My Investments Update – March 2026

Here is my latest monthly update about my investments. You can read my February 2026 Investments Update here if you like.

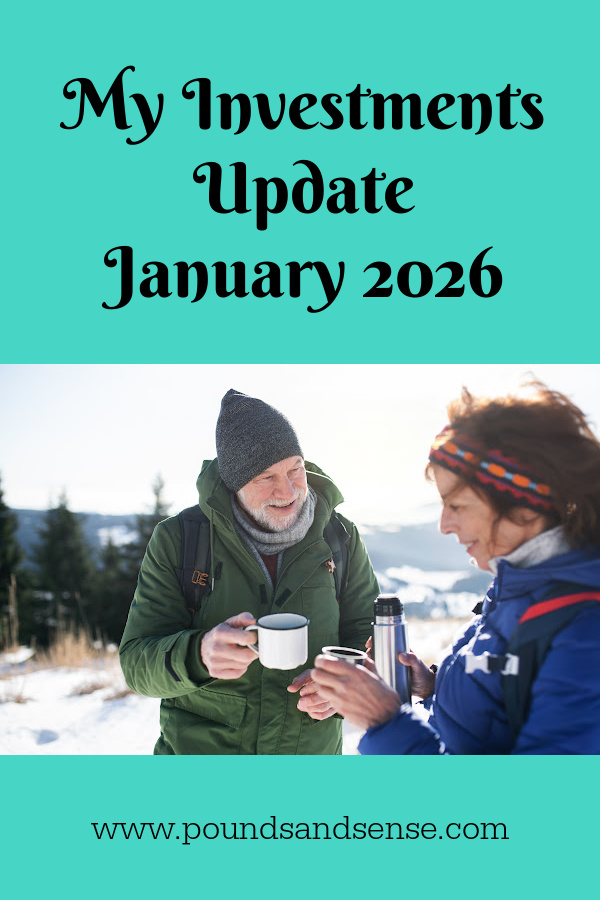

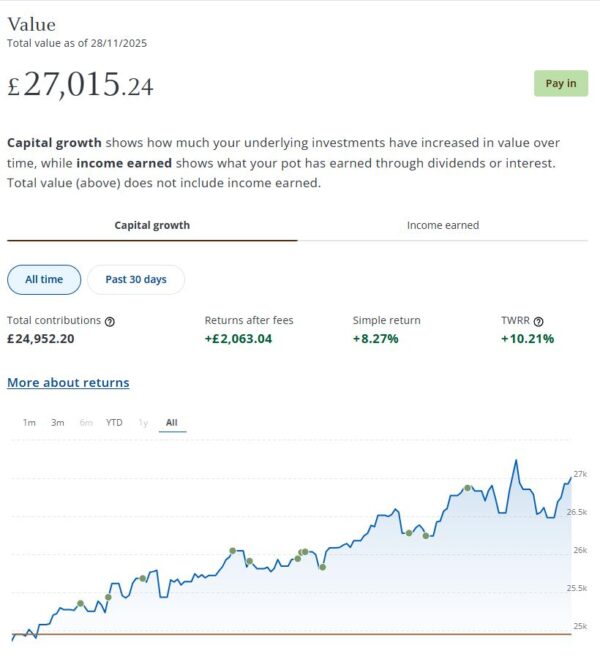

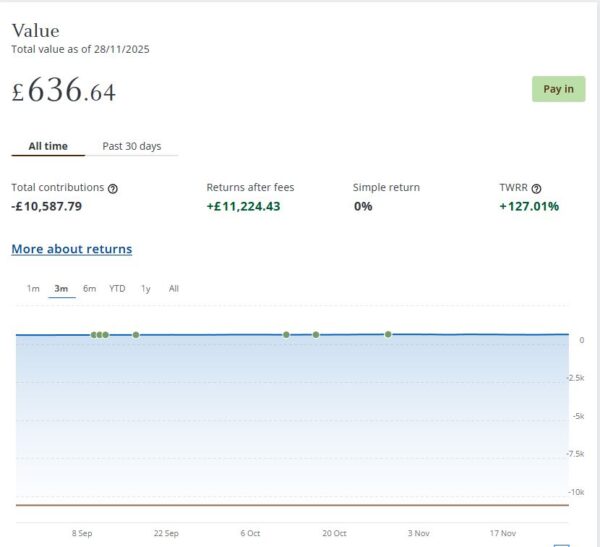

I’ll begin as usual with my JP Morgan Personal Investing (previously Nutmeg) Stocks and Shares ISA. This is the largest investment I hold other than my Bestinvest SIPP (personal pension).

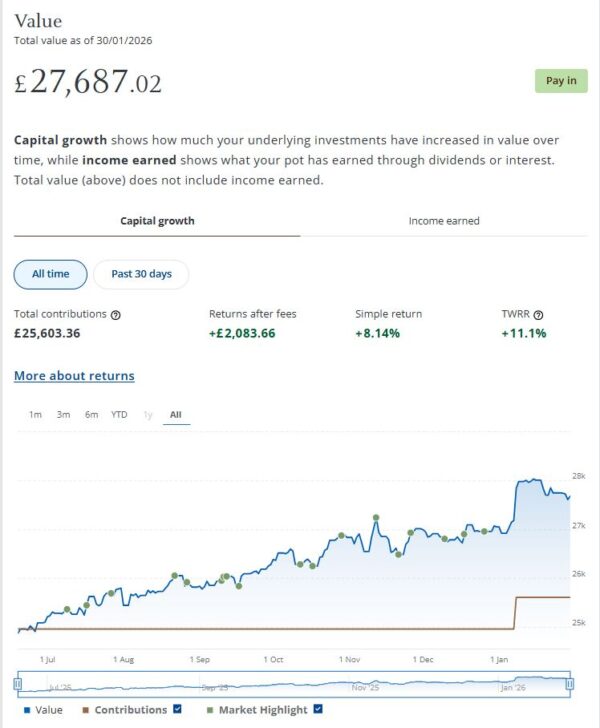

As regular readers will know, in June last year I transferred most of the money in my former Nutmeg Fully Managed portfolio (just under £25,000) to a new Nutmeg Income Portfolio. I discussed this in detail in this post, but basically money in this port is invested to generate an income from share dividends and other sources. This is then paid monthly. Capital appreciation is targeted as well, but these portfolios are aimed primarily at older people (and others) who want/need their investment to generate a regular cash income.

In January my JPM Investing income portfolio generated £124.25 of income, which was duly paid in to my bank account on 24 February 2026. That means I have now received a total (tax-free) income of £198.14 in 2026 and £669.60 since I opened the account in June last year. That’s about what I would have expected based on JPM’s projected annual return of just under 5% for income ports at my chosen risk level (five).

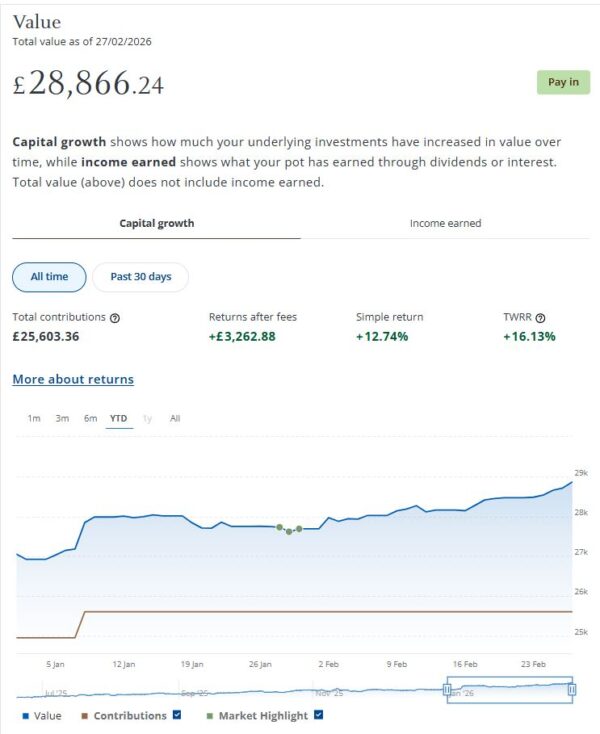

My income portfolio grew in value in February. It’s now worth £28,866 compared with £27,687 at the start of last month, a quite impressive rise of £1,179.

As the year-to-date screen capture below shows, this port has increased by £3,268 (12.74%) after fees since I opened it last June. That’s clearly good going, though I don’t suppose it will carry on like this indefinitely. Performance may have been helped a bit by the no-fees introductory offer on Nutmeg/JPM income portfolios until the end of 2025. That has of course ended now.

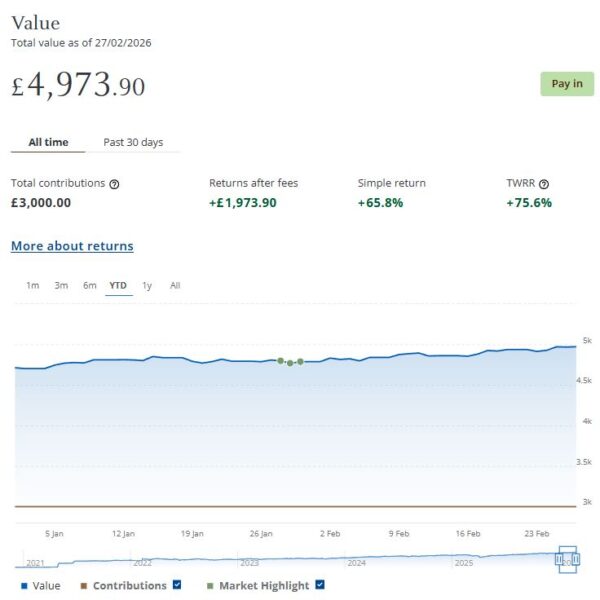

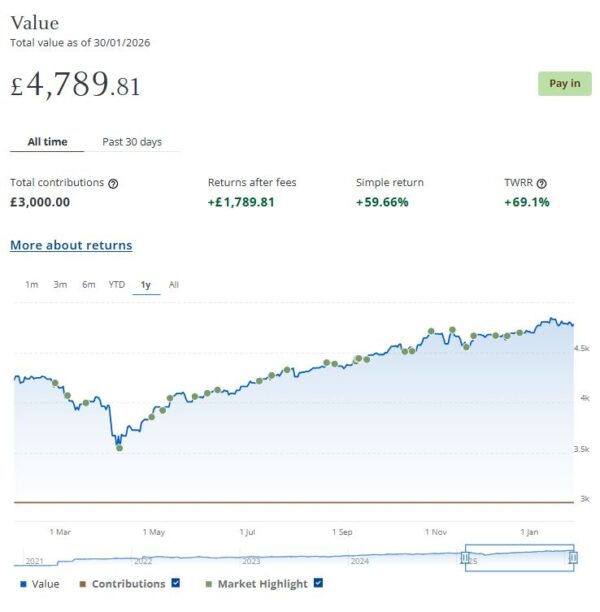

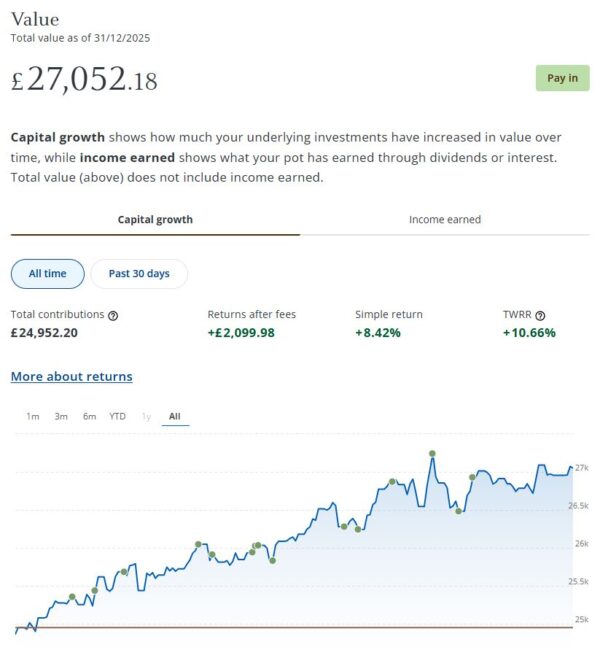

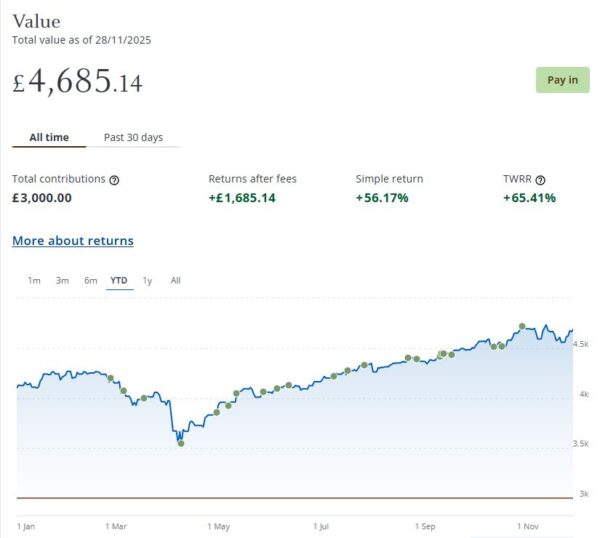

I still have a smaller, growth-oriented pot using JPM Investing’s Smart Alpha option. This is now worth £4,974 (rounded up) compared with £4,790 a month ago, an increase of £184. Here is a screen capture showing performance in the year to date.

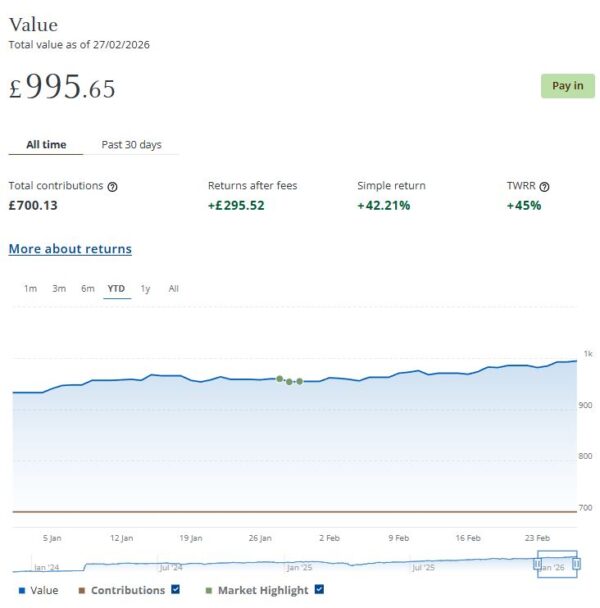

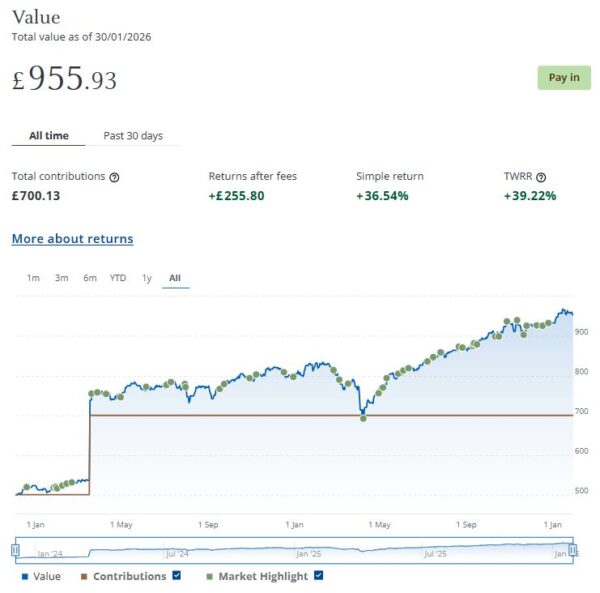

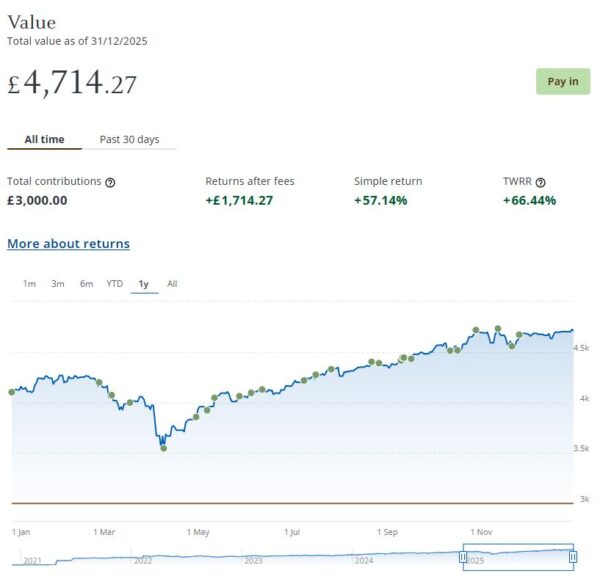

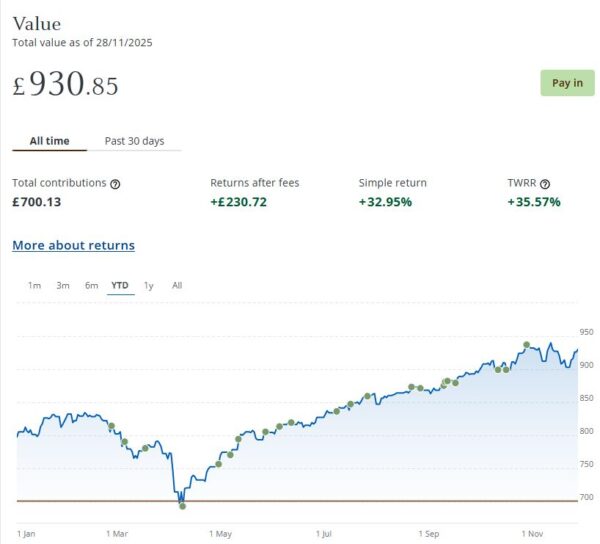

Finally, at the start of December 2023 I invested £500 in one of Nutmeg/JPM’s thematic portfolios (Resource Transformation). In March 2024 I also invested a further £200 from referral bonuses (something I no longer receive). As you can see from the YTD screen capture below, this portfolio is now worth £996 (rounded up) compared with £956 last month, an increase of £40.

Overall in February I was up by £1,403 or 4.20%. In addition I did, of course, receive £124.25 in income from my income portfolio. In total, then, I am in profit for the month by £1,527.25.

Excluding income generated, the overall value of my JPM investments is up by £4,029 or 13.08% since the start of March 2025. If you add to this figure the £669.60 of income generated by my Income portfolio so far, that gives a total profit for the last 12 months of £4,698.60 – not a bad return in these uncertain times.

As I always have to say, some volatility is to be expected with stock market investments, but over the longer term they tend to even themselves out (and typically outperform bank savings accounts, although that is never guaranteed). In general the worst thing you can do is panic and sell up when downturns occur. You are then crystallizing your losses rather than giving the markets time to recover. This is something I had cause to discuss in this blog post.

You can read my full original Nutmeg/JPM review here. If you are looking for a home for your annual ISA allowance, based on my overall experience over the last nine years, they are certainly worth considering. They offer self-invested personal pensions (SIPPs), Lifetime ISAs and Junior ISAs as well.

- As mentioned, Nutmeg have rebranded as J.P. Morgan Personal Investing and their website is now at www.personalinvesting.

jpmorgan.com.

Moving on, I also have investments with P2P property investment platform Housemartin. As discussed in this post, the company rebranded last year from Assetz Exchange.

My investments with Housemartin continue to generate steady returns. Housemartin focuses on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my HM portfolio has generated a respectable £302.22 in revenue from rental income. I have made a small net loss of £20.25 on property disposals. Capital growth generally has slowed, in line with UK property values generally.

At the time of writing, 19 of ‘my’ properties are showing gains, 4 are breaking even, and the remaining 21 are showing losses. My portfolio of 44 properties is currently showing a net decrease in value of £69.21. That means that overall (rental income minus capital value decrease and loss on disposal) I am up by £212.76. That’s still a respectable return on my £1,000 and does illustrate the value of P2P property investments for diversifying your portfolio. And it doesn’t hurt that with Housemartin most projects are socially beneficial as well.

The net fall in capital value of my Housemartin investments is obviously a little disappointing. But it’s important to remember that until/unless I choose to sell the investments in question, it is largely theoretical, based on the latest price at which shares in the property concerned have changed hands. The rental income, on the other hand, is real money (which in my case I’ve reinvested in other HM projects to further diversify my portfolio).

To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of Housemartin as far as i am concerned. You can actually invest from as little as £1 per property if you really want to proceed cautiously.

- As I noted in this blog post, Housemartin is particularly good if you want to compound your returns by reinvesting rental income. This effectively boosts the interest rate you are receiving. Personally, once I have accrued a minimum of £10 in rental payments, I usually reinvest this money in either a new HM project or one I have already invested in (thus increasing my holding). Over time, even if I don’t invest any more capital, this will ensure my investment with Housemartin grows at an accelerating rate and becomes more diversified as well.

My investment on Housemartin is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Housemartin and the returns generated so far, and intend to continue investing with them. You can read my original review of Assetz Exchange/Housemartin here and my article about the rebranding to Housemartin here. You can also sign up for an account directly via this link [affiliate].

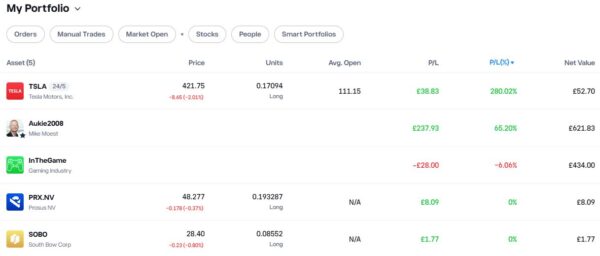

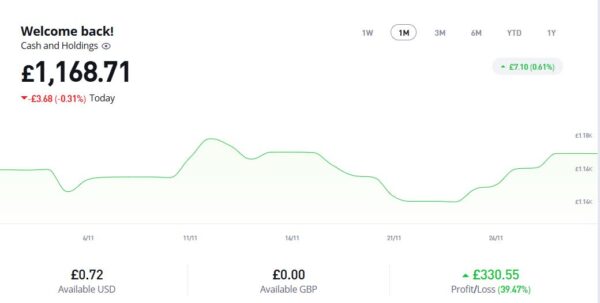

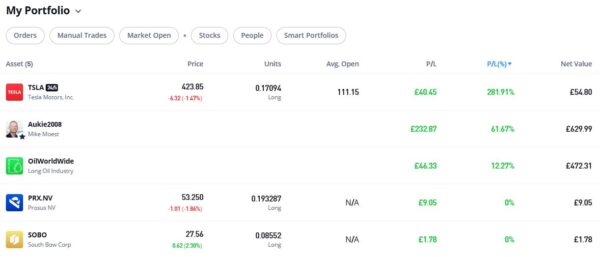

In 2022 I set up an account with investment and trading platform eToro, using their popular ‘copy trader’ facility. I chose to invest $500 (then about £412) copying an experienced eToro trader called Aukie2008 (real name Mike Moest).

In January 2023 I added to this with another $500 investment in one of their thematic portfolios, Oil Worldwide. I also invested a small amount I had left over in Tesla shares.

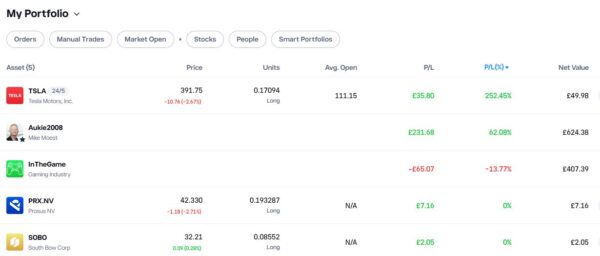

In January this year, as Oil Worldwide hadn’t exactly been setting the world alight, I decided to switch my entire investment in this to another smart portfolio, InTheGame. This port, focusing on the computer gaming industry, has been the top performer for some time in my eToro virtual portfolio.

Unfortunately just as I switched away from Oil Worldwide, US President Trump decided to invade Venezuela. This gave the oil industry a significant boost, which I would otherwise have benefited from. Meanwhile InTheGame hasn’t been doing particularly well, partly due to the recent downturn in AI stocks. At the time of writing the value of my investment in this has fallen by nearly 14%. Hey ho! This does of course demonstrate that there are never any guarantees when investing and unexpected events can thwart the best-laid plans…

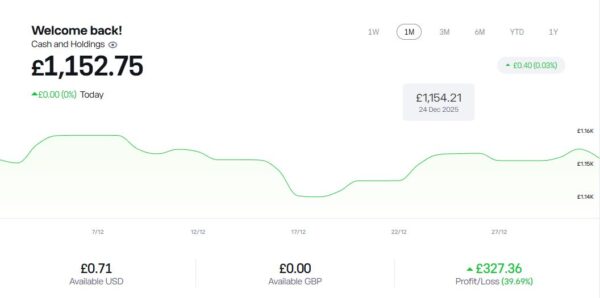

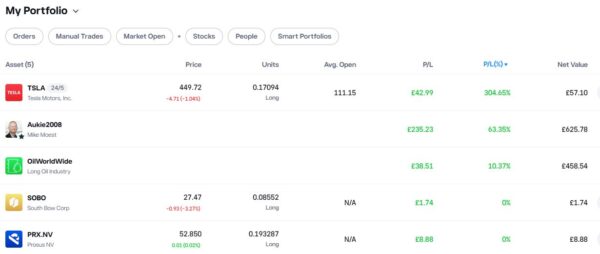

As you can see from the screen captures below, my original eToro investment (total value £888.36 in pounds sterling) is today worth £1,091.94, an overall increase of £203.58 or 22.92%.

- Note: eToro now displays the value of investments in your native currency, although you can change this if you wish.

You can read my full review of eToro here. You may also like to check out my more in-depth look at eToro copy trading. I also discussed thematic investing with eToro using Smart Portfolios in this post.

As mentioned above, my new investment in InTheGame is currently down by nearly 14%. My copy trading investment with Aukie2008 continues to do well, however, with an impressive overall profit of 62.08%. Of course, I have held this investment for quite a bit longer.

My Tesla shares, which I purchased as an afterthought with some spare cash I had in my account, are down again this month but still showing an overall profit of over 252% since I bought them. If only I had put a bit more money into this!

You might also notice that I have small holdings in Prosus NV, a Dutch internet group, and South Bow, a Canadian energy infrastructure company. To be honest I don’t understand how I acquired these, but I assume they are some sort of bonus I was awarded. In any event, I am happy to have them in my portfolio.

- If you would like more information about setting up an eToro account, please click on this no-obligation website link [affiliate]. Don’t forget that you also get a free $100,000 virtual portfolio, which you can use to experiment with trading and investing strategies. I have certainly earned a lot from mine.

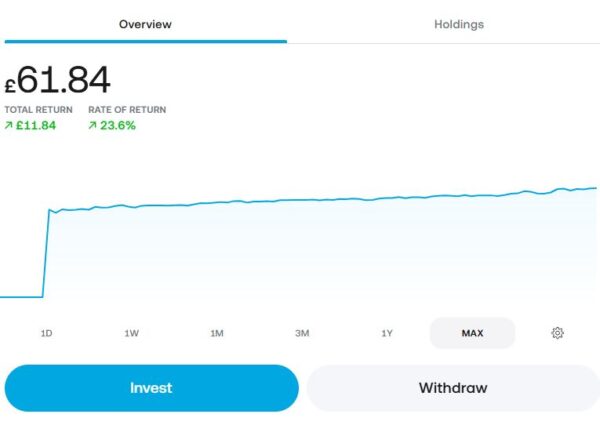

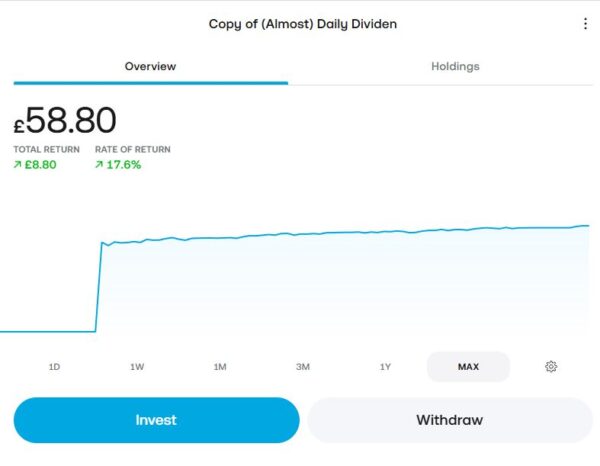

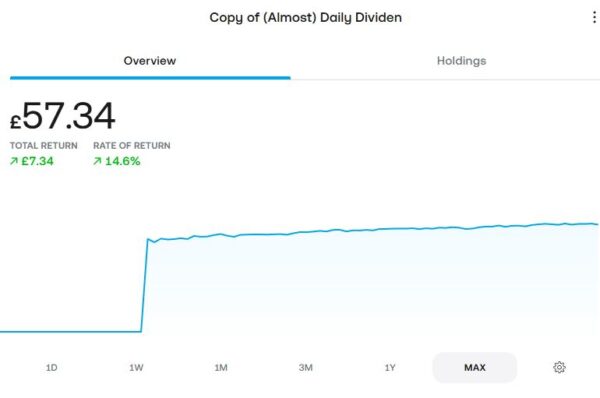

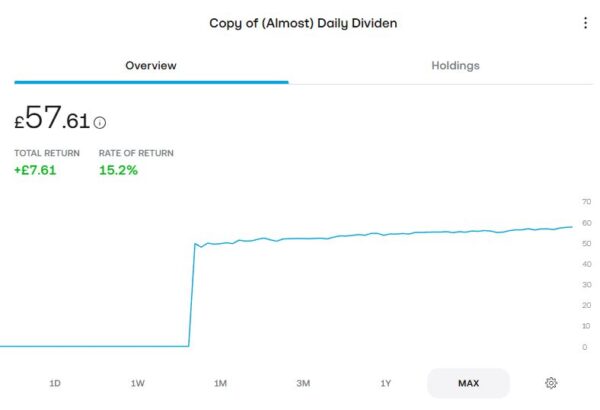

As an experiment, at the start of April last year I put £50 into an investment ISA with Trading 212. As mentioned in my blog post about dividend investing, I put it into the (Almost) Daily Dividends Portfolio, a ready-made portfolio or ‘pie’ on Trading 212. As you can see from the screen capture below, my portfolio is now worth £61.84, an increase of £11.84 or 23.60% over the ten-month period. It has even accrued a grand total of 97p in dividends, most of which has now been (automatically) reinvested.

I am quite impressed with how this investment has been faring, despite the small amount I put in (which means I may be missing out on some smaller dividends). If I increased my investment I would almost certainly become eligible for more dividends, and even more the longer I remain invested. If I had any spare money at the moment, I would consider doing this. Of course, I do now have an income-focused portfolio with JPM Investing as well (see above).

Moving on, I published various posts on Pounds and Sense in February. I have listed below those that are still relevant.

In How to Save Money on Cruise Holidays I looked at a type of holiday that has become increasingly popular with older adults. They offer a relaxed way to travel, with accommodation, meals, entertainment and transport between destinations all included in one package. Cruise prices can vary significantly, however, and it’s not always obvious where good value ends and unnecessary expense begins. So in this post I set out some ways to keep cruise costs under control, while still getting the most from your time away.

I also posted an updated version of Get a Free Share Worth up to £100 with Trading 212. Anyone who hasn’t done this before can get a free share worth up to £100 just by signing up for a new Trading 212 investment account via my link. The current offer closes on Wednesday 4th March so you will need to move quickly on this now!

Also in February I published a guest post on the subject Why a Post-Nuptial Agreement Could be a Wise Financial Decision. This concerns a subject that – while it might seem unromantic – could be crucial to ensuring your financial security in later life. This article is by Richard Scott, a partner in the family team at HCR Law. In it he explains the benefit of having a post-nuptial agreement in place if, sadly, your marriage (or civil partnership) should come to an end.

I also published another guest post, on the subject of How Your Morning Coffee Might Protect Your Brain as You Age. This concerns a subject close to many people’s hearts (including mine!) – what are the benefits (and risks) of coffee drinking and how much a day is best? It may be of particular interest to older people, as the latest research indicates that the caffeine in coffee (and tea) may offer some protection from dementia. The article is by Eef Hogervorst, Professor of Biological Psychology at Loughborough University. It was originally published in The Conversation.

Is a River Cruise Right for You? was a follow-up to my earlier article about how to save money on cruise holidays. In this article I focused on river cruises, which have become a very popular option among older travellers. I explored the pros and cons of river cruising – particularly for older people – and shared some tips to help you get the best value for money on your river cruise holiday.

Finally, in Get Your Will Written Free of Charge in March, I explained how – if you and/or your partner are over 55 – you may be able to get your will written for free by taking advantage of Free Wills Month. Appointments are limited and on a first come, first served basis, so it’s important to take action on this as soon as possible. Once all available appointments are taken, the campaign will close. This may happen before the end of March.

I’ll close with a reminder that you can also follow Pounds and Sense on Facebook or Twitter (or X as it is called now). Twitter/X is my number one social media platform and I post regularly there. I share the latest news and information on financial matters, and other things that interest, amuse or concern me. So if you aren’t following my PAS account on Twitter/X, you are definitely missing out!

- I am also on the BlueSky social media network under the username poundsandsense.bsky.social. Twitter/X remains my primary social media platform, but I also post details of my latest blog posts, third-party articles and other financial news and resources on BlueSky for those who prefer to follow me there.

As always, if you have any comments or questions, feel free to leave them below. I am always delighted to hear from PAS readers

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that posts on PAS may include affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered, but it does help support me in publishing PAS and paying my bills. Thank you!

.

.