Five Things I Have Learned From My eToro Virtual Portfolio

In my post today I’m focusing on the trading and investment platform eToro. I originally reviewed eToro in this post.

eToro is a Israeli fintech company based in Cyprus. The company also has registered offices in the UK, US and Australia. It is a hugely popular platform with 25 million customers from over 140 countries across the world.

eToro is regulated and authorised in the UK by the Financial Conduct Authority (FCA) and is covered by the Financial Services Compensation Scheme (FSCS). That means if eToro were to go bust any deposits with them up to £85,000 would be protected. Of course, the FSCS doesn’t protect you if you lose money simply due to your investments performing poorly.

eToro offers a wide range of investment products, from individual shares to cryptocurrencies, commodities to ETFs, currency pairs to copy trading, and thematic investing via smart portfolios. Today, though, I’m focusing on a feature that doesn’t require any outlay at all. This is the facility to operate a $100,000 virtual portfolio on the platform, to familiarise yourself with how it works and test out trading and investing strategies.

I have been an eToro investor for around a year now. I started with a virtual portfolio, but as regular readers will know I have also invested some real money. I do still use my virtual portfolio, however, and have learned a number of valuable lessons from it. So I thought today I’d set out some of these.

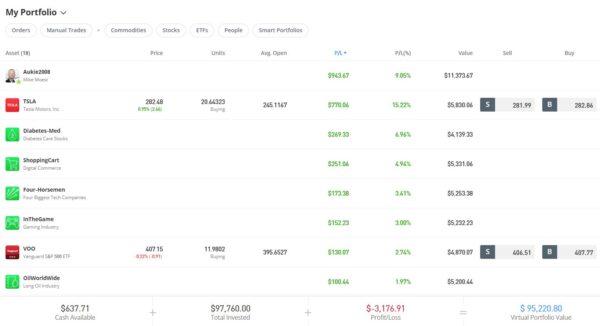

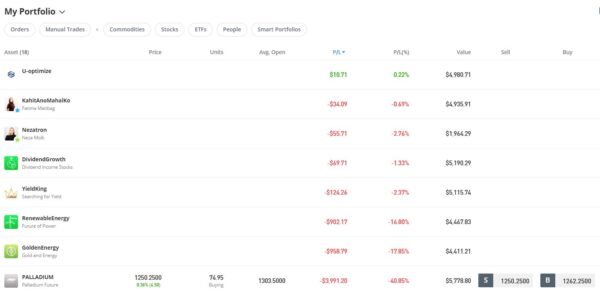

I’ll start by showing you some data on how my virtual portfolio has been performing. As I have quite a lot of different investments in this, I have taken two separate screen captures showing first the best performing and then the worst performing. As you will see, I am down a bit overall, but I’m not upset about that as obviously I have been experimenting to try to assess what works and what doesn’t.

Table of Contents

Best Performing Investments

Worst Performing Investments

Some Lessons Learned

I hope you found the screen captures of my virtual portfolio interesting. They include most of my current investments apart from one or two in the middle. I can’t discuss every investment in detail here, but as promised here are some of the lessons that I have drawn from my experiences to date.

Copy trading can be profitable

As you can see, the best performing investment in my virtual portfolio is copy trading Aukie2008 (Mike Moest). This has generated a profit of almost $1000 for me. Regular readers will know that I also invested some real money following this trader and have done well from this too.

I am obviously a fan of the copy trading feature on eToro, though naturally some traders do better than others. When I was starting out I also considered investing some real money following a trader called Nezatron (of course, I wasn’t the least bit influenced by the fact that she is an attractive blonde…). But as you can see above, the results she has achieved over the last year aren’t nearly as impressive.

Please read my blog post about copy trading on eToro for more information about this feature.

Trading in Commodities/CFDs really IS high risk

Another option for investors on eToro is commodities. These range from precious metals through to food products, including the famous (or infamous) pork bellies.

It’s important to understand that when trading in these markets, you are essentially betting on whether the price will go up or down in future. The mechanism for doing this is something called Contracts for Difference, or CFDs for.short.

CFDs are leveraged investment products. That means you can make a lot of money if they go the way you predict but also lose a lot if they go the opposite way.

In my virtual portfolio I have tried commodity trading three times. The first time was with Nickel and I made a big profit. The next was Gold, and I lost all the money I had made with Nickel and a bit besides. Finally, as you can see, I opened a ‘buy’ trade with the rare metal Palladium. This trade also went the wrong way, so I am currently sitting on a loss of almost $4000. Obviously I am glad that isn’t real money!

- If you’re wondering why my Nickel and Gold trades aren’t showing in my screen captures, it’s because the stop-profit and stop-loss limits respectively were reached and the trades closed out. You are obliged to set stop profits and stop losses on the eToro platform, though you can of course adjust them subsequently if you wish..

To be fair to eToro, they have warnings across the site that trading with CFDs is extremely risky. But trying it myself (in virtual form) really has brought home to me the risk you are running, especially if you don’t fully understand what you’re doing. Indeed, if it wasn’t for my commodity-trading experiments, my virtual portfolio would be well in profit by now.

If, despite this, you still want to find out more about commodity trading using CFDs, the eToro website has a useful introductory guide here. As for me, I am not planning to try it again any time soon!

You can’t always trust ‘the wisdom of the crowd’

You might wonder how I chose which commodities to invest in. Well, eToro shows you what proportion of investors at any time are buying a particular commodity (i.e. forecasting its price will rise) and what proportion are selling (i.e. forecasting it will fall). Here is a screen capture illustrating this.

No doubt naïvely, I assumed that if a very high proportion of investors are ‘buying’ a particular commodity, doing likewise should be profitable. As mentioned, though, while that worked on the first occasion I tried it, it didn’t on the second or third. So while this information might be useful in some circumstances, my experiences indicate that it is definitely not to be relied upon.

Investing in renewables isn’t a one-way bet

You might also assume (as I did) that in the current climate crisis and manic quest to achieve Net Zero, investing in renewables ought to be a profitable strategy.

To test this, I invested in two eToro smart portfolios in this sector. One is called Renewable Energy and the other Golden Energy. As you can see from my earlier screen capture, both have performed poorly and are at the bottom of my list (just above Palladium). I am currently down about $1000 on each.

In a somewhat ironic twist, my investment in a smart portfolio called Oil Worldwide is actually showing a small profit. Regular readers will be aware that I also have some real money in Oil Worldwide.

I don’t really know why companies in the renewable energy sector should be under-performing (on eToro at any rate). But again it does make the point that what may appear to be ‘nailed-on’ profitable investments can still end up losing money. There is never any guarantee!

You can read my blog post here about smart portfolios, which allow you to invest thematically on eToro.

Health and AI are two sectors worth watching

As you can see, one of the best performing investments in my virtual portfolio was Diabetes-Med. This is a smart portfolio covering companies in the field of diabetes care, treatment and prevention. As someone who has previously been diagnosed prediabetic, I had a particular interest in this. And with diabetes on the rise across the world, it did seem to me it was a sector with good profit potential.

Another of my more profitable investments was Cancer-Med. Again I had personal reasons for wanting to invest in this, as my partner Jayne died from cancer and I have been treated for prostate cancer myself. Obviously a lot of research money goes into cancer, and successful treatments can prove extremely lucrative for the companies concerned.

AI, or artificial intelligence, is a major talking point at the moment. While some concerns have been expressed about its potential downsides, businesses are investing heavily in this field and the potential profits to be made appear huge. eToro doesn’t currently have an AI smart portfolio as such. You can, however, invest in four big tech companies (Microsoft, Amazon, Apple and Google) via the Four Horsemen smart portfolio. All four of these companies are currently pouring vast amounts of money into AI research.

My investment in Four Horsemen has generated a decent (virtual) profit for me so far and I don’t see that changing any time soon. I may well be investing some real money in this smart portfolio before long.

- Obviously if you wish you can also invest in any of these companies individually via eToro. But the Four Horsemen smart portfolio provides a convenient method for investing in all four, with the portfolio regularly rebalanced to ensure that investors’ funds are divided proportionately among them.

Final Thoughts

So those are five lessons I have learned from my eToro virtual portfolio. I don’t claim any of them are particularly earth-shattering or that they represent deep universal truths. But I have found all of them valuable in different ways and they will certainly inform my investing in future.

If you are interested in investing and/or trading, I do therefore recommend setting up an eToro virtual portfolio and trying different strategies with it. I shall continue to do so myself, alongside my real investments in eToro and elsewhere.

To remind you, you can read my article about setting up an eToro account – which automatically includes a $100,000 virtual portfolio – here. You can also read how my actual (real money) investments with eToro are performing in my monthly investment updates, of which this is the latest.

As always, if you have any comments or questions about this article – or eToro more generally – please do post them below.

Disclaimer: I am not a professional financial adviser and nothing in this post should be construed as personal financial advice. You should always do your own ‘due diligence’ before investing, and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Please note also that posts on Pounds and Sense may include affiliate links. If you click through these and make a purchase or investment, I may receive a commission for introducing you. This will not affect in any way the price you pay or the product/service you receive. In some instances bonuses and other promotional incentives may only be available if you click through my link.