My Coronavirus Crisis Experience: March 2021 Update

Here is my latest monthly Coronavirus Crisis Update. Regular readers will know I’ve been posting these updates since the first lockdown started a year ago now (you can read my February 2021 update here if you like).

I plan to continue these updates until we are clearly over the pandemic and something resembling normal life has resumed. Obviously, I very much hope that will be sooner rather than later.

As ever, I will begin by discussing financial matters and then life more generally over the last few weeks.

Financial

I’ll begin as usual with my Nutmeg stocks and shares ISA, as I know many of you like to hear what is happening with this.

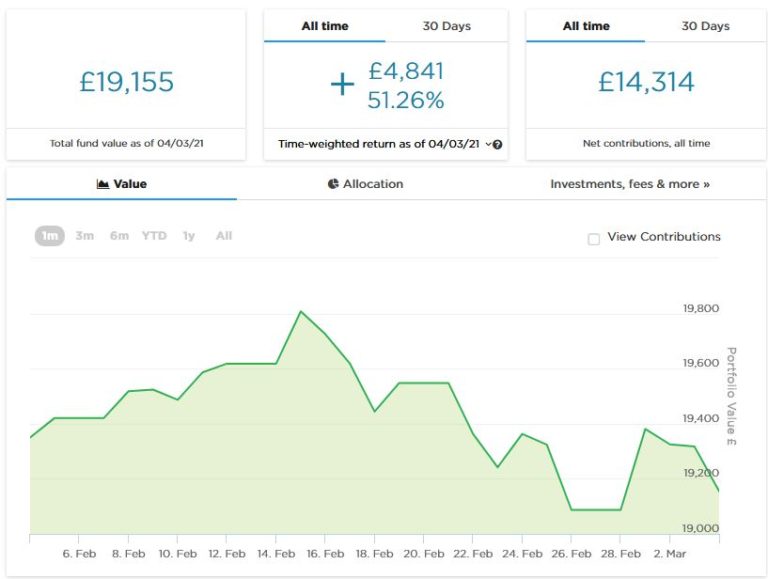

As the screenshot below shows, since last month’s update my main portfolio has been through some ups and downs. It is currently valued at £19,155. Last month it stood at £19,008, so it is at least up a little (£147) overall.

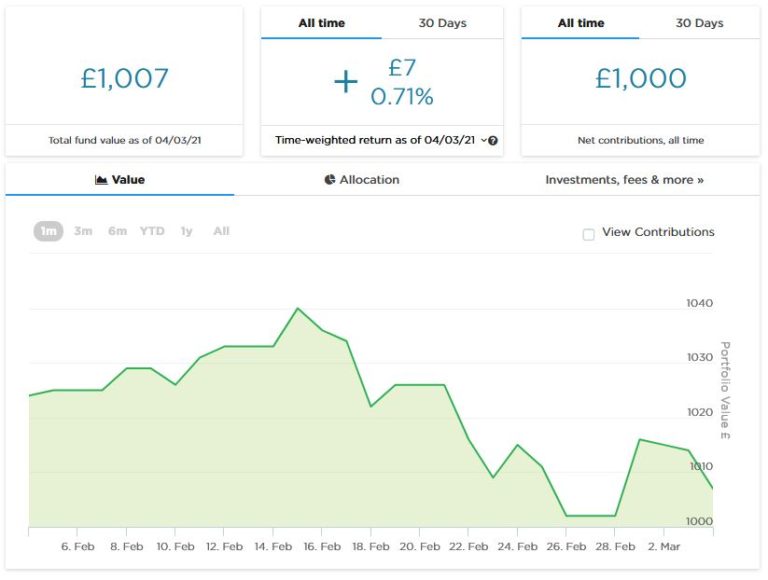

As you may recall, three months ago I put £1,000 into a second Nutmeg pot to try out Nutmeg’s new Smart Alpha option. The value of this pot rose as high as £1,040 in mid-February, though it currently stands at a more modest £1,007. Here is a screen capture showing performance to date, though obviously it is much too early to draw any conclusions from this.

You can see my in-depth Nutmeg review here (including a special offer at the end for PAS readers).

I mentioned last time that my first investment with P2P property investment platform Property Partner reached its five-year anniversary, at which point investors can vote to sell their shares or continue for another five years. Along with just under half of the other investors, I voted to sell my shares.

The shares of everyone who wanted to sell were duly put up for sale on the platform. Unfortunately, though, there were few buyers, so with a substantial number of shares unsold, the property has been put up for sale on the open market. That means there will be a period of several months – possibly longer – before a buyer is found, and there is no guarantee that the independent valuation price will be achieved.

That is obviously disappointing, though as I only have a very small amount invested in this property (about £50) I’m not going to lose any sleep over it. In my view Property Partner didn’t make much effort to market these shares to investors. I suspect the same may be the case with at least some of the other properties coming up to their five-year anniversaries. It may be that Property Partner are happy to get some of the smaller houses and apartments off their books, especially the city-based ones for which demand has fallen as a result of the pandemic. Currently I have another small investment going through the five-year process. I voted to sell my shares in this too, but suspect the outcome will be the same.

As I have noted before on PAS, shares in many properties on Property Partner are currently available on the secondary market at a discount to the independent valuation price Based on my experiences to date, however, I would advise caution about regarding this as a buying opportunity. If properties that are relisted attract little interest from existing PP investors, they will have to be sold on the open market. In that case you are likely to have a long wait until you see any return on your investment, and there is no guarantee of an overall profit even then. I shan’t therefore be investing on the Property Partner secondary market for the foreseeable future.

That wasn’t the only disappointing financial news last month. Property crowdfunding investment platform The House Crowd unexpectedly announced that it was going into administration. I still have some investments with THC, though thankfully not as many as I did two or three years ago.

Apart from one small loan – which I accepted some time ago had gone south – my remaining investments are in traditionally crowdfunded properties, all of which are currently up for sale. The money is therefore secured by bricks and mortar, so I expect to get at least some of it back (and have of course been receiving dividend payments from rent received). As with other property crowdfunding platforms, each THC property is owned and managed by a separate Special Purpose Vehicle (SPV), which gives it legal protection from claims against THC by creditors. How this will pan out in practice remains to be seen, but I note that the administrators have said that their appointment is ‘not expected to have a material impact on investors.’

So I am being philosophical about this and awaiting further developments. These have undoubtedly been tough times for property investors, and regular readers will know that I also recently lost money with another property crowdfunding platform called Crowdlords. Overall, when you allow for my successful property investments and rental income, I am more or less breaking even, but even so (as I have said on the blog before) I am a lot more cautious about this type of investment nowadays.

Personal

February was another long, cold month, but at least there are signs of better times ahead now. The vaccine roll-out continues to go well and case numbers are dropping rapidly, giving us all hope for a return to something approximating normal life in the weeks and months ahead.

And, of course, we are heading into the spring now, with longer, brighter days and – eventually – the prospect of some warmer ones!

One thing that always lifts my spirit at this time of year – and especially in the current circumstances – is the arrival of spring flowers. In my garden I have crocuses and snowdrops out at the moment, and it won’t be long until the daffodils are in bloom. Here’s a photo of a flower bed in my front garden…

I had my first Covid jab in February, at the Whitemore Lakes mass vaccination centre near Lichfield. It was run by a team of NHS staff, military and volunteers. Everyone was friendly and efficient. The only slight blip came when I was checking in. I happened to notice that the clerk had put ‘female’ on my form, doubtless due to my lockdown hair. She was embarrassed when I pointed this out, but of course I couldn’t just say nothing. I shall be very pleased when we are allowed to visit hairdressers again!

I received the Oxford-Astra Zeneca vaccine. After I had a bad reaction to my last flu jab (fever and nausea) I was prepared for something similar with this, but thankfully that didn’t happen. Apart from very slight soreness in my arm the next day, I had no side-effects at all. I hope I am just as lucky with my second jab, which I have already booked for May.

Also on a medical theme. I had my latest trip to the eye clinic at Queens Hospital Burton last week. Regular readers will know that last autumn I was diagnosed with a perforated retina in my left eye. My first laser treatment was only partly successful, so Iast time I received a (more powerful) top-up treatment. This visit was to check if it had been successful, and I was pleased and relieved to hear that it had. So once again I need to express my thanks and gratitude to all the staff there, and especially to Mr Brent, the consultant who performed my final laser treatment and gave me the good news this time. I have been told that if something like this happens once it increases the chances of it happening again, so I have to be on the lookout for any potentially worrying changes to my eyesight in future. But that aside I am lucky that this problem was detected early before anything more drastic (e.g. a detached retina) occurred – so big thanks to my optician at Vision Express Lichfield as well!

As I write this update, the schools are just about to reopen to all students. I am delighted about that, as I know that it has been a tough time for many children. While some schools have been very good about running online classes, these can never be a complete substitute for face-to-face teaching. I also know from speaking to friends that some schools have been less supportive, simply sending pupils written lessons or assignments to complete on their own. That is obviously less than ideal for younger children especially.

I do think it is regrettable that the government has advised that secondary school children should wear masks in classrooms. The same applies to the mandatory twice-weekly testing. In my view these measures will achieve little apart from traumatizing young people and making it harder for them to learn. I understand these measures have been introduced partly to placate the teaching unions and some worried parents, but hope they will be swiftly withdrawn when (as I fully expect) there is no big ‘spike’ in virus cases following the return. Okay, I’ll get off my soapbox now!

As always, I hope you are staying safe and sane during these challenging times. If you have any comments or questions, please do post them below.

March 9, 2021 @ 11:16 am

That’s great that you have had your first vaccine, my Grandparents and my parents have had it now, they seem to be getting through them quickly

March 9, 2021 @ 12:03 pm

Thanks, Jenni. Yes, the vaccine roll-out has been a great success. Looking forward to restrictions being eased going forward now.

March 9, 2021 @ 12:37 pm

A very mixed bag when it comes to your investments, but it seems overly good on your Nutmeg stocks and shares. I’m currently trying to put aside some money that we can use to invest so I’ll need to read up on Nutmeg to find out more x

March 9, 2021 @ 1:35 pm

Thanks, Rhian. Nutmeg is certainly worth considering if you are thinking of investing in stocks and shares. Don’t forget that your current ISA allowance will expire on 5 April 2021!

March 15, 2021 @ 10:52 pm

Can see that you have removed your post from June 2020 regarding Buy2Letcars. Was this due the recent intervention from the FCA which has resulted in payments to investors being halted?

March 16, 2021 @ 7:15 am

Thanks for your query. My review of Buy2LetCars has been unpublished as they are unable to accept new investors at the moment. Hopefully the dispute with the FCA will be resolved soon and if/when that happens I will restore my review of the platform.