Win £250 When You Open a Plum Stocks and Shares ISA!

Updated 19 April 2023

If you’re looking for a home for your 2023/24 Stocks and Shares ISA allowance, this special promotion from money-management app Plum could provide a solution, with a chance of winning a £250 prize as well!

Plum is designed to help you set money aside painlessly for any purpose – from holidays to major purchases or simply for a ‘rainy day’ fund. It is one of a range of apps that make use of so-called Open Banking. This allows third-party apps to access your financial information (read only) – so long as you provide the necessary authorization, of course – and perform certain transactions on your behalf, if you choose to set up a direct debit.

Plum offers four levels of account. These are the free Plum Basic and the paid-for Pro, Ultra and Premium. The Basic account is (as stated) free of charges. Plum Pro costs £2.99 a month, Ultra costs £4.99 a month, and Premium costs £9.99 a month. The Pro, Ultra and Premium accounts offer a wider range of features and higher interest rates in interest-bearing ‘Pockets’. This is further discussed on the main Plum website.

The current promotion is specifically for people who open a Stocks and Shares ISA with Plum, so in this post I will be focusing on that. But first I should answer the most basic question…

- Capital at risk if you invest

What is a Stocks and Shares ISA?

The term ISA is short for Individual Savings Account. ISAs are savings and investment products where you aren’t taxed on the interest you earn or any dividends you receive or capital gains you make, in accordance with ISA rules. An ISA is basically a tax-free ‘wrapper’ that can be applied to a huge range of financial products.

With ISAs you don’t get any extra contribution from the government in the form of tax relief as you do with pensions. But – except in the case of the Lifetime ISA – you can withdraw your money at any time (subject to any provider rules about the term and notice period required) and you won’t be taxed on any earnings.

All adults aged +18 who are registered for tax in the UK have an annual ISA allowance, which is the maximum amount you can invest in ISAs in the year concerned. In the current financial year (2023/24) this is a generous £20,000. But you cannot carry over this allowance into a new tax year, so it really is a case of use it or lose it!

There are four main ISA categories: Cash ISA, Stocks and Shares ISA, Innovative Finance ISA (IFISA) and Lifetime ISA (LISA). You can divide your £20,000 ISA allowance among these in any way you choose, though the most you can invest in a Lifetime ISA in a year is £4,000. Note also that you are only allowed to invest in one ISA in each category per year.

The Plum Stocks and Shares ISA

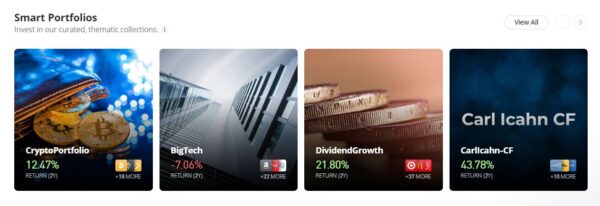

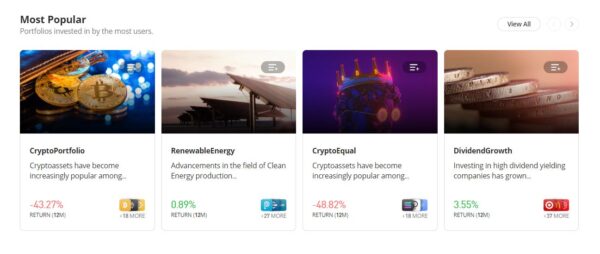

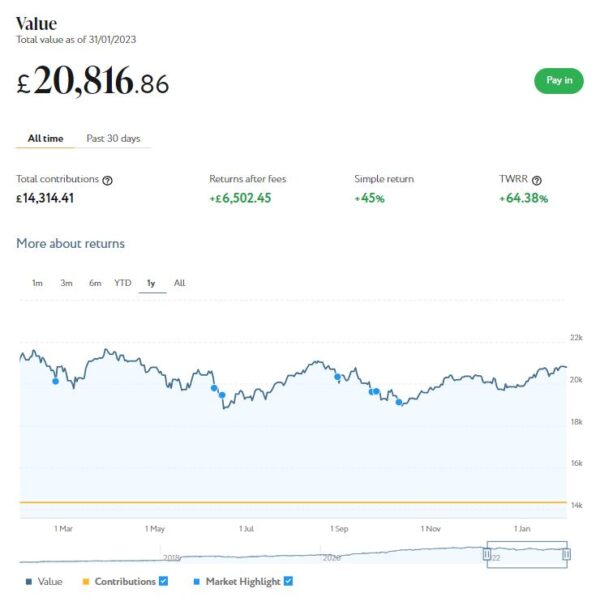

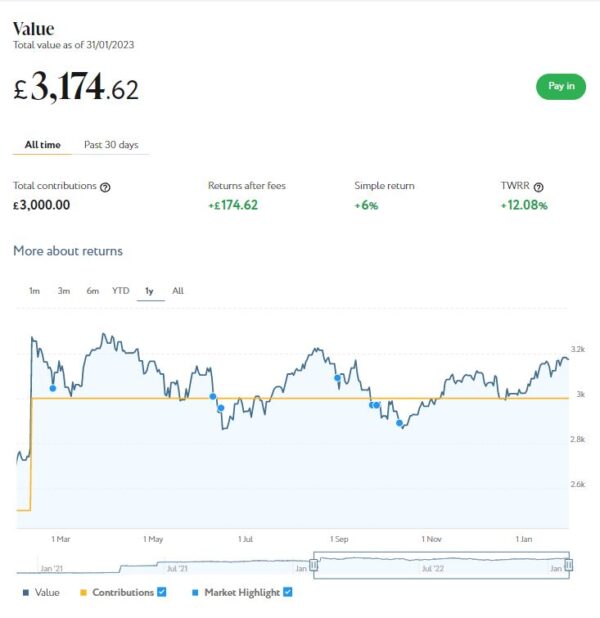

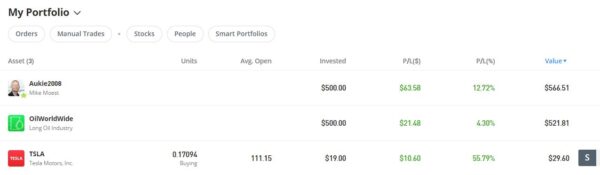

Investing in a single company can be risky, so if you have a Plum Pro account (or higher), the app enables you to invest your money across a range of well-diversified funds. These contain a mixture of shares from thousands of different companies, plus other assets like bonds. So if one investment doesn’t perform well, it should only affect a small portion of your overall portfolio.

Some examples of the themed funds on offer to Plum investors include:

Tech Giants – Allows you to invest in technology shares like Facebook and Apple.

Balanced Bundle – With 60% shares and 40% bonds, this fund offers a balanced combination of shares and bonds.

Future Planet – Invests in shares of companies within an index which is weighted towards companies that meet positive carbon and environmental levels.

Retirement 2050 – Investments that will pay out money for investors planning to retire in or within approximately five years after 2050.

The Medic – Shares of healthcare, pharmaceutical and biotechnology companies.

Once you have deposited your money with Plum, you can choose which funds to invest in from the range available. There are up to 21 funds on offer, though some are only available to customers with a Plum Premium account.

You can start investing with as little as £1, up to the annual ISA maximum of £20,000 (in the current tax year). Subject to these limits, you can deposit or withdraw as often as you like, with no hidden fees or charges. If you have already invested your £20,000 maximum ISA allowance, or have invested in another S&S ISA in the current tax year, you can still invest with Plum in a GIA (general investment account) but obviously this will be liable for tax charges.

- Plum also offer personal pensions. A Plum Self Invested Personal Pension (SIPP) lets you consolidate existing pension policies and invest in risk managed or other well diversified global funds. Capital at risk. Pension and tax rules apply.

£250 Prize Promotion

As an additional incentive to start investing with Plum, anyone opening a Plum Stocks & Shares ISA before 12 noon on 30th April 2023 will be entered into a prize draw to win £250.

Any existing customers who already have an active Stocks & Shares ISA with Plum will also be automatically entered into the draw. An active Plum Stocks & Shares ISA is defined as a customer account with a current subscription to Plum Pro (or above) at the time of competition close, and where no fees or ID verification remain outstanding at that time. Note also that to open a Plum Stocks and Shares ISA you must be over 18 years old and tax-registered in the UK.

No purchase is necessary to enter this prize draw, but to finish opening your Plum Stocks & Shares ISA, the company may need to perform a KYC (Know Your Customer) check. Note that all outstanding checks must be completed before the competition’s end date (see above) for your entry to be included. So if you are going to do this, it is probably best to apply sooner rather than later.

One lucky winner will be selected at random and notified within five working days of the competition close date (see above). The prize of £250 will be paid into the winner’s Primary Plum Pocket within 10 working days of the competition close.

Closing Thoughts

If you are looking for a home for your 2023/24 Stocks and Shares ISA allowance, a Plum S&S ISA is certainly worth considering. It offers a simple, straightforward method for investing in a range of themed and well-diversified funds. As such, it may be particularly suited to people who are new to investing and/or those who don’t want to spend many hours researching specific investments themselves.

Furthermore, as stated above, you can start with as little as a pound and withdraw your money at any time without giving notice or paying extra fees (as with all stock market investments, some fees and charges are payable).

In addition, as a Plum account holder you will enjoy all the other features and benefits of the app too, including interest-paying ‘pockets’ you can use to set money aside for specific purposes such as holidays. See the main Plum website for full details.

And, of course, there is that potential £250 prize to be won as well!

- Capital at risk. The value of your investments can go down as well as up.

As always, if you have any comments or questions about this post, please do leave them below.

Important note: I am not a qualified financial adviser and nothing in this post should be construed as personal financial advice. You should always do your own ‘due diligence’ before investing and seek advice from a qualified professional if in any doubt how best to proceed. All investing carries a risk of loss.

Disclosure: This post and others on Pounds and Sense includes affiliate links. If you click through and make a purchase or perform some other qualifying transaction, I may receive a commission for introducing you. This will not affect in any way any fees you are charged or the product or service you receive.