What Is An IFISA And Why Might You Want One?

If you’re reading this post you will almost certainly know what an ISA is.

The term stands for Individual Savings Account. ISAs effectively serve as tax-free wrappers for various types of savings account. The two best-known types are the Cash ISA and the Stocks and Shares ISA.

You get an annual allowance for your ISA investments which currently stands at a generous £20,000 a year. Money saved in an ISA is permanently exempt from taxes such as income tax, dividends tax, capital gains tax, and so on.

Table of Contents

So What Is An IFISA?

IFISAs are a lesser-known type of ISA that can be used for peer-to-peer (P2P) lending. They were launched in April 2016. After a slow start, the range available has grown steadily.

You can put any amount into an IFISA up to your annual ISA allowance. In the current 2021/22 tax year, as mentioned, this is £20,000. This can be divided however you choose between a cash ISA, a stocks and shares ISA, a Lifetime ISA (if eligible – you have to be under 40) and an IFISA. So, for example, you could invest £6,000 in a cash ISA, £10,000 in a stocks and shares ISA and £4,000 in an IFISA.

- Note that under current rules you are only allowed to invest new money in one of each type of ISA in a tax year. It is though generally possible to transfer money from one type of ISA to another without it affecting your annual entitlement (although there may be platform fees to pay).

IFISAs vary considerably in the returns they offer. Annual rates range from from around 4% to 15%. Obviously, the higher rates reflect the higher levels of risk involved.

Although all IFISAs involve P2P lending, a number of different types are available. They may include lending for all the following purposes:

- property development

- business loans

- personal loans

- green energy projects

- bonds and debentures

- entertainment industry loans

- infrastructure projects

What Are The Risks?

All UK IFISA providers have to be authorized by the Financial Conduct Authority (FCA) and HMRC. This doesn’t in itself protect lenders (or investors if you prefer) against the failure of a platform, however. While savers with UK banks and building societies are covered by the government’s Financial Services Compensation Scheme (FSCS), which guarantees to reimburse up to £85,000 of losses, this does not generally apply to IFISA platforms.

All IFISA providers do offer various safeguards, though. These vary, but include provision funds to cover potential losses, insurance policies, and so forth. In many cases loans are made against the security of property or other assets, which in the worst case could be sold to pay off any debts.

Even so, IFISA investors don’t enjoy the same level of protection in the UK as bank savers. This is, of course, a major reason why the returns on offer are significantly higher. It’s therefore important to be aware of the risks and ensure you are comfortable with them before investing this way. It’s also important to lend across a range of platforms and loans, and not make the mistake of putting all your savings eggs into one P2P lending basket.

What Are The Attractions?

So why might you want an IFISA? There are several reasons.

One is that they offer the potential of much higher rates of return that ordinary (bank) savings accounts. Even the best of these are currently paying interest rates of under 1 percent. IFISAs typically pay several times more than that (though obviously at somewhat greater risk).

Another big attraction of an IFISA is that it provides a way of gaining extra diversification for your portfolio. As mentioned earlier, the law currently only allows you to invest in one type of stocks and shares ISA per year. This rather perverse rule actually makes it harder to diversify your investments. But you can have an IFISA as well as a stocks and shares ISA, so long as you don’t exceed your total £20,000 allowance. So having an IFISA gives you a way of diversifying your investments while keeping them all protected within a tax-free ISA wrapper.

And finally, IFISA investments are typically not tied to the performance of stock markets in the way a stocks and shares ISA would be. This is a different type of investment, with different risks and rewards. While an IFISA won’t provide a way of hedging your equity investments directly, it is likely to be less directly affected by short-term fluctuations in the markets.

Two IFISA Examples

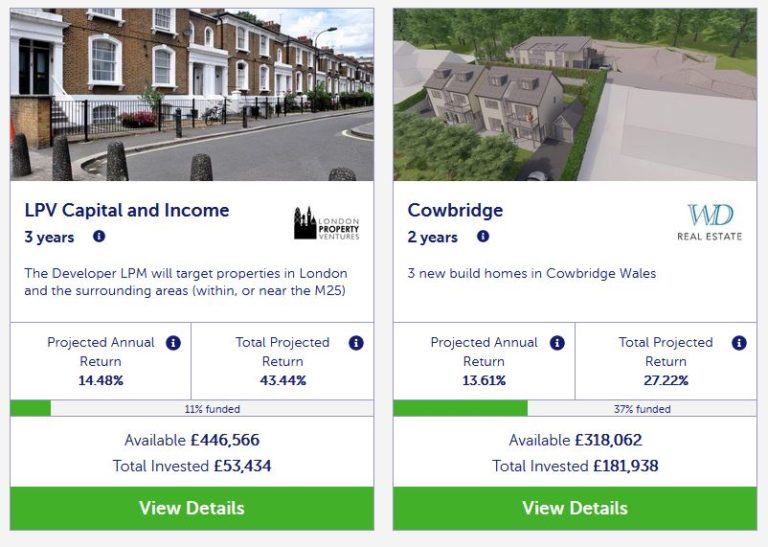

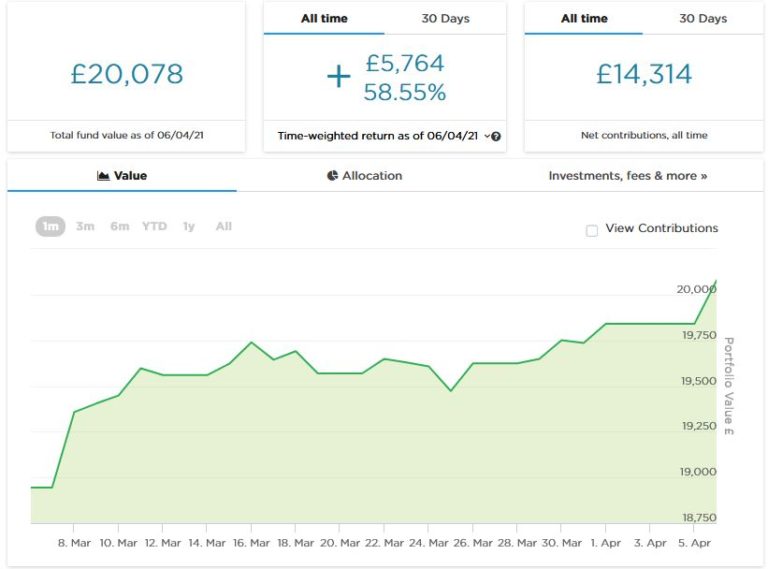

Two IFISAs of which I have direct experience are offered by Kuflink and Assetz Exchange. Both of these platforms offer tax-free IFISA options. They are both based around property investing.

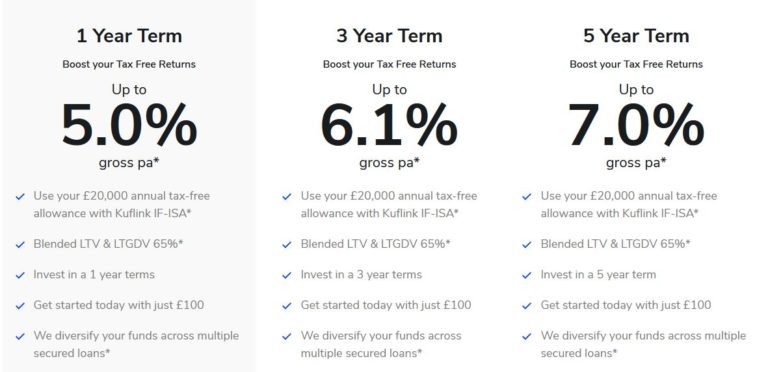

Kuflink – which I reviewed in this post – offers an automatically diversified IFISA comprising loans on property. They quote interest rates from 5% to 7%, depending how long you invest for. Your money is automatically diversified across a range of secured loans. The screen capture below from the Kuflink website sets out the main features of their IFISA.

One point to be aware of is that there is no ‘self-select’ option with the Kuflink IFISA. So you have no choice about which projects your money is invested in. But, of course, it does make investing in a Kuflink IFISA very quick and simple.

- Kuflink are currently offering up to £4,000 in cashback for new investors via my link. Please see my full review for more information.

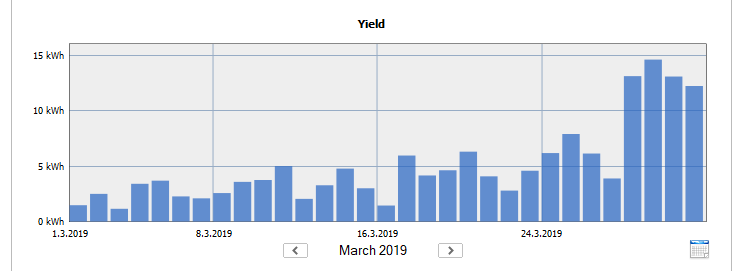

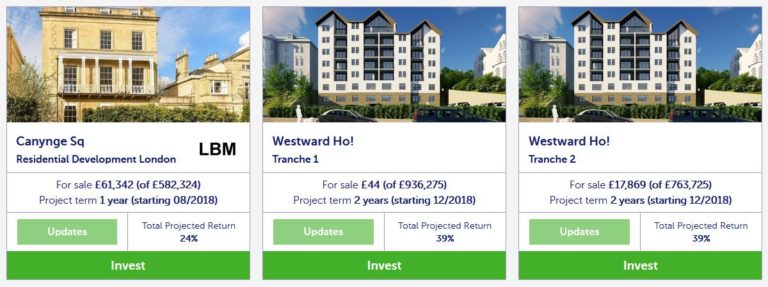

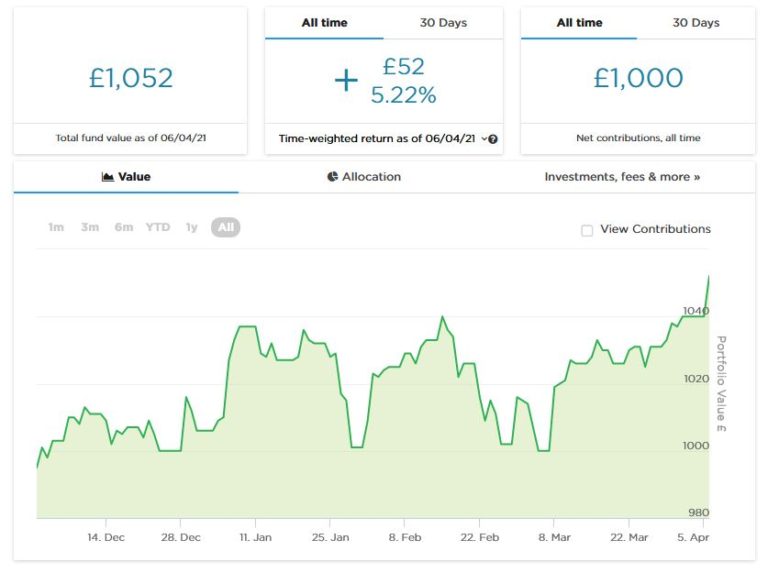

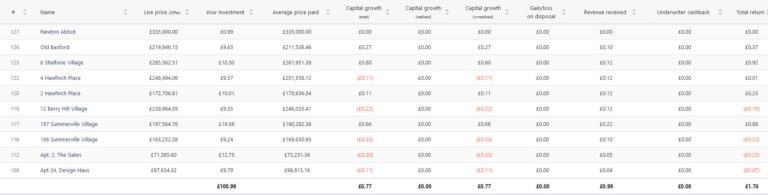

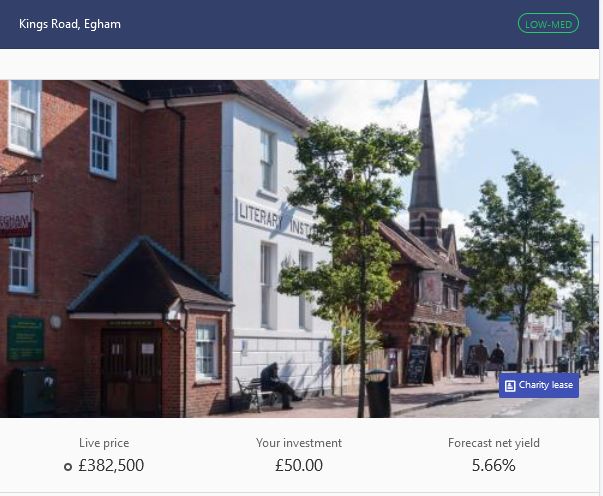

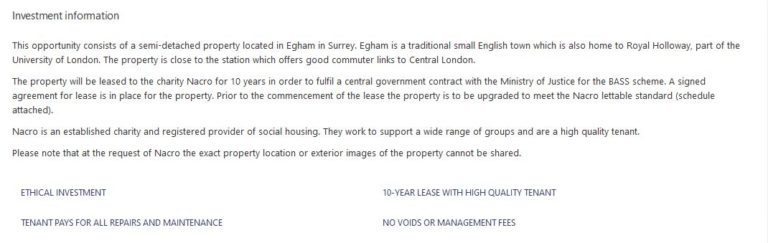

Assetz Exchange – which I reviewed in this post – has some similarities with Kuflink. But they concentrate on low-risk investments, typically with corporate clients (e.g. charities) on long leases. Here’s an example of the sort of investment I mean…

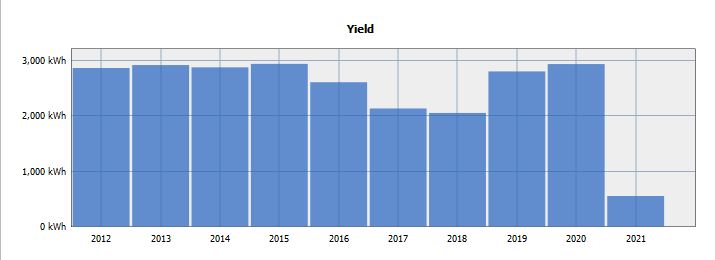

Assetz Exchange aims to offer net yields to investors of between 5.2 and 7.2% per year. One thing I especially like about them is that you can choose your own IFISA investments (indeed, they don’t currently offer an auto-select option). In addition, you can invest as little as 80 pence per project, making it easy to build a well-diversified portfolio even if you are only investing small amounts.

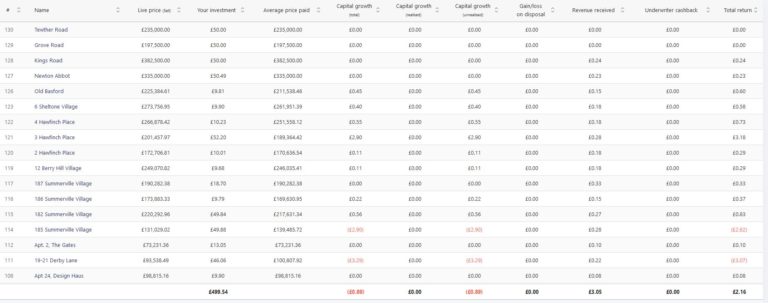

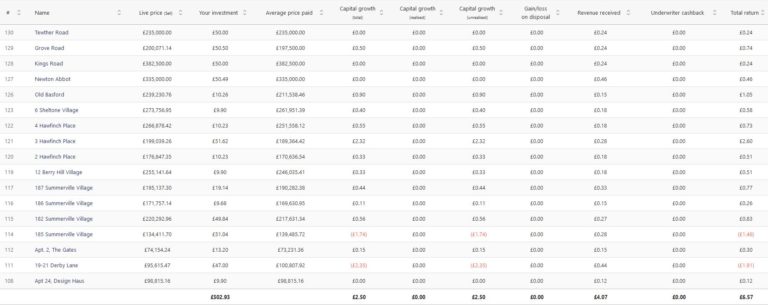

I am using Assetz Exchange for my 2021/22 IFISA, so here is a screen capture of my current portfolio for your interest. Note that while I have only invested £500 so far, I already have a well-diversified portfolio with 17 different investments!

Summing Up

If you are looking for a home for some of your savings that can offer better interest rates than banks and building societies and won’t incur any tax charges, an IFISA is certainly worth considering.

As well as the higher interest rates, they can add diversity to your investments, helping you ride out peaks and troughs in the financial markets.

Just be aware of the risks involved in P2P lending, diversify as widely as possible, and ensure you invest only as part of a well-balanced portfolio.

As always, if you have any comments or questions about this blog post, please do leave them below.

Disclaimer: I am not a registered financial adviser and nothing in this post should be construed as personal financial advice. You should always do your own ‘due diligence’ before investing, and speak to a professional financial adviser/planner if in any doubt before proceeding. All investments carry a risk of loss.

This post (and others on Pounds and Sense) includes my referral links. If you click through and make a qualifying transaction, I may receive a commission for introducing you. This will not affect the products or services you receive or any fees you may be charged.