still beats most ordinary current accounts.

The 123 Lite Alternative

With the potential rate of return on my 123 account falling to around 1.7%, I wanted to see if there were any better alternatives for me. Other things being equal, though, I didn’t want the hassle of switching to a different bank if the returns weren’t going be appreciably better for me.

So I looked into what alternative accounts Santander offer and learned about the Santander 123 Lite account. This doesn’t pay interest at all, but it offers the same cashback as a standard 123 account. And, very importantly, the monthly charge is only £1 instead of £5.

Looking at my potential returns with this account, I came up with the following: total cashback £5.83 minus £1.00 monthly charge = £4.83 a month net profit. Multiplying that by 12 gives a total annual return of £57.96. On an average £1,800 balance that works out as a notional interest rate of 3.22%, which was obviously a lot better than staying with a standard 123 account. So I decided to do that. Even at the current 1.5% interest rate which applies till 5th May 2020, I realized I would still be better off switching to 123 Lite, so there was no reason to delay.

- As a matter of interest, if I reduce the average balance in my Santander account to £900 while still earning the same cashback, that will effectively double the rate of return I receive. Perversely, with the Santander Lite account, the lower the balance you can keep in it while still servicing your direct debits, the better the percentage return on your capital you will get 🙂

The other advantage of switching to a Santander 123 Lite account is that, as I discovered, it is a very simple process. I logged in to my account and selected the option to ‘upgrade’ my account. I had to answer a few simple questions and click to confirm my application. The next day I received an email confirming that I was now the proud owner of a Santander 123 Lite account. The account still has the same sort code and account number, the same PIN card number, and I can log in in exactly the same way. But at a stroke I have effectively doubled the returns I will be making from my account!

Other Alternatives

I strongly recommend that anyone with a Santander 123 account performs a similar calculation to the one I described above (bearing in mind there is now a cap of £5 a month on cashback in each of the three tiers). This will reveal if you would be better off switching to a 123 Lite account (and by how much per year). If you choose this option, switching is – I promise – a quick and painless process.

There are, of course, other alternatives, though. For example, HSBC have just introduced (or actually reintroduced) a one-off £175 bonus for anyone switching to their Advance current account. Note that to qualify for this you have to pay at least £1,750 into the account each month (or £10,500 every six months) and set up at least two direct debits or standing orders. More information about this can be found in this article from Which?

There are also still a few other current accounts that pay interest. An example is Nationwide’s FlexDirect account, which pays 5% interest on balances of £2,500 a year for the first 12 months (reducing to 1% a year after that). You have to pay in a minimum of £1,000 a month to qualify for this. Neither HSBC nor Nationwide offers cashback as well, so it is important to take that into account when deciding whether switching to them will be worth your while.

I hope you found this post of value if you have a Santander 123 account. I wish you every success in deciding how best to proceed. As ever, if you have any comments or questions, please do post them below..

UPDATE 5th MAY 2020 – I have just heard that Santander are cutting the interest rate on their 123 account AGAIN to 0.6% in August 2020. That makes the case for changing to a 123 Lite account – or switching away from Santander entirely – even more compelling.

August 25, 2020 @ 9:29 am

How do you view monthly statements on 123 lite

August 25, 2020 @ 10:58 am

I view mine via the Santander website as usual, or I guess you could request paper statements. You can also print out monthly statements via the website. In that respect tt’s really just the same as a standard 123 account.

August 20, 2021 @ 3:58 pm

Thank you for the clear writeup and instructions to upgrade. Something Santander doesn’t show you how to do.

August 20, 2021 @ 4:09 pm

No problem. Glad you found my blog post helpful 🙂