Property Partner: My Review of This Property Crowdfunding Platform

Today I am spotlighting Property Partner, a property crowdfunding platform I have been investing with since 2015.

As I have noted before on Pounds and Sense, I am something of an enthusiast for property investment (and specifically property crowdfunding). Among other things, I like the fact that you can make money from both rental income and capital growth. And investing in property can be a good way of spreading risk when you have equity-based investments.

Table of Contents

Property Partner

Launched in January 2015, Property Partner has swiftly become the UK’s largest property crowdfunding website. They have over 11,500 investors, who between them have invested over £122.7 million in properties across the UK. Non-UK investors are welcome to join Property Partner too, so long as the legal system in their country permits it. Unfortunately US residents cannot invest via Property Partner at this time.

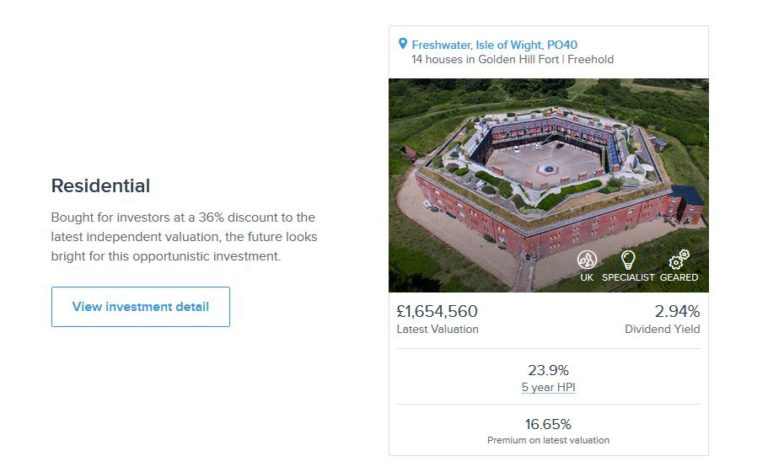

Property Partner offer shares in a wide range of properties. They include commercial buildings and residential ones, including PBSA (purpose built student accommodation). The properties tend to be on the larger side, so you won’t generally find single flats or terraced houses here. Neither do they sell shares in development or bridging loans, as offered by several other property crowdfunding platforms. This is what you might call ‘traditional’ property crowdfunding, where a property is bought on behalf of investors, who then receive a share of the rental income and any capital gains when the property (or their share in it) is sold. Here is a sample listing from their website…

One big attraction of Property Partner is that they have an active secondary market. That means investors can offer part or all of their portfolio for sale at any time. Obviously, to sell your shares in a property you will need a buyer, but Property Partner say that so long as they are priced reasonably (i.e. at or below the current official price) shares normally sell within 72 hours. By contrast, other property crowdfunding platforms such as The House Crowd and CrowdLords do not run formal secondary markets, though they say they will always help would-be sellers find a buyer if required.

Another attraction of Property Partner is that dividends are paid monthly, unlike other platforms which typically pay quarterly, biannually or annually. Money from dividends builds up in your account, and you can either withdraw it or reinvest it in other properties. When you add that you can get started on Property Partner for as little as £250, it is not all that surprising to me that they have enjoyed such success.

For legal reasons explained on the website, you can’t currently invest on Property Partner through a tax-efficient ISA or a SIPP. That means rental income will be liable for tax at your highest marginal rate, and any profits on selling will be subject to Capital Gains Tax (though there is quite a generous annual CGT allowance).

On the positive side, for anyone investing £5000 or more, you can opt for one of three managed plans: income focused, growth focused, or balanced. Your investments in them will be managed on your behalf to ensure good diversification of assets. Property Partner say that the net annual return (capital growth plus rental income) of the dividend plan should be at least 6.5%, the balanced plan at least 7.5% and the growth plan at least 8.5%.

My Experience

I have been investing with Property Partner for three years now, and have shares in a total of 17 properties. My largest single holding is around £2,550 (St David’s Lodge in Hastings, pictured above) and the smallest is £27.90.

I have aimed to build a diversified portfolio within Property Partner. I hold shares in both residential and commercial properties, in London and across the English regions (Property Partner doesn’t have properties in Scotland or Northern Ireland, and they have just one in Wales). To diversify further, I also recently bought a share in some purpose-built student accommodation in Leicester. Although as Leicester is my old university city, sentimental reasons may also have played a part in this decision!

During all the time I have been with Property Partner there have been no defaults or delays, and dividends have arrived in my account every month like clockwork. I understand that is true of all the properties on their books.

All properties on Property Partner are purchased for an initial five years. After the five years are up, all investors will get the opportunity to sell their share (or part of it) at a market valuation made by an independent chartered surveyor. As the platform hasn’t yet been going for 5 years, that hasn’t happened yet. Alternatively, as mentioned above, you can put your share up for sale at any time on the secondary market.

Pros and Cons

Based on my experiences, here is my list of pros and cons for Property Partner.

Pros

1. Fast, easy sign-up.

2. Well-designed, intuitive website.

3. Low minimum investment of just £250.

4. Property Partner take care of all the work involved in buying and managing properties. You just choose which ones to invest in.

5. Possibility to access your money at any time by selling on secondary market (though this does depend on another investor being willing to buy your shares at a price you find acceptable).

6. Guaranteed opportunity to sell at a fair market price after five years.

7. Customer service (in my experience anyway) is fast, friendly and helpful.

8. Charges are reasonable, with an initial 2% fee. There is no charge for selling shares.

9. Potential to profit through both capital appreciation and rental income.

10. Rental income is paid into your account every month. You can either withdraw it or reinvest it.

11. Up to £750 cashback is available for new investors of £2,000 or more via my referral link (see below).

12. Managed investment plans are available for investors of £5,000 or more.

Cons

1. No tax-free ISA or SIPP option available.

2. Rates of return are competitive but not the highest.

3. No development or bridging loans.

4. Some properties are purchased with gearing (loan finance). This makes them riskier if the value of the property should fall.

Conclusion

Overall, I have been impressed by my experiences with Property Partner. There have never been any delays or defaults, which can’t be said of every crowdfunding platform I have invested with. Property Partner state that the returns generated across all their properties since 2015 average 7.3% a year, taking into account both rental income and capital appreciation. That obviously beats bank and building society accounts by a considerable margin.

As ever, it is important to note that investments with Property Partner do not enjoy the same level of protection as bank and building society savings, which are covered (up to £85,000) by the Financial Services Compensation Scheme. All investments are secured against bricks and mortar, however, so even in a worst case scenario it is highly unlikely you would lose all your money.

The lack of liquidity with property investments generally means they should be regarded as medium- to long-term investments, and you should only invest money you are unlikely to need at short notice. The active secondary market on Property Partner does though mean that you should be able to recover your capital quickly if you need it, though there is no guarantee what price you will get.

Clearly, no-one should put all their spare cash into Property Partner (or any other investment platform). Nonetheless, it is certainly worth considering as part of a diversified portfolio. Not only are the rates of return significantly higher than those offered by banks and building societies, they are relatively unaffected by ups and downs in the stock market. Property investments aren’t a way of hedging your equity-based investments directly, but they do help spread the risk.

Welcome Offer

As an existing Property Partner investor, I can offer a special bonus for anyone joining via my link. If you click through this special invitation link, sign up and invest a minimum of £2,000 within 60 days, you will receive an extra bonus as follows (and so will I):

£2,000 – £30

£10,000 – £150

£20,000 – £300

£50,000 – £750

Not only that, once you are an investor with Property Partner, even if you only start with £250, you will be able to offer the same bonus to your friends and relatives and earn commission yourself. There is no limit to the number of people you can introduce through this scheme.

Obviously, this is a generous promotional offer by Property Partner and I assume it won’t be available forever. If you want to take advantage, therefore, don’t wait too long. I will remove this information if/when I hear the offer is no longer valid.

If you have any comments or questions about this review, as always, please do leave them below.

Disclosure: this post includes affiliate links. If you click through and make an investment at the website in question, I may receive a commission for introducing you. This has no effect on the terms or benefits you will receive. Please note also that I am not a professional financial adviser. You should do your own ‘due diligence’ before making any investment, and seek professional advice from a qualified financial adviser if in any doubt how best to proceed.