My Investments Update – January 2022

Happy New Year! I hope you had an enjoyable festive season, not marred too much by Covid and/or government restrictions.

As usual, here is my latest monthly update about my investments. You can read my December 2021 Investments Update here if you like

I’ll begin as usual with my Nutmeg Stocks and Shares ISA, as I know many of you like to hear what is happening with this.

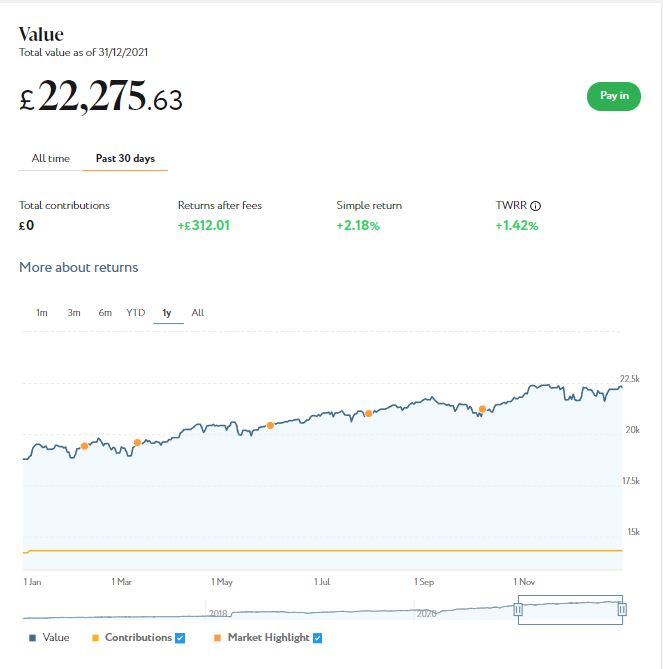

As the screenshot below shows, my main portfolio is currently valued at £22,275. Last month it stood at £21,963, so that is a rise of £312. Obviously in these uncertain times I am very happy with that.

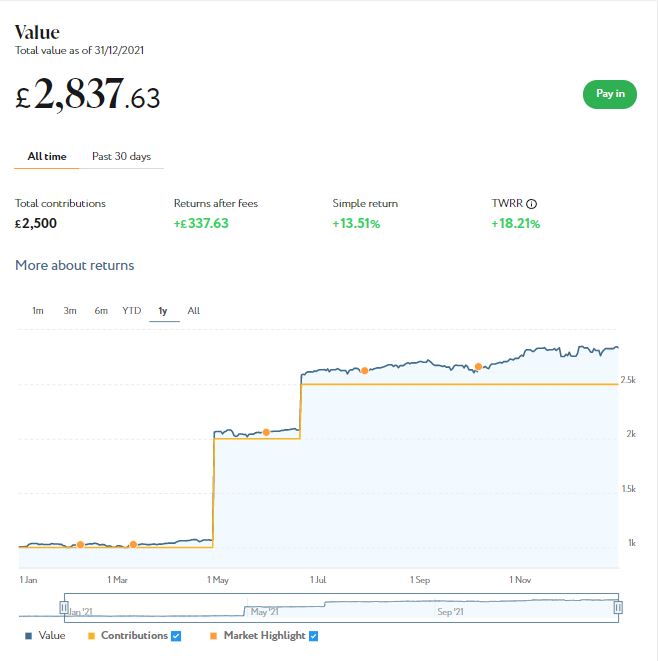

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £2,837 compared with £2,795 last month, a net monthly increase of £42. Again that’s a good result, pro rata slightly better than my main portfolio. Here is a screen capture showing performance over the last year.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are still looking for a home for your 2021/22 ISA allowance, based on my experience they are certainly worth considering.

If you haven’t yet seen it, check out also my blog post in which I looked at the performance of Nutmeg fully managed portfolios at every risk level from 1 to 10 (my main port is level 9). I was actually pretty amazed by the difference the risk level you choose makes. If you are investing for the long term (and you almost certainly should be) opting for a hyper-cautious low-risk strategy actually may not be the smartest thing to do.

As regular readers will know, this year I am using Assetz Exchange for my IFISA. This is a P2P property investment platform that focuses on lower-risk properties (e.g. sheltered housing on long leases). I put an initial £100 into this in mid-February 2021 and another £400 in April. Everything went well, so in June 2021 I added another £500, bringing my total investment on the platform up to £1,000.

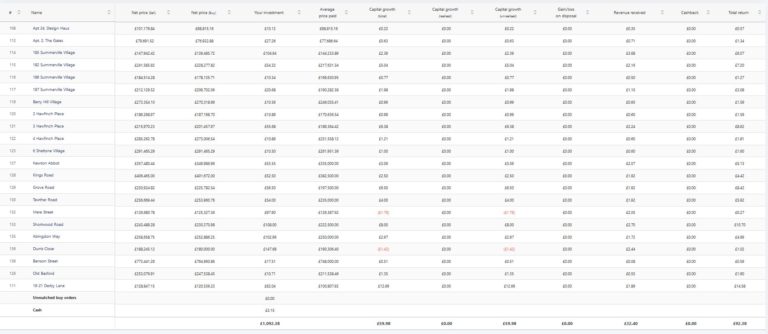

Since I opened my account, my portfolio has generated £32.40 in revenue from rental and £59.98 in capital growth, for a total return of £92.38. Here is my current statement:

To control risk with all my property crowdfunding investments nowadays, I am investing relatively modest amounts in individual projects. I don’t therefore put more than around £150 into any one project. As you can see, I have a well-diversified portfolio with Assetz Exchange comprising 21 different projects. This is a particular attraction of AE in my view. You can actually invest from as little as 80p per property if you really want to proceed cautiously.

As a matter of interest, I have also included a capture of my Assetz Exchange dashboard below. As you will see, this shows an average AER (Annual Equivalent Rate) yield of 5.38%. That is better than I could have got in interest from almost any savings account at the moment and doesn’t include capital growth either. Of course, money in Assetz Exchange is not protected by the Financial Services Compensation Scheme (FSCS), which covers all deposits with registered UK banks and building societies up to £85,000.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here if you like. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

Another property platform I have investments with is Kuflink. They have been doing well recently, with new projects launching almost every day. I currently have just over £2,000 invested with them, quite a large proportion of which comes from reinvested profits. To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question.

My loans with Kuflink pay annual interest rates of 6 to 7.5 percent. As mentioned above, these days I invest no more than around £150 per loan (and often less). That is not because of any issues with Kuflink but more to do with losses of larger amounts on other P2P property platforms (such as this one). My days of putting four-figure sums into any single property investment are behind me now!

- Nowadays I mainly opt to reinvest the monthly repayments I receive from Kuflink, which has the effect of boosting the percentage rate of return on the projects in question

You can read my full Kuflink review here. They offer a variety of investment options, including a tax-free IFISA paying up to 7% interest per year with built-in automatic diversification. Alternatively you can now build your own IFISA, with most loans on the platform being IFISA-eligible.

I’d also particularly draw your attention to their revised and more generous cashback offer for new investors [affiliate link]. They are now paying cashback on new investments from as little as £500 (it used to be £1,000). And if you are looking to invest larger amounts, you can earn up to a maximum of £4,000 in cashback. That is one of the best cashback offers I have seen anywhere (though admittedly you will need to invest £100,000 or more to receive that!).

- I have also been investigating another P2P property investment platform called BLEND recently. Like Kuflink, they offer the opportunity to invest in secured loans to experienced property developers. They offer (on average) somewhat higher rates of return than Kuflink, though arguably with a bit more risk. Watch out for my in-depth blog post about them soon. You can also check out what they have to offer on their website [affiliate link].

Moving on, I have another article on the always-excellent Mouthy Money website. This is about how to save money on your water bills. I enjoyed researching this and some of the things I found out were quite eye-opening 🙂

That’s all for now, so please stay safe and warm in these challenging times. And as I said last time, don’t let scare stories in the mainstream media freak you out. It is now increasingly apparent that while the Omicron variant is more transmissible, it also tends to produce less severe illness. I am increasingly optimistic that as 2022 continues the virus will loom less large in our lives. But Covid will be with us forever, so we really do need to learn to live with it and start getting back to normal now.

As ever, if you have any questions or comments about this post, please do leave them below.

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that this post includes affiliate links (disclosed). If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered.

January 6, 2022 @ 12:28 pm

That’s good to see about your nutmeg investments. I really want to invest more this year but with some home bits and a wedding it’s not that easy. We have some monthly money going into a Stocks & Shares ISA which is a start x

January 6, 2022 @ 12:58 pm

Thanks, Rhian. Glad to hear you have an S&S ISA. I hope it is performing well for you.

January 6, 2022 @ 1:49 pm

I can’t wait to hear what you have to say about BLEND. We are still tentatively taking some steps towards investing and find your blog posts so helpful and interesting!

January 6, 2022 @ 3:18 pm

Thanks, Rebecca. That’s very kind of you. My BLEND review has just been published: https://www.poundsandsense.com/spotlight-the-blend-network-p2p-property-investment-platform/