Nutmeg Launches ‘Smart Alpha’ Portfolios Powered by J.P. Morgan Asset Management

Updated 16 November 2023.

Regular readers of PAS will know that I am a fan of the Nutmeg robo-adviser investment platform, and have a good portion of my own money in a Nutmeg stocks and shares ISA. You can read my in-depth review of Nutmeg here.

I was interested to hear that Nutmeg had launched a new investment style for their ISA, Lifetime ISA, Junior ISA, SIPP (personal pension) and general investment account customers. Previously such customers had a choice of three options: Fixed Allocation, Fully Managed and Socially Responsible.

All Nutmeg portfolios are managed by human experts, but the Fixed Allocation ones are altered annually, whereas the others are managed more actively. The Socially Responsible portfolio aims to optimize your investments according to various environmental, social and governance (ESG) factors. So it focuses on companies with a good track record and proactive strategy in such areas as water use, pollution, greenhouse gas emissions, proportion of female board members, and so on. Currently my own stocks and shares ISA is in the Fully Managed category (which was the only option available when I originally invested with Nutmeg).

Whilst all three of these investment styles remain available, a new one was launched in 2020…

Smart Alpha Portfolios

Nutmeg’s Smart Alpha portfolio range is powered by J.P. Morgan Asset Management. It includes five risk-rated portfolios, each holding between 10 and 14 passive and active exchange traded funds (ETFs). They are run by J.P. Morgan’s multi-asset solutions team, giving Nutmeg clients access to the investment giant’s experience and expertise. Writing on the Nutmeg blog, their Chief Investment Officer James McManus explained the benefits of this approach as follows:

The name recognises the intelligent way these portfolios are designed with the potential to achieve alpha (returns above the market) for our clients in three ways.

Firstly: The use of J.P. Morgan Asset Management’s multi-asset specialists, a team with a 50-year history of investing for institutions and professionals worldwide. These specialists inform Smart Alpha portfolios’ long-term (strategic) asset allocation.

Secondly, Smart Alpha portfolios have the ability to be flexible around this long-term asset allocation, allowing us to manage risk and capture opportunities at different stages of the market cycle.

Thirdly: Nutmeg and J.P. Morgan Asset Management have added to these capabilities a means to make smart security selections within active exchange traded funds (ETFs). These smart selections are made based on the insights of J.P. Morgan Asset Management’s research analysts with the aim being to capture returns in excess of the market benchmark (alpha).

How do these smart selections seek to gain alpha? The active ETFs we use allow us to move overweight in certain positions that J.P. Morgan Asset Management’s analysts expect to perform well and underweight in those positions they expect to perform poorly. This gives us the ability to move above and below market benchmark positions, delivering greater potential returns with similar risk to the overall market.

As well as allowing Nutmeg investors to tap into the expertise of J.P. Morgan Asset Management, these portfolios are ESG integrated, meaning that (as mentioned above) environmental, social and corporate governance considerations are factored into every research and investment decision. These portfolios are therefore suitable for the growing number of investors for whom ethical considerations are particularly important.

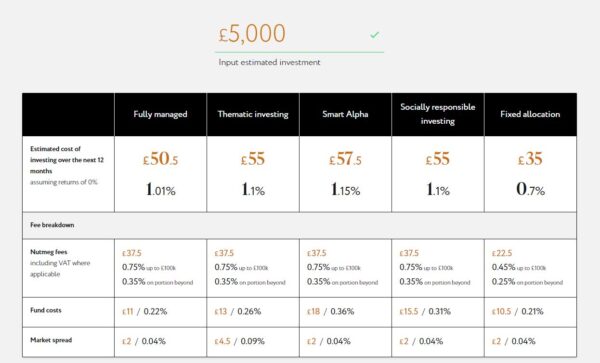

The terms and conditions for the new Smart Alpha portfolios are copied below, alongside the other portfolio types.

The above is correct as at 16 November 2023, but may have changed subsequently. Please note also that Nutmeg has also recently introduced a new ‘thematic’ investment style. More information about this can be found about this in my full Nutmeg review and on the Nutmeg website. Remember that all investing carries a risk of loss.

My Thoughts

This is undoubtedly an interesting move by Nutmeg and gives investors the opportunity to benefit from having their portfolio actively managed by a leading investment house at no extra cost. If you are a Nutmeg investor already, you can start by investing as little as £500 to test the water. You can either use ‘new money’ from your bank account or another ISA, or you can transfer money from another pot within your Nutmeg ISA account.

Personally I am very happy with the way my Nutmeg ISA has performed during this tumultuous year and don’t want to rock the boat too much. On the other hand, I am curious to see how the new Smart Alpha portfolios perform in comparison. So I have created a new £1,000 pot within my ISA and have selected Smart Alpha as the investment style. The risk level is 4/5, which roughly corresponds with the 9/10 risk level in my Fully Managed portfolio.

I will of course report back on Pounds and Sense about how my investments perform. Obviously, if my Smart Alpha pot seems to be doing significantly better than my Fully Managed one, I will switch some or all of the latter to Smart Alpha as well. It is one of the attractions of Nutmeg that you can have multiple pots within a single ISA with different investment styles and risk levels attached to them.

- Capital at risk. Tax treatment depends on your individual circumstances and may change in the future.

In Conclusion

I am obviously a fan of Nutmeg and – as stated above – have a significant proportion of my investments with them.

Of course, I am not a qualified financial adviser and everyone should do their own ‘due diligence’ (and/or take professional advice) before deciding to invest. In addition, you shouldn’t consider investing with Nutmeg (or anyone else) unless you have paid off any interest-charging debts and have at least three months of easily-accessible savings in case of emergencies.

Based on my personal experiences with Nutmeg, though, I am happy to recommend them. They provide a simple, easy-to-understand investment platform, the customer service is excellent, and certainly in my case the results to date have exceeded my expectations.

If you have any comments or questions about this post or Nutmeg in general, please do leave them below.

PLEASE NOTE: As with all investing, your capital is at risk. Tax treatment depends on your individual circumstances and may be subject to change in the future. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest.

Note also that I am not a qualified independent financial adviser and nothing in this review should be construed as personal financial advice. You should always do your own ‘due diligence’ before investing and take professional advice if in any way uncertain how best to proceed. All investing carries a risk of loss.

Please note also that this review includes affiliate links. If you click through and make an investment or perform some other qualifying transaction, I may receive a commission for introducing you. This will not affect in any way the terms you are offered or any fees you may be charged.