Mintos Crowdlending Platform – Bonus Offer!

Updated 20 November 2023

Today I’m spotlighting Mintos, a European crowdlending platform based in Latvia but open to people in the UK. You may have seen my earlier post on Investing Basics for Beginners, which was sponsored by MIntos.

With Mintos, your money is invested in loans to businesses and private individuals arranged by Mintos’s partner lending companies around the world. Mintos act as intermediaries between lenders and borrowers. They aim to ensure that both groups act responsibly and loans are repaid in a timely way.

Currently Mintos offer the opportunity to invest in agricultural loans, business loans, car loans, car rentals, invoice financing, mortgage loans, personal loans, pawnbroking loans and short-term loans.

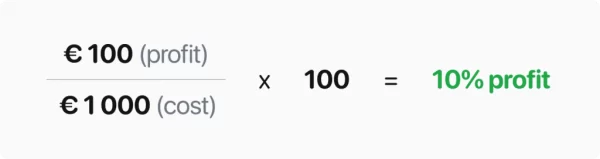

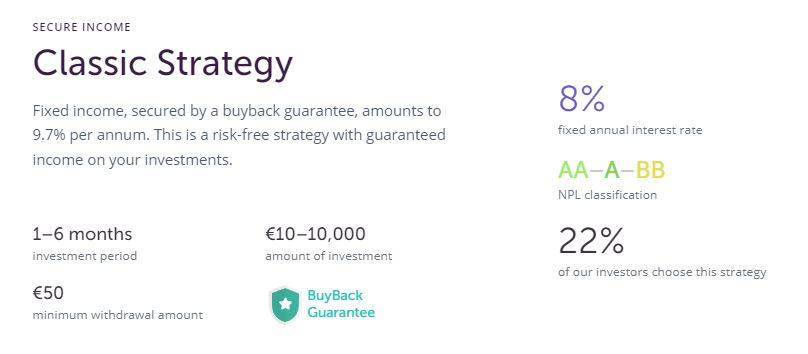

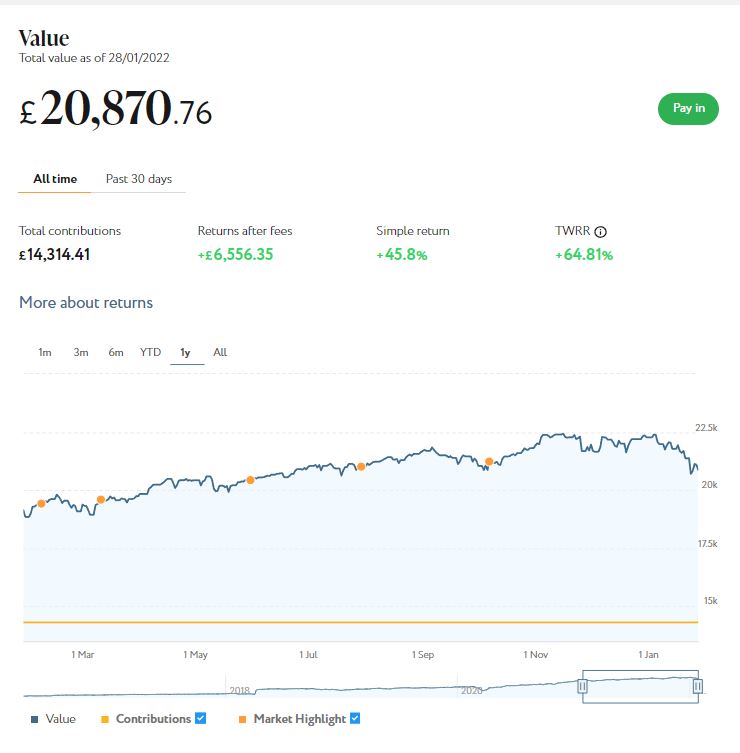

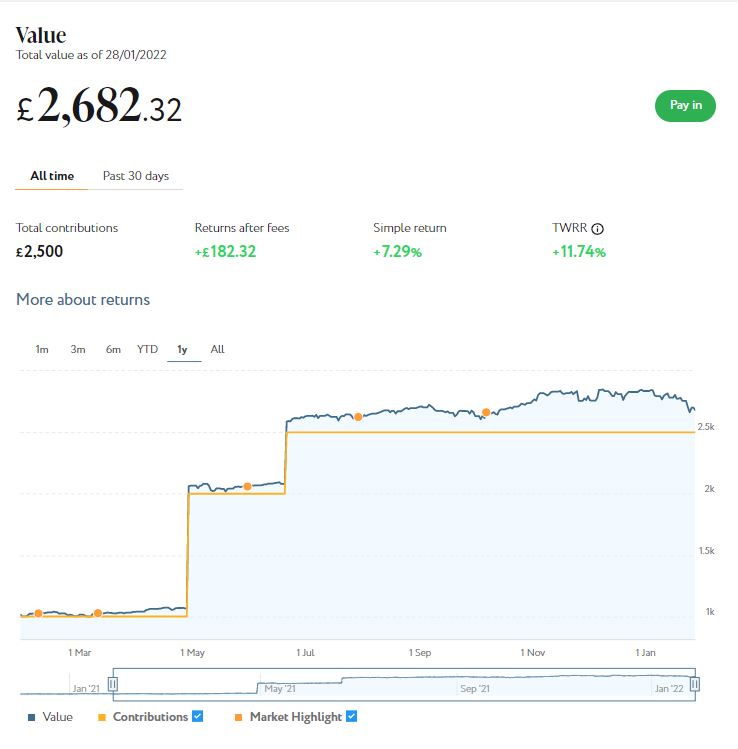

You can begin investing with just €50 (around £43). Since 2015, investors with Mintos have earned a 9.54% net return per year on average. Of course, past performance is no guarantee of how any investment platform will do in future. Currently, however, interest rates on the platform are averaging around 12.50%.

What Guarantees Are There?

To ensure security, Mintos provides a return-on-investment guarantee. If a loan instalment remains unpaid 60 days after becoming due, Mintos say they will repay the investment at face value with any accrued interest.

Mintos further insist that all lenders on their platform maintain 5-10% of any loan on the platform themselves. This means that in the event of a default, the lender will lose some of their own money also. So they have ‘skin in the game’, as the expression goes 🙂

The other main risk, of course, is the collapse of the platform itself. While this could happen, it’s worth noting that Mintos is licensed and supervised by Latvijas Banka, the central bank of Latvia, and a member of the Latvian national Investor Compensation Scheme. If Mintos fails to provide investment services, retail investors are entitled to compensation of 90% of the irrevocable loss resulting from the non-provision, up to a limit of €20 000.

In addition, as is generally the case with crowdlending/P2P platforms, your assets are held quite separately from Mintos’s assets.

Investing in Euro

As Mintos is a European operation, you will need to invest in euro and your returns will be paid in this currency. That obviously adds a layer of complication for UK residents, but there are various ways round this. If you have a UK bank account you will normally be able to make (and receive) payments in euro, but may be charged a transaction fee.

You could use your own bank to fund your account initially, but if you become a regular investor with Mintos you might want to use a service/account that charges lower fees. You could use a money transfer service such as Paysera or Wise (formally TransferWise). These will enable you to transfer funds between Mintos and your own bank account with (potentially) lower charges and a more favourable exchange rate.

Another option would be to open a euro account with a provider such as Starling. This will allow you to receive and make payments in both sterling and euro, again at a lower overall cost.

Opening an Account

To open a Mintos account, your first step will be to click on Create Account at the top of the Mintos homepage. There are then certain preliminary steps you will need to take…

- Verify your identity and answer some questions about yourself

This is necessary to comply with anti-money laundering laws and KYC (Know Your Customer) requirements. - Take the Suitability & Appropriateness assessment

As a licensed investment firm, Mintos are required to ensure that the products they offer are suitable and appropriate for investors. Based on your answers, they will make certain methods of investing available to you and set a responsible investment limit for your account. You can retake the assessment at any time if your situation changes. - Transfer funds to your Mintos account (see above)

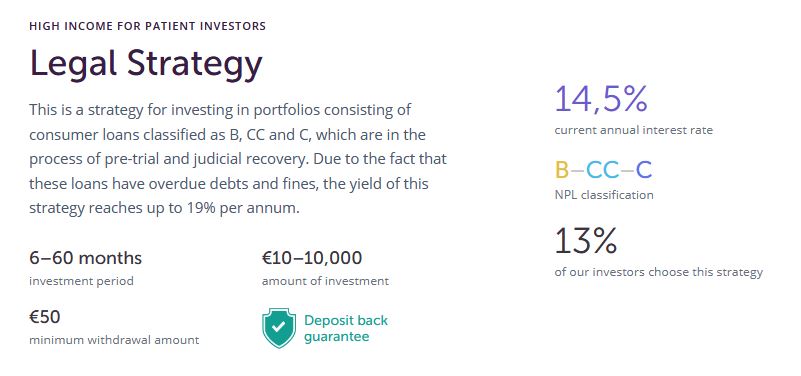

Once this has been done, you can start investing. You have various options here. The simplest is to use one of Mintos’s automated strategies. These work as follows:

- Choose a strategy that matches your preference: Diversified, Conservative, or High-yield.

- Your strategy will buy small fractions of many different loans or Sets of Notes from different lending companies around the world.

- You will be shown the weighted average interest rate of available investments before you invest.

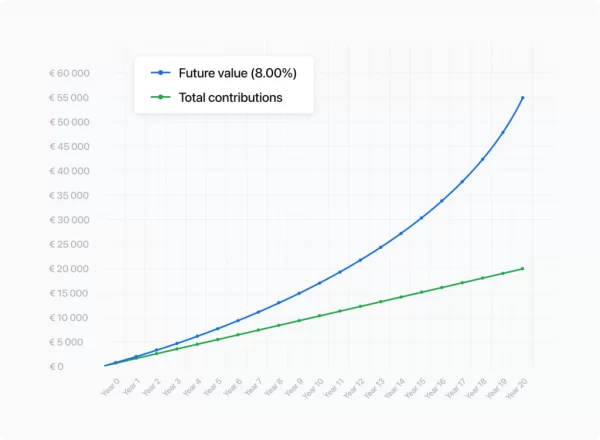

- Mintos can (if you wish) reinvest your returns so your money can work continuously and earn even more interest.

- You can get your investment back any time by cashing out funds from your Mintos strategy.

- You can start or stop your strategy at any time.

- Your exposure is capped at 15% per lending company.

Alternatively, you can use a custom strategy, where you choose from a huge range of available investments yourself. You can filter by more than 20 different investing criteria and diversify your portfolio according to your preferences. You can do this entirely manually or create a custom automated investing strategy based on the rules you set.

When you want to withdraw money, your Mintos Core portfolio will automatically sell investments in your portfolio to other investors. Selling may take from a couple of minutes to a few days, depending on demand from other investors at the time. Note that loans which are in default cannot be cashed out this way, and you will have to wait until the loan in question is back in good stead or the 60-day guarantee (see above) kicks in. In some circumstances you may be able to sell loans which are unavailable for cashing out on Mintos’s secondary market, for which a 0.85% fee will be charged. This article on the MIntos website has more information about the cashing out rules and restrictions.

Special Bonus!

Until 30 November 2023, if you click through any link to Mintos in this article and invest €1000 or more, you will get a €50 instant bonus and a 1% bonus of your average investment in the first 90 days.

If you invest €5000, for example, in addition to the returns advertised (currently averaging 12.5%), you will also receive a €50 instant bonus and a further 1% bonus of €50 after 90 days. Effectively that’s an extra 2% bonus. Remember, this special offer closes on 30 November 2023.

If you have any comments or questions, as always, please do leave them below.

Disclosure: I am not a registered financial adviser and nothing in this article should be construed as personal financial advice. You should always do your own ‘due diligence’ before investing, and if in any doubt seek advice from a registered financial adviser before proceeding. All investing carries a risk of loss.

This post includes affiliate links. If you click through and make an investment (or perform some other designated action) I may receive a commission for introducing you. This will not affect the product or service you receive or any charges you may pay. Note also that the special bonus referred to in this article is only available if you click through one of my links. It will not apply if you go to the Mintos website directly.