My Investments Update – December 2023

Here is my latest monthly update about my investments. You can read my November 2023 Investments Update here if you like

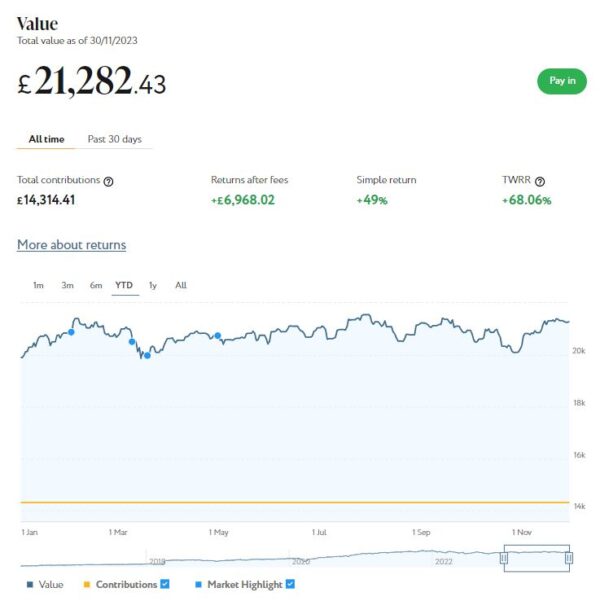

I’ll start as usual with my Nutmeg Stocks and Shares ISA. This is the largest investment I hold other than my Bestinvest SIPP (personal pension).

As the screenshot below for the year to date shows, my main Nutmeg portfolio is currently valued at £21,282. Last month it stood at £20,214 so that is a welcome increase of £1,068.

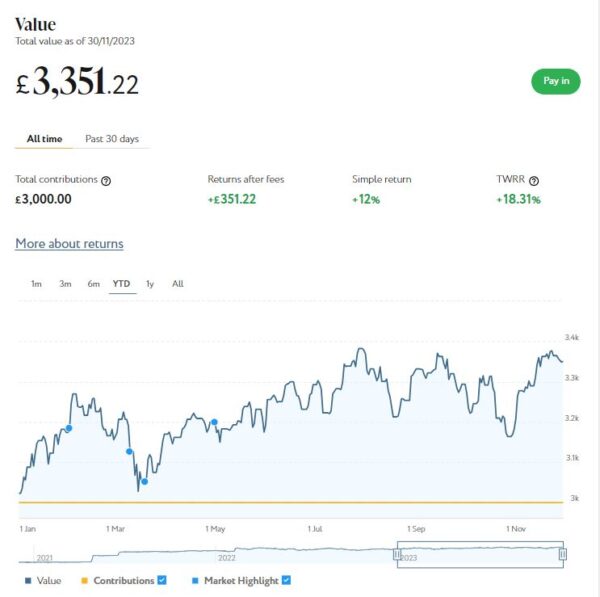

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £3,351 compared with £3,183 a month ago, a rise of £168. Here is a screen capture showing performance since the start of this year.

November was obviously a good month for my Nutmeg investments after a disappointing previous three months. Their total net value rose by £1,236 or 5.28% month on month – a rise of £1,712 (7.47%) since 1st January 2023. This has obviously been another roller-coaster year, but as things stand I think that’s a pretty decent annual return. I am hoping the trend will continue with the traditional Santa Rally in December!

Of course, as I always have to say, investing is (or should be) a long-term endeavour. Over a period of years stock market investments such as those used by Nutmeg typically produce better returns than cash accounts, often by substantial margins. But there are never any guarantees, and in in the short to medium term at least, losses are always possible.

As you may know, I recently revised and updated my full Nutmeg review. This was mainly to incorporate details of their new thematic investment styles, but I took the opportunity to update some other information and performance stats as well.

As it says in the updated review, the new thematic style provides a globally diversified, risk adjusted portfolio with a tilt (up to 20% of equity exposure) towards your chosen theme. The majority of the portfolio will be actively managed by Nutmeg’s investment team, whilst the ’tilted’ part of the portfolio will be made up of ETFs that their investment team believes will deliver the best returns from the trend in question (to be reviewed annually).

Currently three themes are available, these being Technical Innovation, Resource Transformation and Evolving Consumer. Nutmeg thematic portfolios are only available on Risk Level 5 or above. There’s a minimum investment of £100 for Junior ISAs and Lifetime ISAs or £500 for stocks and shares ISAs and pensions. There is a 0.75% management fee. For more details about what each of the themes comprise, check out the Nutmeg website.

I like the new thematic styles on Nutmeg and have just invested a modest amount in one myself (I opted for Resource Transformation). I will talk more about this in my next monthly update in January, and will obviously keep PAS readers informed as to how it fares.

- Nutmeg’s thematic styles are similar in concept to the so-called smart portfolios on eToro, which I discussed in this recent blog post. They appear to be more broadly diversified, however, so may be a good choice for those who are new to thematic investing and want to dip a cautious toe in the water first.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are looking for a home for your annual ISA allowance, based on my overall experience over the last seven years, they are certainly worth considering. They offer self-invested personal pensions (SIPPs), Lifetime ISAs and Junior ISAs as well.

I also have investments with the property crowdlending platform Kuflink. They continue to do well, with new projects launching every week. I currently have around £2,100 invested with them in 12 different projects paying interest rates typically around 7%.

To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question.

As mentioned last time, there is now an initial minimum investment of £1,000 and a minimum investment per project of £500. Kuflink say they are doing this to streamline their operation and minimize costs. I can understand that, though it does mean the option to ‘test the water’ with a small first investment has been removed. It will also make it harder for small investors (like myself) to build a well-diversified portfolio on a limited budget.

One possible way around this is to invest using Kuflink’s Auto/IFISA facility. Your money here is automatically invested across a basket of loans over a period from one to three years. Interest rates currently range from 7% for one year to 9.83% gross for a three-year term.

As you may gather, you can invest tax-free in a Kuflink Auto IFISA. Or if you have already used your annual iFISA allowance elsewhere, you can invest via a taxable Auto account. You can read my full Kuflink review here if you wish.

Moving on, my Assetz Exchange investments continue to generate steady returns. Regular readers will know that this is a P2P property investment platform focusing on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my AE portfolio has generated a respectable £149.50 in revenue from rental income. As I said in last month’s update, capital growth has slowed, though, in line with UK property values generally.

At the time of writing, 6 of ‘my’ properties are showing gains, 3 are breaking even, and the remaining 18 are showing losses. My portfolio is currently showing a net decrease in value of £42.37, meaning that overall (rental income minus capital value decrease) I am up by £107.13. That’s still a decent return on my £1,000 and does illustrate the value of P2P property investments for diversifying your portfolio. And it doesn’t hurt that with Assetz Exchange most projects are socially beneficial as well.

- As a matter of interest, I recently reinvested £40 of my rental income from Assetz Exchange in a house for asylum seekers in Sunderland. This property is being managed by Mears on behalf of the Home Office, so I think the chances of them going into default are pretty remote!

The fall in capital value of my AE investments is obviously a little disappointing. But it’s important to remember that until/unless I choose to sell the investments in question, it is largely theoretical, based on the most recent price at which shares in the property concerned have changed hands. The rental income, on the other hand, is real money (which in my case I’ve reinvested in other AE projects to further diversify my portfolio).

To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as i am concerned (especially now that Kuflink have raised their minimum investment per project to £500). You can actually invest from as little as 80p per property if you really want to proceed cautiously.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

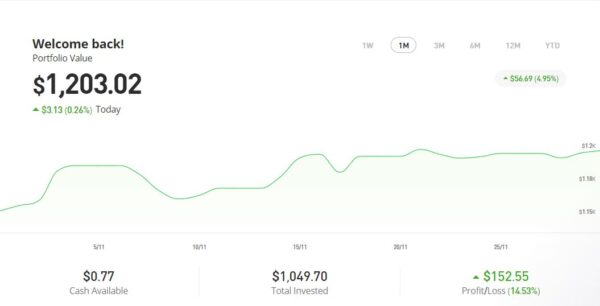

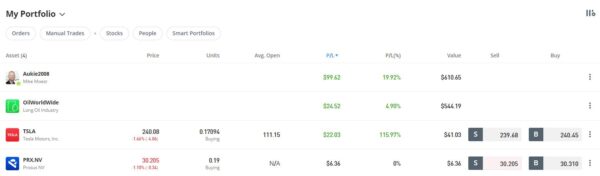

Last year I set up an account with investment and trading platform eToro, using their popular ‘copy trader’ facility. I chose to invest $500 (then about £412) copying an experienced eToro trader called Aukie2008 (real name Mike Moest).

In January 2023 I added to this with another $500 investment in one of their thematic portfolios, Oil Worldwide. I also invested a small amount I had left over in Tesla shares.

As you can see from the screen captures below, my original investment totalling $1,022.26 is today worth $1,203.02, an overall increase of $180.76 or 17.68%. In these turbulent times I am very happy with that.

You can read my full review of eToro here. You may also like to check out my more in-depth look at eToro copy trading. I also discussed thematic investing with eToro using Smart Portfolios in this recent post. The latter also reveals why I took the somewhat contrarian step of choosing the oil industry for my first thematic investment with them.

- eToro also recently introduced the eToro Money app. This allows you to deposit money to your eToro account without paying any currency conversion fees, saving you up to £5 for every £1,000 you deposit. You can also use the app to withdraw funds from your eToro account instantly to your bank account. I tried this myself and was impressed with how quickly and seamlessly it worked. You can read my blog post about eToro Money here.

I had another article published in November on the excellent Mouthy Money website. This explains how you may be able to Write and Publish Kindle e-Books for Profit. This is something I have done myself in the past, and when I was researching this article I was impressed to discover it’s easier than ever now. It’s a competitive field, but definitely worth checking out if you’re looking for an extra string to your sideline-earning bow.

As I’ve said before, Mouthy Money is a great resource for anyone interested in money-making and money-saving. I particularly like the ‘Deals of the Week’ feature compiled by Jordon Cox (‘Britain’s Coupon Kid’) which lists all the best current money-saving offers for savvy shoppers. Check out the latest edition here

You might also like to know that Mouthy Money are currently running a competition to win one of five free copies of Freedom: Earn It, Keep It, Grow It by Robert Gardner (see Amazon image link below). Visit this page of the Mouthy Money website for further info and to enter.

I also published various posts on Pounds and Sense in October. I won’t bother to mention those that are out of date now, but the rest are listed below.

Key Things to Consider When Making a Gift or Loan to Married Children was an eye-opening guest post by Joanna Toloczko, a partner, family law solicitor and mediator at UK law firm RWK Goodman. Joanna’s article discusses what can become a major issue for parents when making gifts or loans to their married children. Specifically, it looks at what you can do to ensure that your wishes are respected should the worst happen and the marriage fails.

I also published (or more accurately republished) How to Make More Money From National Grid Powersaving Events. For the second winter in a row some energy companies are offering incentives to customers to reduce their electricity use during periods of peak demand, with payments made to those who succeed in doing this. In this article I explained how these schemes work and what you can do to maximize your earnings from them.

Also in November I published an article about a survey from HSBC regarding how British people choose life insurance. There were some interesting findings in this, including the growing numbers of people deciding against getting life insurance due to the cost-of-living crisis. As I note in this article, this could sadly prove to be a false economy.

Next up, I published a short post about an important (in my view) change to the tax-free ISA rules in the Chancellor’s Autumn Statement. This is a rule change I warmly welcome and have in fact been advocating on PAS (and elsewhere) for some time.

Finally, I published a fully updated post on the subject What Are the Best Video Calling Tools for Older People? This is particularly relevant in the run-up to Christmas. Video calling can provide an invaluable means for older people (and others) to keep in touch with far-flung friends and family. In this post I set out a wide range of options you can use.

On other matters, the opportunity to get a free share worth up to £100 with Trading 212 has now closed, but you can still Get a Free ETF Share Worth up to £200 with Wealthyhood. This DIY wealth-building app is aimed especially at people new to stock market investing. The minimum investment to qualify for the free share offer has been raised from £20 to £50 – but on the plus side, they now guarantee your free ETF share will be worth at least £10. What’s more, for the next month Wealthyhood say they will plant a tree for every new account opened

I did just want to mention as well that I am still using and getting good results from the cashback app JamDoughnut. You can see my review of JamDoughnut here, along with a referral code that will get you a £2 bonus when you sign up. To be honest I’m a bit surprised more PAS readers haven’t taken advantage of this opportunity. Not only can you get discounts of up to 20% using the app, they also hold regular contests and promotions offering additional bonuses and discounts.

Finally, a quick reminder that you can also follow Pounds and Sense on Facebook or Twitter (or X as we have to learn to call it now). Twitter/X is my number one social media platform these days and I post regularly there. I share the latest news and information on financial (and other) matters, and other things that interest, amuse or concern me. So if you aren’t following my PAS account, you are definitely missing out!

That’s all for today. Do hope you are keeping safe and warm in the current Arctic spell. As always, if you have any comments or queries, feel free to leave them below. I am always delighted to hear from PAS readers

December 16, 2023 @ 5:24 am

Came to your pieces as I search on background for what I believe is a systemic issue, to the negative, in an investment option you wrote on in 2021.

This regular update is great, gives perspective and ideas.

Thanks