Investing Basics for Beginners

Today I have a collaborative post for you in association with my friends at European crowdlending platform Mintos.

The article sets out some basic principles for anyone who may be considering investing for the first time.

Table of Contents

Introduction

if you’re looking to build long-term wealth and create the financial means to achieve life-long goals, investing can be the key to doing this. To get you started, we’ve put together an overview of what investing is, what people invest in, how people invest, and what you might need to start your investment journey.

Key takeaways

- Investing can be an effective way to build long-term wealth and unlock financial freedom.

- When you invest, you can expect to earn a profit on the money you have invested, otherwise known as an investment return.

- Investment returns compound (grow bigger and bigger) each time you reinvest them, helping you achieve financial goals faster.

- Investments are referred to as assets; they are grouped into asset classes, e.g. cash, stocks, bonds, real estate, commodities, and alternatives.

- Anyone can start investing, regardless of experience or financial situation. Even just a little money can go a long way.

What Is Investing?

Whether consciously or not, we invest our time and energy throughout our lives, whether it’s on getting a university degree or learning to cook a new recipe. Typically we do these things because we expect them to bring us value in future, e.g. landing our dream job after finishing university.

With investing money, the concept is similar – you put your money into something with the expectation that you’ll make a profit from this in the future.

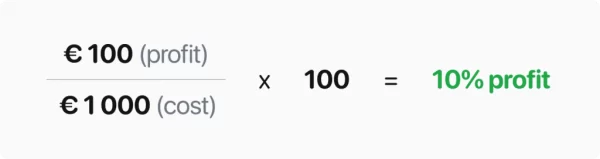

The profit you earn from investments is commonly referred to as a return. This is often expressed as a percentage. For example, if you invest €1000 in something and at the end of the investment period, you get back €1100, then your profit would be €100, giving you a 10% return on your investment.

Why Do People Invest?

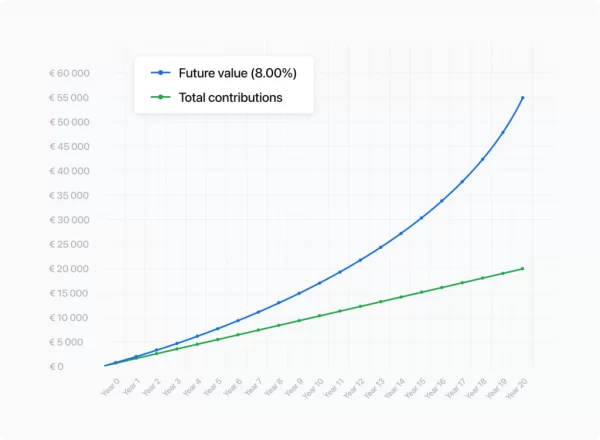

For many years people have used investing as a means to build their wealth. The reason long-term investing is so effective is because of compound growth. Investment returns compound (grow bigger and bigger) each time they are reinvested, helping you achieve your financial goals faster.

For example, if you invest €100 a month over the next 20 years at an 8% interest rate, each year your funds will grow at a faster pace (see chart below). The idea is that by the end of the investment period, you will have significantly more money than if you’d added the same amount to a savings account.

For many, investing provides the means to pay for education, home ownership, cars, travel, retirement, and so on. So people often look to investing because it can provide them with opportunities.

What Do People Usually Invest In?

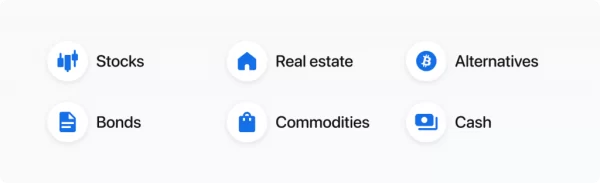

When you own something of value that can be converted to money, it’s described as an asset. Assets can be liquid, meaning they can be quickly converted to money, or illiquid, where it’s more time-consuming and complex to turn them into money.

In the investment market, assets are categorized into asset classes. These are groups of assets with similar characteristics. Some examples of popular asset classes are:

Where to Start?

As you can see, there are many different ways of investing. How people choose often comes down to prior experience and financial objectives. Although the investment landscape may seem vast, there are options to suit everybody.

A great way to get started is to set investment goals. Once you have some clarity around your goals and budget, you can begin to research which assets or asset classes will suit your financial objectives and risk appetite.

Investment platforms that offer simple, automated investing strategies can be an easy place to begin. These strategies are built using expert analysis and data, reducing the need for prior expertise or in-depth research. An example here is Wealthyhood.

Investments in Exchange Traded Funds or ETFs (large investment portfolios investors can buy shares in) are also relatively straightforward. They’re managed by investment firms and require no work from an investor’s perspective. One example of a robo-adviser investment platform that uses ETFs is Nutmeg.

Or, if you’d like more control, you can research and make individual investment decisions yourself using brokers or self-investment platforms such as eToro.

Some investors only have one asset, such as a real estate (property) investment. Others own many different assets, forming what’s known as an investment portfolio.

When creating a portfolio, it’s important not to put all your eggs in one basket. It can be beneficial to invest smaller amounts across multiple assets, so your lower-risk investments balance the higher-risk ones – an investment strategy known as diversification. Doing this can increase the chances you’ll achieve the returns you expected while reducing the risk of significant losses.

Many investment platforms only require small amounts to get started. For example, on Mintos you can begin investing with just €50 (around £43). When you invest responsibly, even a little money can go a long way and bring you closer to achieving your financial goals.

As mentioned earlier, Mintos is a European crowdlending platform. Your money is invested in loans to businesses and private individuals arranged by MIntos’s partner lending companies from around the world.

As Mintos is a European operation, you will need to invest in euro and your returns will be paid in this currency. That obviously adds a layer of complication for UK residents, but there are various ways around this. If you have a UK bank account you will normally be able to make (and receive) payments in euro, but may be charged a transaction fee.

You could use your own bank to fund your account initially, but if you become a regular investor with Mintos you might want to use a service/account that charges lower fees. You could use a money transfer service such as Paysera or Wise (formally TransferWise). These will enable you to transfer funds between Mintos and your own bank account with (potentially) lower charges and a more favourable exchange rate.

Another option would be to open a euro account with a provider such as Starling. This will allow you to receive and make payments in both sterling and euro, again at a lower overall cost.

If you’d like to check out the options for inventors on Mintos – and learn more about how they operate and how risks are managed – please see this page of their website. Since 2015, investors with Mintos have earned a 9.54% net return per year on average. Of course, past performance is no guarantee of how any investment platform will do in future.

Special Bonus!

Until 30 August 2023, if you click through any link to Mintos in this article and invest €1000 or more, you will get a €50 instant bonus and a 1% bonus of your average investment in the first 90 days.

- If you invest €5000, for example, in addition to the returns advertised, you will also receive a €50 instant bonus and a further 1% bonus of €50 after 90 days.

Thank you again to my friends at Mintos for their assistance with this article. If you have any comments or questions, as always, please do leave them below.

Disclosure: This is a collaborative post in association with Mintos. I am not a registered financial adviser and nothing in this article should be construed as personal financial advice. You should always do your own ‘due diligence’ before investing, and if in any doubt seek advice from a registered financial adviser before proceeding. All investing carries a risk of loss.

This post includes affiliate links. If you click through and make an investment (or perform some other designated action) I may receive a commission for introducing you. This will not affect the product or service you receive or any charges you may pay. Note also that the special bonus referred to in this article is only available if you click through one of my links and will not apply if you go to the Mintos website directly.