What is AER and Why is it Important to Savers and Investors?

I recently posted about the importance of compounding to investors. In the article I pointed out that compounding, when combined with the magic of compound interest, is a powerful tool for building wealth and long-term financial success.

Compounding involves earning interest on both your initial investment and the accumulated interest from previous periods. In other words, it’s the process of generating earnings from an asset’s reinvested earnings. The more frequently your money is compounded, the faster it grows. And the longer your money remains invested, the more significant the compounding effect becomes.

A reader asked me if the effect of compounding is equivalent to getting a higher annual interest rate. The answer to that is yes, if interest is compounded more than once a year. The more times per year interest is compounded, the higher the effective annual rate becomes. The official term for this is AER, or annual equivalent rate.

In this article I thought I would explain AER in a bit more detail, as it is a very important concept for savers and investors to grasp.

What is AER?

Annual Equivalent Rate (AER) is a standardized way of expressing the interest rate on savings or investment products over a one-year period. It allows investors to compare the potential returns on different financial products on a like-for-like basis. AER takes into account the effect of compounding, providing a more accurate representation of the overall return on an investment.

Why is AER Important?

AER is crucial for investors as it helps them make more informed decisions when comparing different savings and investment options. While nominal interest rates may seem attractive at first glance, they can be misleading. AER provides a more accurate reflection of the actual return on an investment by factoring in the compounding of interest over time.

Example

Let’s consider two savings accounts:

- Savings Account A offers a nominal interest rate of 7% per annum, compounded annually.

- Savings Account B offers a nominal interest rate of 7% per annum, compounded quarterly.

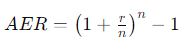

To compare these accounts accurately, we can use the AER formula:

Where:

- is the nominal interest rate (as a decimal)

- is the number of compounding periods per year

For Account A:![]()

For Account B:![]()

In this example, even though both accounts have the same nominal interest rate, Account B has a higher AER due to the more frequent compounding.

Let’s now add a third savings account, Account C, again with a nominal annual interest rate of 7% but this time compounded monthly. We can calculate the AER for Account C using the formula as before:

![]()

As you can see, the AER is higher again due to the increased frequency of compounding. If compounding was even more frequent (e.g. daily) the difference would be even more pronounced. In addition, the longer the period over which you invest, the greater the difference frequency of compounding will make.

While AER is often considered with regard to savings accounts, it also applies to investments. As I said in my earlier post, with a property crowdlending platform like Assetz Exchange [referral link] which pays monthly dividends (and has low minimum investments), you can keep reinvesting the income you receive to boost the returns you make.

Closing Thoughts

Understanding AER is crucial for UK savers and investors as it provides a standardized measure to compare the true potential returns of different financial products.

By taking into account the compounding effect, AER offers a more accurate picture of overall returns on investments. When evaluating savings or investment opportunities, always look beyond nominal interest rates and consider the AER to make informed decisions that align with your financial goals. And take any opportunity that arises to reinvest your returns to harness the power of compounding to grow your wealth faster.

As ever, if you have any comments or questions about this post, please do leave them below.

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.