Credit Card Borrowing Set to Boom

Today I am sharing some information and advice from my friends at Smart Money People, the UK’s largest financial services review site

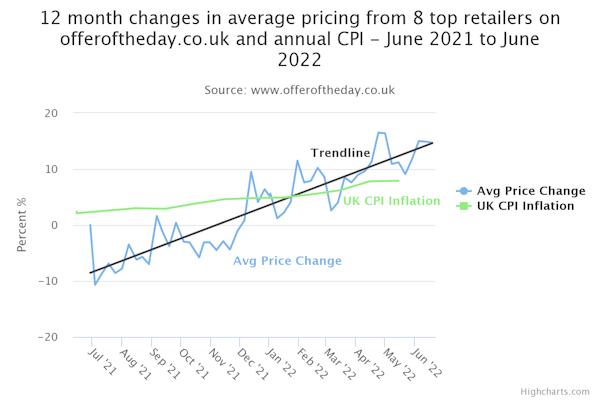

With UK inflation now running at around 10 percent (and forecast to go even higher), many people are feeling the pinch right now. For the large number who have little or no savings to fall back on, borrowing may be their only option to make ends meet.

Table of Contents

Research on Borrowing

New research undertaken by YouGov on behalf of Smart Money People shows that the UK’s adults will borrow £101.1 bn on new credit cards, loans, overdrafts and other forms of new credit arrangements in the next 12 months.

The company found that 71% of people currently have less disposable income than they would usually have on average per month due to the current rise in the cost of living. This is leading people to consider other ways to make ends meet:

-

Two-fifths (40%) of UK adults will have some form of credit over the next year due to the cost of living crisis (i.e. rising prices for fuel, energy and food).

-

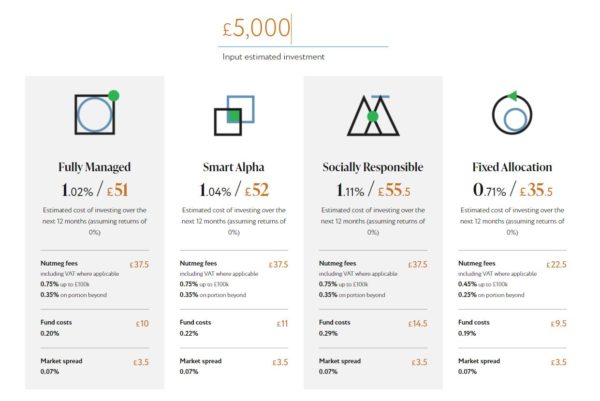

Borrowers predicted they would look to borrow an average of £5,259 each.

-

43% of people who will take out new credit are already worried about how they are going to meet the terms of their repayments.

-

A fifth (21%) of the adults who say they expect to take out a new form of borrowing in the next 12 months, will do so to cover day-to-day expenses. This is equivalent to 8% of the adult population as a whole, or 5.5 million people.

-

One in ten (10%) people borrowing over the next 12 months will do so to consolidate existing debts.

The bulk of this new borrowing is predicted to occur during autumn (15%) and winter (32%). A further 13% were unsure exactly when they would borrow but expect it to be when energy price rises affect them.

Smart Money People’s survey also revealed that the most popular type of credit in the next 12 months will be a credit card: 34% of expected borrowers say this will be their preferred method of credit.

Based on the survey, the other most popular types of borrowing in the next year are expected to be an agreed overdraft (17%) and Buy-Now-Pay-Later (15%), a relatively new form of credit where the method of payment is in instalments with low or no interest rates.

Twelve percent of people stated they would borrow from family and friends.

Other Findings

Other findings from the survey include:

-

68% of people are more worried about their finances now than during the pandemic.

-

A quarter (25%) of people don’t understand how inflation and interest rates will affect their finances.

-

36% of people are unsure whether they have the best financial products for the current situation.

Jacqueline Dewey, CEO of Smart Money People said: “We know that many people have very little, if any, savings to help them get through this period of high inflation, and if they have already made cutbacks, they have almost no choice but to turn to credit.

“Providers will do credit checks for some forms of lending but Buy-Now-Pay-Later schemes do not apply the same rules, and of course, family and friends don’t either, so it is entirely possible to accumulate a worrying level of debt very quickly.

“Anyone who needs to take out a new credit card or another form of credit would be wise to check out the company and the contract and not simply jump at the first provider who will lend to them. Take time to understand if they have good customer service and offer channels that suit your style of managing money.”

Guidance for Borrowers

Smart Money People offers the following guidance for people who are considering taking out a new form of credit:

-

Borrow responsibly: if you miss a repayment your credit score will be affected for six years.

-

Don’t simply borrow from the provider who will lend you the highest amount.

-

Check you understand the product: what you will owe and by when.

-

Does the interest rate look reasonable compared to other lenders?

-

You may be penalised if you pay back the debt early – understand the T&Cs.

-

Find out if the lender has a reputation for good customer service by checking ratings on a financial review site.

-

When borrowing from family and friends, make sure both parties agree on how and when monies will be repaid.

-

If you are struggling to make repayments, speak to the credit provider as early as possible to avoid defaulting on a payment. They should work with you to find an affordable means to repay.

My Thoughts

Thank you to Smart Money People for their help in compiling this article, and in particular for their valuable tips and advice about borrowing sensibly.

I would say, though, that borrowing to pay bills should only ever be a last resort. At the risk of stating the obvious, any money you borrow will sooner or later have to be repaid, probably with interest. And credit card borrowing, once the interest-free period has elapsed, is one of the most expensive ways there is to borrow money.

if you’re worried about your finances, before taking on any type of credit, my top tip is to ensure you’ve done everything possible to maximize your income, minimize your expenditure, and budget smartly (using your existing resources to best effect, in other words). These are all subjects I cover regularly on Pounds and Sense, especially in the Making Money and Saving Money categories. By doing these things you may be able to reduce the amount of money you need to borrow, or even avoid the need entirely.

Remember, also, that the government has already set out a range of financial support measures, with more promised when a new prime minister is (finally!) in post. You can find a useful summary of support currently on offer from the government and local authorities on this official web page.

As always, if you have any comments or questions about this post, please do leave them below.