The House Crowd: My Review of this Property Crowdfunding Platform

Regular readers will know that I am something of an enthusiast for property investment (and specifically property crowdfunding). Among other things, I like the fact that you can make money from both rental income and capital growth. And investing in property can be a good way of spreading risk when you have equity-based investments.

The House Crowd was actually the first property crowdfunding company I invested with, starting in 2014. So I thought I would say a few words today about my experiences with the company and the investment opportunities they offer.

History

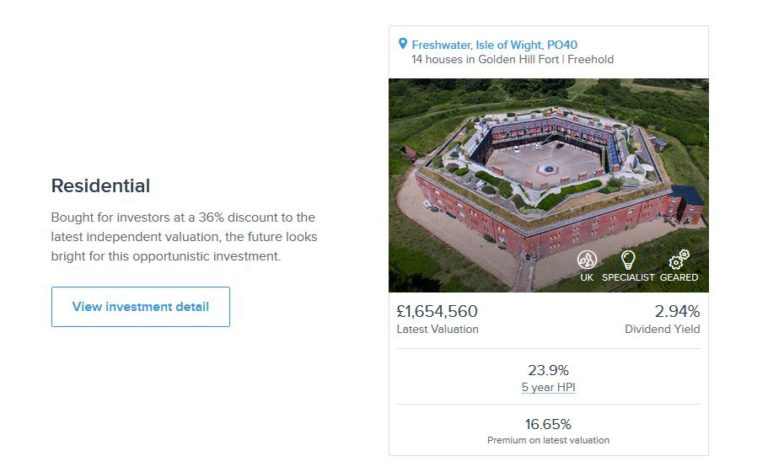

When I started investing with The House Crowd, they were offering mainly shares in specific properties. Investors pooled their money to buy a property and received a share of the rental income (distributed annually) with their money back – and hopefully a good profit – when the property concerned was sold. Typically a five-year timescale was specified, with investors then able to vote on whether to sell and take their profits or continue for another year (or more).

I still have shares in seven House Crowd properties. There haven’t been any disasters, though in certain cases rental income has been lower than forecast. This was typically due to voids (tenants leaving and not being replaced). There were also a few cases of tenants failing to pay their rent and absconding. And there was one ‘tenant from hell’, who apparently threatened other tenants with a knife so they all left, caused serious damage to the property, and left owing six months’ rent. Reading about this made me glad I invest via property crowdfunding platforms (and REITs) and am not a landlord myself.

One drawback of this type of investment is that it is quite illiquid. If you want your money back before a property is sold, The House Crowd will try to sell your share to another investor. There is no guarantee a buyer will be found, however, and even if one is you will only get the price you paid for your share. There is currently no formal secondary market, as on some other platforms such as Property Partner.

On the plus side, this sort of investment has its attractions from a tax perspective. Rental distributions are paid as dividends. There is currently a £2,000 annual tax-free dividend allowance which many people don’t otherwise use. And even if your dividend income exceeds £2,000, as a basic rate taxpayer you will only pay 7.5% tax on the balance above this. Gains when selling are – of course – treated as capital gains, and again there is a generous annual tax-free CGT allowance (£12,000 in 2019/20).

New Types of Investment

In recent years, recognizing that some investors were being deterred by the lack of liquidity, The House Crowd have introduced other types of investment. One of these is secured loans. Here money is lent to developers (or THC’s sister company, House Crowd Developments) for short- to medium-term projects, typically between 6 and 18 months.

Obviously you don’t get rental income with these, but you get your money back with interest once the loan is paid off. Interest rates vary, but are typically in the region of 7 to 12% per year. The rate paid generally depends on the LTV (loan to value). The higher the LTV (the loan amount compared with the property value), the riskier the loan, and the higher the interest rate on offer as a result. Some example projects open for investment at the time of writing can be seen in the cover image at the top of this post.

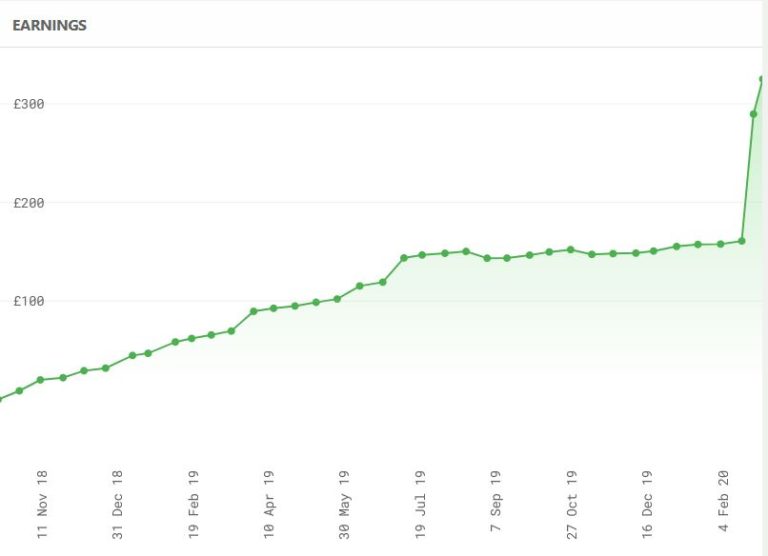

I have invested in loans with The House Crowd as well. The majority have gone well. For example, I invested £5,000 in a development loan for a Welsh property called Croesyceiliog Farm. I got this back with £461.99 interest ten months later.

Other loan investments haven’t gone as smoothly. For example, in 2016 I invested £1,000 in a loan for a property called Caverswall Castle. This was meant to be 12-month loan, but the borrower defaulted and legal action is now being taken to sell the property and repay investors. I still expect to get my money back eventually, but legal proceedings move at a glacial pace. How much interest I will get after all costs are covered I don’t know. At this stage, if I just get my £1,000 back, I will be more than happy.

Secured loans have various attractions for investors, and many property crowdfunding platforms as well as The House Crowd are now offering more opportunities of this nature. They have the advantage of shorter timescales than direct investment and decent rates of return (assuming the borrower doesn’t default). One drawback is that the interest paid when the loan is redeemed is treated as income, so you will have to pay tax on it at your highest marginal rate.

Auto-Invest and IFISA

In recent years The House Crowd have introduced an Auto-Invest product which you can (optionally) hold as an Innovative Finance ISA (IFISA).

As you may know, IFISAs offer the opportunity to invest in P2P lending and get tax-free returns. Everyone has a generous annual ISA allowance of £20,000 (in the current 2019/20 tax year). This can be divided any way you like among the three types of ISA. So if you open a House Crowd IFISA, you can still have cash and stocks and shares ISAs with other providers as well, so long as you don’t invest more than £20,000 in total. Note that you can also only invest in one ISA of each type per financial year.

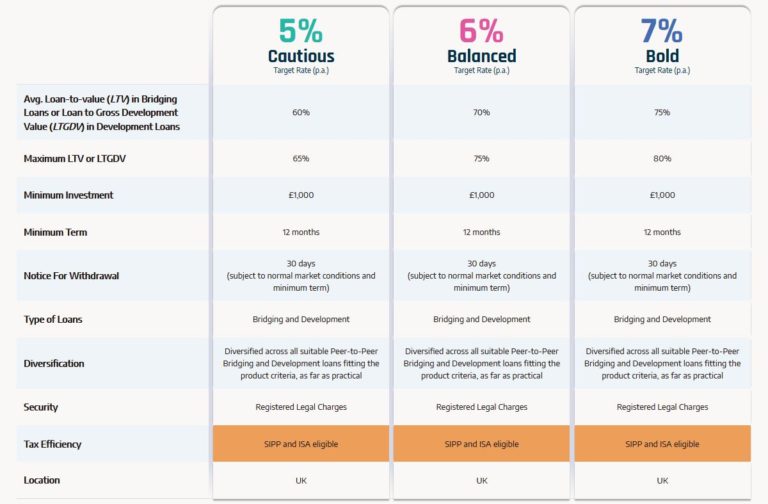

The House Crowd Auto-Invest product allows you to invest in one of three investment portfolios: Cautious, Balanced or Bold. Each of these comprises a basket of bridging and development loans, providing automatic diversification. The Cautious product has a target return of 5%, the Balanced 6%, and the Bold 7%. Note that these are target rates and they are not guaranteed. I have copied a summary table about the three products from the House Crowd website below .

As you can see, the more ‘adventurous’ the product, the higher the average LTV and the higher the maximum LTV. As mentioned earlier, the higher the LTV (other things being equal) the riskier the loan, and the higher the interest rate on offer as a result.

There is a minimum investment of £1,000 and a minimum 12-month term. After that you can withdraw by giving 30 days’ notice. Your money is protected by a legal charge secured against the borrower’s land/property, which can be possessed and sold in the event of the borrower not repaying.

It is possible to transfer another ISA to the House Crowd IFISA free of charge if it is over £5,000 (there is a £50 transfer fee for ISAs valued from £1,000 to £4,999).

Pros and Cons

As usual, here is my list of pros and cons for The House Crowd.

Pros

1. Well-established property crowdfunding platform with a good track record.

2. Customer service is fast, friendly and helpful.

3. Choice of investment types.

4. Tax-free IFISA option available.

5. Competitive rates of interest.

6. Attractive, user-friendly website.

7. Detailed information provided about loans and investments.

Cons

1. Limited liquidity with no formal secondary market.

2. Rental income (where applicable) only distributed annually.

2. Minimum £1,000 investment.

3. Some loans are currently in default.

4. Can’t open an IFISA if you have already put money in another IFISA this year.

Conclusion

For the most part I have been happy with my experiences with The House Crowd to date. Although (as mentioned above) there have been ups and downs, overall I have still made a good net return from my investments with them.

I like the new Auto-Invest/IFISA option, which is automatically diversified across a range of loans (thus reducing volatility and risk). The minimum 12 month term and withdrawal on 30 days’ notice thereafter is attractive as well. It is, however, important to be aware that the target rates of return quoted are not guaranteed.

You should also bear in mind that investments with The House Crowd do not enjoy the same level of protection as bank and building society savings, which are covered (up to £85,000) by the Financial Services Compensation Scheme. All investments are though secured against bricks and mortar, so in the event of a borrower defaulting you should still get your money (or most of it) back once the property has been sold. But obviously, this may take a while.

The lack of liquidity with property investments generally – and the absence of a formal secondary market with The House Crowd – means you should only invest money you are unlikely to need at short notice. This should be regarded as a medium- to long-term investment, therefore.

Clearly, no-one should put all their spare cash into The House Crowd (or any other investment platform). Nonetheless, it is worth considering as part of a diversified portfolio. Not only are the rates of return significantly higher than those offered by banks and building societies, they are relatively unaffected by fluctuations in the stock market. Property investments aren’t a way of hedging your equity-based investments directly, but they do help spread the risk

- A further consideration is that with world stock markets in chaos at the moment due to the coronavirus outbreak, now is probably not an ideal time for the average individual to be investing in stocks and shares. P2P lending of the type offered by The House Crowd represents an alternative investment approach that may be less susceptible to the wild ups and downs (mostly downs) on stocks and shares right now..

Welcome Offer

Unfortunately at present there is no welcome offer (or referral scheme) for new investors with The House Crowd. If a welcome offer is launched in future, I will of course post full details here.

If you plan to open an account with The House Crowd after reading this review, I’d still be grateful if you could let me know by sending a message via my contact form or leaving a comment on this post. This may help me persuade THC to set up a referral scheme and/or welcome offer in future 🙂

And of course, if you have any comments or questions about this review, as always, please do leave them below.

Note: This is a fully revised and updated version of my original 2017 review.

Disclosure: I am not a professional financial adviser and nothing in this post should be construed as personal financial advice. You should do your own ‘due diligence’ before making any investment, and seek professional advice from a qualified financial adviser if in any doubt how best to proceed. All investments carry a risk of loss. Finally, in the interests of full disclosure, I should reveal that as well as being an investor with The House Crowd, I also own shares in the company.