My Investments Update – April 2024

Here is my latest monthly update about my investments. You can read my March 2024 Investments Update here if you like

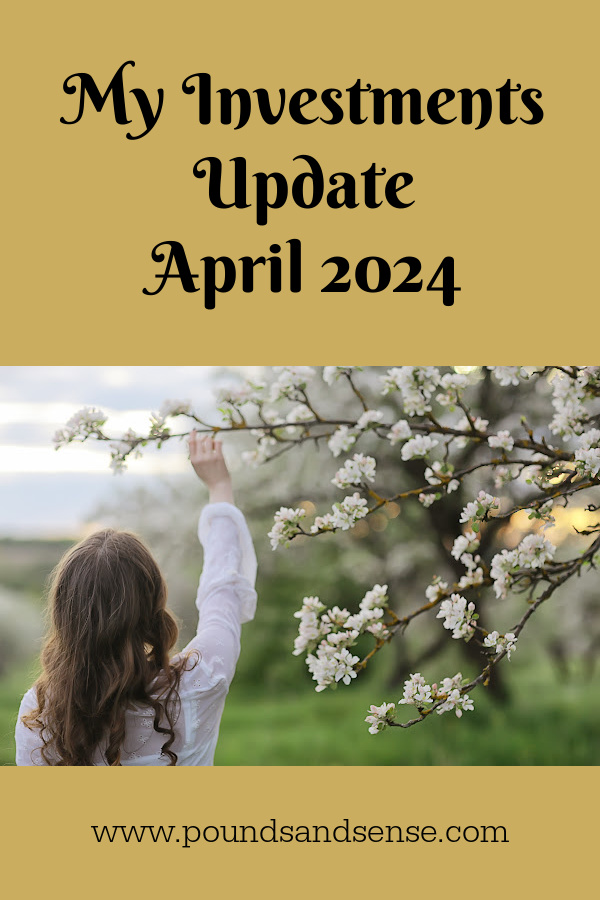

I’ll begin as usual with my Nutmeg Stocks and Shares ISA. This is the largest investment I hold other than my Bestinvest SIPP (personal pension).

As the screenshot below for the year to date shows, my main Nutmeg portfolio is currently valued at £23,859. Last month it stood at £22,994 so that is a welcome increase of £865.

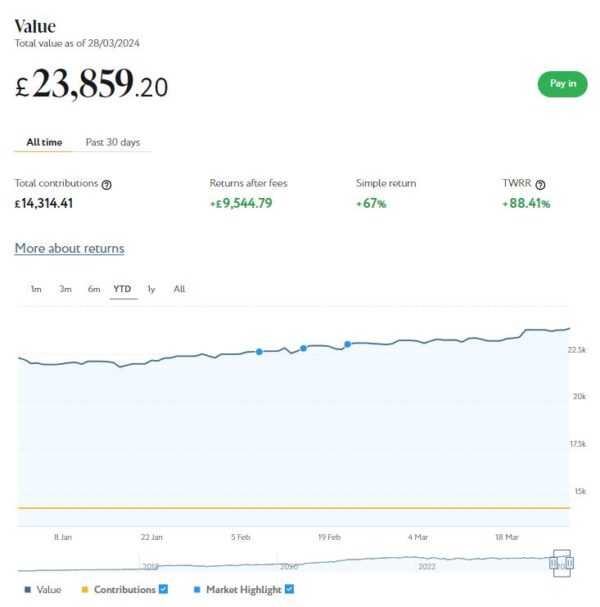

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £3,781 compared with £3,640 a month ago, a rise of £141. Here is a screen capture showing performance over the year to date.

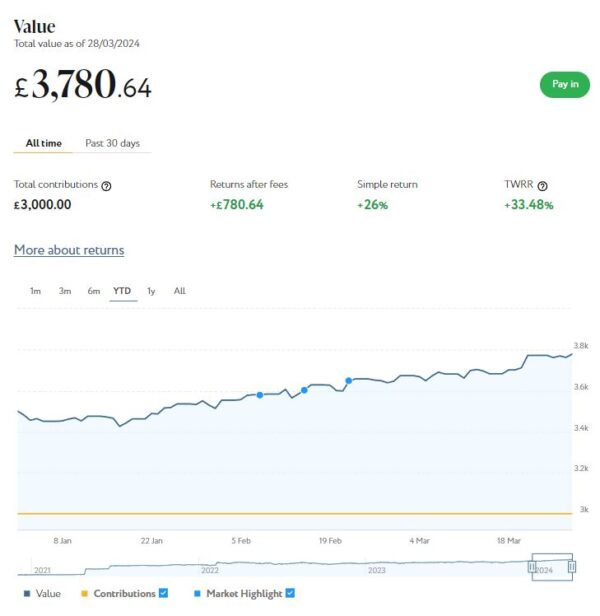

Finally, at the start of December 2023 I invested £500 in one of Nutmeg’s new thematic portfolios (Resource Transformation). As you can see from the screen capture below, this is now worth £759 compared with £530 last month, an increase of £229 since last month.

I should though say that £200 of this is ‘new money’. This came from a ‘Refer a Friend’ bonus, which I decided to pay into this pot rather than withdrawing. So if you disregard that, this portfolio has actually risen in value by £29 since last month.

March was obviously another good month for my Nutmeg investments. Overall – and disregarding the £200 RAF bonus – I was up £1,035 or 3.55%. And since the start of the year (again disregarding the £200 RAF bonus in March) I am up by £1,882 or 7.15%. In these turbulent times I am more than happy with that.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are looking for a home for your annual ISA allowance, based on my overall experience over the last eight years, they are certainly worth considering. They offer self-invested personal pensions (SIPPs), Lifetime ISAs and Junior ISAs as well.

- Don’t forget, the current tax year ends on 5 April 2024 and after that the 2023/24 tax-free ISA allowance of £20,000 will be gone forever. But the good news is that you will then have a whole new £20,000 ISA allowance for 2024/25!

I also have investments with the property crowdlending platform Kuflink. They continue to do well, with new projects launching every week. I currently have around £1,570 invested with them in 10 different projects paying interest rates averaging around 7%. I also have £14 in my Kuflink cash account.

To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question.

There is now an initial minimum investment of £1,000 and a minimum investment per project of £500. Kuflink say they are doing this to streamline their operation and minimize costs. I can understand that, though it does mean that the option to test the water with a small first investment has been removed. It also makes it harder for small investors (like myself) to build a well-diversified portfolio on a limited budget.

One possible way around this is to invest using Kuflink’s Auto/IFISA facility. Your money here is automatically invested across a basket of loans over a period from one to five years. Interest rates range from 7% to around 10%, depending on the length of term you choose. Full up-to-date details can be found on the Kuflink website.

You can invest tax-free in a Kuflink Auto IFISA. Or if you have already used your annual iFISA allowance elsewhere, you can invest via a taxable Auto account. You can read my full Kuflink review here if you wish.

Moving on, my Assetz Exchange investments continue to generate steady returns. Regular readers will know that this is a P2P property investment platform focusing on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my AE portfolio has generated a respectable £173.90 in revenue from rental income. As I said in last month’s update, capital growth has slowed, though, in line with UK property values generally.

At the time of writing, 8 of ‘my’ properties are showing gains, 7 are breaking even, and the remaining 14 are showing losses. My portfolio is currently showing a net decrease in value of £35.05, meaning that overall (rental income minus capital value decrease) I am up by £138.85. That’s still a decent return on my £1,000 and does illustrate the value of P2P property investments for diversifying your portfolio. And it doesn’t hurt that with Assetz Exchange most projects are socially beneficial as well.

The overall fall in capital value of my AE investments is obviously a little disappointing. But it’s important to remember that until/unless I choose to sell the investments in question, it is largely theoretical, based on the most recent price at which shares in the property concerned have changed hands. The rental income, on the other hand, is real money (which in my case I’ve reinvested in other AE projects to further diversify my portfolio).

To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as i am concerned (especially now that Kuflink have raised their minimum investment per project to £500). You can actually invest from as little as 80p per property if you really want to proceed cautiously.

- As I noted in this recent post, Assetz Exchange is particularly good if you want to compound your returns by reinvesting rental income. This effectively boosts the interest rate you are receiving. Personally, once I have accrued a minimum of £10 in rental payments, I reinvest this money in either a new AE project or one I have already invested in (thus increasing my holding). Over time, even if I don’t invest any more capital, this will ensure my investment with AE grows at an accelerating rate and becomes more diversified as well.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

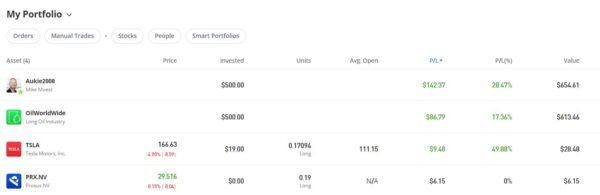

In 2022 I set up an account with investment and trading platform eToro, using their popular ‘copy trader’ facility. I chose to invest $500 (then about £412) copying an experienced eToro trader called Aukie2008 (real name Mike Moest).

In January 2023 I added to this with another $500 investment in one of their thematic portfolios, Oil Worldwide. I also invested a small amount I had left over in Tesla shares.

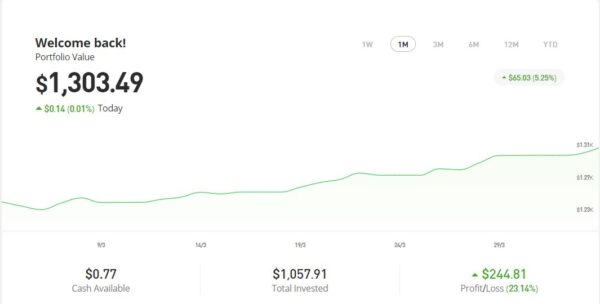

As you can see from the screen captures below, my original investment totalling $1,022.26 is today worth $1,303.49, an overall increase of $281.23 or 27.51%.

You can read my full review of eToro here. You may also like to check out my more in-depth look at eToro copy trading. I also discussed thematic investing with eToro using Smart Portfolios in this recent post. The latter also reveals why I took the somewhat contrarian step of choosing the oil industry for my first thematic investment with them.

- eToro also offer the free eToro Money app. This allows you to deposit money to your eToro account without paying any currency conversion fees, saving you up to £5 for every £1,000 you deposit. You can also use the app to withdraw funds from your eToro account instantly to your bank account. I tried this myself and was impressed with how quickly and seamlessly it worked. You can read my blog post about eToro Money here. Note that it can also serve as a cryptocurrency wallet, allowing you to send and receive crypto from any other wallet address in the world.

I had two more articles published in March on the excellent Mouthy Money website. The first is Saving versus Investing – What’s the Difference and Why You Should Do Both. People often get confused between saving and investing, and it doesn’t help that the words are sometimes used loosely and interchangeably. In reality, though, there is a clear difference between them. In this article I explain why saving should always be your first priority, but ideally you should do both.

Also in March Mouthy Money published my article Are Solar Panels Still Worthwhile? As you probably know, solar PV panels generate electricity from sunlight. Growing numbers of homeowners (me included) have them on their roofs. At one time solar panels came with generous payment tariffs known as FiTs (feed-in tariffs), but those days are long gone. So in this article I examine what incentives exist today for installing panels and whether the sums still add up. I also look at the other pros and cons of solar panels.

As I’ve said before, Mouthy Money is a great resource for anyone interested in money-making and money-saving. I am a particular fan of my fellow MM contributor and money blogger Shoestring Jane. She writes mainly about money saving and frugal living. Her latest article Save Money on Gifts Throughout the Year sets out some top tips for saving money on gifts without (of course!) being a skinflint. You can see all of Jane’s articles for Mouthy Money via this web page.

I also published several posts on Pounds and Sense in March. I won’t bother mentioning those that are no longer relevant now, but the others are listed below.

One was a reminder that the Trading 212 welcome offer has reopened. If you haven’t done this before, you can get a free share worth up to £100. As I said in the article, my free share in AMD is now worth £151.88! This offer closes on 16 April 2024.

Also in March I published Don’t Miss Out! Use Your £20,000 ISA Allowance Before It’s Too Late. This was a reminder to use your 2023/24 allowance before it vanishes on 6th April 2024. Obviously you will need to move very smartly if you are going to do this now. But (as I said earlier) the good news is that everyone will have a fresh £20,000 allowance from that date.

- Another bit of good news is that as from 2024/25, ISAs will become more flexible and you can invest in more than one of each type in the same tax year. Check out my post about the ISA rule changes in 2024/25 here.

Also this year I became a regular contributor to the Over 60s Discounts website. You can read my latest article here: Grand Adventures on a Budget – How to Save Money on Days Out With Your Grandchildren. I highly recommend registering at Over 60s Discounts, by the way – they list a growing range of discounts and bonuses for older people, including some that are unique to O60D.

One other bit of news this month is that I finally got around to buying a home storage battery to connect to my solar panels (see my recent MM article about panels). I used a local (Staffordshire) company called The Energy Box for this, and am very happy to recommend them.

I’ve had my battery for just over a fortnight now and it’s been quite eye-opening. Using the battery app I can see how much electricity my solar panels are generating at any time and how much I am using in my home. I can also check the battery charge level and whether it’s charging or discharging. Even at this time of year, if there’s a bit of sunshine I am generating enough electricity in the day to cover my needs and charge the battery to a level where I’m running the house from it till well into the evening.

In the summer I’d expect to be generating enough to live off solar-generated power entirely, meaning there will only be the dreaded standing charge to pay. So I will actually be saving more money than I originally anticipated, though admittedly it will still be a number of years before the cost is covered.

It wasn’t just a financial decision, though. My other aim was to be able to continue as normal in the event of power cuts (which I expect to become more frequent in coming years as the UK transitions away from fossil fuels), and that should be the case too. The only issue might be a power cut in the depths of winter when the battery hasn’t charged up from the panels. Even so, if I know (or suspect) a cut is coming I can charge the battery in advance from the mains.

I’ve written an article going into more detail about home storage batteries (including my own) for my regular clients at Mouthy Money. This will be published in April, so keep an eye out for it!

Finally, a quick reminder that you can also follow Pounds and Sense on Facebook or Twitter/X. Twitter/X is my number one social media platform these days and I post regularly there. I share the latest news and information on financial (and other) matters, and other things that interest, amuse or concern me. So if you aren’t following my PAS account, you are definitely missing out!

That’s all for today. As always, if you have any comments or queries, feel free to leave them below. I am always delighted to hear from PAS readers

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that posts may include affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered, but it does help support me in publishing PAS and paying my bills. Thank you!