What Are Smart Portfolios on eToro?

In my post today I’m focusing on the trading and investment platform eToro. I originally reviewed eToro in this post.

eToro is a Israeli fintech company based in Cyprus. The company also has registered offices in the UK, US and Australia. It is a hugely popular platform with 25 million customers from over 140 countries across the world.

eToro is regulated and authorised in the UK by the Financial Conduct Authority (FCA) and is covered by the Financial Services Compensation Scheme (FSCS). That means if eToro were to go bust any deposits with them up to £85,000 would be protected. Of course, the FSCS doesn’t protect you if you lose money simply due to your investments performing poorly.

eToro offers a wide range of investment products, from individual shares to cryptocurrencies, commodities to ETFs, currency pairs to copy trading. Today, though, I’m focusing on investing in thematic portfolios (referred to on eToro as Smart Portfolios). I recently invested in one of these myself and will talk more about this later. But before that, let’s start by answering the most basic question…

Table of Contents

What Is Thematic Investing?

Thematic investing is a term you are likely to hear a lot more in the coming months. I know for a fact that at least one other major investment platform is planning to roll out this option soon.

There is no generally accepted official definition of thematic investing. It has some similarities with sector investing, but is more wide-ranging. To quote Wikipedia, ‘Thematic investing is a form of investment which aims to identify macro-level trends, and the underlying investments that stand to benefit from the materialisation of those trends.’ Thematic funds and portfolios tend to span a variety of sectors and pick companies within those sectors that are relevant to the chosen theme.

Thus, a healthcare-themed fund might invest in pharmaceutical companies, hospital companies, health insurance companies, nursing homes, surgical equipment manufacturers and other high-tech and information technology companies operating in the healthcare field.

Thematic investing involves assembling a collection of companies in an area you predict will generate above-average returns over the long term. Themes can be based on a concept such as ageing populations or the switch to renewables, or a narrower sub-sector such as robotics or driverless cars. Obviously, if the trend in question continues, a fund or portfolio based on it is likely to do well.

Thematic Investing on eToro

eToro offers a growing range of thematic portfolios you can invest in. As mentioned above, they are referred to on the platform as Smart Portfolios.

Most Smart Portfolios are created and managed by experts on the eToro investment team, taking into account factors such as balance, exposure, potential yield, risk and so on. In addition, there are some created and managed by eToro’s partners, including specialist investment firms and high-profile investors such as Warren Buffet.

An important question for investors is whether these portfolios are actively managed or passive. In fact, eToro say it’s a mixture of both. On the one hand, Smart Portfolios are not generally updated on a daily basis. However, they are regularly rebalanced and fine-tuned by the eToro investment team. Rebalancing is a means of ensuring that each portfolio is regularly realigned to match the original asset allocation plan and optimized for best results. Rebalancing periods differ from portfolio to portfolio, with details about this on each portfolio’s info page.

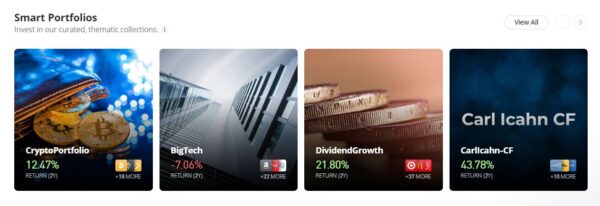

Some examples of eToro Smart Portfolios are listed below:

- Cloud Computing

- Crypto Portfolio

- Renewable Energy

- Dividend Growth – high-dividend-yielding companies

- Cannabis Care – medical marijuana

- Metaverse Life – virtual worlds

- China Tech – technology leaders in China

- Diabetes-Med – diabetes care stocks

- Oil World Wide – long oil industry

- Travel Kit – travel and leisure

The minimum investment in an eToro Smart Portfolio is $500 (about £416 at the time of writing). The reason for this is that when you invest in a Smart Portfolio, eToro automatically duplicates all trades in proportion to the size of your investment. eToro has a minimum investment size of $1 and if a trade would work out less than that pro rata it will not be executed. Setting a minimum investment of $500 therefore ensures that there are enough funds to open all the positions needed for the investment.

When assets that are eligible for dividend payments are held via a Smart Portfolio, these dividends are added to the portfolio’s cash balance. When the portfolio is rebalanced, these sums are then reinvested in the portfolio’s holdings.

How to Invest in an eToro Smart Portfolio

Before you can start investing, you will of course need to register for an account with eToro and deposit some funds with them. I talked about this in my original eToro review. I also recommend opening an eToro Money account (as discussed in this blog post), as this will speed up the process and ensure any costs are kept to a minimum).

Once you have done this, you can check out eToro’s range of Smart Portfolios by clicking on Discover in the left-hand menu of your dashboard when logged on. When you do this and scroll down a bit, you should see a section like the one below…

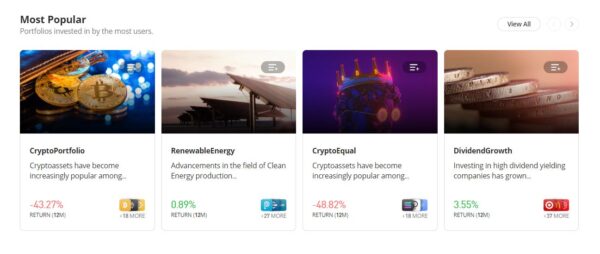

Click on View All and you will be taken to a page listing Smart Portfolios in various categories. The top one is Most Popular. When I tried this today, the section concerned looked like this…

Again, you can see all the portfolios in this category by clicking on View All. Further down the page are sections for other categories, including Tech Focused, Crypto Based and Created by Partners. There is also a filter tool allowing you to search for Smart Portfolios covering particular interests – from utilities to medical technology, cryptocurrencies to media services.

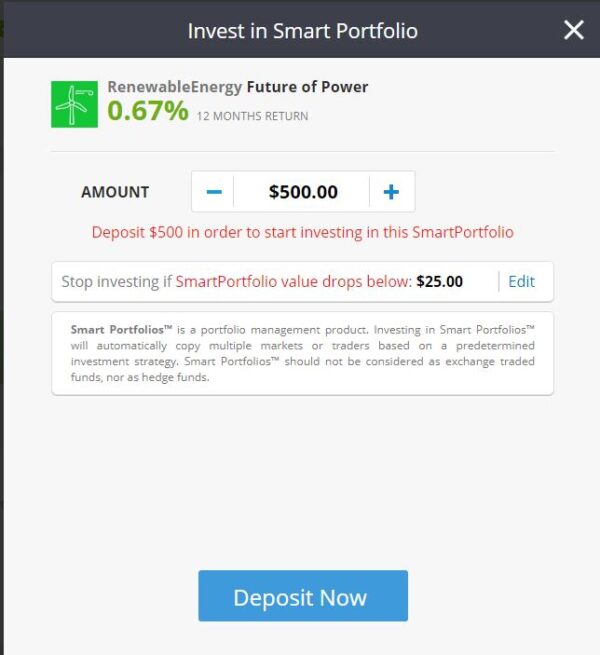

Once you have found a Smart Portfolio you want to invest in, all you need to do is go to the page for the SP in question and click on Invest in the top-right-hand corner. A pop-up box should then appear…

You can of course change the amount in the top box if you want to invest more than the minimum $500.

One other choice you have to make here concerns the Stop Loss figure. If the value of your portfolio falls below this, the Stop Loss will automatically close your investment and return the remaining money to your eToro balance. You can set this figure anywhere between 5% and 95%. My top tip is not to set this figure too high, as even a brief ‘wobble’ will then trigger the stop loss and crystallize your losses. Personally I wouldn’t set this figure any higher than 70% ($350 with a $500 investment). But it’s your decision, of course, based on your tolerance for risk.

Once you are happy with the settings, click on Deposit Now and your investment in the Smart Portfolio in question will be made.

- If any of the above sounds at all daunting, don’t forget that everyone on eToro also gets a $100,000 virtual portfolio to practise with. You can invest using this virtual money to see how the process works and what returns you make.

My Experience with eToro Smart Portfolios

On 4th January this year (2023) I invested $500 in the Oil Worldwide smart portfolio. This SP focuses on the world’s leading oil-related companies, oil-related ETFs (exchange traded funds) and direct oil price derivatives.

I know this might seem rather a contrarian choice in these eco-aware times, but it seems to me that oil will still have a vital role to play in the world economy for many years to come. Plus the big oil companies are making huge profits at the moment, so I figured I might as well grab a share of that!

In addition, with oil companies currently out of favour with (some) investors, I thought there might be value to be found investing in this sector. These are large, successful companies, and they are increasingly diversifying from ‘black gold’ to renewables as well. And finally, this particular SP has a good recent profit record on eToro (much better than most crypto portfolios, for instance).

Obviously I have only been invested for just over a month to date. Even so, the value of my SP has risen to $513.62 at the time of writing, an increase of 2.66 percent. I am quite happy with that. In any event, I’m looking on this as a long-term investment so won’t be judging it yet.

Closing Thoughts

If you are looking for an interesting – and rather different – investment opportunity, thematic investing with eToro Smart Portfolios is certainly worth considering. They allow you to back your opinions on probable trends in the years ahead, and profit if the trends in question do indeed come to pass.

Of course, as with all investing, there is never any guarantee you will make money. And you could lose money if trends falter or go into reverse. In addition, unexpected events can torpedo any trend – just look what happened to the leisure and tourism industry in 2020 when the pandemic struck. It’s therefore essential to diversify your investments as much as possible and avoid the cardinal sin of putting all your investment eggs in one basket.

- Remember, also, that investing is (or should be) a long-term exercise. The value of your investments can go down as well as up, and in the short- to medium-term at least you could end up getting back less than you put in. Ideally you should have a time-frame of five years or longer for any equity-based investment. In any event, you should avoid investing money you may need at short notice in the next year or two.

Nonetheless, eToro Smart Portfolios are a welcome addition to the platform’s range of investment products. And with eToro’s low fees, easy-to-use website and good social investing features, it’s a site all investors should at least check out.

For more information about eToro, please see my original eToro review and also my posts about copy trading on eToro and the eToro Money app. You can also if you wish sign up directly on the eToro website via this link [affiliate].

I will continue to update Pounds and Sense readers about the performance of my eToro investments in my monthly updates (such as this one).

As always, if you have any questions or comments about this post or eToro more generally, please do post them below.

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that this post includes affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered.

April 19, 2023 @ 12:36 am

Good review. Can you also explain how to check whether a smart portfolio incur over night fees/ weekend fees?

April 19, 2023 @ 9:21 am

Thanks! In common with other trading platforms, eToro charges overnight/weekend fees (aka rollover fees) on CFDs (Contracts for Difference). As you probably know, these are high-risk, leveraged products. They are not something I choose to invest in personally.

AFAIK, most (possibly all) eToro smart portfolios do not incorporate CFDs. Having checked quickly today, the only one I could find which might was Active Traders, which duplicates the trades of some top traders on eToro. There is a warning about the volatility of CFDs in the description of this portfolio, which suggests to me that it might. No other smart portfolio description I could find included a CFD warning, so I doubt very much that in these portfolios you would be exposed to CFDs or have rollover fees deducted. But obviously, you are always free to ask a question on the relevant page of the eToro website before investing.