My Investments Update – August 2023

Here is my latest monthly update about my investments. You can read my July 2023 Investments Update here if you like

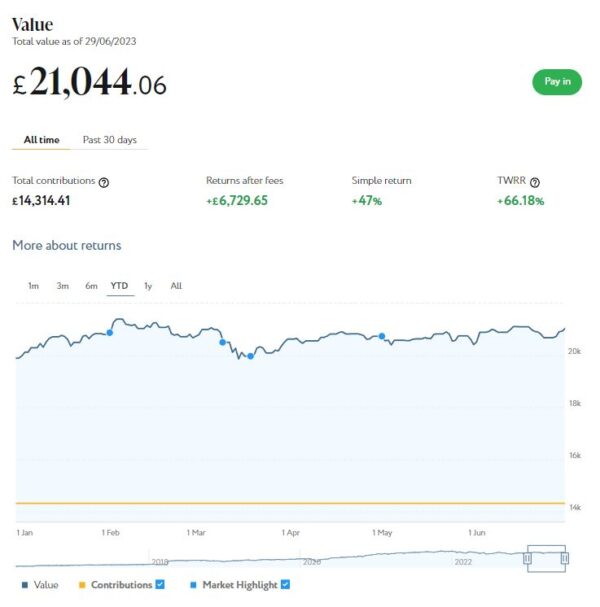

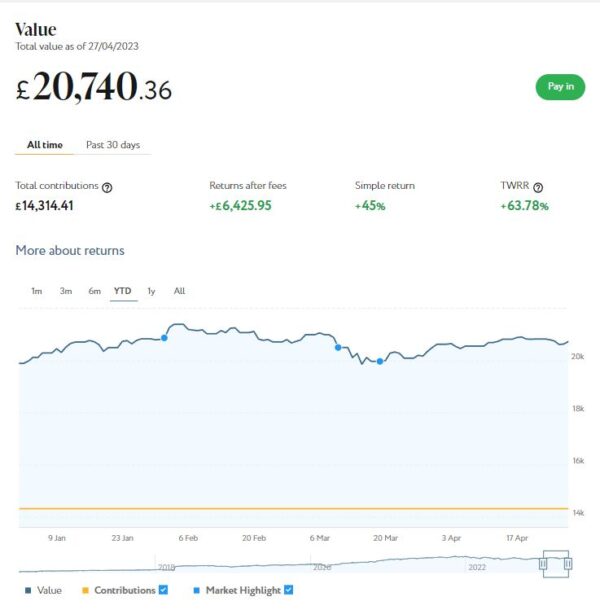

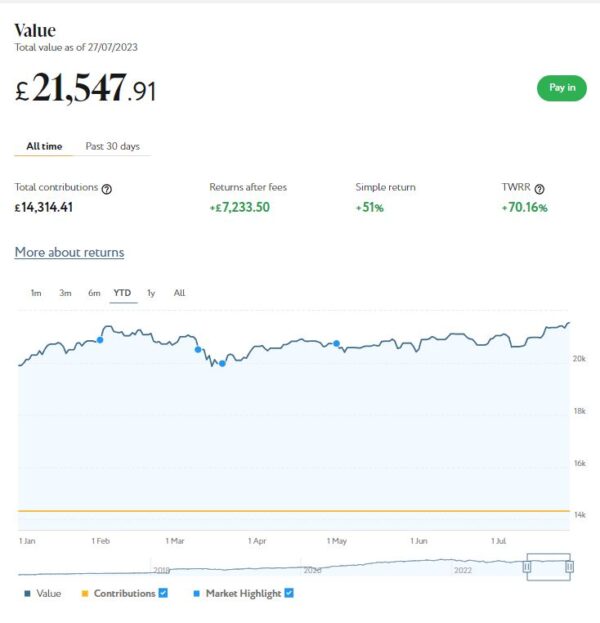

I’ll start as usual with my Nutmeg Stocks and Shares ISA. This is the largest investment I hold other than my Bestinvest SIPP (personal pension).

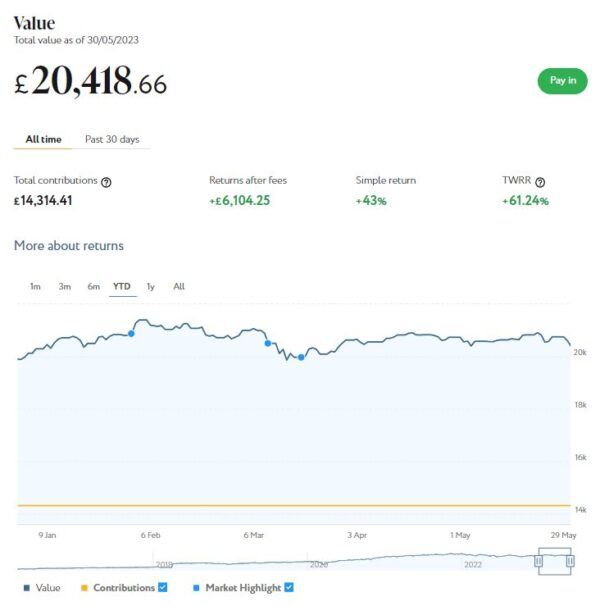

As the screenshot below for the year to date shows, my main Nutmeg portfolio is currently valued at £21,548. Last month it stood at £21,044 so that is a rise of £504.

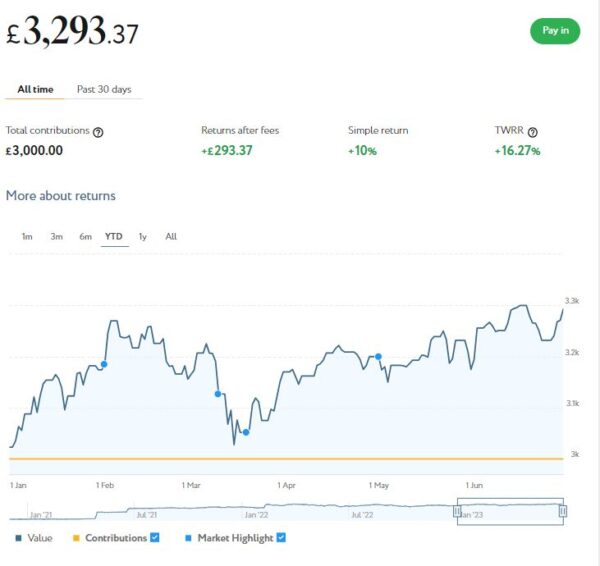

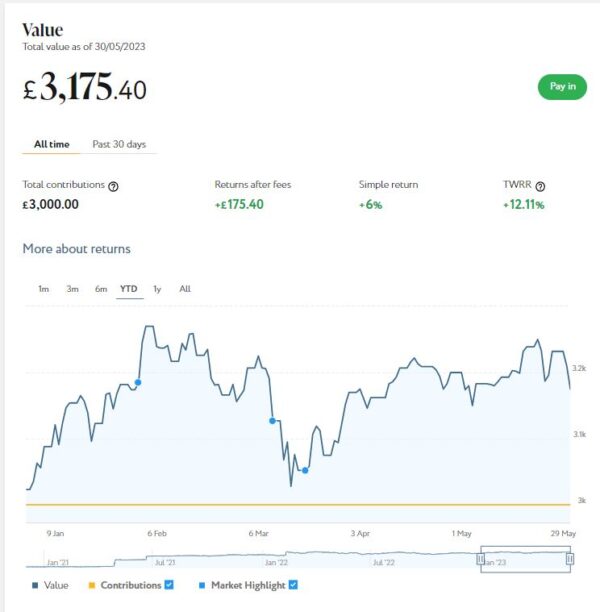

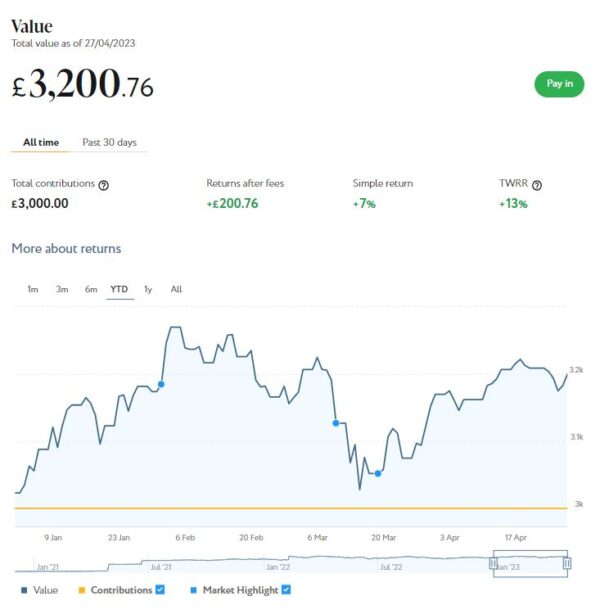

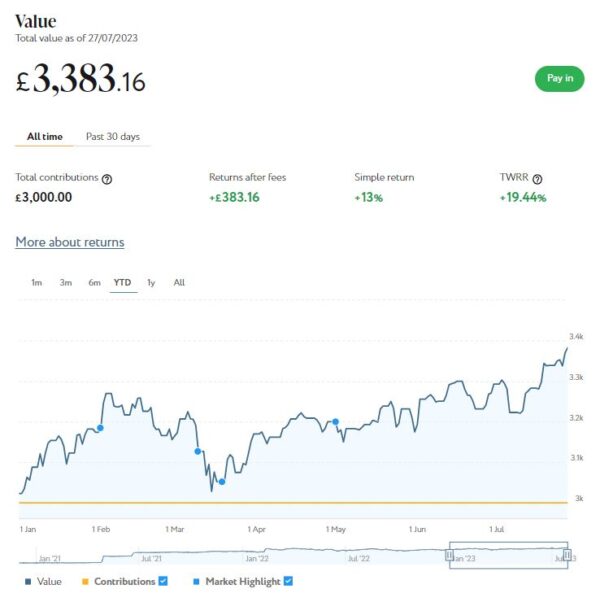

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £3,383 compared with £3,293 a month ago, an increase of £90. Here is a screen capture showing performance since the start of this year.

This has clearly been another good month for both my Nutmeg pots. Their total value has risen by £594 or 2.44% month on month. Since the start of 2023 the net value of my Nutmeg investments has grown by £2,010 or 8.78%. Compared with mid-October last year that’s an impressive rise of £3,118 or 14.29%.

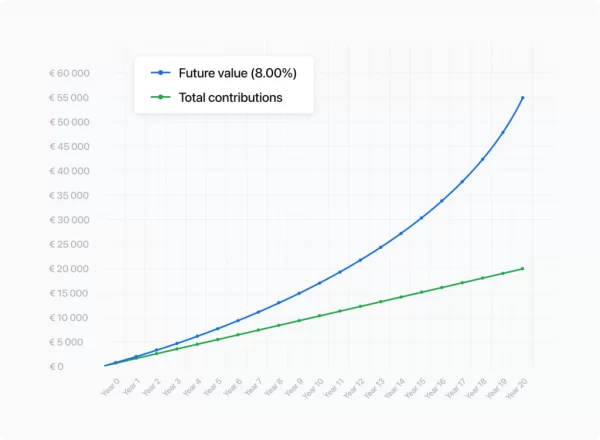

Of course, all investing is (or should be) a long-term endeavour. Over a period of years stock market investments such as those used by Nutmeg typically produce better returns than cash accounts, often by substantial margins. But there are never any guarantees, and in in the short to medium term at least, losses are always possible.

- Also, as you may know, both my Nutmeg pots have quite high risk levels (9/10 main, 5/5 Smart Alpha). If you haven’t yet seen it, you might like to check out my blog post in which I looked at the performance over time of Nutmeg fully managed portfolios at every risk level from 1 to 10 . I was pretty amazed by the difference risk level makes, with higher-risk ports over almost any period of three or more years in the last ten generating significantly better overall returns. If you are investing for the long term (and you almost certainly should be) choosing a hyper-cautious low-risk level might not therefore be the smartest strategy. The one exception is if you plan to withdraw your money soon and don’t want to risk losing too much if there is a sudden downturn.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are looking for a home for your annual ISA allowance, based on my overall experience over the last seven years, they are certainly worth considering. They offer self-invested personal pensions (SIPPs) and Junior ISAs as well.

I also have investments with the property crowdlending platform Kuflink. They continue to do well, with new projects launching every week. I currently have £2,185 invested with them in 18 different projects paying interest rates typically around 7%. To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question.

Last month a couple of my Kuflink loans were repaid, so I got my capital back with interest. I decided to withdraw about half of the proceeds to help pay for a couple of big purchases. The other half I reinvested in short-term loans on Kuflink’s secondary marketplace.

I heard this month that Kuflink are changing their terms and conditions. Specifically, from Monday 21st August there will be an initial minimum investment of £1,000 and a minimum investment per project of £500.

Kuflink say they are doing this to streamline their operation and minimize costs. I can understand their reasoning, though it does mean the option to ‘test the water’ with a small first investment has been removed. It will also make it harder for small investors (like myself) to build a well-diversified portfolio on a limited budget. As mentioned, my current portfolio of £2,185 comprises 18 different investments ranging from £50 to £200. Once the minimum £500 per project limit applies, the same amount of money would only stretch to four!

One possible way around this is to invest using Kuflink’s Auto/IFISA facility. Your money here is automatically invested across a basket of loans over a period from one to three years. The rates on offer from August 1 2023 are shown in the graphic below.

As you may gather, you can invest tax-free in a Kuflink Auto IFISA. Or if you have already used your annual iFISA allowance elsewhere, you can invest via a taxable Auto account.

You can read my full Kuflink review here. Note that I haven’t updated the information there about minimum investments as yet, but will do so shortly. You can of course still invest smaller amounts than £500 until the August 21st deadline.

Moving on, my Assetz Exchange investments continue to generate steady returns. Regular readers will know that this is a P2P property investment platform focusing on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my AE portfolio has generated a respectable £128.32 in revenue from rental income. As I said in last month’s update, capital growth has slowed, though, in line with UK property values generally.

At the time of writing, 12 of ‘my’ properties are showing gains, 1 is breaking even, and the remaining 13 are showing losses. My portfolio is currently showing a net decrease in value of £17.46, meaning that overall (rental income minus capital value decrease) I am up by £110.86. That’s still a decent return on my £1,000 and does illustrate the value of P2P property investments for diversifying your portfolio. And it doesn’t hurt that with Assetz Exchange most projects are socially beneficial as well.

Obviously the fall in capital value of my AE investments is slightly disappointing. But it’s important to bear in mind that unless and until I choose to sell the investments in question, it is largely theoretical. The rental income, on the other hand, is real money (which in my case I have chosen to reinvest in other AE projects to further diversify my portfolio).

I also spoke to the CEO of Assetz Exchange, Peter Read, recently. He made the point that capital values on the platform simply reflect the latest price at which shares in the property concerned have changed hands on their exchange. They do not represent objective or independent valuations of the properties. If you are investing long term with AE, the annual yield from rentals is really a much more important consideration.

Peter also made the point that the current high inflation rate has actually been beneficial for Assetz Exchange investors. That is because properties on the platform generally have an annual review when rentals are increased in line with inflation. That means from the end of the financial year in April, rentals have increased in most cases by around 10%. Assetz Exchange recently published a blog post about this which is worth a read.

To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as i am concerned (especially now that Kuflink have raised their minimum investment per project to £500). You can actually invest from as little as 80p per property if you really want to proceed cautiously.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

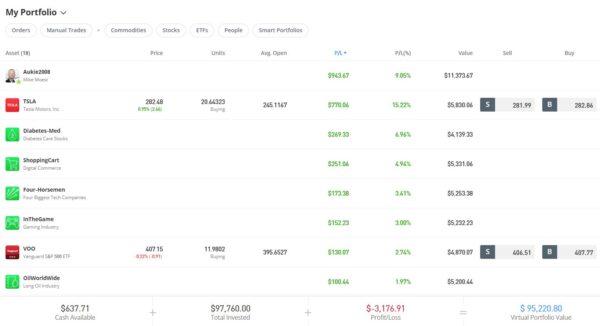

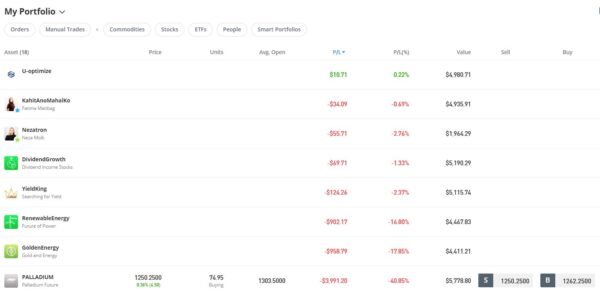

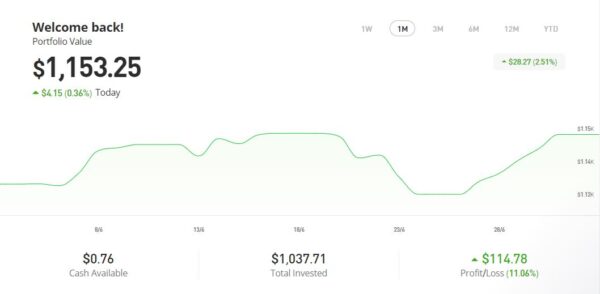

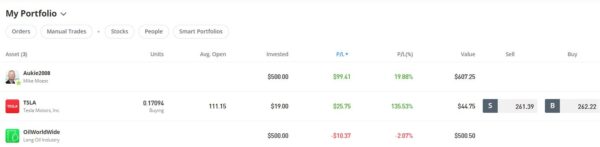

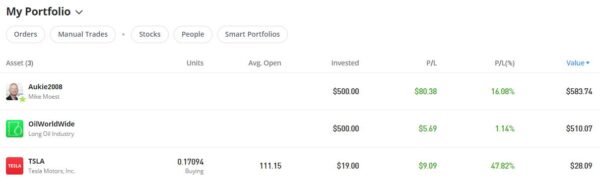

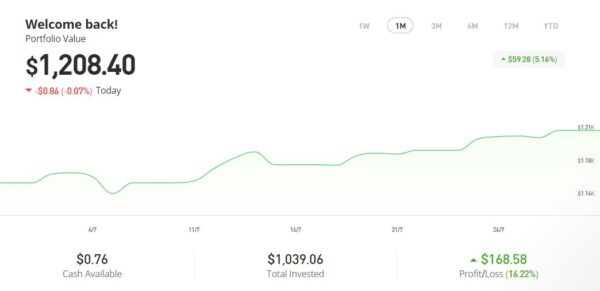

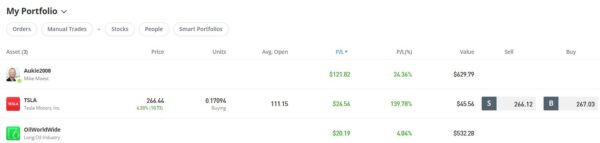

Last year I set up an account with investment and trading platform eToro, using their popular ‘copy trader’ facility. I chose to invest $500 (then about £412) copying an experienced eToro trader called Aukie2008 (real name Mike Moest).

In January 2023 I added to this with another $500 investment in one of their thematic portfolios, Oil Worldwide. I also invested a small amount I had left over in Tesla shares.

As you can see from the screen capture below, my original investment of $1,022.26 is today worth $1,208.40, an overall increase of $186.14 or 18.20%. in these turbulent times I am very happy with that.

In the last month my Tesla shares and my copy trading portfolio with Aukie2008 have both done well. I am also pleased that my investment in Oil Worldwide is back in profit again. This has happened since the Oil Worldwide portfolio was rebalanced by eToro – which is, of course, as I hoped

You can read my full review of eToro here. You may also like to check out my more in-depth look at eToro copy trading. I also discussed thematic investing with eToro using Smart Portfolios in this recent post. The latter also reveals why I took the somewhat contrarian step of choosing the oil industry for my first thematic investment.

- eToro also recently introduced the eToro Money app. This allows you to deposit money to your eToro account without paying any currency conversion fees, saving you up to £5 for every £1,000 you deposit. You can also use the app to withdraw funds from your eToro account instantly to your bank account. I tried this myself recently and was impressed with how quickly and seamlessly it worked. You can read my blog post about eToro Money here.

I had two more articles published in July on the excellent Mouthy Money website. The first was How to Make Money Selling Photos to Stock Photography Services. If you enjoy photography – even if only on your mobile phone – this is definitely an opportunity you should check out.

My other article was How to Find Out What Your State Pension Will Be. The state pension is a very important component of most people’s income in later life (including mine). In this article I discuss changes to the state pension age and explain how to check when you will become eligible and how much you are on track to receive. I also discuss what options you may have if your projected pension is less than you hoped.

As I’ve said before, Mouthy Money is a great resource for anyone interested in money-making and money-saving. I particularly like the ‘Deals of the Week’ feature compiled by Jordon Cox (‘Britain’s Coupon Kid’) which lists all the best current money-saving offers for savvy shoppers. Check out the latest edition here 🙂

I also published several new posts on Pounds and Sense in July. One of these was Make a Sideline Income Renting Out Your Driveway. As I explain in the article, this is a money-making opportunity that – if you’re in a position to do it – can bring you a steady income for very little effort.

Also in July I published an article explaining why it was Time to Use or Exchange Your Old Non-Barcoded Postage Stamps. That deadline has now passed, but if you still have any ordinary non-barcoded stamps lying around, as the article explains, you can still exchange them using Royal Mail’s ‘Swap Out’ scheme.

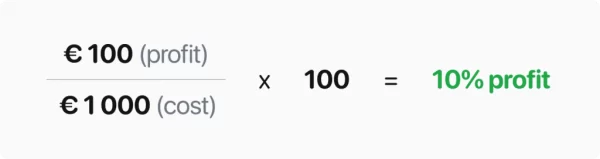

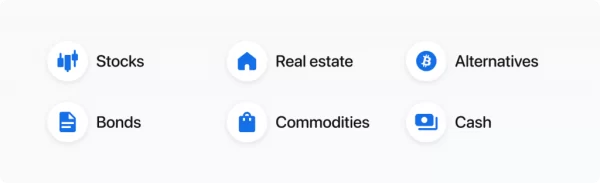

Investing Basics for Beginners is a collaborative post with my friends at the European crowdlending platform Mintos. The article sets out some basic principles for anyone who may be considering investing for the first time (though it may also be of interest to more experienced investors).

Finally in July I published Five Things I Have Learned from my eToro Virtual Portfolio. Anyone with an eToro account gets a $100,000 virtual account to practise trading and investing with. I have found this interesting and enjoyable, not to mention educational. In the article I set out five lessons learned from my virtual account that have helped inform my real-life investing decisions. I am considering publishing a further update about my virtual portfolio and how it’s doing, if there is sufficient interest in this.

Lastly, I would mention that the opportunity to Get a Free ETF Share Worth up to £200 with Wealthyhood is still open. To remind you, Wealthyhood is a DIY wealth-building app aimed especially at people new to stock market investing. As from June 2023 they changed their fee structure to make it (even) more attractive to small investors. They have now increased the minimum investment to qualify for the free share offer from £20 to £50 – but on the plus side, they guarantee that your free ETF share will be worth at least £10.

That’s all for today. I hope you’re enjoying the summer, even though July has been a damp squib in Britain compared with June. If you’re looking for some ideas for short breaks, don’t forget to check out my blog post listing some of my favourite UK holiday destinations. Here’s hoping the warm, sunny weather makes a reappearance soon…

As always, if you have any comments or queries, feel free to leave them below. I am always delighted to hear from PAS readers

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that posts may include affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered, but it does help support me in publishing PAS and paying my bills. Thank you!

Cover image courtesy of BingAI.