My Investments Update – June 2022

Here is my latest monthly update about my investments. You can read my May 2022 Investments Update here if you like

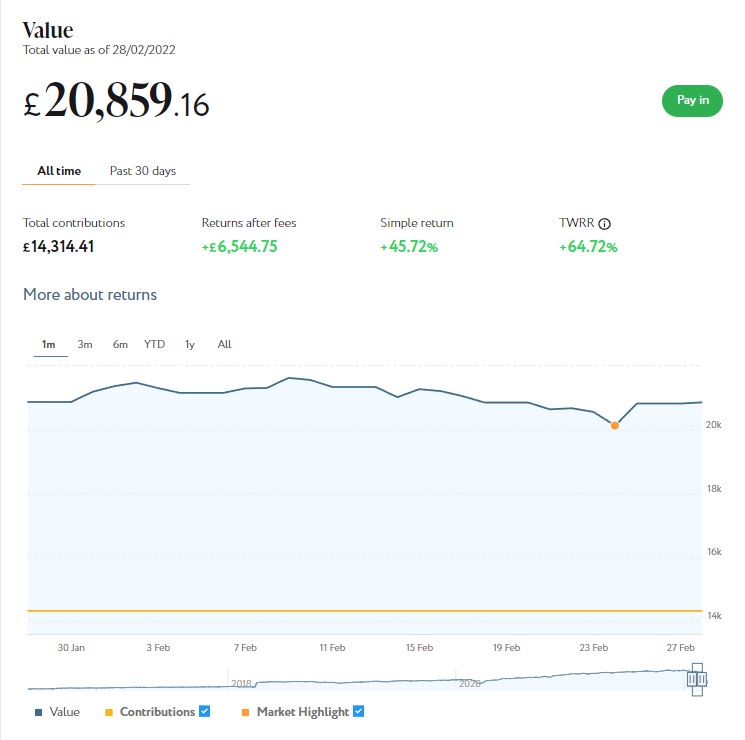

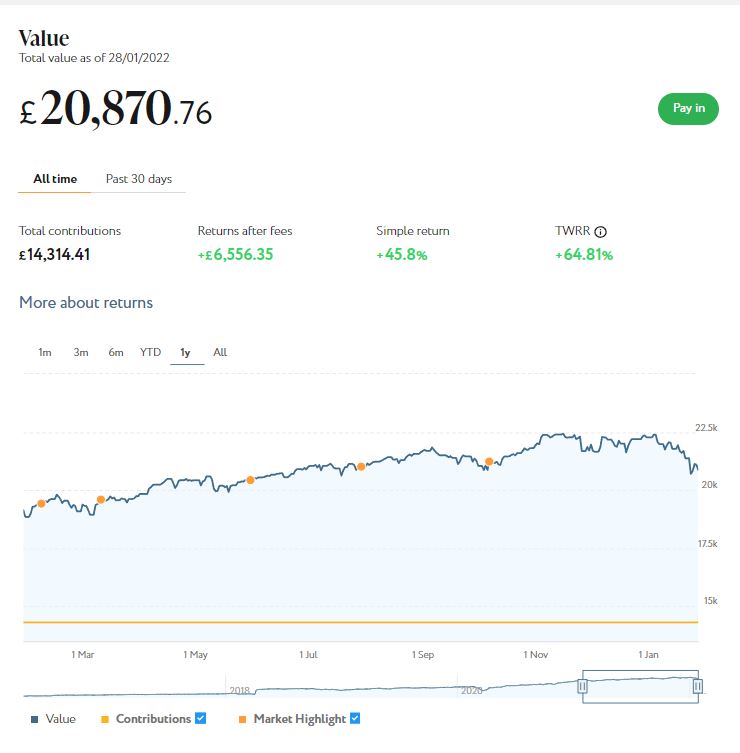

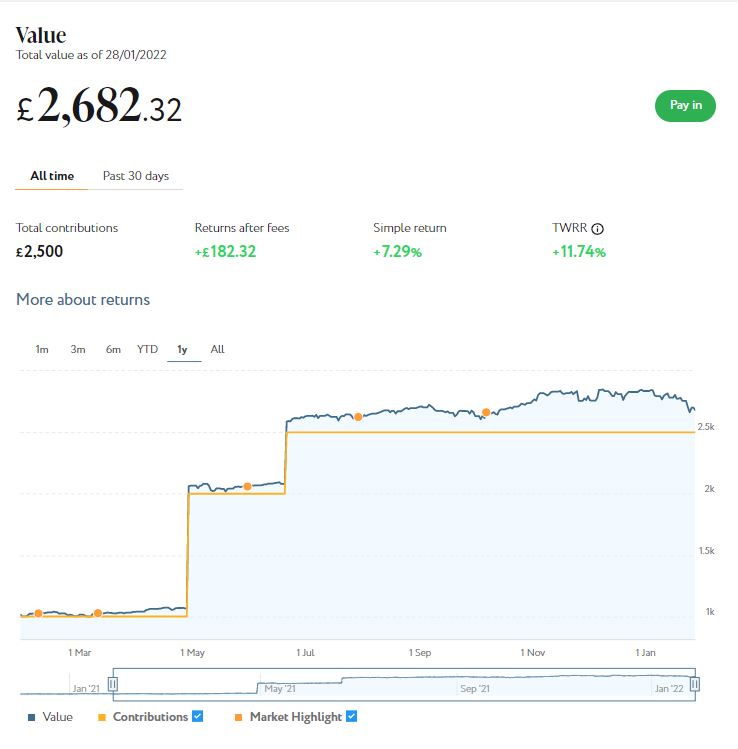

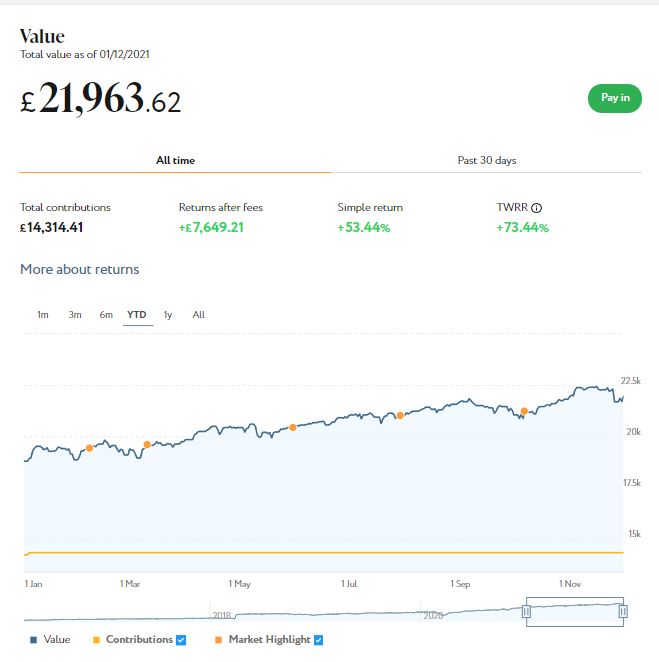

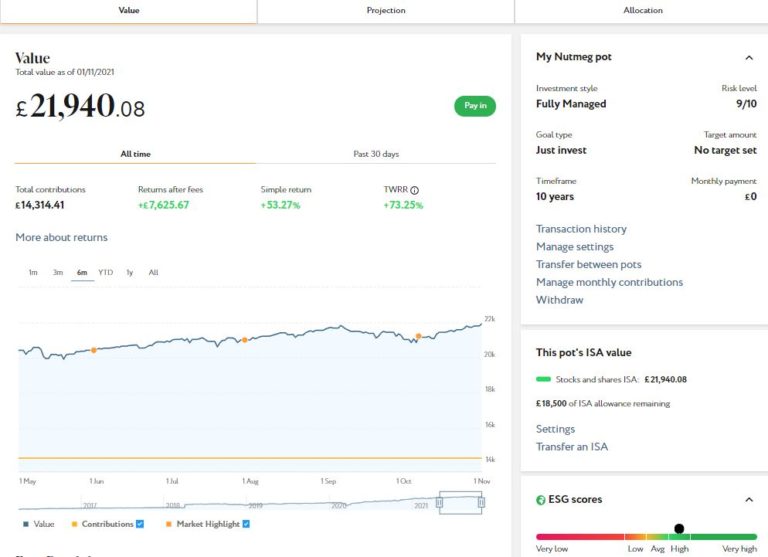

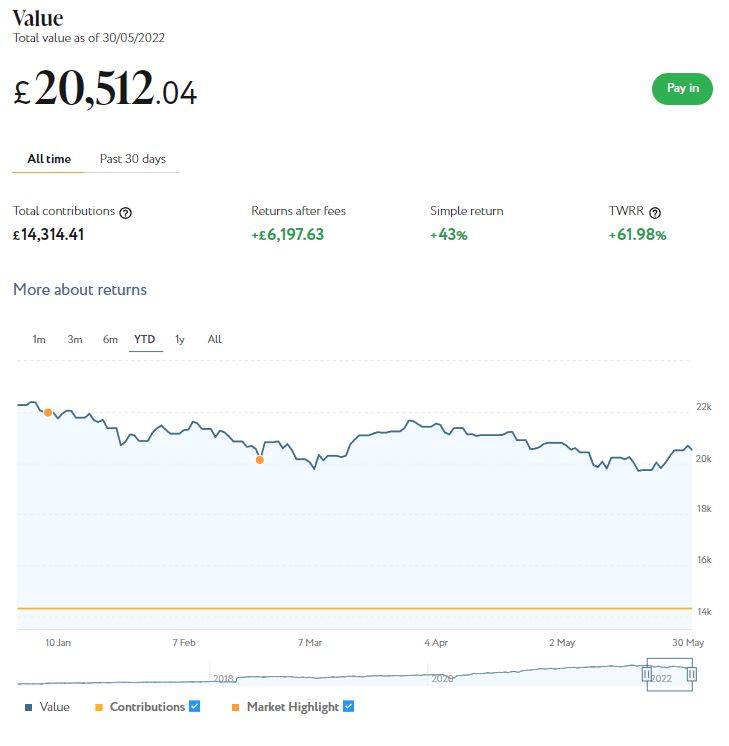

I’ll begin as usual with my Nutmeg Stocks and Shares ISA. This is the largest investment I hold other than my Bestinvest SIPP (personal pension).

As the screenshot below of performance in the year to date shows, my main portfolio is currently valued at £20,512. Last month it stood at £20,799 so, after a roller-coaster month, that is a fall of £287.

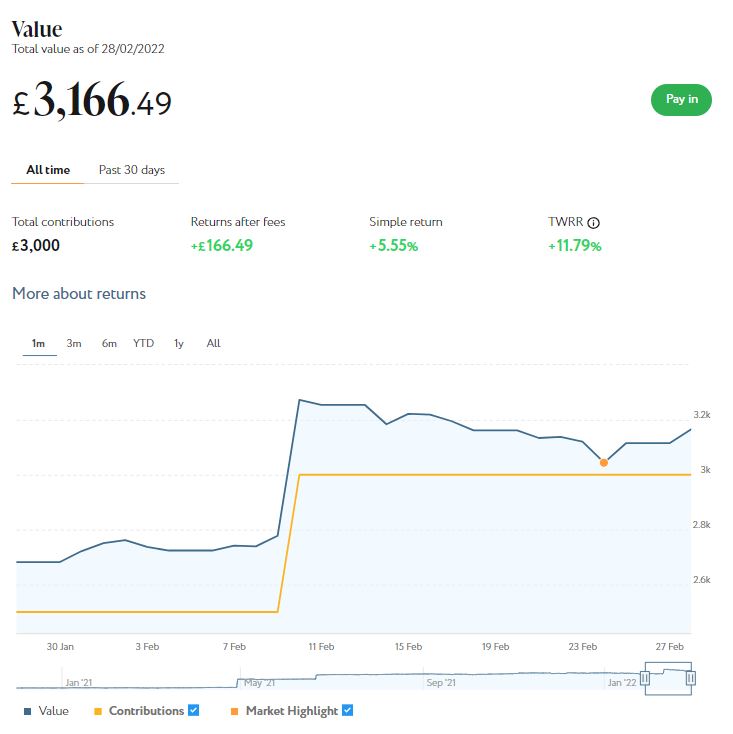

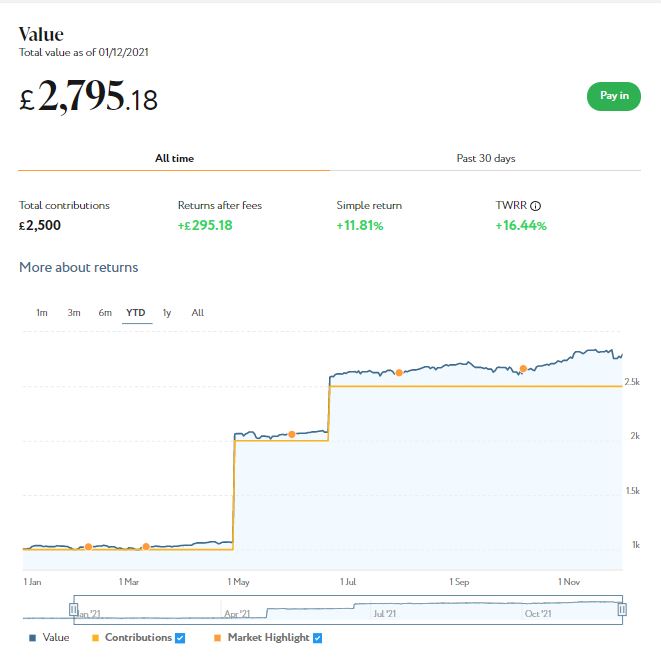

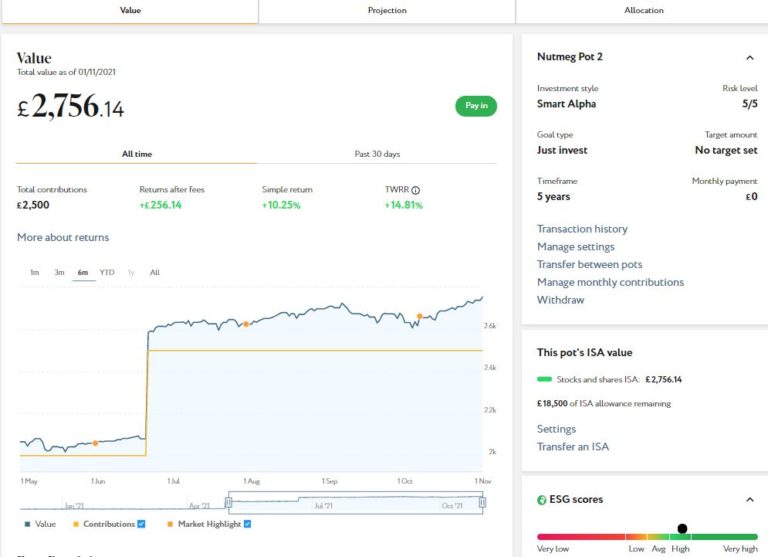

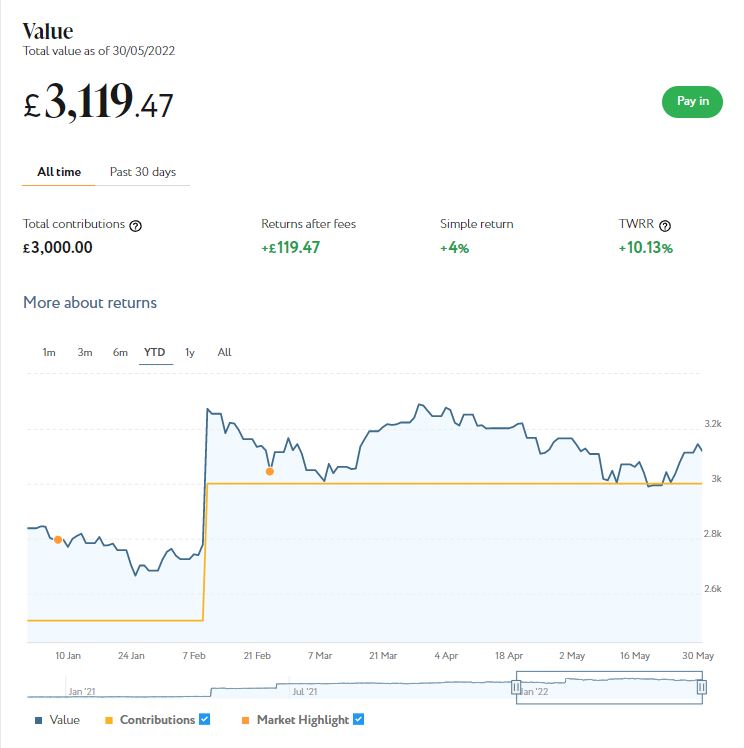

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £3,119 compared with £3,166 last month, a fall of £47

Here is a screen capture showing performance this year.

Obviously the continuing falls are disappointing (though much smaller than last month). As I’ve noted previously on PAS, you do have to expect ups and downs with equity-based investments, and certainly over the last few months there has been no shortage of volatility in world markets. And it’s also worth noting that since I started investing with Nutmeg in 2016 I have still enjoyed a total return of 36.48% (or 62.07% time-weighted).

I should also mention that I selected quite a high risk level for both my Nutmeg accounts (9/10 for the main one and 5/5 for Smart Alpha). This has served me well generally, but I’m sure investors who selected lower risk levels will have seen smaller falls over the last two months.

- If you also have a Nutmeg portfolio and plan to withdraw from it in the next few months, there is certainly a case for switching to a lower risk level right now.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are looking for a home for your annual ISA allowance, based on my experience over the last six years, they are certainly worth considering.

If you haven’t yet seen it, check out also my blog post in which I looked at the performance of Nutmeg fully managed portfolios at every risk level from 1 to 10 (as mentioned, my main port is level 9). I was actually pretty amazed by the difference the risk level you choose makes. If you are investing for the long term (and you almost certainly should be) opting for a hyper-cautious low-risk strategy may not be the smartest thing to do.

Moving on, my Assetz Exchange investments continue to perform well. Regular readers will know that this is a P2P property investment platform focusing on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my AE portfolio has generated £57.24 in revenue from rental and £92.28 in capital growth, a total of £149.52. That’s a decent rate of return on my £1,000 investment and does illustrate the value of P2P property investment for diversifying your portfolio when equity markets are volatile (as at the moment).

I now have investments in 22 different projects and all are performing as expected, generating rental income and – in every case but one – showing a profit on capital. So I am very happy with how this investment has been doing. And it doesn’t hurt that most projects are socially beneficial as well.

- To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as i am concerned. You can actually invest from as little as 80p per property if you really want to proceed cautiously.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

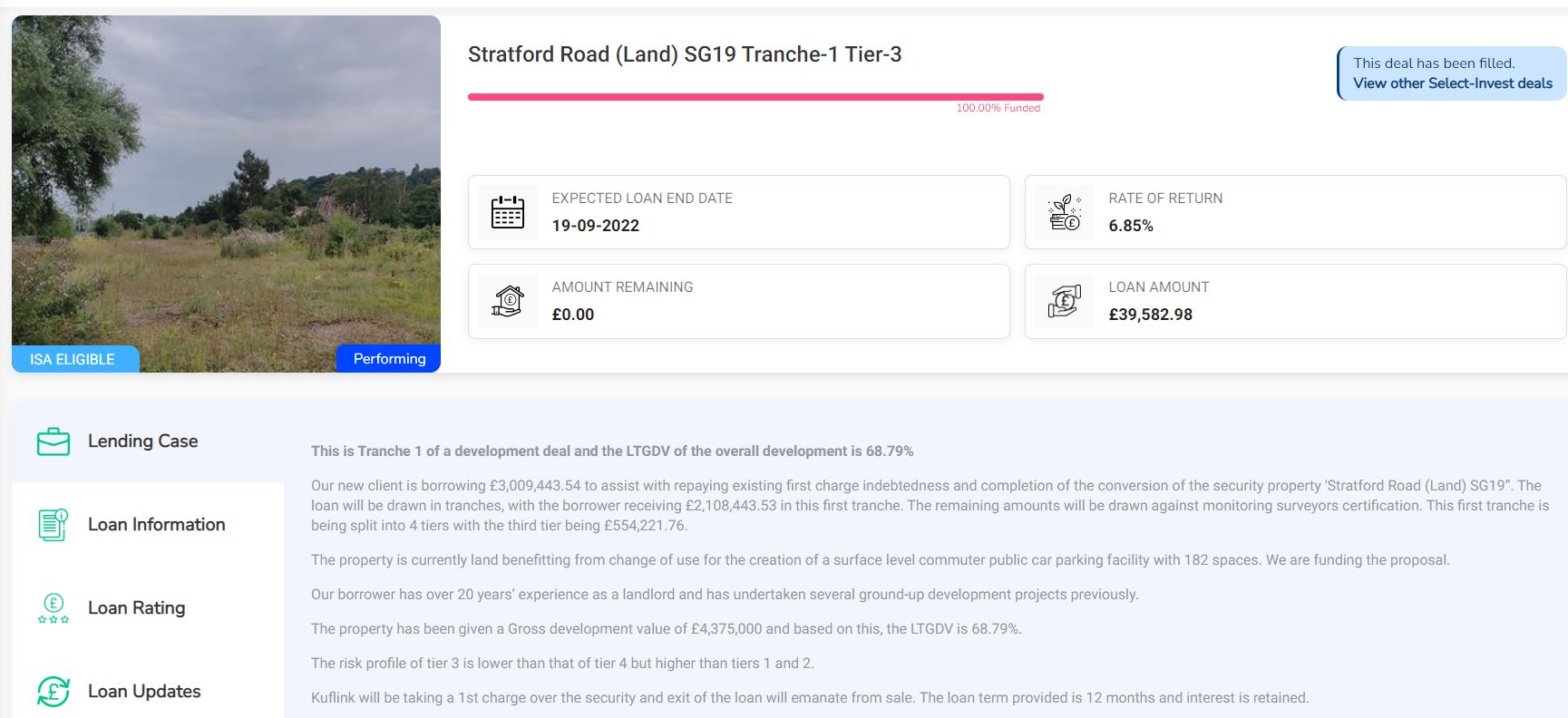

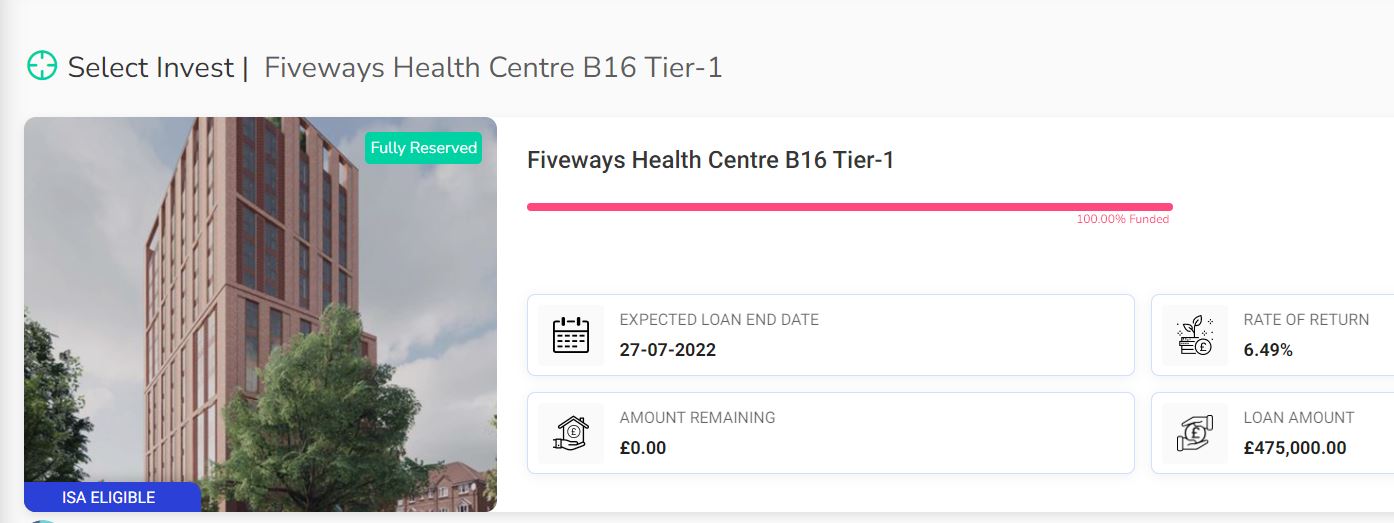

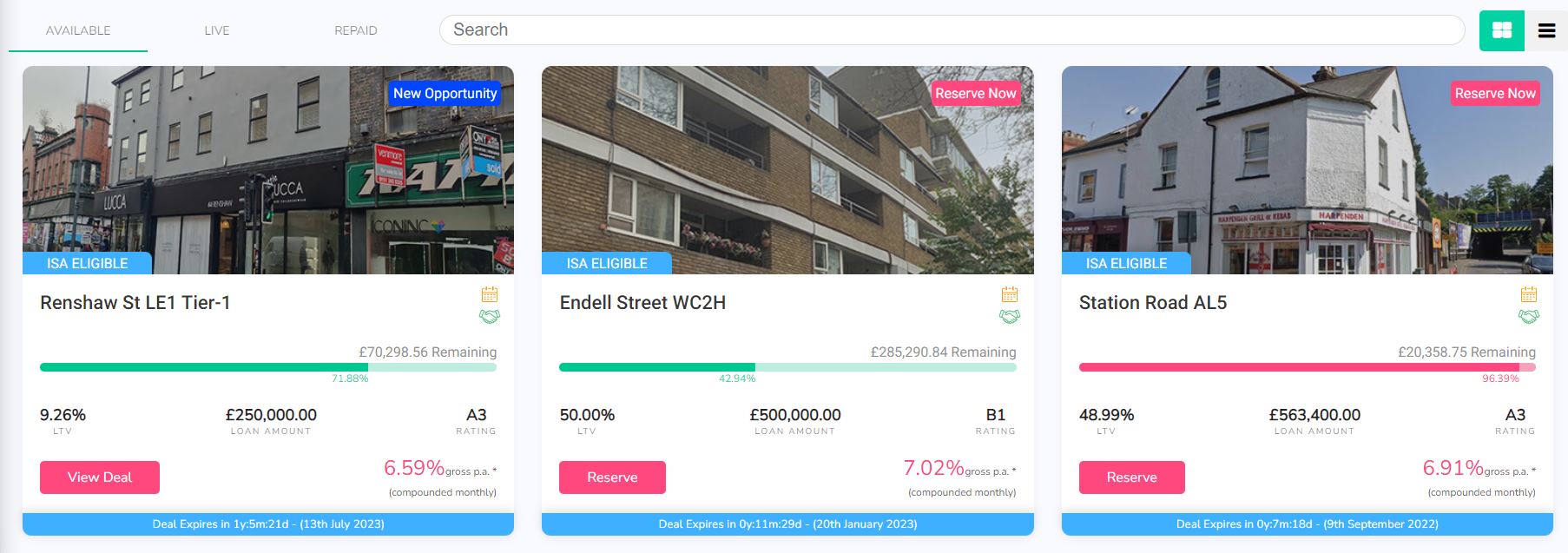

Another property platform I have investments with is Kuflink. They have been doing well recently, with new projects launching almost every day. I currently have over £2,150 invested with them, quite a large proportion of which comes from reinvested profits. To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question. At present all my Kuflink loans are performing to schedule, though one is showing as ‘pending a status update’. I suspect this may translate to a delay in repayment. We shall see.

My loans with Kuflink pay annual interest rates of 6 to 7.5 percent. These days I invest no more than around £150 per loan (and often less). That is not because of any issues with Kuflink but more to do with losses of larger amounts on other P2P property platforms in the past. My days of putting four-figure sums into any single property investment are behind me now!

- Nowadays I mainly opt to reinvest the monthly repayments I receive from Kuflink, which has the effect of boosting the percentage rate of return on the projects in question

Obviously a possible drawback with Kuflink and similar platforms is that your money is tied up in bricks and mortar, so not as easily accessible as cash savings or even (to some extent) shares. They do, however, have a secondary market on which you can offer any loan part for sale (as long as the loan in question is performing and not in arrears). Clearly that does depend on someone else wanting to buy it, but my experience has been that any loan parts offered are typically snapped up very quickly. So if an urgent need arises, withdrawing your money (or part of it) is unlikely to be an issue.

You can read my full Kuflink review here. They offer a variety of investment options, including a tax-free IFISA paying up to 7% interest per year with built-in automatic diversification. Alternatively you can now build your own IFISA, with most loans on the platform (including the one shown above) being IFISA-eligible.

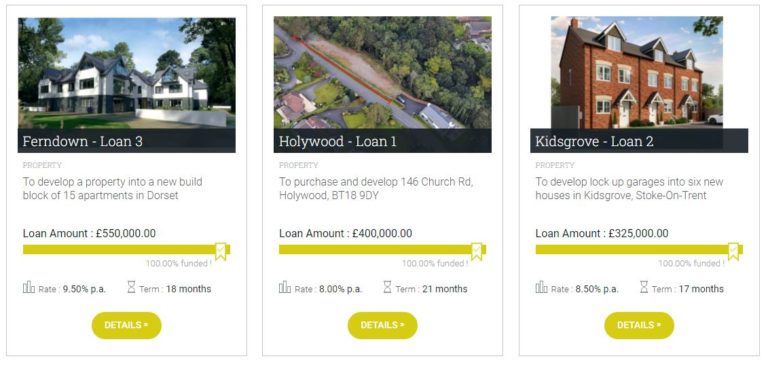

- I also recently published a blog post about another P2P property investment platform called BLEND. Like Kuflink, they offer the opportunity to invest in secured loans to experienced property developers. They offer (on average) somewhat higher rates of return than Kuflink, though arguably with a little more risk. As well as my blog post about BLEND, you can also check out what they have to offer on their website [affiliate link].

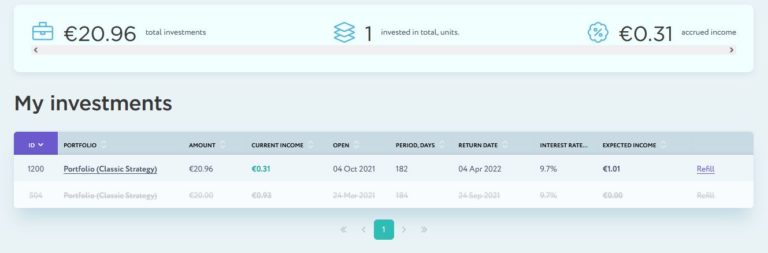

As mentioned last time, I invested some more money in European crowdlending platform Nibble last month. On this occasion I invested in their Legal Strategy. The loans in question are in default and facing legal action. Nibble buy these loans at a heavily discounted rate and then seek to recover as much as possible of the money owed. The minimum investment is 10 euro and the minimum period is six months.

The Legal Strategy comes with a deposit-back guarantee. This is a guarantee to return the full investment amount at the end of the investment period and a minimum yield of 9% per annum. The actual yield will depend on how successful recovery efforts prove, so in practice you may end up with a return of anywhere between 9% and 14.5%. All is going well so far, but I will obviously continue to report on this in the months ahead.

- I recently updated my original review of Nibble, which you can read here if you wish. You can also sign up directly on the Nibble website if you like [affiliate link].

One other thing I wanted to mention is that I have just opened an account with online share trading/investment platform eToro. I’ve been planning to do this for a while, with a view to reviewing it on PAS. I’m finding it quite different from other online investment platforms I have used such as Bestinvest.

As well as commission-free share trading, eToro offer a popular copy-trading feature, where you can copy the trades of other successful investors automatically. You can also practise with a virtual portfolio of $100,000. I put some of this into Platinum on the eToro commodities market and initially its value soared. But then it went right down again. So I am not the investment genius I thought I was at first 😀 It’s all very interesting, though. If you’d like to check out eToro for yourself, here’s an invitation link [affiliate]. And keep an eye open for my full review in due course.

Moving on, I have two more articles on the always-excellent Mouthy Money website. The first concerns Two Important State Benefits Many Older People Are Missing Out On. And the second is on the subject Could You Make Money as a Blogger? I have been blogging for over twenty years now, initially about freelance writing and now about personal finance. So I had plenty to talk about in this article!

- Incidentally, Mouthy Money currently have a vacancy for a graduate-level personal finance reporter. This is a one-year paid internship working partly from home and partly from MM’s London office. If you know anyone who might be interested in this opportunity, please do draw it to their attention.

Finally, there has been a lot of talk about the cost of living crisis this month. As you may know, Chancellor Rishi Sunak announced a raft of measures to try to mitigate the worst effects of this.

Whatever your political or economic views, I do think he has been quite generous to older people in particular. Not only will those of us receiving the state pension get £400 off our household energy bills, we will also receive an extra £300 on top of our usual Winter Fuel Allowance (that means I’ll get £500 this year).

Many pensioners will also qualify for the £150 bonus for those on non-means-tested disability benefits such as Attendance Allowance. And they may also get the £650 cost of living payment going to anyone receiving various means-tested benefits (everyone getting pension credit will qualify for this, for example). Some households will receive a total of £1,500 in additional benefits through these measures, which should certainly help in these challenging times. .

If you would like to know more about the latest round of financial support from the government, Martin Lewis has a good summary on his Moneysaving Expert website. The government has also published a web page which sets out all the help that may be available for those on lower incomes.

That’s enough for today, so I’ll close by wishing you a very happy Jubilee Holiday. Whatever you are doing in the next few days – going away or staying home with family and friends – I do hope you have a relaxing and enjoyable time. As ever, if you have any comments or queries, please feel free to leave them below. I always love hearing from my readers 🙂

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that posts may include affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered, but it does help support me in publishing PAS and paying my bills. Thank you!