My Coronavirus Crisis Experience: May 2021 Update

Another month has passed, so it’s time for another of my Coronavirus Crisis Updates. Regular readers will know I’ve been posting these updates since the first lockdown started in March 2020 (you can read my April 2021 update here if you like).

As ever, I will begin by discussing financial matters and then life more generally over the last few weeks.

Financial

I’ll begin as usual with my Nutmeg stocks and shares ISA, as I know many of you like to hear what is happening with this.

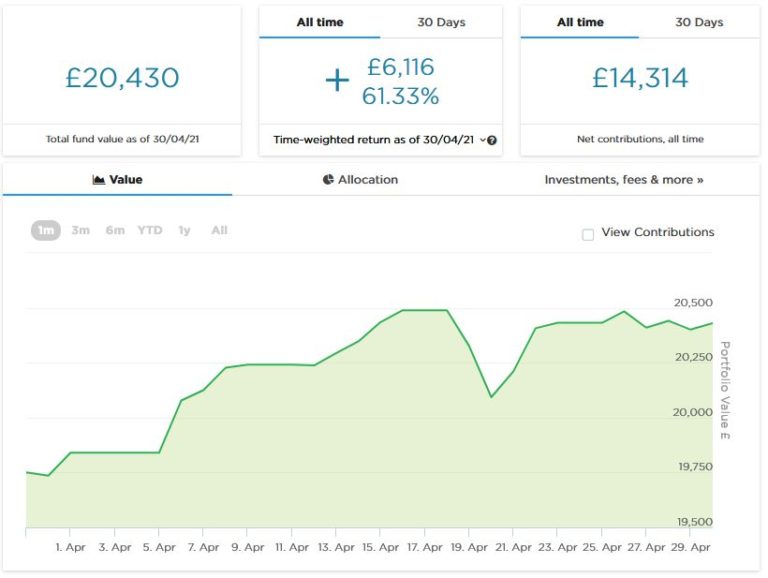

As the screenshot below shows, the value of my main portfolio rose fairly steadily in the first half of April, after which it remained around the same level (apart from a brief dip around the 20th). It is currently valued at £20,430. Last month it stood at £20,078, so overall it has gone up by £352. I am happy enough with that.

Apart from my main portfolio, five months ago I put £1,000 into a second pot to try out Nutmeg’s new Smart Alpha option. This has done pretty well, so in April I added another £1,000 from some money returned to me by RateSetter (as discussed in last month’s update). This pot is now worth £2,067. Here is a screen capture showing performance in April.

I updated my full Nutmeg review in April and you can read the new version here (including a special offer at the end for PAS readers). If you are looking for a home for your new 2021/22 ISA allowance, based on my experience they are certainly worth a look.

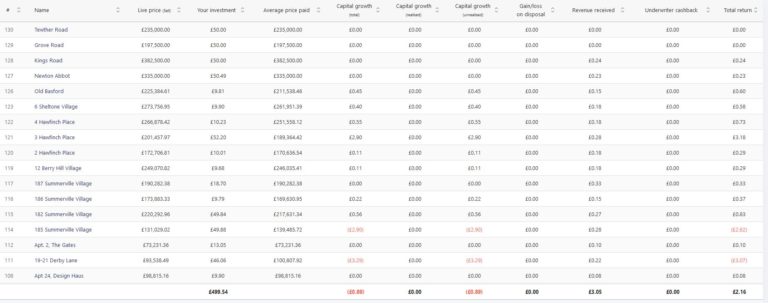

I also added £400 (from RateSetter again) to my initial test investment of £100 with Assetz Exchange. As you may recall, Assetz Exchange is a P2P property investment platform that focuses on lower-risk properties (e.g. sheltered housing on long leases). I put £100 into this in mid-February and (as mentioned) another £400 in April. Since then my portfolio has generated £3.05 in revenue received from rental (equivalent to an annual interest rate of about 10% on my original £100 investment). Here’s my current statement in case you’re interested:

As you can see, even though I have only invested £500, I already have a well-diversified portfolio. This is a particular attraction of Assetz Exchange in my view. You can actually invest from as little as 80p per property if you really want to proceed cautiously!

You may also notice that some of the properties in my portfolio have gone up in value and some have gone down. This makes it a bit harder to judge overall performance compared with an equity-based investment like Nutmeg. The property values quoted by Assetz Exchange represent the best price you can sell at currently on the exchange, which is where all investments on AE are bought and sold. But they are only really relevant if you want to buy or sell that day. By contrast, Property Partner (a somewhat similar P2P property investment platform) quote a value for each property based on an independent surveyor’s valuation every 6-12 months. That means the values displayed on Property Partner are more stable, but of course they are only theoretical as there is no guarantee that this valuation would be achieved if the property was put on the market.

As I noted before, my investment on Assetz Exchange is in the form of an IFISA (Innovative Finance ISA), so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and therefore intend to continue investing with them. You can read my full review of Assetz Exchange here if you like. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

- In case you’re not aware, everyone has a generous £20,000 tax-free ISA allowance in the current tax year (2021/22). However, for some reason the government only allows you to invest in one of each type of ISA in any particular.tax year. So you can only put new money into one stocks and shares ISA per year, but you can invest in a cash ISA and/or IFISA as well if you wish – just as long as you don’t exceed the £20,000 total limit. In the 2021/22 tax year I am therefore investing in a Nutmeg stocks and shares ISA and an Assetz Exchange IFISA. This gives me additional diversification compared with investing in just one type of ISA.

Moving on, I heard last month that I will not be eligible for any more SEISS income support payments for the self-employed. Along with many other self-employed people, my income took a hit when the pandemic struck and this money from the government came in very useful (though I do thankfully have a personal pension and other investments as well). However, I have become a victim of the rule that says to receive SEISS your average self-employed income must represent at least half of your total income.

For the first three rounds of SEISS that was indeed the case. However, the latest round of payments incorporates another set of tax returns (2019/20) when calculating average income. Because my income was lower in these accounts (partly due to the pandemic) my four-year average is now less than what I draw from my personal pension. So at a stroke I am no longer eligible for any more support. It’s not the end of the world, but I do find it bizarre that a scheme intended to support self-employed people whose livelihoods have been affected by the pandemic can cut off completely when your average income drops. Commiserations to any PAS readers who may have found themselves in a similar situation 🙁

Personal

In April, as I’m sure you know, some of the government’s lockdown restrictions finally began to be lifted.

I was glad to be able to go for a swim for the first time since Christmas, and have been doing so twice a week since it became possible again. I am a member of the David Lloyd Club in Lichfield which has two pools, one inside and one out. Although I’ve heard that you have to book slots at some swimming pools, that has never been the case at DL Lichfield, and in fact in many ways it feels reassuringly normal. Of course, you have to wear a mask as you enter the building, but thankfully not in the changing rooms or the pool 😀

- I have just been told that if the pools get very busy, DL staff ask people to wait in the changing rooms until others have left. I haven’t witnessed this myself and don’t think it happens very often, but am happy to place this info on record.

What I do find bizarre is the rules about buying and consuming refreshments. The club room (aka coffee shop) at DL Lichfield is open for the purchase of drinks and light meals, but you can’t consume them within the building. You are, however, allowed to sit at a table in the club room (no need for a mask) to read and relax or just stare at the four walls. But heaven help you if you try to eat or drink anything.

I was told by a staff member that it was okay to take a drink to the outdoor pool as long as I was going for a swim, but not if I simply wanted to lie on a sunbed. Even though I am fast becoming a connoisseur of strange lockdown rules, this one seems barmy to me and I’d love to know how DL Lichfield plan to enforce it (“Unless you get in that pool in the next five minutes, I’m taking your coffee away.”). I’d like to support the DL club room/coffee shop, but the incomprehensible rules have defeated me. So I’m now taking a flask of tea and a biscuit with me and having that on the poolside or in the changing room after my swim. So far no Covid police have come for me.

I have also been pleased (and relieved) to have my hair cut again, six months after this was last done. Thankfully I didn’t have to queue up, as my hairdresser comes to me and cuts my hair in my conservatory. We have both had Covid jabs and agreed to dispense with masks and just kept the door and window open (thankfully it was quite a warm day). Again, it all felt reassuringly normal.

I haven’t so far taken advantage of the reopening of pub gardens, largely because it has been so cold (and wet) most days. It’s good to see at least some of my local pubs open again, but a shame they still aren’t allowed to open inside as well as out. Last year we had Eat Out to Help Out at a time when there were more Covid cases and deaths then there are now (just one death yesterday, I read). I am looking forward to May 17th when pubs and restaurants can reopen inside as well, but believe this has been delayed too long personally.

I am probably one of the few people who didn’t watch the Line of Duty finale. Indeed, I haven’t watched any of the series, as it didn’t really appeal to me. For one thing it sounded downbeat and depressing, and life has been grim enough recently. But also, it appeared a bit too complicated for my liking. Especially as i grow older, I find following series with large casts and labyrinthine plots increasingly challenging. I can remember laughing (affectionately) at my dad when he expressed confusion at the plot of some TV detective show, but I am obviously going down the same route myself now 😮

I have watched a couple of shows I enjoyed this month, though, so thought I’d share details in case anyone fancies giving them a try.

The first is an Amazon Prime Video series called Upload. This is a dystopian science fiction tale, set in a not-too-distant future when a method has been found for transferring people’s minds at the point of death (or before) to a virtual afterlife. This service is provided by a number of large corporations. They employ minimum-wage ‘angels’ in large warehouse-like offices to monitor these worlds and support the clients who live in them (at least, until their money runs out). It is quite a dark concept, but full of laugh-out-loud moments and some great characters. There is also a mystery in it, and a romance between a female ‘angel’ and one of her (deceased) male clients. It’s well worth a watch if you like something a bit different (and have Amazon Prime Video, of course).

I am also enjoying a US fantasy series called The Librarians (see below). I originally caught a couple of episodes on an obscure Freeview channel and decided I’d like to watch the whole (four) series from the beginning. Doing that proved a bit more challenging than I anticipated, but eventually I managed to track down a DVD box set on eBay.

The Librarians is a tongue-in-cheek fantasy series with a certain retro feel to it. It reminds me a bit of the old Avengers TV show in its heyday (with Diana Rigg as Emma Peel).

The Librarians are a group of misfits who are recruited to work at the mysterious Library, a place where magical artefacts of all kinds are stored. Early in the first series magic is released into the world again, having been suppressed for many centuries. In each episode the Librarians investigate some mysterious incident and try to stop evil individuals deploying magic for nefarious ends, generally using their intelligence rather than violence.

Again, it’s hard to explain in a few words, but you soon get the hang of things. And the characters, while perhaps excessively goofy at times, are all endearing in different ways. The Librarians is really old-fashioned family entertainment (with little if any swearing) and none the worse for that. If you can get hold of it – I’m not sure whether it’s on any streaming services – it offers an enjoyable (and at times hilarious) drop of escapism, something I guess many of us need at the moment.

As always, I hope you are staying safe and sane during these challenging times. If you have any comments or questions, please do post them below.

May 4, 2021 @ 12:37 pm

It’s good to see your Nutmeg ISA’s doing well,I want to start upping my S&S ISA contributions but it’s just not feasible moneywise at the moment. I really enjoyed upload too, it was a really fun show x

May 4, 2021 @ 1:01 pm

I have been meaning to check out Upload for some time now so will definitely bump it up my list. I always love reading about your investments and how things are going for you. I’ve only got a few small investments so far.

May 4, 2021 @ 2:44 pm

Thanks, Rebecca and Rhian. Glad you both enjoy reading about my investments. And yes, I thought Upload was entertaining and at times thought-provoking. I did just think the last episode ended on rather a downbeat note. I gather a second season has been commissioned, though, so it may be they wanted to whet viewers’ appetites for that.

May 4, 2021 @ 8:46 pm

Great blog nick I realy enjoy reading it.Im a fan of Assetz Exchange too and joined them just recently and was surprised to get a call fron Peter welcoming me to the platform it was a nice touch.I mentioned you as I had read your review of Assetz Exchange and he had a lot of praise for you and by the way he his doing a live stream on financial thing in June so that should be good….Keep up the good work Nick.

May 4, 2021 @ 9:18 pm

Thanks, Paul. That’s very kind of you. Yes, I have been impressed with Assetz Exchange and am enjoying investing with them. I have spoken with Peter as well and found him helpful and genuine.