My Investments Update – November 2022

Here is my latest monthly update about my investments. You can read my October 2022 Investments Update here if you like

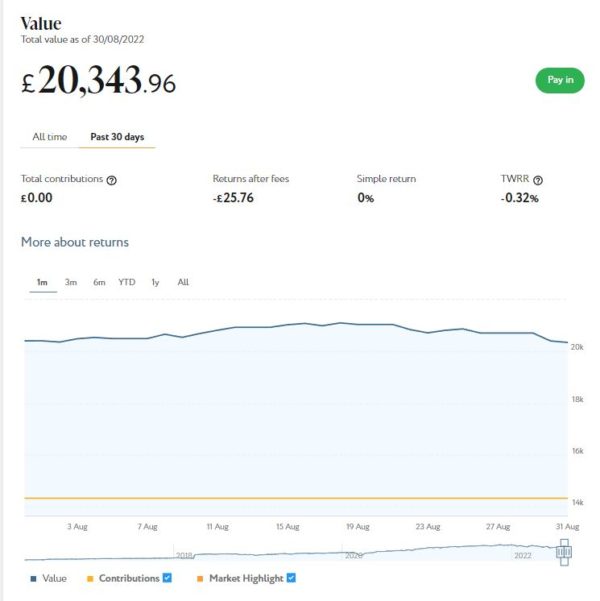

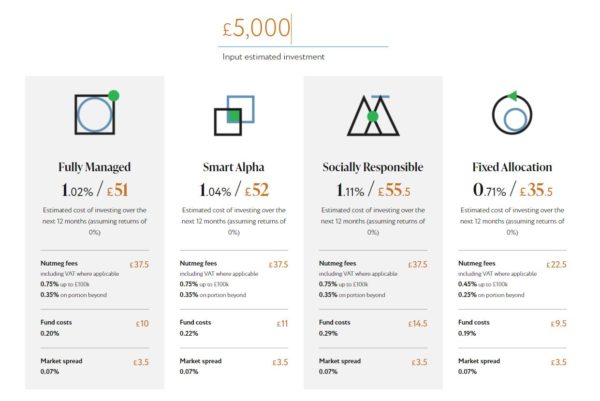

I’ll begin as usual with my Nutmeg Stocks and Shares ISA. As I only updated my full review of Nutmeg last week, however, I will keep it fairly brief today.

Nutmeg is the largest investment I hold other than my Bestinvest SIPP (personal pension). Withdrawals from the latter are still on hold to avert the risk of pound-cost ravaging.

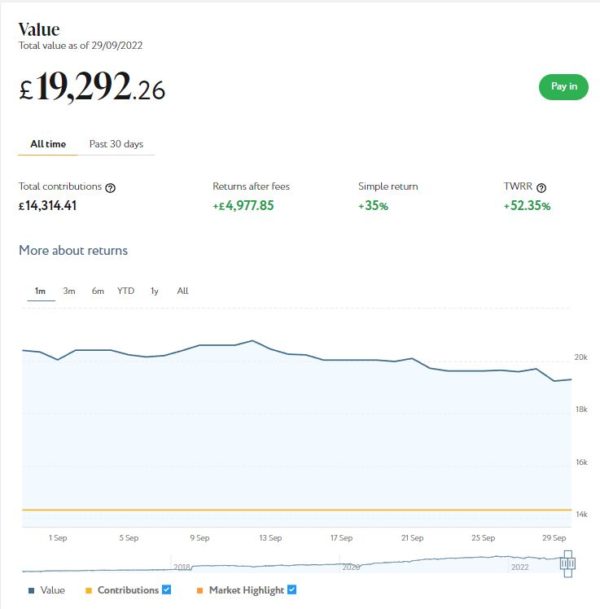

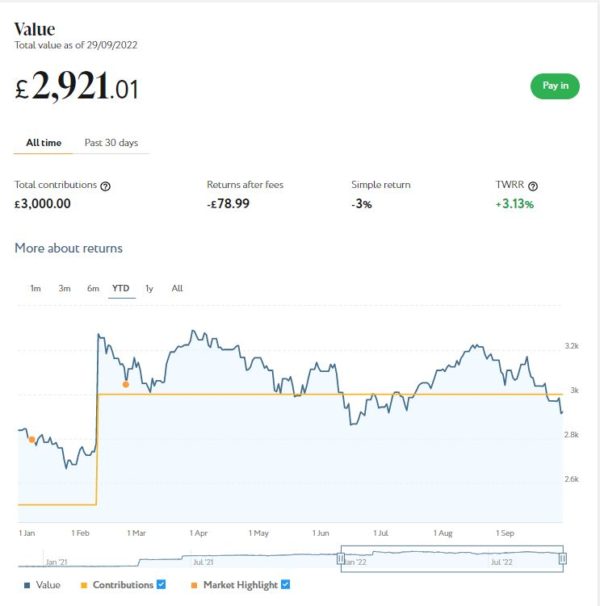

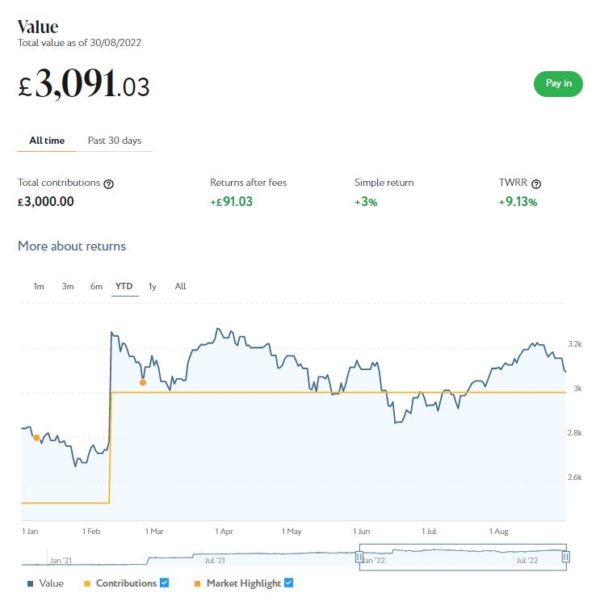

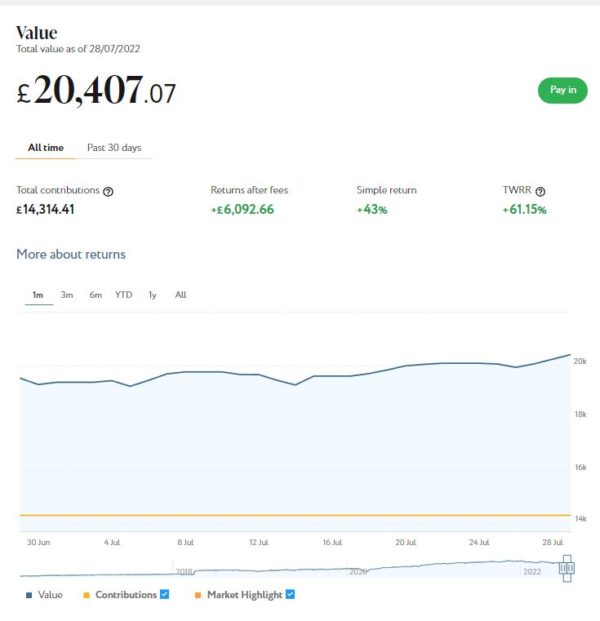

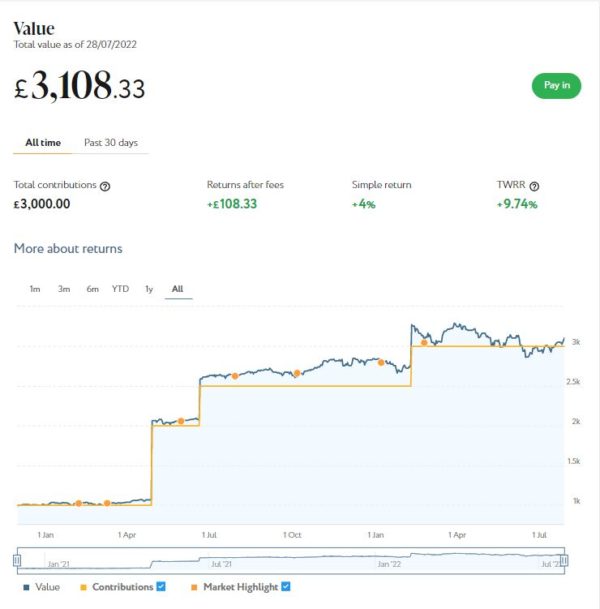

My main Nutmeg portfolio, which I opened back in 2016, is currently valued at £19,733. Last month it stood at £19,292 so that is a rise of £441. My smaller Smart Alpha investment (opened in 2020) is currently valued at £2,987. Last month it stood at £2,921, so that is a rise of £66. My total Nutmeg investments have therefore increased by £507 month on month.

While the rise in October is of course welcome, my Nutmeg investments are still down by about 11% in value since the start of the year. As I said in my recent Nutmeg review, that’s clearly disappointing, but it’s still a lot less than the amount by which they went up in 2021 alone. And I am still over £5,400 in profit overall. I am therefore philosophical about this, recognising that all investments have their ups and downs and Nutmeg is hardly alone in seeing a drop in values this year. But I do understand why people who started investing with them in the last twelve months or so may be feeling disappointed. You might like to read this recent article on the Nutmeg blog where they discuss the performance of Nutmeg portfolios in 2022 and examine the outlook going forward.

- There is actually an argument that now may be a good opportunity to invest while asset values are depressed. At some point we will see a recovery and people who invest at the present time will be well placed to benefit from this. Of course, nobody knows for sure when the recovery will happen or how much further asset values might fall first. Nonetheless, I am certainly considering adding further to my Nutmeg investments in the coming months.

Moving on, my Assetz Exchange investments continue to perform well. Regular readers will know that this is a P2P property investment platform focusing on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my AE portfolio has generated £81.40 in revenue from rental and £30.80 in capital growth, a total of £112.20. That’s a decent rate of return on my £1,000 investment and does illustrate the value of P2P property investment for diversifying your portfolio when equity markets are volatile.

I now have investments in 23 different projects and all are performing as expected, generating rental income and in most cases showing a profit on capital as well. So I am very happy with how this investment has been doing. And it doesn’t hurt that most projects are socially beneficial as well.

- To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as i am concerned. You can actually invest from as little as 80p per property if you really want to proceed cautiously.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

Another property platform I have investments with is Kuflink. They continue to do well, with new projects launching almost every day. I currently have around £2,600 invested with them in 17 different projects. To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question. At present most of my Kuflink loans are performing to schedule, though five have had their repayment dates put back.

My loans with Kuflink pay annual interest rates of 6 to 7.5 percent. These days I invest no more than £200 per loan (and often less). That is not because of any issues with Kuflink but more to do with losses of larger amounts on other P2P property platforms in the past. My days of putting four-figure sums into any single property investment are behind me now!

- Nowadays I mainly opt to reinvest the monthly repayments I receive from Kuflink, which has the effect of boosting the percentage rate of return on the projects in question

Obviously a possible drawback with Kuflink and similar platforms is that your money is tied up in bricks and mortar, so not as easily accessible as cash savings or even (to some extent) shares. They do, however, have a secondary market on which you can offer any loan part for sale (as long as the loan in question is performing and not in arrears). Clearly that does depend on someone else wanting to buy it, but my experience has been that any loan parts offered are typically snapped up very quickly. So if an urgent need arises, withdrawing your money (or part of it) is unlikely to be an issue.

You can read my full Kuflink review here. They offer a variety of investment options, including a tax-free IFISA paying up to 7% interest per year with built-in automatic diversification. Alternatively you can now build your own IFISA, with most loans on the platform (including the one shown above) being IFISA-eligible.

My investment in European crowdlending platform Nibble continues to perform as advertised. My latest investment was in their Legal Strategy. These are loans that are in default and facing legal action. Nibble buy these loans at a heavily discounted rate and then seek to recover as much as possible of the money owed. The minimum investment is 10 euros and the minimum period is six months. I invested 100 euros for 12 months initially at a target annual interest rate of 12.5%.

The Legal Strategy comes with a deposit-back guarantee. This is a guarantee to return the full investment amount at the end of the investment period and a minimum yield of 9% per year. The actual yield depends on how successful recovery efforts prove, so in practice you may end up with a return of anywhere between 9% and 14.5%. All has gone to plan so far, but I will obviously continue to report on this in the months ahead.

- You can read my updated review of Nibble here if you like. You can also sign up directly on the Nibble website [affiliate link]

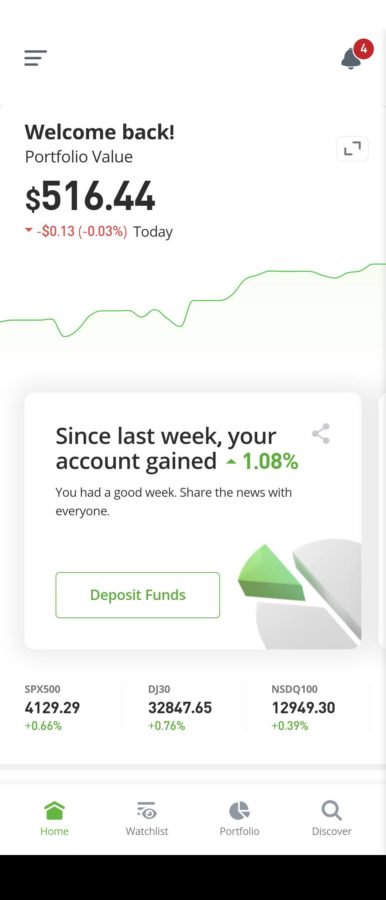

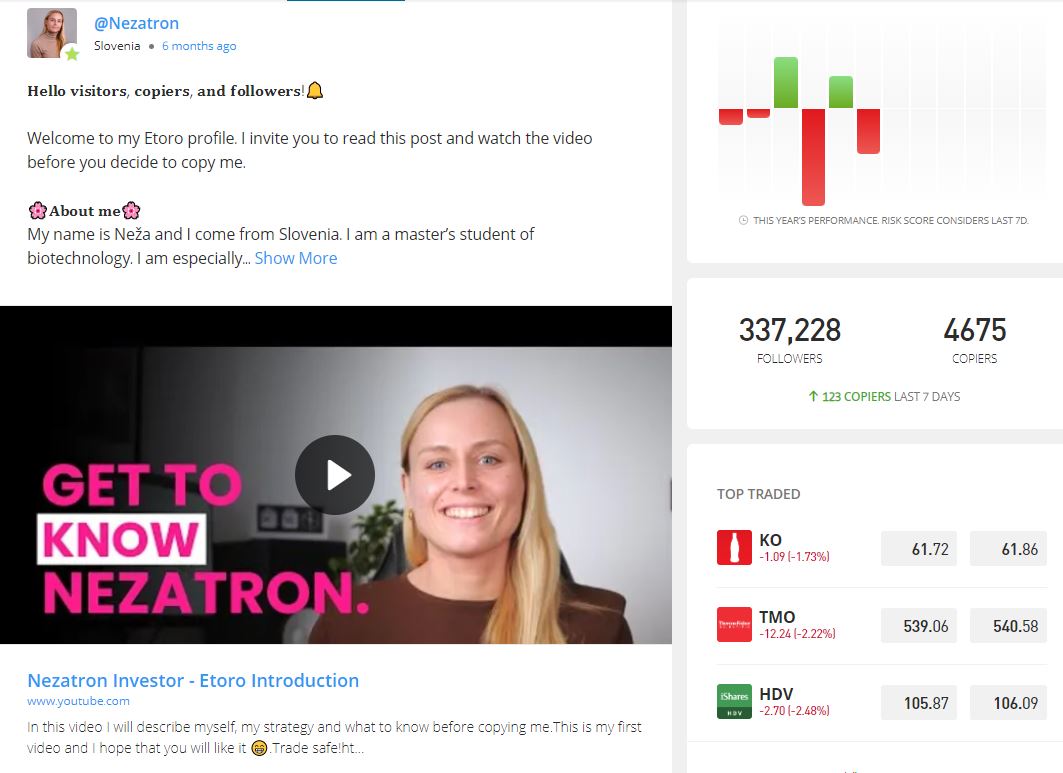

Earlier this year I set up an account with investment and trading platform eToro, using their popular ‘copy trader’ facility. I chose to invest $500 (then about £412) copying an experienced eToro trader called Aukie. Unsurprisingly my investment has been up and down in the last few months, but it is currently about $8 in profit. In these turbulent times I am quite happy with that.

In addition, since I started on eToro, the pound has weakened against the US dollar, so my investment has benefited from this. My $508 US is now worth around £440 in UK pounds, so I am effectively £28 up overall. I am not claiming this as a particular benefit of eToro, but it does demonstrate how exchange rate fluctuations can sometimes work in your favour!

In any event, I’m looking on this as a long-term investment so won’t be judging it yet. I am also considering a further investment with eToro, possibly in one of their themed portfolios. You can read my full in-depth review of eToro here. I am also planning to publish a more in-depth look at eToro copy trading on the blog soon.

Moving on, I had another article published on the always-excellent Mouthy Money website. This one is entitled How to Save Money on Petrol. I was actually commissioned to write this when petrol prices were peaking. Since then they have fallen back somewhat, but with no end in sight to the war in Ukraine prices could easily shoot back up again. In the article I discuss my favourite website for monitoring petrol prices locally and also set out my top tips for cutting your petrol (or diesel) consumption.

As a matter of interest, Mouthy Money recently asked if I could increase the number of articles I write for them (so I guess I must be doing something right!). From November they will be publishing two articles a month from me. While they don’t pay me a fortune, the extra cash will undoubtedly help a lot in the cold winter months ahead.

Obviously energy bills are a particular concern for many people at the moment, so I hope you are getting all the help you are entitled to. By now everyone should have received the first instalment (£66) of the £400 rebate all UK residents are due on their energy bills for the next six months. If not, chase it up with your energy supplier.

- I am with EDF, and they are crediting the rebate payments to my bank account once my monthly direct debit has been taken. Other energy suppliers are doing it differently, e.g. deducting the rebate from monthly direct debits before they are taken. This article from the popular Moneysavingexpert website explains how different energy suppliers are applying the rebate.

I also received a letter last week confirming that, as I receive the state pension, I shall be getting an enhanced Winter Fuel Payment of £500 in November or December this year, which will be very welcome as well 🙏

In the last few years I also qualified for the Warm Home Discount, which this year is being increased from £140 to £150. The rules are changing, however, and I suspect I shall be one of the people who misses out. The full new rules still haven’t been announced, but I will update my blog post about WHD as soon as I know more.

- As I’ve said previously, the government’s Help for Households website has a helpful summary of all the financial assistance currently available and is regularly updated.

Please do check out as well some of the other posts on Pounds and Sense for advice and resources, especially in the Making Money and Saving Money categories.

- Don’t forget, also, that there are currently two opportunities to claim a free share available. One is with Wealthyhood and the other with Trading 212 (the links will take you to the relevant blog posts). The Trading 212 offer closes on 8 November 2022, so don’t delay if you want to take advantage of this one. As far as I know the Wealthyhood offer is open indefinitely, but that could always change, of course 🙂

That’s all for today. As always, if you have any comments or queries, feel free to leave them below. I am always delighted to hear from PAS readers

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that posts may include affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered, but it does help support me in publishing PAS and paying my bills. Thank you!