My Short Break in Criccieth

I recently returned from a three-night break in Criccieth. This is a village on the Llyn (or Lleyn) Peninsula in NW Wales. It was the first time I had stayed in Criccieth, although I have visited a few times before.

The place I stayed was a self-contained, self-catering apartment facing the sea-front. I booked it using the website Booking.com. I’ll say more about the accommodation below.

Criccieth is by the coast, roughly half way between Porthmadog (home of the Ffestiniog Railway) and Pwllheli (famed for its Butlins camp, now run by Haven Holidays). Here is a map of the area from Google Maps.

Accommodation

As mentioned, I stayed in a self-catering apartment in Criccieth. This was on the second floor, with a view of the sea from the kitchen/lounge. The owners’ name for the apartment is Foel Wen.

The main Criccieth beach was ten minutes’ walk away, but I was happy where I was. It was quiet, there was plenty of free parking on the road outside, and while it wasn’t the most stunning length of beach, there was a small promenade which was pleasant to walk along in the morning or evening. You can see a photo of the beach opposite my apartment below.

You can read more about the accommodation on this page of the Booking.com website. It had a lounge/kitchen at the front, a small bedroom with bunk beds in the middle (which I didn’t use) and the main bedroom at the rear. The bathroom was next to the small bedroom; it was quite compact but fine for a short stay. There was a good-quality modern electric shower but no bath.

The kitchen area was well equipped with an electric cooker, microwave, fridge/freezer, dishwasher, toaster, sink, and so on. On my first and last nights I cooked for myself (Criccieth isn’t exactly crammed with eating places) and on the middle night I got fish, chips and peas from a local takeaway, Castle Fish and Chips, which was excellent 🙂

The apartment had free wifi which worked perfectly during my stay (not always the case in my experience). The location was quiet and peaceful, and I slept very well.

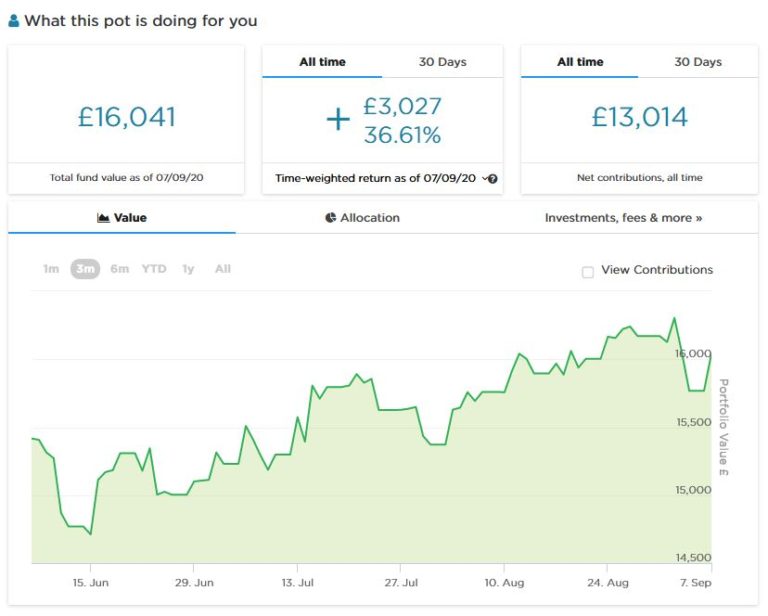

Financials

As Pounds and Sense is primarily a money blog, I should say a word about this.

I paid £355 for my three-night stay, which works out to around £118 per day. I thought that was very reasonable bearing in mind the high standard of the accommodation and the convenience of the location. Obviously as this was self-catering no meals were included, but there was more space and better facilities than you would get in a comparable hotel or B&B.

Things to Do

I won’t give you a blow-by-blow account of what I did while I was there, but here are a few highlights.

Portmeirion

This is about 15 minutes’ drive from Criccieth (or a short train journey to Minffordd and a ten-minute walk). I spent my first morning here.

Portmeirion is a beautiful Italianate village created by the architect Clough Williams Ellis. These days it is probably best known as the location for the 1960s cult TV series The Prisoner, starring Patrick McGoohan. It is a wonderful place to while away a few hours.

There is an admission fee to get into Portmeirion, At the time of writing (July 2022) this is as follows:

- Adult £17.00

- Concessions £13.50 (this applies to anyone aged 60+ or a student with a valid student ID)

- Children £10.00 (5-15 years)

- Children (under 5 years) Free

There are also discounted family tickets for various permutations of adults and children.

You can also get free admission (in the afternoon) by booking a minimum two-course lunch at Castell Deudraeth; this is part of the Portmeirion estate, a short walk from the village itself. Free admission to the village is also available if you book a spa treatment or afternoon cream tea there.

More information is available on the Portmeirion website. One thing you may need to know is that they don’t allow dogs (other than guide dogs) into the grounds.

Ffestiniog Railway

This heritage steam railway has two separate lines, both of which run from Porthmadog.

The Welsh Highland Railway takes you on a scenic two-and-a-quarter hour trip through the heart of Snowdonia to Caernarfon, while the original Ffestiniog Railway takes you on a one-hour trip to Blaenau Ffestiniog. On this occasion I took the shorter journey, but I have done the Welsh Highland Railway trip before and highly recommend it as well. You can get more info on both (and book in advance) via the Ffestiniog Railway website.

The harbour station in Porthmadog has a small car park which quickly gets full, but there is a free car park for people travelling on the railway at the back of the public car park opposite (Llyn Bach). I used that myself on this occasion. There were plenty of spaces when I arrived at around 10 a.m. but I noticed it was full later. So my top tip if going by car is to book a ticket on a morning train rather than leaving it until the afternoon!

- You can also travel to Porthmadog via the mainline railway if you wish. This is on the beautiful Cambrian Coast line which runs from Pwllheli at one end to Aberdyfi (and beyond) at the other.

Criccieth Castle

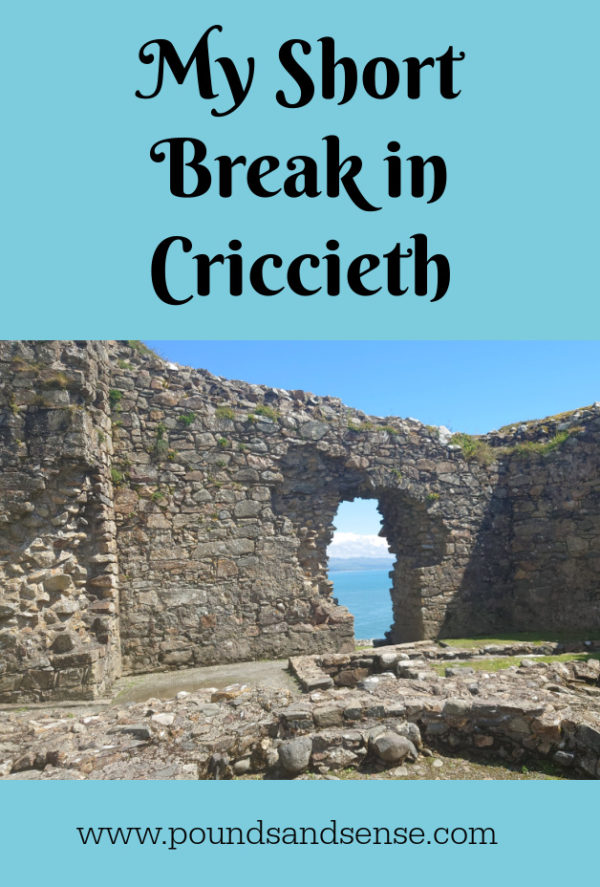

My accommodation was literally five minutes walk from Criccieth Castle, so of course I had to pay it a visit.

The castle itself is a ruin but (as the photo shows) plenty of the walls are still standing. There is also a visitor centre where, as well as buying your ticket and guidebook, you can learn more about the history of the castle and see some relics that have been found there.

Arguably the best reason for visiting the castle, though, is the spectacular views. The photo below shows the main Criccieth beach. You can even see as far as Harlech Castle from here, although you might need binoculars!

Final Thoughts

As you may gather, I enjoyed my short break in Criccieth, and am happy to recommend both the village and the accommodation where I stayed for a short break.

Criccieth is a lovely place to relax and chill out. It has excellent road and rail connections, and – as mentioned above – there are also some high-quality tourist attractions nearby.

One thing I really enjoyed about this holiday was the number of casual conversations I struck up with other visitors, staff, locals and so on. This applied especially on my Ffestiniog Railway trip, where I ended up chatting with half the people in my carriage! I’d have to say it did help that only a small minority of people are nowadays wearing face-masks. That human contact is something I missed during the pandemic, and as a solo traveller especially it is great to be able to get back to chatting with strangers again 😀

As always, if you have any comments or questions about this post, please do leave them below.