My Coronavirus Crisis Experience: June 2021 Update

Another month has gone by, so it’s time for another of my Coronavirus Crisis Updates. Regular readers will know I’ve been posting these since the first lockdown started in March 2020 (you can read my May 2021 update here if you like).

As ever, I will begin by discussing financial matters and then life more generally over the last few weeks.

Financial

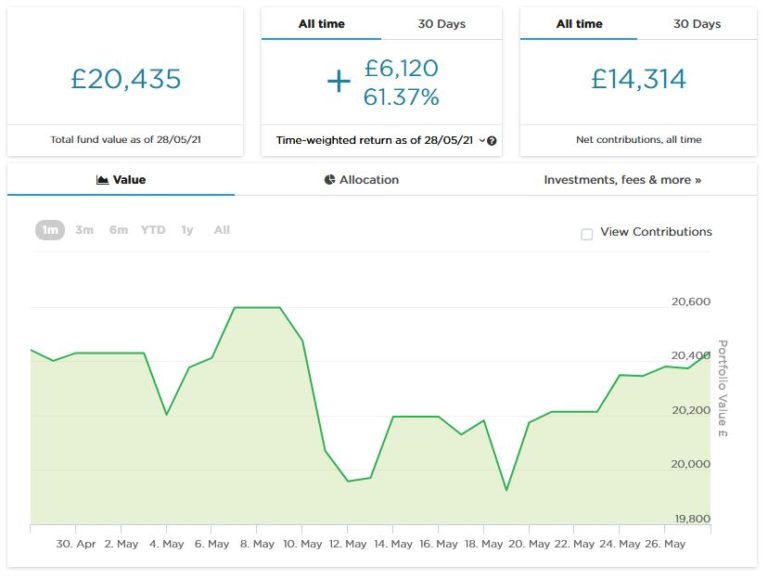

I’ll begin as usual with my Nutmeg stocks and shares ISA, as I know many of you like to hear what is happening with this.

As the screenshot below shows, my main portfolio has been on a roller-coaster ride in May. It is currently valued at £20,435. Last month it stood at £20,430, so overall it has gone up by the princely sum of five pounds! Since 20th May it has been on an upward trajectory, so clearly I hope that trend continues 🙂

.

.

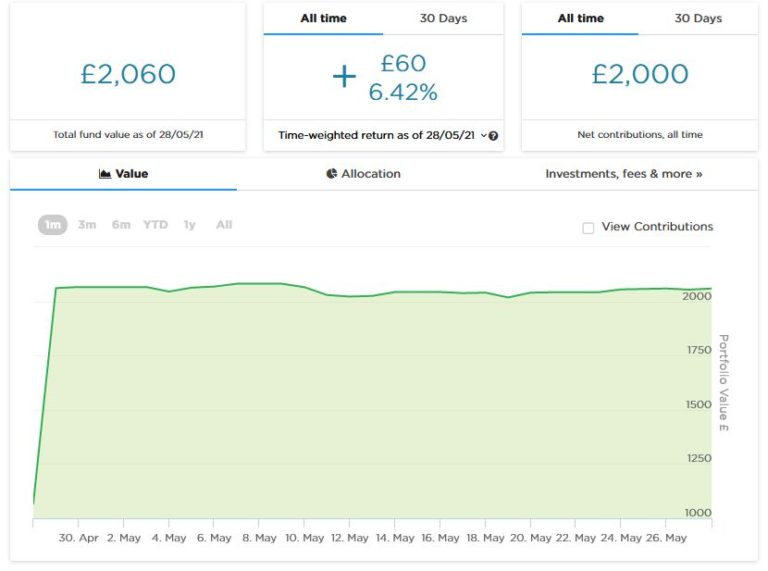

Apart from my main portfolio, six months ago I put £1,000 into a second pot to try out Nutmeg’s new Smart Alpha option. This did pretty well, so in April I added another £1,000 from some money returned to me from another investment. This pot is now worth £2,060 (£7 down on last month’s figure). Here is a screen capture showing performance in May 2021.

I updated my full Nutmeg review recently and you can read the latest version here (including a special offer at the end for PAS readers). If you are looking for a home for your new 2021/22 ISA allowance, based on my experience they are certainly worth considering.

- If you haven’t yet seen it, check out also my recent blog post in which I looked at the performance of Nutmeg fully managed portfolios at every risk level from 1 to 10 (my main port is level 9). I was truly amazed by the difference the risk level you choose makes.

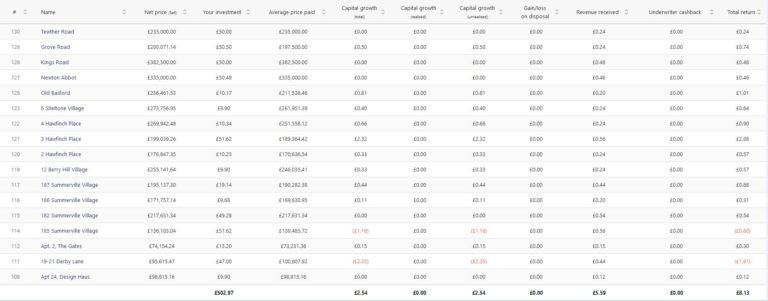

This year I am using Assetz Exchange for my IFISA. This is a P2P property investment platform that focuses on lower-risk properties (e.g. sheltered housing on long leases). I put £100 into this in mid-February and another £400 in April. Since then my portfolio has generated £5.59 in revenue received from rental and £2.54 in capital growth for a total return of £8.13. Here’s my current statement in case you’re interested:

As you can see, even though I have only invested £500, I already have a well-diversified portfolio with 17 different projects. This is a particular attraction of Assetz Exchange in my view. You can actually invest from as little as 80p per property if you really want to proceed cautiously!

As mentioned above, my investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here if you like. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

In May several of the loans I invested in with the P2P property investment platform Kuflink were repaid (with interest) and I duly reinvested the money in other loans.

I have a well-diversified portfolio of loans with Kuflink paying annual interest rates of 6 to 7.5 percent. These days I invest no more than £200 per loan (and often £100 or less). That is not because of any issues with Kuflink but more to do with losses of larger amounts on other P2P property platforms (such as this one). My days of putting four-figure sums into any single property investment are definitely behind me now!

You can read my full Kuflink review here. They recently passed the milestone of £100 million loaned, and say that since their launch no investor has lost money with them. They offer a variety of investment options, including a tax-free IFISA paying up to 7% interest per year, with built-in automatic diversification. And I’d particularly draw your attention to their revised and more generous cashback offer for new investors. They are now paying cashback on new investments from as little as £500 (it used to be £1,000). And if you are looking to invest larger amounts, you can earn up to a maximum of £4,000 in cashback. That is one of the best cashback offers I have seen anywhere (though admittedly you will need to invest £100,000 or more to receive that!).

Moving on, if you haven’t seen it yet, you might like to check out this eye-opening post about ‘how much is enough to retire on’ published on the PensionBee blog – I am quoted representing people in their 60s in this article!

You may also like to read my article on the Mouthy Money site in which I reveal why I am not a fan of premium bonds. I was recently hired as a regular contributor for Mouthy Money, so watch out for more articles from me there in the coming months. I also highly recommend reading the articles on the site by other contributors.

And finally, you can read my Q&A on the Lifeline24 blog, in which I talk about Pounds and Sense and share a few financial tips. Lifeline24 is a personal alarm service for older people and people with disabilities. If you’re interested, there is a code to get £10 off their already reasonably priced service at the end of the article. And no, I’m not getting any commission from them!

Personal

In May, as I’m sure you know, more of the government’s lockdown restrictions were eased. In particular, pubs and restaurants were allowed to open inside as well as out. Considering the monsoon-conditions that ensued after the outdoor reopening in April, that was a relief all round!

Last week I enjoyed my first pub lunch since the autumn at the Spread Eagle in Gailey, near Cannock. I met up with my old friend Liz, a former colleague from my days working at Wolverhampton University (the last ‘proper’ job I ever had). It was wonderful to see Liz again and in retrospect I hope I didn’t come across as too demob-happy! The food and service were both excellent. The pub was pretty quiet when we arrived at 12.30 but got busier later. There was still plenty of room inside and out, though.

Also in May I had my second Covid jab. For some reason I wasn’t able to book a slot at Whitemoor Lakes where I had my first jab, so this time I made my way to Great Wyrley Community Centre, another voyage of discovery for me. Everything went well, though bizarrely when I arrived a man at the door offered to ‘fast-track’ me if I took a lateral flow test (I declined). I had no side effects at all from this jab (the Oxford again), not even a sore arm. It is strange how people react so differently. I have friends who have had quite nasty reactions, though generally these lasted no more than a day or two. As for me, I have had (much) worse reactions from my annual flu jab.

With the better weather over the last week or two, I have resumed my habit of going for a breakfast walk. This is by far my favourite time of the day for walks, and I now have a good variety of routes to choose from around the local lanes. The photo in my cover image shows the beautiful Wisteria on Hope Cottage. This is about half a mile from where I live and features on many of my routes 🙂

Also in the last month I got back into the habit of reading again. I know many people say they read more during lockdown. However, I found that my concentration and attention-span were badly affected by the pandemic, so I more or less stopped reading for pleasure.

But in the last few weeks I’ve been feeling a bit more relaxed and that has helped me get back to reading, starting with some short books. Initially I picked up The No. 1 Ladies’ Detective Agency by Alexander McCall Smith. Having enjoyed that I moved on to the follow-up novel, Tears of the Giraffe. which is also very good. I remember that these light-hearted books were made into a TV series a few years ago, so I am thinking of buying the DVD set now.

After that, I moved on to another short novel, The Mountains of Majipoor by US science-fiction/fantasy writer Robert Silverberg.

Silverberg wrote a series of novels set on the giant world of Majipoor. I read most of them around 30 years ago, but for some reason this is the one novel in the series I never got around to.

I did enjoy it, but if you have never read any of the Majipoor novels, I wouldn’t start with this one. The place to begin is undoubtedly Lord Valentine’s Castle, a tour de force of the imagination with a compelling storyline. As a matter of interest, Lord Valentine’s Castle inspired me with the desire to learn to juggle (if you read the book you’ll understand why). But sadly despite many hours of trying I proved to have zero aptitude for it! Here’s an image link (affiliate) to the Amazon UK sales page.

The novel I’m reading at the moment is The Long Way to a Small Angry Planet by Becky Chambers. This is a longer science-fiction novel, which was recommended to me by Amazon as something I might enjoy.

Amazon recommendations can be hit or miss, of course, but I was very glad I acted on this one. The Long Way to a Small Angry Planet is a novel of great wit and charm, and I have been engrossed by it. It is mainly set on a small, commercial spaceship called The Wayfarer, whose job is to ‘tunnel’ wormholes in space. Becky does a brilliant job of bringing the ship and its (mostly) lovable multi-species crew to life.

The story is episodic – you could almost say picaresque – and told from the viewpoints of different crew members – from the reptilian pilot Sissix to the amiable alien chef/doctor called (quite reasonably) Dr Chef. There are some humans too, including the captain, Ashby, and the ship’s clerk and newest crew member, Rosemary Harper, who has a secret that is tearing her apart. There is plenty of humour and emotion alongside the science, so you definitely don’t need to be an SF aficionado to enjoy it. Anyway, I won’t rave on about it any more. If you want to find out more, here’s an image link (affiliate) to the Amazon sales page.

Finally on the subject of books, my nephew Steve (a semi-professional guitarist) has just published his first on Amazon. It’s called Crucial Guitar Basics and was written as a lockdown project. I had a very small input into it and my sister Annie rather more (she edited/proofread it). I’m no guitarist myself but thought it was a well-written and accessible introductory guide. Here’s an image link (affiliate) in case this might interest you. It’s available in both print and Kindle ebook form.

As I write this, the whole UK has just enjoyed its first day since March 2020 without a single Covid death. There is still some concern over the rise in cases of ‘The Indian Variant’, but so far these don’t appear to be causing a significant increase in hospitalizations or deaths. There is some speculation about whether the final stage of the PM’s ‘Roadmap to Recovery’ will take place on June 21st as promised. Personally I think it should, but in my view it’s more likely we will see a partial lifting of restrictions, with others retained for longer. I would particularly like to see an end to mandatory masks, as the evidence in favour of their use is weak (and many US states have done away with them for months now with no calamity ensuing). But we will see, I guess!

I hope that at some point soon I will be able to stop producing ‘Coronavirus Crisis Updates’ as normal life resumes. At that point, I may switch to creating monthly updates about my investments and maybe separate, more personal updates if anyone would be interested to read them. But I will definitely do at least one more full Coronavirus Crisis update next month.

As always, I hope you are staying safe and sane during these challenging times. If you have any comments or questions, please do post them below.

June 2, 2021 @ 1:53 pm

Assetz exchange sounds like an interesting place to invest money, it’s nice that yours has been so diversified x

June 2, 2021 @ 2:07 pm

Thanks, Rhian. Yes, I have been impressed with Assetz Exchange so far. It’s good also that your money is invested in socially beneficial projects such as sheltered housing.

June 4, 2021 @ 2:24 pm

I also found it hard to concentrate enough to read during the height of the pandemic but am pleased to have read a few brilliant books in the last few weeks.

June 4, 2021 @ 3:01 pm

Thanks, Jenny. Glad it wasn’t just me!